- Home

- »

- Organic Chemicals

- »

-

North America Adipic Acid Market Size, Industry Report 2030GVR Report cover

![North America Adipic Acid Market Size, Share & Trends Report]()

North America Adipic Acid Market Size, Share & Trends Analysis Report By Application (Nylon 6, 6 Fiber; Nylon 6, 6 Resin; Polyurethane, Adipate Esters), By Country (U.S., Canada, Mexico), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-273-9

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

North America Adipic Acid Market Trends

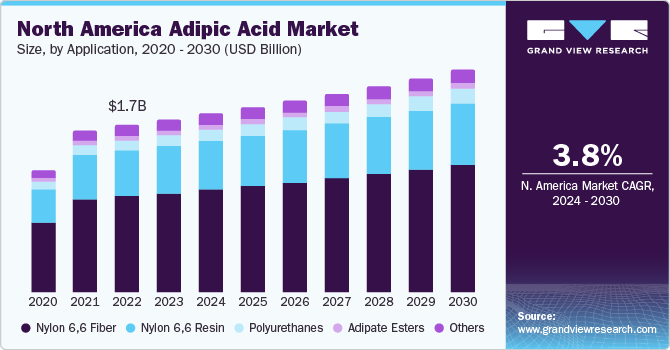

The North America adipic acid market size was valued at USD 1.66 billion in 2023 and is expected to grow at a CAGR of 3.8% from 2024 to 2030. North America is one of the world's major adipic acid consumers. The majority of nylon produced in North America is nylon 6,6, which is split into engineering resins and fibers that are propelling the market's expansion. Furthermore, the market is anticipated to grow due to the expanding residential construction industry in countries such as Canada and Mexico. This is expected to fuel the market's expansion by raising demand for adipic acid.

Adipic acid is an organic chemical, also known as hexanedioic acid. It is the most significant dicarboxylic acid from an industrial standpoint; each year, around 2.5 billion kilograms of this white, crystalline powder are manufactured, mostly as a precursor for the manufacture of nylon. Other than infrequently occurring in nature, adipic acid is a synthetic food additive with the E number E355. Adipates are the salts and esters of adipic acid. Beet juice naturally contains a dibasic carboxylic acid called adiabatic acid. In the food sector, this acid is frequently used for neutralizing and buffering purposes. It works well for making baking powder and soft drink powders because of its hygroscopic nature.

The need for adipic acid is being driven by the increasing usage of nylon 6, 6 to produce lightweight, durable plastic that is employed in the rapidly expanding automotive and electrical & electronics sectors worldwide. Adipic acid has widespread application in many end-use industries, including but not limited to electrical and electronics, automotive, building and construction, packaging and consumer goods, and textiles. Increasing demand in various industries for polyurethane, nylon 6, and 6 fiber is expected to support market expansion in the upcoming years.

Furthermore, due to its strong dielectric strength, flame retardancy, and insulation resistance, Nylon 6, 6 resin is also utilized in the electronics industry for the development of circuit breakers, computer motherboards, power tool housing, terminal blocks for electronic devices, and connectors for mobile phones. In the upcoming years, it is projected that further digitization and the rising use of electronic devices like computers, television sets, and smartphones will support the expansion of the electrical and electronics business globally. This is anticipated to increase the demand for adipic acid, which is used as a feedstock to produce nylon 6, 6, and consequently boost the use of nylon 6, 6.

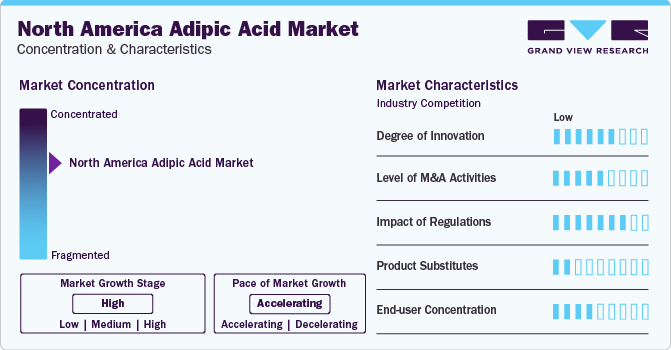

Market Concentration & Characteristics

The North America Adipic Acid Market is marked by a moderate to high degree of innovation. Adipic acid applications and production methods may exhibit some innovation, but not to an unusually high degree when compared to other industries. Since adipic acid is a well-known chemical molecule with proven uses, advancements might be more gradual than revolutionary.

The market has witnessed a moderate amount of merger and acquisition activity. For instance, in October 2023, Thermo Fisher, the leader in the world of supporting science, and Olink Holding AB (publ) (“Olink”) (Nasdaq: OLK), a prominent supplier of next-generation proteomics solutions, jointly announced that their boards of directors have authorized Thermo Fisher's acquisition proposal of Olink for $26.00 in cash per common share, or $26.00 per American Depositary Share (ADS). Although there has been significant consolidation among major firms, mergers and acquisitions are not causing the market to consolidate quickly.

The market is significantly impacted by regulations about safety requirements and environmental impact in chemical manufacture. Adherence to rules holds significant importance for industry participants as it can impact manufacturing processes, expenses, and competitiveness in the market.

Primarily, adipic acid is utilized as an intermediate in the manufacturing of nylon and other polymers. In these businesses, there aren't many alternatives to its applications, hence the impact of replacement services is minimal. The overall degree of product expansion is low, even though there might be some level of it, especially in terms of niche applications or modified forms of adipic acid. The need for well-established industries including electronics, automobiles, and textiles drives the industry.

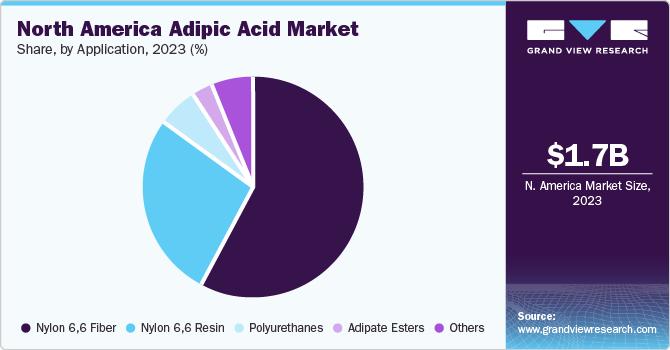

Application Insights

The nylon 6,6 fiber dominated the market with the largest revenue share of 57.8% in 2023. This growth is attributed to the advantages of nylon 6,6 fiber, including its resistance to moisture and mildew, high melting point, exceptional durability, and enhanced strength. A nylon flake is melted and extruded via spinnerets to create nylon 6,6 fiber, which is a long filament or fiber. Usually, amines and straight-chain aliphatic acids are used in its synthesis. In its name, the first digit stands for a diamine, and the second for a diacid. Among other things, this fiber is utilized in tire cords, parachutes, and women's undergarments.

The Nylon 6,6 Resin registered a significant market share in 2023 owing to its increased use in the automotive industry to reduce the overall weight of vehicles, which is anticipated to result in a reduction in the amount of harmful gasses that autos emit into the atmosphere. A semi-crystalline engineering thermoplastic, nylon 6,6 resin is easily processed for use in injection molding and extrusion applications. Because of its excellent chemical and heat resistance, high mechanical strength, and stiffness, nylon 6,6 resin is a great material to use in carpets, clothing, airbags, vehicle parts, and electrical and electronic components.

Country Insights

U.S. Adipic Acid Market Trends

The U.S. adipic acid market accounted for the largest market share of 79.4% in 2023. This growth is due to the increased use of nylon 6,6 fiber in the automotive industry due to its strength and durability, the U.S. market for adipic acid is growing. Furthermore, new uses for adipic acid are being developed as a result of the inventiveness and technological breakthroughs of the American chemical industry, including the manufacture of coatings, adhesives, and medications. The nation's strong regulatory framework, emphasis on sustainability, and well-developed infrastructure all contribute significantly to the growth of the adipic acid industry.

Canada Adipic Acid Market Trends

The adipic acid market in Canada held a significant market share in 2023. The robust manufacturing sector in the country, especially in the automotive and textile industries-supports the expansion of the adipic acid market. The development of bio-based substitutes and the growing emphasis on sustainable practices both serve to increase the demand for adipic acid. The Adipic Acid market is growing due in part to Canada's advantageous trading position and highly skilled labor population, which attracts both manufacturers and investors.

Mexico Adipic Acid Market Trends

The mexico adipic acid market witnessed substantial growth in 2023. Mexico's expanding industrial base, particularly in the textile and automotive industries, is fueling the country's adipic acid market expansion. Mexico's status as a manufacturing powerhouse is strengthened by government attempts to stimulate foreign investment and trade agreements with important markets, which raises demand for adipic acid, a crucial raw material. The development of Mexico's adipic acid sector is further aided by the nation's improved infrastructure, cost-effective labor force, and proximity to the American market.

Key North America Adipic Acid Company Insights

Many smaller manufacturers and suppliers serve specialized markets or local markets, and a small number of major firms control a sizable percentage of the industry. This modest fragmentation suggests chances for innovation and a wide range of product offers, as well as healthy competition. Key players in the market include Ascend Performance Materials, INVISTA, and Dow Chemical Company.

-

Ascend Performance Materials produces and distributes Chemical products. The company provides a range of product categories, such as compounds, fibers, resins, specialized chemicals, and intermediate chemicals. The company has nine global locations where it conducts business, five of which are fully integrated plants in the Southeastern United States that produce and innovate nylon 6. There are three sizable, top-notch chemical processing facilities there

-

INVISTA is a company that deals in the production of fibers and textiles for the outdoor and travel, automobile, flooring, interior design, and clothing industries. Its Polymers & Plastics business also offers engineering polymer, nylon polymer, PET polymer, high-performance polyamide, and resin. In addition, the company manufactures chemical intermediates for various fiber and resin applications, including spandex and nylon.

G.J. Chemical; Toronto Research Chemicals; and Reagents are some other participants in the North America Adipic Acid market.

-

G.J. Chemical offers a GJ Therm range of industrial heat transfer fluids and coolants, along with hundreds of additional premium chemicals, blends, and bespoke formulations. In addition, the company provides FDA-registered repackaging, bottling, labeling, delivery, and other services.

Key North America Adipic Acid Companies:

- Ascend Performance Materials

- INVISTA

- Química Delta

- Dow Chemical Company

- SAE Manufacturing Specialties Corp

- Thermo Fisher Scientific Inc.

- GJ Chemical

- Toronto Research Chemicals

- MilliporeSigma

- CJ Chemicals

- Reagents

Recent Developments

-

In March 2024, Dow Chemical Company introduced two new sustainable propylene glycol (PG) solutions with circular and bio-circular feedstocks in North America. Due to a mass balance approach, clients can now provide their high-performance goods with externally proven environmental benefits, making them suitable for a wide range of applications. The mass balancing method, which was recently certified by ISCC PLUS in Freeport, Texas, tracks the movement of circular and bio-circular materials required to create PG through intricate value chains and assigns values based on verifiable bookkeeping

-

In November 2023, Thermo Fisher Scientific Inc. (NYSE: TMO), and bioplatform innovation business Flagship Pioneering announced the establishment of a strategic alliance to speed the development and commercialization of multi-product platforms. Using this partnership, Thermo Fisher and Flagship will jointly establish new platform firms that prioritize cutting-edge tools and skills intending to bolster the biotech ecosystem and expedite the creation of best-in-class therapeutics. The recently established strategic alliance is an extension of Thermo Fisher and Flagship's long-standing supply relationship, spanning across Flagship's network of businesses and utilizing both companies' areas of expertise in life science tools, diagnostics, and services

-

In June 2023, Ascend Performance Materials announced the launch of Cerene, a series of recycled polymers and materials created using the company’s unique carpet reclamation technique. Cerene is accessible as calcium carbonate, PET, polyamides 6 and 66, and polypropylene as a reliable, sustainable feedstock for a variety of uses, such as compounding and molding. Cerene aims to carry on this history by providing nylon 6,6 products and introducing recyclable polymers including PET, PP, and nylon 6. A method that reduces environmental impact and our carbon footprint is used to mechanically recycle cerene

North America Adipic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.72 billion

Revenue forecast in 2030

USD 2.15 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilo tons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Key companies profiled

Ascend Performance Materials; INVISTA; Química Delta; Dow Chemical Company; SAE Manufacturing Specialties Corp; Thermo Fisher Scientific Inc.; GJ Chemical; Toronto Research Chemicals; MilliporeSigma; CJ Chemicals; Reagents.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Adipic Acid Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America adipic acid market report based on application, and region:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Nylon 6,6 Fiber

-

Automobile

-

Polyurethanes

-

Adipate Esters

-

Others

-

-

Country Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America adipic acid market size was estimated at USD 1.66 billion in 2023 and is expected to reach USD 1.72 billion in 2024.

b. The North America adipic acid market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 2.15 billion by 2030.

b. Nylon 6,6 fiber segment dominated the North America adipic acid market with a share of 57.8% in 2023. This is attributable to the advantages of nylon 6,6 fiber, including its resistance to moisture and mildew, high melting point, exceptional durability, and enhanced strength.

b. Some key players operating in the North America adipic acid market include Ascend Performance Materials; INVISTA; Química Delta; Dow Chemical Company; SAE Manufacturing Specialties Corp; Thermo Fisher Scientific Inc.; GJ Chemical; Toronto Research Chemicals; MilliporeSigma; CJ Chemicals; Reagents.

b. Key factors that are driving the market growth include expanding residential construction industry in countries such as Canada and Mexico, and rapid employment in the expanding automotive and electrical & electronics sectors worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."