- Home

- »

- Petrochemicals

- »

-

North America Aerosol Lubricants Market Size Report, 2030GVR Report cover

![North America Aerosol Lubricants Market Size, Share & Trends Report]()

North America Aerosol Lubricants Market Size, Share & Trends Analysis Report By Product (Dry/Solid, Mineral), By End-use (Aerospace, Automotive, Construction, Food Processing), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-457-4

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

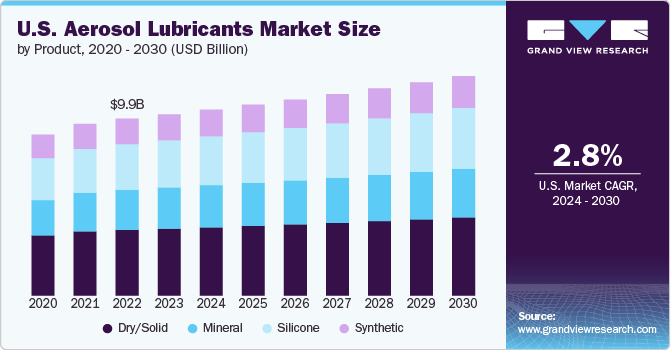

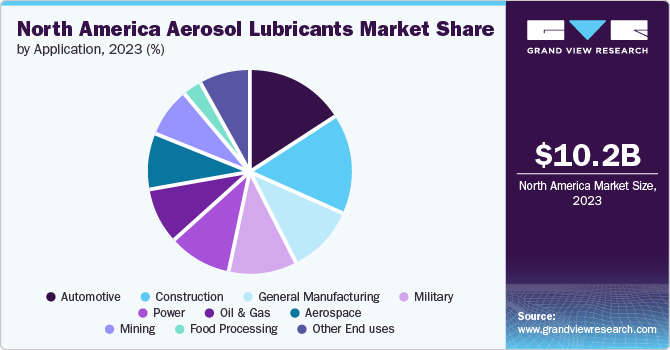

The North America aerosol lubricants market was valued at USD 10.22 billion in 2023 and is projected to grow at a CAGR of 3.0% from 2024 to 2030. The increase in construction activities in the region has emerged as a major driver for the growth of aerosol lubricants market in North America. Construction machinery and equipment, including excavators, bulldozers, cranes, and loaders, require efficient lubrication to ensure their smooth operations and longevity. This fuels the consumption of aerosol lubricants in the region.

The market is a significant segment of the overall global lubricants market. Aerosol lubricants are widely used in automotive, aerospace, industrial machinery, power generation units, and transportation applications. They have high boiling point, viscosity index, and oxidation resistance, along with hydraulic and thermal stability. These lubricants help reduce friction in different applications, thereby contributing to their increased global demand.

The surge in demand for aerosol lubricants in emerging applications such as food & beverages and the increasing development of food-grade aerosol lubricants by leading manufacturers drive the growth of the market in North America.

Aerosol cans are pressurized vessels that are designed to store fluidic substances under high pressure. These cans have specialized valves, nozzles, and propellants that allow the controlled dispensing of their content. They are widely used for painting, polishing, and lubricating applications. Aerosol cans are also commonly used in the automotive and construction industries. In addition, food-grade aerosol lubricants display qualities of non-toxicity, water resistance, and corrosion inhibition, thereby leading to their use in the packaging of food products.

The growth of the global aerosol lubricants market is driven by the flourishing automotive industry and ongoing industrial development across the world, along with the presence of automotive manufacturing industries in key countries of Asia Pacific, including China and India. Additionally, aerospace lubricant market has witnessed considerable growth due to increasing air traffic and ongoing mobility advancements in emerging economies.

Product Insights

Dry/Solid aerosol lubricants segment dominated the market in 2023 by accounting for a revenue share of 36.72%. These aerosol lubricants are particularly useful in extreme operational conditions, vacuum environments, corrosive environments, or high temperatures, wherein it is not suitable to use oil or grease.

Mineral aerosol lubricants are typically composed of mineral oils such as base oil, which is a petroleum fraction. These lubricants possess several characteristics that make them useful in various applications. They have a high boiling point and low freezing point that allow mineral aerosol lubricants to remain in a liquid state within a wide range of temperatures. Silicone aerosol lubricants are primarily composed of silicone as a raw material, along with other additives.

End-use Insights

Automotive aerosol lubricants segment dominated the market in 2023 by accounting for a revenue share of 16.15%. The growth of the automotive industry in North America acts as a driver for the surged consumption of aerosol lubricants in the region. According to Organisation Internationale des Constructeurs d'Automobiles (OICA), the automotive industry in North America has been witnessing steady growth owing to surged vehicle production and ownership in the region with over 15.5 million automobiles sold in 2023 that was the highest since 2019.

Construction is one of the key end use segments for the North America aerosol lubricants market. Aerosol lubricants are widely used in the construction industry for maintenance and repair purposes. They are particularly useful for lubricating hard-to-reach areas, such as hinges, nuts, bolts, and other moving parts. Aerosol lubricants are also used to protect equipment from rust and corrosion, which is a common problem in the construction industry, due to exposure to harsh weather conditions.

Country Insights

U.S. Aerosol Lubricants Market Trends

The U.S. emerged as a leading consumer of aerosol lubricants in North America in 2023 and accounted for a revenue share of 77.99% of the market in the same year. The mining industry in the country is a key consumer of aerosol lubricants. This industry is growing in the U.S. due to tripled demand for lithium, a 40% rise in nickel demand, and a 70% increase in demand for cobalt observed in the country from 2017 to 2022 as per the Critical Mineral Market Review of the International Energy Administration. The surging demand for minerals in the U.S. is expected to provide impetus to mining operations in the country in the coming years, thereby leading to a rise in the consumption of aerosol lubricants.

Canada Aerosol Lubricants Market Trends

The lubricants market in Canada is expected to experience growth, due to factors, such as increased vehicle demand, the development of road infrastructure, and technological advancements. Infrastructure development projects, such as road construction and expansion, contribute to the demand for aerosol lubricants in the local construction industry. For instance, according to the Canadian Construction Association, the construction industry contributes around USD 151 billion to the country’s GDP in 2023. The increasing number of construction projects being undertaken by the federal government for residential as well as industrial projects are poised to act as major drivers for the construction industry in Canada.

Mexico Aerosol Lubricants Market Trends

According to the U.S. International Trade Administration, Mexico is the world’s seventh-largest passenger vehicle manufacturer in 2023, producing more than 3.5 million vehicles per year. The country acts as a major exporter of vehicles to the U.S., exporting 76% of the total produced units to the U.S. The heavy vehicles section of the industry is a major contributor to the Mexican economy, forming the fifth-largest industry in the world on account of the presence of more than 14 manufacturers of trucks, buses, tractors, and others in the country. Thus, the automotive industry forms one of the major end user industries for the aerosol lubricants market in the country.

Key North America Aerosol Lubricants Company Insights

Major players operating in the market are 3M, Blaster Holdings, ITW ProBrands, Schaeffer Manufacturing Company, WD-40, Condat Corp, CRC Industries Americas Group, Ambro-Sol, etc.

-

3M is one of the leading manufacturing companies serving a wide range of products to numerous end use industries like automotive, electronics & electrical, transportation, consumer goods, energy, healthcare, and general manufacturing. The company operates through four business segments, namely safety & industrial; healthcare; transportation & electronics; and consumer. It offers aerosol lubricants in its general-purpose lubricants segment. The U.S. alone accounted for 39% of the company’s sales in 2022. It has subsidiaries in over 70 countries and manufacturing sites across 37 of them. The company lays a strong emphasis on research & development with USD 1.8 billion spent in 2022 alone for maintaining labs in 36 countries and involving over 8,100 researchers worldwide.

-

AEROCHEM INC. is a Canadian manufacturer and distributor of lubricants, cleaners, cutting fluids, greasers, and other products for specific uses in industrial equipment. It was acquired by Walter Surface Technologies in 2020. Around 90% of the company’s products are authorized to be used in the Canadian food sector. The company offers aerosol lubricants under its special lubricants product segment. It helps provide alternative solutions to customers for industry cleaning and maintenance operations.

Key North America Aerosol Lubricants Companies:

- 3M

- AEROCHEM INC.

- Ambro-Sol

- American Honda Motor Co., Inc.

- B’laster Holdings

- CONDAT Corporation

- CRC Industries

- Eureka Chemical Company

- HUSK-ITT Corporation

- Illinois Tool Works Inc.

- JAX Incorporated

- Kano Laboratories, LLC.

Recent Development

-

Leading manufacturers of aerosol lubricants launch new products in the market to meet the rising demand for novel products. For instance, in September 2022, ROCOL introduced ROCOL FOODLUBE 1500, which offers water resistance and corrosion protection.

North America Aerosol Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10,500.52 million

Revenue forecast in 2030

USD 12,532.41 million

Growth rate

CAGR of 3.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

3M, Blaster Holdings, ITW ProBrands, Schaeffer Manufacturing Company, WD-40, Condat Corp, CRC Industries Americas Group, Ambro-Sol, etc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Aerosol Lubricants Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America aerosol lubricants market report based on product, end-use, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Dry/Solid

-

Mineral

-

Silicone

-

Synthetic

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Aerospace

-

Automotive

-

Construction

-

Food Processing

-

General Manufacturing

-

Military

-

Mining

-

Oil & Gas

-

Power

-

Other End uses

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America aerosol lubricants market was valued at USD 10.22 billion in 2023 and is projected to reach USD 10.50 billion by 2030

b. The North America aerosol lubricants market is projected to reach USD 12.53 billion by 2030, at a CAGR of 3.0% from 2024 to 2030.

b. Dry/Solid aerosol lubricants segment dominated the market in 2023 by accounting for a revenue share of 36.72%. These aerosol lubricants are particularly useful in extreme operational conditions, vacuum environments, corrosive environments, or high temperatures, wherein it is not suitable to use oil or grease.

b. Some prominent players in the North America aerosol lubricants market include: ● 3M ● AEROCHEM INC. ● Ambro-Sol ● American Honda Motor Co., Inc. ● B’laster Holdings ● CONDAT Corporation ● CRC Industries ● Eureka Chemical Company

b. Construction machinery and equipment, including excavators, bulldozers, cranes, and loaders, require efficient lubrication to ensure their smooth operations and longevity. This fuels the consumption of aerosol lubricants in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."