- Home

- »

- Advanced Interior Materials

- »

-

North America Air Conditioning Systems Market Report, 2033GVR Report cover

![North America Air Conditioning Systems Market Size, Share & Trends Report]()

North America Air Conditioning Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Package Air Conditioners, Split Air Conditioning Systems, Ductless Mini-Split Systems), By Technology (Inverter, Non-Inverter), By End, By Country, And Segment Forecasts

- Report ID: 978-1-68038-131-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Air Conditioning Systems Market Summary

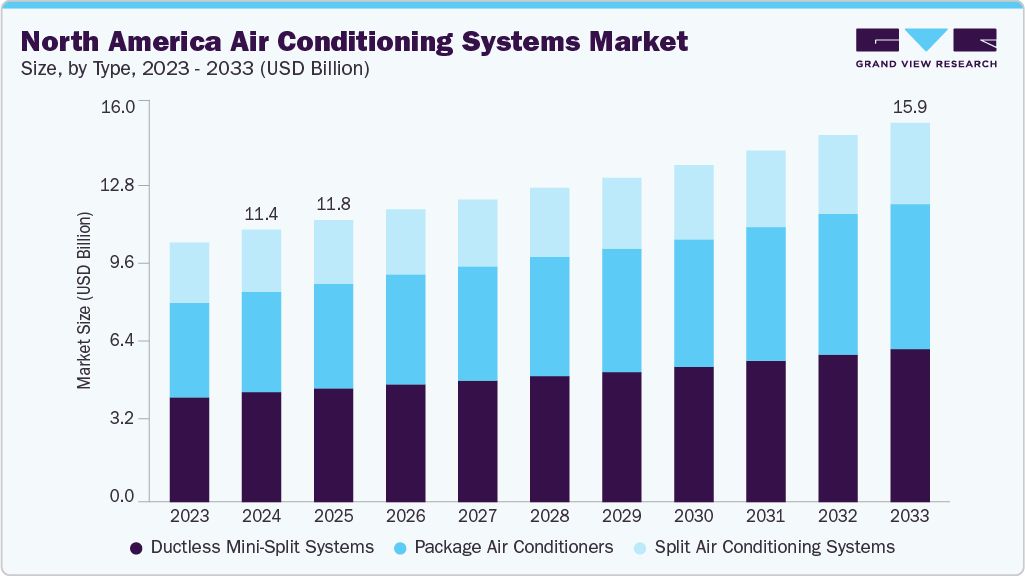

The North America air conditioning systems market size was estimated at USD 11.38 billion in 2024 and is projected to reach USD 15.92 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The North America air conditioning systems industry is driven by rising demand for energy-efficient HVAC solutions amid growing awareness of environmental concerns.

Key Market Trends & Insights

- The air conditioning systems market in Mexico is expected to grow at a substantial CAGR of 5.1% from 2025 to 2033.

- By type, the package air conditioners segment is expected to grow at the fastest CAGR of 4.0% from 2025 to 2033.

- By technology, the inverter waste segment is expected to grow at the fastest CAGR of 4.5% from 2025 to 2033.

- By end use, the residential segment is expected to grow at the fastest CAGR of 5.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 11.38 Billion

- 2033 Projected Market Size: USD 15.92 Billion

- CAGR (2025-2033): 3.9%

The adoption of smart home technologies and the integration of IoT-enabled systems are boosting market growth. Rising construction activities across the U.S. and Canada, particularly in residential and commercial real estate, are fueling demand for advanced air conditioning systems. The replacement of aging HVAC infrastructure with modern, sustainable units is a key trend. Moreover, tax incentives and rebates for energy-efficient appliances encourage consumers to invest in upgraded systems. The market also benefits from increased spending on home improvement and comfort-focused renovations.

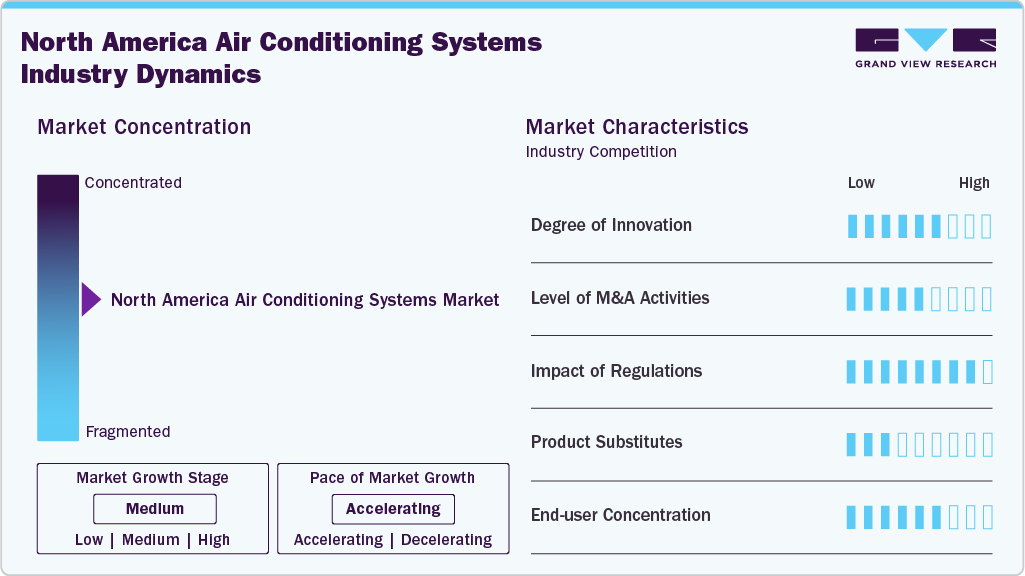

Market Concentration & Characteristics

The North America air conditioning systems industry is moderately concentrated, with a few major players holding significant market share. Leading companies dominate through extensive distribution networks, strong brand recognition, and continuous product innovation. However, smaller regional manufacturers also contribute, especially in niche or customized solutions. This mix of dominant firms and regional players creates a competitive yet moderately consolidated market landscape.

The North American air conditioning industry is marked by a high degree of innovation, driven by the need for energy efficiency and smart technology integration. Companies are focusing on developing systems with advanced controls, variable-speed compressors, and IoT connectivity. Innovations also target eco-friendly refrigerants and low-emission designs. This emphasis on sustainability and performance gives firms a competitive edge.

Mergers and acquisitions are a common strategy among key players in North America to expand market reach and enhance product portfolios. Large firms acquire regional manufacturers to strengthen their distribution networks and gain access to emerging technologies. These activities also help in consolidating market position amid rising competition. Cross-border deals and strategic alliances are also shaping market dynamics.

Regulatory policies in North America strongly influence the air conditioning industry, particularly regarding energy efficiency and refrigerant usage. Stricter standards from agencies like the U.S. Department of Energy and the EPA push manufacturers toward greener solutions. Compliance with SEER rating updates and low-GWP refrigerant mandates drives product development. These regulations ensure sustainability while encouraging technological advancement.

Drivers, Opportunities & Restraints

Rising temperatures and frequent heat waves across North America are increasing the demand for air conditioning systems. Growth in residential and commercial construction further supports market expansion. Energy efficiency awareness and smart home adoption are driving upgrades to advanced HVAC units. Government incentives for sustainable technologies also fuel consumer interest in modern systems.

The growing trend of smart and connected homes offers strong growth potential for intelligent AC systems. Replacement of aging infrastructure with energy-efficient models presents significant opportunities. Expanding demand for green buildings supports the integration of eco-friendly HVAC technologies. Technological innovations, including AI and IoT-enabled controls, open new avenues for market players.

High upfront costs of advanced air conditioning systems can limit adoption among budget-conscious consumers. Supply chain disruptions and material price volatility affect manufacturing and distribution. Strict environmental regulations may increase compliance costs for companies. Seasonal demand fluctuations also impact consistent revenue generation across the region.

Type Insights

The ductless mini-split systems segment led the market with the largest revenue share of 40.2% in 2024, due to their energy efficiency and flexible installation. They are ideal for retrofitting older homes without ductwork and offer individual room temperature control. Their quiet operation and compact design appeal to both residential and light commercial users. Growing awareness of energy savings further boosts their demand across the region.

The packaged air conditioners segment is anticipated to grow at the fastest CAGR during the forecast period, due to their space-saving design and ease of installation. These systems integrate all components into a single unit, making them ideal for commercial rooftops and compact buildings. Rising construction in the commercial sector and increased preference for pre-assembled units drive this trend. Their low maintenance requirements also attract cost-conscious businesses.

Technology Insights

The inverter-based air conditioners segment led the market with the largest revenue share of 68.6% in 2024, owing to their superior energy efficiency and precise temperature control. These systems adjust compressor speed based on cooling demand, reducing energy consumption and operational costs. Consumers are increasingly favoring them for long-term savings and environmental benefits. Their quiet performance and durability also enhance residential and commercial appeal.

The non-inverter systems segment is anticipated to grow at the fastest CAGR during the forecast period, driven by their lower initial cost and simpler design. They are preferred in budget-conscious segments and smaller residential applications. However, rising energy standards and demand for efficiency are gradually shifting focus away from these units. Despite this, they remain relevant in specific use cases where affordability is a key factor.

End Use Insights

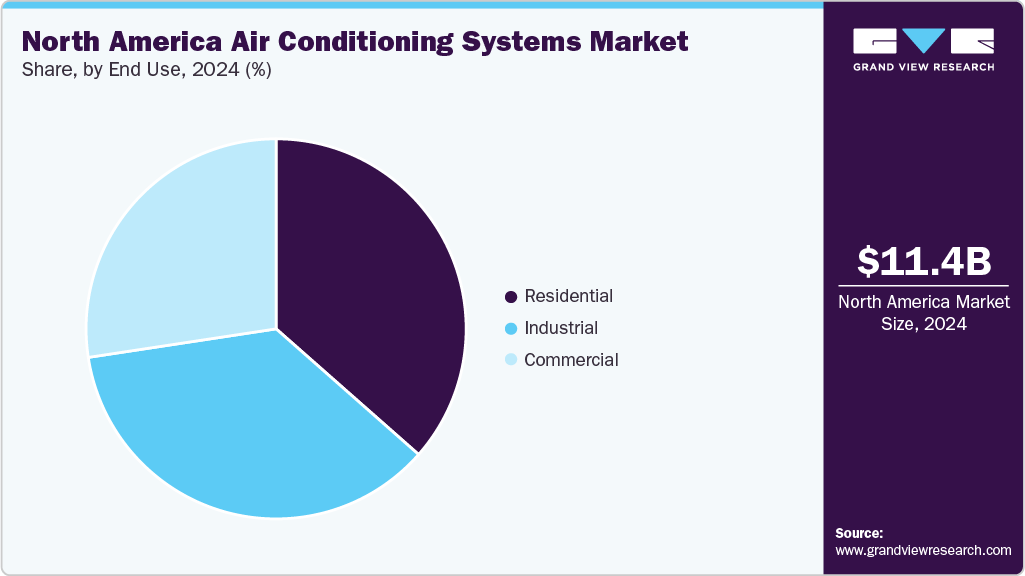

The residential sector segment led the market with the largest revenue share of 36.5% in 2024, due to widespread homeownership and rising temperatures. Increasing demand for comfort, energy-efficient systems, and smart home integration fuels adoption. Government incentives for upgrading to high-efficiency units further drive replacements. Home renovation trends and rising disposable income also support sustained demand.

The commercial segment is anticipated to grow at the fastest CAGR during the forecast period, supported by expanding office spaces, retail outlets, and hospitality developments. Businesses are investing in advanced HVAC systems to meet energy codes and enhance indoor air quality. Growing awareness of employee comfort and environmental standards drives upgrades. In addition, increased construction of data centers and healthcare facilities fuels demand for reliable cooling systems.

Country Insights

U.S. Air Conditioning Systems Market Trends

The air conditioning system market in the U.S. accounted for the largest market revenue share in North America in 2024, due to its large population, extreme weather variations, and high rate of HVAC adoption. Strong residential and commercial construction activity continues to boost demand. Government regulations promoting energy-efficient systems support market growth. Technological advancements and smart home integration further enhance system adoption across the country.

The Canada air conditioning system market is experiencing steady growth in air conditioning demand, driven by rising summer temperatures and increased urbanization. The shift toward energy-efficient and environmentally friendly systems aligns with national sustainability goals. Growth in the residential renovation sector also supports new installations. In addition, incentives for green buildings are encouraging the adoption of modern HVAC solutions.

The air conditioning system market in Mexico is growing rapidly due to rising urban development and expanding middle-class income. Increasing temperatures and greater demand for indoor comfort in both homes and businesses drive installations. The commercial sector, including tourism and retail, plays a significant role in market expansion. Adoption of energy-efficient systems is also gaining traction amid rising electricity costs.

Key North America Air Conditioning Systems Company Insights

Some of the key players operating in the market include DAIKIN INDUSTRIES, Ltd., Carrier., and Haier Group.

-

Daikin specializes in advanced air conditioning systems, with a strong focus on inverter and energy-saving technologies. The company leads in environmentally responsible solutions, particularly through its early adoption of R-32 refrigerants. It heavily invests in R&D to develop smart and AI-enabled HVAC products. Daikin has a robust manufacturing and distribution presence across Asia, Europe, and North America. Its product strategy emphasizes performance, low environmental impact, and regulatory compliance.

-

Carrier is known for its high efficiency HVAC systems tailored for both residential and large-scale commercial applications. The company emphasizes sustainable technologies, offering solutions with low-GWP refrigerants and energy optimization features. Its portfolio includes smart AC systems integrated with building automation platforms. Carrier is active in acquisitions to strengthen its digital and green HVAC offerings. The company leverages data-driven innovation to improve lifecycle performance and reduce carbon footprints.

Key North America Air Conditioning Systems Companies:

- DAIKIN INDUSTRIES, Ltd.

- Carrier.

- Haier Group

- Johnson Controls - Hitachi Air Conditioning Company

- Lennox International Inc.

- LG Electronics.

- Mitsubishi Electric India Pvt. Ltd.

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- Whirlpool

Recent Developments

-

In August 2025,Bosch completed a USD 8 billion acquisition of Johnson Controls' residential and light commercial HVAC business, including full ownership of the Hitachi joint venture. The deal adds North American ducted systems and strengthens Bosch's global HVAC footprint. With this move, Bosch’s Home Comfort division nearly doubles in size. It significantly boosts the company’s presence in the U.S. and Asia.

-

In January 2025, Panasonic introduced its OASYS Residential Central AC System in the U.S., combining mini-split AC, ventilators, and transfer fans. It reduces energy use by over 50% and ensures quiet, uniform airflow for well-insulated homes. The system helps prevent condensation and mold in hidden spaces.

North America Air Conditioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.76 billion

Revenue forecast in 2033

USD 15.92 billion

Growth rate

CAGR of 3.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Thousand Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

DAIKIN INDUSTRIES, Ltd.; Carrier.; Haier Group; Johnson Controls - Hitachi Air Conditioning Company; Lennox International Inc.; LG Electronics.; Mitsubishi Electric India Pvt. Ltd.; Panasonic Corporation; Samsung Electronics Co. Ltd.; Whirlpool.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Air Conditioning Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America air conditioning systems market report based on type, technology, end use, and country.

-

Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Package Air Conditioners

-

Split Air Conditioning Systems

-

Ductless Mini-Split Systems

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Inverter

-

Non-Inverter

-

-

End Use Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America air conditioning systems market size was estimated at USD 11.38 billion in 2024 and is expected to be USD 11.76 billion in 2025.

b. The North America air conditioning systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2033 to reach USD 15.92 billion by 2033.

b. Inverter-based air conditioners segment held the largest share in the market and accounted for a share of 68.6% in 2024 owing to their superior energy efficiency and precise temperature control. These systems adjust compressor speed based on cooling demand, reducing energy consumption and operational costs.

b. Some of the key players operating in the North America air conditioning systems market include DAIKIN INDUSTRIES, Ltd.; Carrier.; Haier Group; Johnson Controls - Hitachi Air Conditioning Company; Lennox International Inc.; LG Electronics.; Mitsubishi Electric India Pvt. Ltd.; Panasonic Corporation; Samsung Electronics Co. Ltd.; Whirlpool.

b. Key factors driving the North America air conditioning systems market include rising temperatures, increased construction activity, and growing demand for energy-efficient solutions. The adoption of smart and connected HVAC systems is gaining momentum across residential and commercial sectors. Additionally, government incentives and regulations promoting sustainable technologies further accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.