- Home

- »

- Specialty Polymers

- »

-

North America Alcohol Ethoxylates Market Size Report, 2030GVR Report cover

![North America Alcohol Ethoxylates Market Size, Share & Trends Report]()

North America Alcohol Ethoxylates Market Size, Share & Trends Analysis Report By Product (Fatty Alcohol Ethoxylates, Lauryl Alcohol Ethoxylates), By Application (Emulsifier, Dispersing Agent), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-147-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

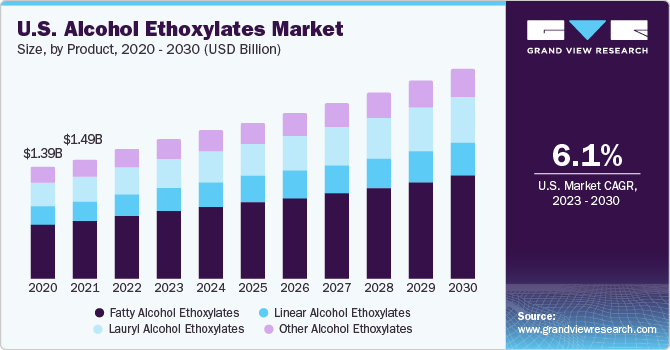

The North America alcohol ethoxylates market size was estimated at USD 2.05 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.1% in terms of revenue from 2023 to 2030. This is attributed to the growing demand for high-grade industrial and household cleaners. Alcohol ethoxylates are also increasingly used in emulsification and agricultural chemicals due to their low level of toxicity. Alcohol ethoxylates contain emulsifying properties and tend to have a cooling effect on the skin when used to cleanse skin and hair. These properties have made it a lucrative option to be used in personal care product applications such as eyeshadows, lipsticks, mascara, eyeliners, and foundation. It also increases the shelf life of personal care products owing to its low foaming properties.

There has been a steady increase in personal care and cosmetics products due to rising disposable incomes as well as changing lifestyles in the region, fueling the demand for surfactants. This rising demand can also be attributed to the heightened strictness of environmental regulations. Governments and regulatory agencies are advocating for the adoption of eco-friendly and biodegradable chemicals across various industries. The smaller environmental footprint and lower toxicity of alcohol ethoxylates are significant factors driving their increasing usage as businesses aim to comply with environmental guidelines and lower their impact on the environment. For instance, the Canadian Environmental Protection Act, of 1999 specifies measures and controls over the manufacturing, usage, and waste treatment of alcohol ethoxylates.

Alcohol ethoxylates are renowned for their excellent surfactant characteristics, which enable them to lower surface tension and facilitate the effective blending and distribution of liquids. This attribute has led to their widespread application in cleaning agents, detergents, and household cleaning solutions. Their efficiency in eradicating dirt, stains, and oils from a wide range of surfaces and fabrics is a key factor fueling their demand within the cleaning and laundry sectors.

Continuous research and innovation in the chemical industry have led to the development of new formulations and applications for alcohol ethoxylates. For instance, they are increasingly being used in the formulation of enhanced oil recovery chemicals in the oil and gas sector. The ethoxylated alcohol sulfate compound, when combined with propoxylated alcohol sulfate and internal olefin sulfate, causes low microemulsion viscosities and interfacial tensions. These innovations open up new opportunities and contribute to the expansion of the market.

The Covid-19 pandemic had a significant impact on the alcohol ethoxylates market, both positive and negative. The market benefitted from the increased demand in the pharmaceutical industry during the pandemic. The healthcare and pharmaceutical industry relied heavily on alcohol ethoxylates for the production of disinfectants, sanitizers, and other pharmaceuticals. On the other hand, the disruption caused in other industries such as hospitality and tourism resulted in the demand for cleaning products reducing drastically. This had a profound negative impact on the demand for alcohol ethoxylates.

Product Insights

Based on product, the fatty alcohol ethoxylates segment dominated the market with the largest revenue share of 49.0% in 2022. This is attributed to their usage as hard surface cleaners in cleaners, detergents, and personal care products such as shower gel & shampoo. They are also applied in the paints and agriculture domain as well as in leather and textile processing. This extensive usage in varied industries contributes to it being the dominant segment amongst alcohol ethoxylates.

Lauryl alcohol ethoxylates are used as foaming agents in personal care products such as bath gels and shampoos as they help to reduce the surface tension in liquid. Also, their effective wetting property makes them applicable in household cleaning products, including hard surface cleaners, laundry pre-spotters, and hard surface cleaners. Industrial manufacturing of leather and textiles also finds usage of the wetting property offered by lauryl to reduce surface tension.

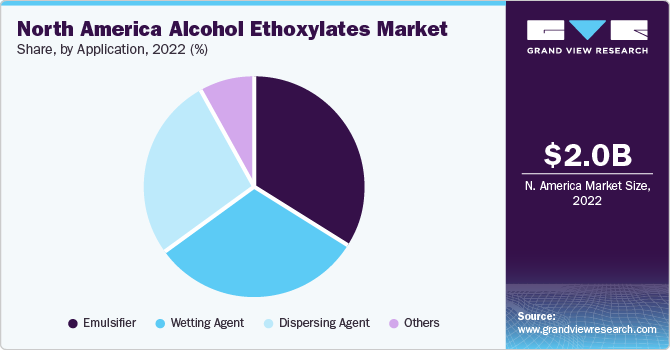

Application Insights

The emulsifier segment dominated the market with the largest revenue share of 35.4% in 2022. This is attributed to the exceptional surfactant property of alcohol ethoxylates which paves the way for their usage as emulsifiers in a wide range of industries such as food & beverages, cosmetics & personal care, agrochemicals, cleaning products, textiles, and leather industry. Their ability to allow even dispersion of components in the mixture helps form consistent and stable emulsion as well as enhances the visual appeal of the products.

Alcohol ethoxylates are extensively used as wetting agents and play a pivotal role in reducing the surface tension of liquids, ensuring direct contact with solid surfaces. This property helps them find utility in an array of sectors from paints, and agriculture to textiles and pharmaceuticals. In agriculture, alcohol ethoxylates help lower the surface tension in pesticide solutions, allowing them to be distributed across plant surfaces.

In the paints & coating industry, where achieving a smooth and even application is very important, they aid in the dispersion of pigments and other solid particles in the paint formulation, while also enabling better adhesion to the surface and ensuring a more consistent finish.

Regional Insights

The U.S. dominated the market with the largest revenue share of 77.5 % in 2022. This is attributed to the large-scale manufacturing industry present in the country, spanning various end-user sectors of alcohol ethoxylates. The U.S. industrial sector relies heavily on them in the textile, agriculture as well and oil & gas sectors. U.S. is a leading producer of oil & gas in the world and is home to a range of giants in the industry such as Chevron and Exxon Mobil and international corporations such as Shell and BP. This ensures a constant and growing demand for alcohol ethoxylates in the country.

Canada holds a significant position in the alcohol ethoxylates industry with a rising demand coming from detergents, personal care, and cosmetics industry. The rising population in the country fueled by immigration has also been a major factor in the increasing consumption of household cleaning as well as personal care products in the country. The stringent environmental regulations set by the Canadian government augur well for the biodegradable variants in alcohol ethoxylates as they help lower the carbon footprint of the end-user industries in the country.

Key Companies & Market Share Insights

Strategically investing in the development of cost-effective and environmentally sustainable products offers significant growth potential for major players within the industry. These companies are prioritizing the manufacturing of alcohol ethoxylate products that are both biodegradable and characterized by lower toxicity levels. Notably, the North American market is currently dominated by key industry leaders such as Huntsman International LLC, Clariant, and BASF SE.

Prominent market leaders exercise significant control, leveraging diverse strategic actions like product introductions, expansion endeavors, and mergers & acquisitions. For instance, in December 2022, Clariant announced the expansion of its ethoxylation plant in Huizhou, China to support industrial applications, personal care, and home care customers in the country. The expansion is likely to cost approximately USD 88.8 million and will help to expand the production capacity for existing and new products by the end of 2024.

Key North America Alcohol Ethoxylates Companies:

- AkzoNobel N.V.

- BASF SE

- Clariant

- Dow

- DuPont

- Evonik Industries

- Huntsman International LLC

- India Glycols Limited

- Mitsui Chemicals, Inc.

- Royal Dutch Shell plc

- SABIC

- Sasol Limited

- Solvay

- Stepan Company

North America Alcohol Ethoxylates Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.16 billion

Revenue forecast in 2030

USD 3.28 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

AkzoNobel N.V.; BASF SE; Clariant; Dow; DuPont; Evonik Industries; Huntsman International LLC; India Glycols Limited; Mitsui Chemicals, Inc.; Royal Dutch Shell plc; SABIC; Sasol Limited; Solvay; Stepan Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Alcohol Ethoxylates Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America alcohol ethoxylates market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fatty Alcohol Ethoxylates

-

Lauryl Alcohol Ethoxylates

-

Linear Alcohol Ethoxylates

-

Other Alcohol Ethoxylates

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Emulsifier

-

Dispersing Agent

-

Wetting Agent

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. U.S. dominated the North America Alcohol Ethoxylates market with a share of 77.5% in 2022. This is attributable to the large-scale end-use industry present in the country. U.S. is a leading producer of oil & gas in the world and is home to a range of giants in the industry such as Chevron and Exxon Mobil and international corporations such as Shell and BP.

b. Some key players operating in the North America alcohol ethoxylates market include AkzoNobel N.V., BASF SE, Clariant, Dow, DuPont, Evonik Industries, Huntsman International LLC, India Glycols Limited, Mitsui Chemicals, Inc., Royal Dutch Shell plc, SABIC, Sasol Limited, Solvay, Stepan Company.

b. Key factors that are driving the market growth include the growing demand for high-grade industrial and household cleaners around the world. Alcohol ethoxylates are also increasingly used in emulsification and agricultural chemicals due to their low level of toxicity.

b. The North America alcohol ethoxylates market size was estimated at USD 2.05 billion in 2022 and is expected to reach USD 2.16 billion in 2023.

b. The North America alcohol ethoxylates market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 3.28 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."