- Home

- »

- Organic Chemicals

- »

-

North America Aerosol Propellants Market, Industry Report, 2030GVR Report cover

![North America Aerosol Propellants Market Size, Share & Trends Report]()

North America Aerosol Propellants Market Size, Share & Trends Analysis Report By Product (Hydrocarbons, DME, Nitrous Oxide & Carbon Dioxide), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-275-8

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

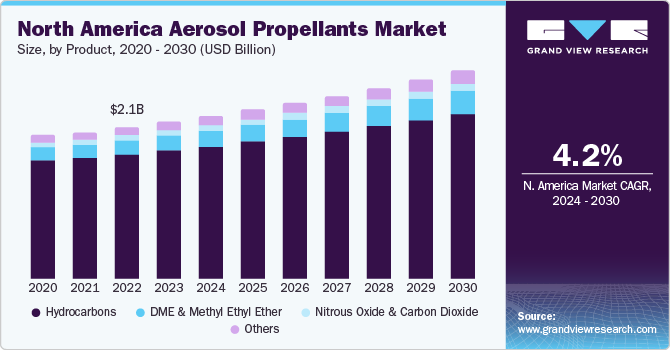

The North America aerosol propellants marketwas valued at USD 2.22 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. This growth is attributed to several key driving factors including the significant expansion of the cosmetic industry, leading to an increased preference for aerosol-based products. These propellants find application in antiperspirants, shaving creams, hair mousses, and air fresheners. Secondly, the trend of urbanization, especially in developing economies, has spurred demand for aerosol-based household formulations such as insect repellents, disinfectants, and air fresheners.

Aerosol paints are widely used for refurbishing vehicles, touching up dents, and enhancing aesthetics. Furthermore, innovations like environment-friendly propellants have gained traction. These cans minimize volatile organic compounds (VOCs) and find applications in health and hygiene products. Rising consumer spending capacity and the continual launch of novel gender-specific personal care items further bolster the market’s prospects.

Regulations play a crucial role in shaping the market. For instance, Section 610 (d) of the Clean Air Act resulted in the prohibition of HCFC-141b in aerosol solvents. Additionally, there are increasing government and environmental regulations concerning ozone layer depletion, attributed to compounds like CFC, HCFC, and HFC. These stringent measures are expected to restrain the market’s growth in the near future. Furthermore, the phasing out of chlorofluorocarbons (CFCs) as propellants due to regulatory requirements regarding volatile organic compounds (VOC) emissions and ozone depletion potential (ODP) has significantly affected the industry in Europe, North America, and Asia-Pacific.

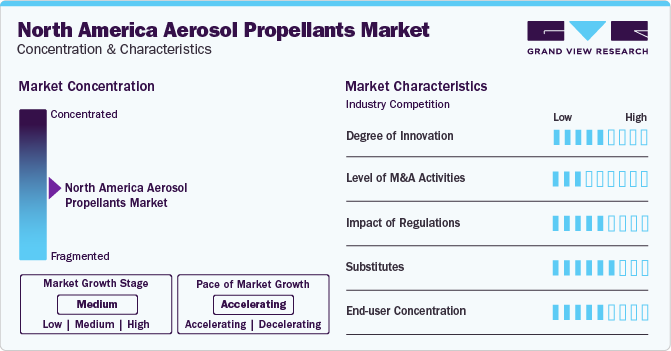

Market Concentration & Characteristics

Innovation within the market is robust, with companies investing in research and development to create eco-friendly, low-cost, and low-VOC products. This innovation is driven by the need to comply with environmental regulations and consumer demand for sustainable products.

The threat of substitutes in the industry is moderated by the industry’s move towards more sustainable and environmentally friendly options. However, the market does face challenges from the potential health risks associated with the use of chemical compounds in products. These concerns could drive consumers towards alternative products that do not use propellants. Additionally, companies are developing products with very low Global Warming Potential (GWP), which could increase the demand for other alternatives such as nitrogen, DMEs, and carbon dioxide.

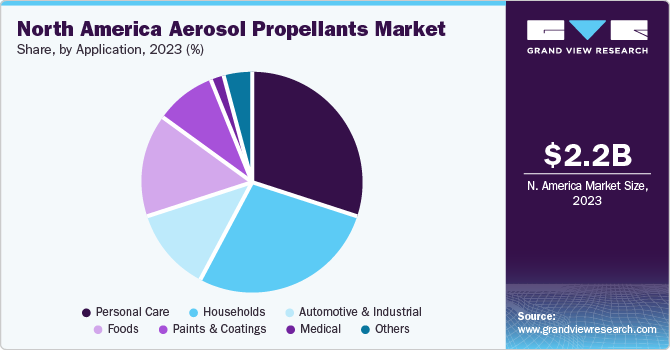

The personal care segment dominates the end-user market, reflecting the extensive use of aerosol propellants in products like deodorants, hair sprays, and shaving creams. This segment’s growth is fuelled by rising consumer spending power and the growing skincare industry in emerging economies.

Product Insights

Hydrocarbons dominated the market with a revenue share of 81.5% in 2023. This dominance can be attributed to their widespread use in various applications due to their cost-effectiveness and ease of availability. Hydrocarbons, such as propane, butane, and isobutane, are commonly used as propellants in aerosol products. They are preferred for their low cost, high stability, and good performance characteristics. However, environmental concerns related to the use of hydrocarbons may impact their market share in the future.

On the other hand, dimethyl ether (DME) and methyl ethyl ether are projected to witness the fastest growth in terms of revenue, with a CAGR of 5.8% from 2024 to 2030. The growth of these segments can be attributed to their superior properties such as low toxicity, non-flammability, and high stability. These ethers are increasingly being used as alternatives to traditional hydrocarbon propellants in various applications, including personal care products, paints, and medical aerosols. Their rapid growth indicates a shift in the market towards more environmentally friendly and sustainable propellant options.

Application Insights

The personal care application dominated the market with a revenue share of 29.4% in 2023. This segment encompasses a wide range of products, including deodorants, hair sprays, shaving creams, and antiperspirants. The high market share is indicative of the growing consumer demand for personal hygiene and grooming products. The trend toward personal care products that offer conveniences, such as aerosol-based cosmetics and pharmaceuticals, has been a major growth driver.

The medical segment is projected to experience the fastest growth, with a CAGR of 6.9% from 2024 to 2030. This rapid growth can be attributed to the increasing use of aerosol propellants in pharmaceutical applications, including inhalers and topical medications. The convenience and precision in dosage that aerosol delivery systems provide make them indispensable in medical treatments. Moreover, the ongoing research and development in the field of aerosol medicine are likely to introduce innovative products that could further drive the demand for product in this segment. The aging population and the rising prevalence of respiratory diseases are additional factors contributing to the growth.

Country Insights

U.S. Aerosol Propellants Market Trends

The U.S. dominated the market with a revenue share of 79.3% in 2023. The country holds a pivotal position in the North America aerosol propellants market, driven by robust demand in personal care and household applications. The market is propelled by technological advancements and the presence of major industry players who are focusing on eco-friendly and low-VOC products. The U.S. market is also influenced by stringent regulations on aerosol emissions, which has led to innovation in product development to meet environmental standards.

Canada Aerosol Propellants Market Trends

Canada’s aerosol propellants market is a significant contributor to the North American region. The market benefits from the country’s advanced healthcare and personal care industries. Canadian consumers’ growing awareness of eco-friendly products is shaping the market. The demand for aerosol propellants in food applications is also on the rise, reflecting global trends towards convenience in food packaging.

Key North America Aerosol Propellants Company Insights

The North America aerosol propellants market exhibits a moderate level of market concentration, with a few key players dominating the industry. Some key players operating in this market include Royal Dutch Shell PLC, Honeywell International, and Arkema Group:

-

Royal Dutch Shell PLC offers a diversified product portfolio, Shell has been focusing on sustainable solutions to meet the evolving demands of the market. In the context of aerosol propellants, Shell offers a range of products that are designed to be environmentally friendly, aligning with the market’s shift towards low-VOC and zero-ODP substances

-

Honeywell International Inc. is a multinational conglomerate that plays a pivotal role in the North America aerosol propellants market. Honeywell’s expertise in developing advanced materials has allows it to offer a variety of aerosol propellant solutions that cater to the needs of personal care, household, and medical applications

Key North America Aerosol Propellants Companies:

- Royal Dutch Shell PLC

- Honeywell International Inc.

- Arkema Group

- The Chemours Company

- Nouryon

- Aeropres Corporation

- BOC Ltd.

- AkzoNobel NV

- DuPont de Nemours, Inc.

- Lapolla Industries Inc

Recent Developments

-

In November 2023, The Chemours Company commenced a strategic enhancement of its manufacturing capabilities, targeting a 20% increase in the production of the eco-friendlier aerosol propellant, HFC-152a, at its Texas plant. This initiative is in direct response to evolving regulatory standards aimed at minimizing the usage of propellants with a high global warming potential (GWP)

-

In August 2023, Honeywell announced a commercial partnership with Recipharm to speed the development of pressurized metered dose inhalers (pMDIs) that use Honeywell’s near-zero global warming potential (GWP) propellant. This highlightsa broader industry shift towards environmentally responsible products

-

In June 2023, AkzoNobel NV disclosed a series of new investments within the North American territory, encompassing the establishment of a pilot manufacturing facility and a dedicated regional research and development hub. These strategic investments are anticipated to significantly contribute to the growth trajectory in the region, enhancing its innovation capacity and market reach.

North America Aerosol Propellants Market Scope

Report Attribute

Details

Market size value in 2024

USD 2.30 billion

Revenue forecast in 2030

USD 2.94 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, country

Country Scope

U.S., Canada, Mexico

Key companies profiled

Royal Dutch Shell PLC; Honeywell International Inc.; Arkema Group; The Chemours Company; Nouryon; Aeropres Corporation; BOC Ltd.; AkzoNobel NV; DuPont de Nemours, Inc.; Lapolla Industries Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Aerosol Propellants Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America aerosol propellants market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hydrocarbons

-

DME and Methyl Ethyl Ether

-

Nitrous Oxide and Carbon Dioxide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Personal Care

-

Households

-

Automotive and Industrial

-

Foods

-

Paints and Coatings

-

Medical

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America aerosol propellants market size was estimated at USD 2.22 billion in 2023 and is expected to reach USD 2.30 billion in 2024.

b. The North America aerosol propellants market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 2.94 billion by 2030.

b. Hydrocarbons dominated the North America aerosol propellants market with a share of 81.5% in 2023. This is attributable to their widespread use in various applications due to their cost-effectiveness and ease of availability. They are preferred for their low cost, high stability, and good performance characteristics.

b. Some key players operating in the North America aerosol propellants market include Royal Dutch Shell PLC; Honeywell International Inc.; Arkema Group; The Chemours Company; Nouryon; Aeropres Corporation; BOC Ltd.; AkzoNobel NV; DuPont de Nemours, Inc.; Lapolla Industries Inc.

b. Key factors that are driving the market growth include the significant expansion of the cosmetic industry, leading to an increased preference for aerosol-based products. Secondly, the trend of urbanization, especially in developing economies, has spurred demand for aerosol-based household formulations such as insect repellents, disinfectants, and air fresheners.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."