North America Air Compressor Market Size, Share & Trends Analysis Report By Type (Stationary), By Product (Reciprocating), By Lubrication, By Application (Manufacturing), By Operating Mode (Electric), By Power Range, By Country And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-169-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The North America air compressor market size was estimated at USD 4.68 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.6% from 2024 to 2030. Stringent environmental regulations and a growing emphasis on sustainability have led industries to adopt more environmentally friendly equipment. Air compressors are used in various pollution control and emission reduction processes, to ensure compliance with these regulations. Furthermore, rising automation and robotics in many industries are driving market growth, since air compressors play a crucial role in powering pneumatic systems used in these applications. The above factors are likely to impact the market growth positively.

Governments of different countries across North America have introduced stringent environmental regulations, which have further increased the demand for energy-efficient air compressors used in different industries. In addition, end-users prefer replacing their on-and-off control compressors with variable-speed drive (VSD)-based control systems, which ensure the required flow and keep the pressure in pipes stable for energy-efficient air compression. Variable-speed drive-based air compressors also help in leakage detection and reduce compressor motor service requirements by extending the service cycle of these motors. These aforementioned factors are anticipated to propel the market growth over the forecast period.

Automotive production in America reached 17.8 million units in 2022, witnessing an increase of 10.0% as compared to 2021. As air compressors are used in various stages of vehicle production, right from the usage of compressed air by spray painting guns to its utilization for pushing paints through robots or paint guns onto the body of automobiles, the surge in vehicle production is anticipated to fuel the growth of the North America air compressor market.

According to the U.S. Department of Agriculture, the growing population, rising disposable income of consumers, and ongoing urbanization in the country are expected to augment the growth of food and beverages industry in the coming years. In 2021, food accounted for the third-largest share of 11.9% of average U.S. household expenditure after housing and transportation. Thus, surging demand for food and beverages is anticipated to drive the demand for air compressors used in the food processing and packaging industry over the forecast period.

Market Concentration & Characteristics

Market growth stage is high, and pace is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in water lubricated oil-free screw compressors, low-pressure screw compressors, variable speed drive compressors, Subsequently, the market is also governed by various standards, regulations from U.S., Canada, Mexico government.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including increasing the reach of their products in the market and enhancing the availability of their products and services in diverse geographical areas. Key market players adopting this inorganic growth strategy include Ingersoll Rand, Atlas Copco, Hitachi Industrial Equipment Systems Co., Ltd., MAT Holdings, Inc., and Sullair LLC.

The market is currently undergoing heightened regulatory scrutiny, reflecting a growing emphasis on environmental considerations and energy efficiency within the region. This scrutiny has significant implications for manufacturers and users of air compressors, necessitating compliance with evolving regulations and the adoption of eco-friendly technologies. As a result, companies in the North American air compressor industry face the challenge of adapting their products and operations to align with these stringent regulatory measures while also addressing the rising demand for energy-efficient solutions. This regulatory landscape is reshaping the market dynamics, emphasizing the need for innovation and sustainable practices in the air compressor sector within North America.

Product substitutes for air compressors vary based on the specific application requirements, but some notable alternatives include hydraulic systems, electric motors, and manual labor. Hydraulic systems can replace air compressors in certain industrial settings, offering efficient power transmission and precise control. Electric motors, especially in smaller-scale applications, may serve as an alternative, providing a cleaner and quieter operation. However, their feasibility depends on factors like power availability and cost-effectiveness. In some cases, manual labor or alternative power sources like natural gas may be considered. When evaluating substitutes, factors such as energy efficiency, operational costs, and application-specific requirements play a crucial role in determining the most suitable alternative.

The market exhibits a diverse end-user concentration, with prominent sectors driving demand. The manufacturing industry emerges as a primary consumer, leveraging air compressors for pneumatic tools and automated processes. Construction also contributes significantly, relying on compressors to power various tools and machinery. The healthcare sector forms a specialized market, utilizing compressed air for medical equipment. Additionally, the automotive industry plays a pivotal role, in employing air compressors in manufacturing and assembly processes. The oil and gas sector, with applications in drilling and extraction, further diversifies the end-user landscape. This broad spectrum of industries underscores the market's resilience, as demand is spread across sectors, mitigating risks associated with over-reliance on a single industry. Manufacturers must stay attuned to sector-specific needs to navigate this varied landscape effectively.

Application Insights

Manufacturing end-use segment led the market in 2023. The growth of the manufacturing sector has indeed played a significant role in the expansion of the air compressor market. Manufacturing processes often require compressed air for various applications, such as operating pneumatic tools, controlling valves, powering machinery, and more. As the manufacturing sector expands, the demand for compressed air also grows. Further, modern manufacturing facilities increasingly use automation and robotics to improve efficiency and productivity. These automated systems often rely on compressed air for their operation, which is driving the need for reliable and efficient air compressors.

The semiconductor and electronics end-use segment is projected to witness the highest growth rate over the forecast period. The demand for air compressors in the semiconductor and electronics industry is rapidly growing due to the need for high-quality compressed air for a range of processes, including chip manufacturing, wafer fabrication, and assembly. The semiconductor and electronics industries require high-purity compressed air because contamination can cause product defects.

Type Insights

Stationary type segment led the market and accounted for 56.9% of the North American market revenue in 2023. Stationary air compressors are intended to remain in one location connected to a building's electrical circuit. Stationary air compressors typically have a capacity ranging from 60 to 240 gallons. These compressors are ideal for use in manufacturing plants, industrial plants, and auto repair shops.

The efficiency of a portable air compressor depends on its design, size, and usage. Smaller, well-maintained air compressors with modern technology tend to be more energy efficient. Additionally, proper maintenance and correct usage play a crucial role in ensuring energy efficiency. The key factors driving the industry-wide adoption of these compressors are low maintenance cost, efficient operation, retrofitting, and aftermarket service of existing air compressors. Increased demand for energy-efficient portable air compressors is expected to drive the product demand over the forecast period.

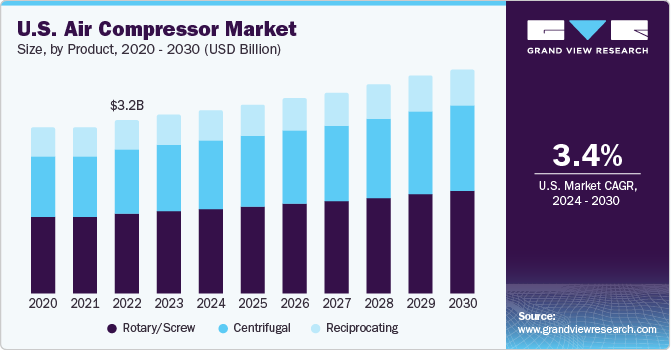

Product Insights

Rotary/Screw product segment accounted for the largest market revenue share in 2023. The features of rotary/screw air compressors, such as low noise output, high energy efficiency, good performance, easy maintenance, and uninterrupted operation, are anticipated to attract more and more customers over the forecast period resulting in an increasing demand for rotary/screw air compressors.

Centrifugal product segment is expected to register the fastest CAGR during the forecast period. A centrifugal air compressor is a type of dynamic compressor that uses high-speed rotating impellers to compress air or gas. It operates by converting kinetic energy into potential energy, resulting in the compression of the incoming air. Centrifugal air compressors offer several advantages, making them a preferred choice for certain industrial applications. Centrifugal air compressors are highly efficient, particularly at higher capacities.

Lubrication Insights

Oil-filled lubrication accounted for the largest market revenue share in 2023. Oil-filled air compressors are widely used in the energy, manufacturing, and chemical industries. They are more robust and make less noise than oil-free compressors. The aforementioned factors will drive the demand for oil-filled air compressors over the forecast period. Atlas Copco offers oil-lubricated rotary/screw compressors that provide consistent, energy-efficient, and smart AIR solutions. They also incur a lower overall lifecycle cost, which drives the market demand.

Oil-free lubrication technology is expected to register the fastest CAGR during the forecast period. The oil-free lubrication segment is expected to grow due to the implementation of legislation to reduce emissions and increased emphasis on environmental safety. Factors such as rapid industrialization and growth of the food processing, manufacturing, and semiconductor sectors are propelling the demand for air compressors.

Power Range Insights

The air compressor in 51-250 kW power range accounted for the largest market revenue share in 2023. The dominance of 51-250 kW air compressors in the North America market can be attributed to a combination of factors. This power range strikes a balance between versatility and efficiency, making it suitable for a wide array of applications across various industries. Industries such as manufacturing, construction, and automotive often require mid-range compressors for diverse tasks, including pneumatic tools, assembly lines, and other production processes.

The air compressor in 251-500 kW power range segment is expected to register the fastest CAGR during the forecast period due to several key factors. This segment caters to industries with high-demand applications such as large-scale manufacturing, energy, and heavy-duty processes, where substantial compressed air output is essential. The forecasted growth is also driven by a surge in industrial activities, particularly in sectors like energy, where oil and gas exploration and production operations often require higher-powered compressors.

Operating Mode Insights

Electric operating mode segment led the market in 2023. Electric air compressors are versatile tools used in various industries and applications. One of the primary driving factors for electric air compressors is their energy efficiency. Compared to their gasoline or diesel counterparts, electric compressors tend to be more energy-efficient, resulting in cost savings over time.

Internal combustion operation mode is projected to witness highest growth rate over the forecast period. Their mobility makes them ideal for applications where a stationary compressor may not be practical. In industries such as construction, mining, and agriculture, work often takes place in remote locations where access to electrical power sources may be limited.

Country Insights

U.S. dominated the market and accounted for a 70.9% share in 2023. Air compressors are used for powering a wide range of tools and equipment in industries like manufacturing, construction, healthcare, oil & gas, and automotive. One notable trend in the U.S. air compressor market has been the growing emphasis on energy efficiency and sustainability. With environmental concerns becoming increasingly important, many businesses and industries have been actively seeking energy-efficient compressor solutions to reduce their carbon footprint and operating costs. This has driven innovation and the adoption of advanced compressor technologies.

Mexico is anticipated to witness significant growth in the market. The flourishing automotive industry in Mexico, owing to the rising popularity of electric vehicles, the presence of favorable government regulations for foreign companies to establish their automobile plants, and the low production costs, is anticipated to have a positive impact on the adoption of air compressors in the country. This, in turn, is anticipated to lead to the growth of the market in Mexico in the coming years.

Key Companies & Market Share Insights

Some of the key players operating in the market include Atlas Copco, BAUER COMP Holding Gmb, Ingersoll Rand, MAT Holding, Inc., Sullair LLC, Doosan Portable Power.

-

Atlas Copco operates through four segments, namely, industrial technology, power technology, vacuum technology, and compressor technology. The compressor technology division of Atlas Copco manufactures gas and process compressors and expanders, air management systems, oil and gas treatment equipment, vacuum solutions, and industrial compressors.

-

Ingersoll Randproducts are sold under more than 40 brands, including Gardner Denver and Ingersoll Rand, which are globally recognized in their respective end markets and are known for superior customer service, product efficiency, reliability, and quality.

-

Sullivan-Palatek Inc, FS-ELLIOT CO., LLC, Oasis Manufacturing are some of the emerging market participants in the North America air compressor market.

-

Sullivan-Palatek Inc. has a large selection of portable and electric rotary screw air compressors. The company has evolved from a company that provides engineering services to existing clients to one that manufactures dependable and rugged machinery. Its compressors are built to be low-maintenance.

-

FS-ELLIOT CO., LLC specializes in incorporating the latest technologies, such as control systems and aerodynamic technologies, into its gas and air compressors to ensure optimal performance.

Key North America Air Compressor Companies:

- Atlas Copco

- BAUER COMP Holding GmbH

- Hitachi Industrial Equipment Systems Co. Ltd.

- Ingersoll Rand

- KAESER KOMPRESSOREN

- MAT Holding, Inc.

- Hanwha Power Systems CO., LTD.

- Sullair LLC

- Doosan Portable Power

- Sullivan-Palatek, Inc.

- ELGi

- FS-ELLIOT CO., LLC

- ZEN AIR TECH PRIVATE LIMITED

- Frank Technologies Private Limited

- Oasis Manufacturing

Recent Developments

-

In April 2023, Atlas Copco completed the acquisition of Shandong Bozhong Vacuum Technology Co., Ltd., an innovator and manufacturer of vacuum systems and pumps. The acquired company became a division of the industrial vacuum division in the vacuum technique business segment of Atlas Copco.

-

FS Elliot Co., LLC introduced the P400HPR Centrifugal Air Compressor in August 2023. The P400HPR ensures energy efficiency and dependability while meeting any high-pressure application with improved features and exceptional performance.

-

ELGi opened a manufacturing facility in Tamil Nadu, India, in May 2023. The 50,000-square-foot factory started producing pressure-reducing stations, cutting-edge high-pressure compressors, and portable breathing air compressors for the commercial shipping, navy, and industrial markets in India with an investment of over USD 4.8 million.

North America Air Compressor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.82 billion |

|

Revenue forecast in 2030 |

USD 5.96 billion |

|

Growth rate |

CAGR of 3.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, product, lubrication, application, operating mode, power range, country |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

Atlas Copco; BAUER COMP Holding GmbH; Hitachi Industrial Equipment Systems Co. Ltd.; Ingersoll Rand; KAESER KOMPRESSOREN; MAT Holding, Inc.; Hanwha Power Systems CO. LTD.; Sullair LLC; Doosan Portable Power; Sullivan-Palatek, Inc.; ELGi; FS-ELLIOT CO. LLC; ZEN AIR TECH PRIVATE LIMITED; Frank Technologies Private Limited. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Air Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America air compressor market report based on type, product, lubrication, application, operating mode, power range, and country.

-

Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Stationary

-

Portable

-

-

Product Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Lubrication Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Food & Beverage

-

Semiconductor & electronics

-

Healthcare/Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

Others

-

-

Operating Mode Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Electric

-

Internal Combustion engine

-

-

Power Range Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

over 500 kW

-

-

Country Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. North America air compressor market size was estimated at USD 4.68 billion in 2023 and is expected to be USD 4.82 billion in 2024.

b. The North America air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 5.96 billion by 2030.

b. U.S. country dominated the market in 2023 by accounting for a share of 70.9% of the market. One notable trend in the U.S. air compressor market has been the growing emphasis on energy efficiency and sustainability. With environmental concerns becoming increasingly important, many businesses and industries have been actively seeking energy-efficient compressor solutions to reduce their carbon footprint and operating costs. This has driven innovation and the adoption of advanced compressor technologies.

b. Some of the key players operating in the North America air compressor market include Atlas Copco, BAUER COMP Holding GmbH, Hitachi Industrial Equipment Systems Co. Ltd., Ingersoll Rand, KAESER KOMPRESSOREN, MAT Holding, Inc., Hanwha Power Systems CO., LTD., Sullair LLC, Doosan Portable Power, Sullivan-Palatek, Inc., ELGi, FS-ELLIOT CO., LLC, ZEN AIR TECH PRIVATE LIMITED, Frank Technologies Private Limited, Oasis Manufacturing.

b. Stringent environmental regulations and a growing emphasis on sustainability have led industries to adopt more environmentally friendly equipment. Air compressors are used in various pollution control and emission reduction processes, to ensure compliance with these regulations. These factors are expected to augment the market demand in the coming years.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."