- Home

- »

- Petrochemicals

- »

-

North America Adhesives And Sealants Market, Industry Report, 2030GVR Report cover

![North America Adhesives And Sealants Market Size, Share & Trends Report]()

North America Adhesives And Sealants Market Size, Share & Trends Analysis Report By Technology (Water-based, Solvent-based, Hot Melt), By Product, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-290-3

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The North America adhesives and sealants market was estimated at USD 14.49 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The growth is attributed to a confluence of factors such as advancements in chemical engineering, an uptick in manufacturing and construction activities, and a heightened demand for sustainable and high-performance materials. As industries seek more efficient and durable bonding solutions, the market is set to adhere to an upward path, sealing its importance in the fabric of North American commerce.

Regulations have a significant impact on the market in North America. For instance, the United States Environmental Protection Agency (USEPA) has enforced stringent regulations that have compelled manufacturers to produce eco-friendly products with no or low Volatile Organic Compound (VOC) levels. This is because VOCs contribute to air pollution, which can lead to health issues such as respiratory and cardiovascular diseases.

In response to these regulations, manufacturers are shifting towards the production of environmentally friendly adhesives and sealants. This shift, while aligning with the industry’s commitment to sustainability, has also created opportunities for companies to expand their business. However, it’s worth noting that these environmentally conscious alternatives often come at a higher cost, which can affect the profit margins of manufacturers.

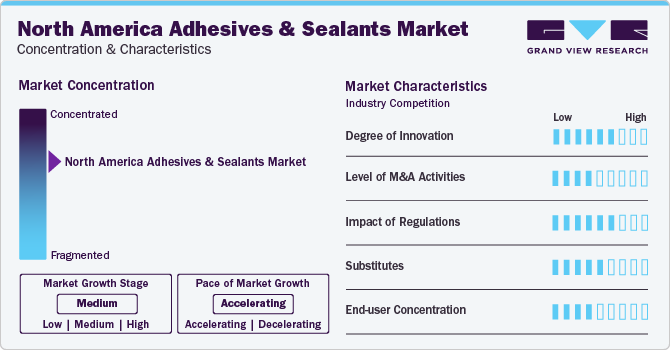

Market Concentration & Characteristics

In terms of innovation, the market is highly dynamic. Companies are continuously investing in R&D to develop new and improved products. For instance, there has been a significant focus on developing environmentally friendly adhesives and sealants in response to regulatory pressures and changing consumer preferences.

The threat of substitutes is relatively low due to the specialized nature of several products. However, ongoing research and development activities could potentially lead to the introduction of new materials that could act as substitutes.

The end-user concentration varies across different industries. The construction, automotive, packaging, and electronics industries are among the major end-users of adhesives and sealants. The U.S. dominates the demand for the adhesives and sealants market in North America.

Adhesives Technology Insights

Water-based dominated the market with the highest revenue share of 23.5% in 2023. These are preferred due to their non-flammable nature, making them safer to handle and store. They find extensive applications in the packaging, construction, automotive, leather, and furniture industries. The demand for water-based adhesives in North America is driven by their environmental benefits and compliance with stringent regulations. The market for water-based adhesives is projected to witness the fastest growth, attributed to advancements in emulsion technology and the development of water-based inks and adhesives as sustainable alternatives to solvent-based systems.

Solvent-based are expected to experience a notable growth rate of 7.8% from 2024 to 2030. These adhesives offer unique characteristics and performance advantages, leading to their extensive applications across various industries. However, they face challenges due to environmental concerns and regulatory pressures to reduce volatile organic compound (VOC) emissions. Despite these challenges, the solvent-based adhesives market is anticipated to grow, driven by improvements in the economy and the alleviation of supply chain concerns.

Adhesives Product Insights

Acrylic adhesives dominated the market with a revenue share of 36.7% in 2023. These adhesives are known for their excellent environmental resistance and fast-setting times, making them ideal for a wide range of applications. They are extensively used in industries such as packaging, construction, automotive, leather, and furniture. The increase in the number of construction projects, as well as the expansion of the packaging industry, are also driving demand for acrylic adhesives.

Ethylene Vinyl Acetate (EVA) adhesives are projected to experience the second-fastest growth in revenue in the North America adhesives market, with a CAGR of 6.5% from 2024 to 2030. EVA adhesives are known for their versatility and are used in a variety of applications, including cardboard sealing, joining paper packaging, and laminating films. The growth of the EVA adhesives market can be attributed to the increasing demand for food and beverage packaging and the rapid growth of sustainable packaging solutions. Despite the challenges posed by environmental concerns and regulatory pressures, the EVA adhesives market is anticipated to grow, driven by improvements in the economy and the alleviation of supply chain concerns.

Adhesives Application Insights

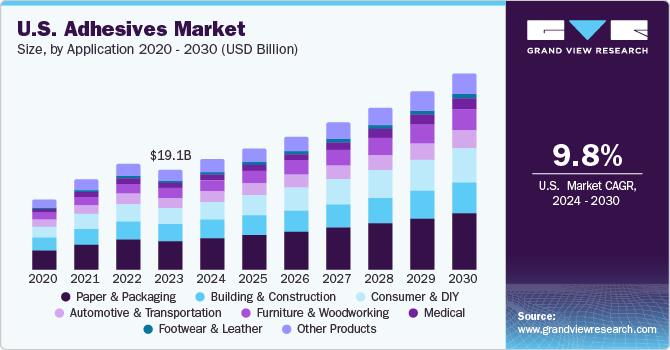

The paper and packaging sector dominated the market with a revenue share of 29.4% in 2023. This dominance can be attributed to the extensive use of adhesives in various packaging applications, including carton sealing, labeling, and flexible packaging. The growth in e-commerce and the increasing demand for packaged food and beverages are likely to drive the demand for adhesives in this sector. Moreover, the shift towards sustainable packaging solutions is expected to further boost the market for adhesives in the paper and packaging industry.

The furniture and woodworking segment is projected to witness the fastest growth in terms of revenue, with a CAGR of 9.6% from 2024 to 2030. Adhesives play a crucial role in this industry, being used in a wide range of applications such as panel lamination, edge banding, doweling, and veneering. The growth in this segment can be attributed to the increasing demand for furniture due to urbanization and the rise in residential and commercial construction activities. Furthermore, the trend towards DIY furniture and the growing popularity of engineered wood products are likely to fuel the demand for adhesives in the furniture and woodworking industry.

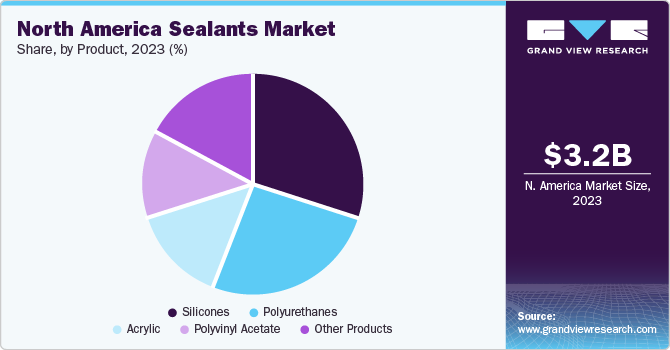

Sealants Product Insights

Silicones dominated the market with the highest revenue share of 33.1% in 2023. This dominance can be attributed to the extensive use of silicone sealants in various applications due to their excellent properties such as high flexibility, chemical stability, and weather resistance. Silicones are widely used in construction, automotive, and electronics industries. Moreover, the silicone segment is also projected to witness the fastest growth in the market. This is due to the growing need for silicone sealants in the rising construction industry, particularly in residential and commercial building projects.

Acrylic sealants are projected to witness the second-fastest growth in terms of revenue, with a CAGR of 6.2% from 2024 to 2030. Acrylic sealants are popular due to their easy application, paintability, and compatibility with most materials. They are widely used in sealing and bonding applications in the construction industry, such as in joints, cracks, and gaps in building components. The growth in this segment can be attributed to the increasing construction activities in North America and the growing demand for high-quality and durable sealants in the construction industry. Furthermore, the trend toward sustainable and green building practices is likely to fuel the demand for acrylic sealants.

Sealants Application Insights

The construction sector dominated the market with the highest revenue share in 2023. This dominance can be attributed to the extensive use of sealants in various construction applications, including glazing, waterproofing, and insulation. The growth in the construction industry, particularly in residential and commercial building projects, is likely to drive the demand for sealants. Moreover, the shift towards sustainable construction practices and the increasing demand for energy-efficient buildings are expected to further boost the market for sealants in the construction industry.

The packaging segment is projected to witness the second-fastest growth in terms of revenue, with a CAGR of 7.9% from 2024 to 2030. Sealants play a crucial role in this industry, being used in a wide range of applications such as carton sealing, labeling, and flexible packaging. The growth in this segment can be attributed to the increasing demand for packaged food and beverages and the growth in e-commerce. Furthermore, the trend towards sustainable packaging solutions and the increasing need for tamper-evident and leak-proof packaging are likely to fuel the demand for sealants in the packaging industry.

Country Insights

In North American adhesives and sealants market, the U.S. holds the largest market share. Specifically, it accounts for around 83% of the total revenue in the adhesives market and around 80% in the sealants market. This dominance can be attributed to the extensive use of adhesives and sealants in various industries such as construction, automotive, and packaging that are thriving in the U.S. The growth in these industries, particularly in residential and commercial building projects, is likely to drive the demand for adhesives and sealants in the U.S.

Mexico Adhesives And Sealants Market Trends

Adhesives and sealants market in Mexico, on the other hand, is projected to witness the fastest growth in terms of revenue with a CAGR of 9.7% and 9.1% from 2024 to 2030, respectively. The growth in this country can be attributed to the increasing industrialization and the growth in the manufacturing sector. Furthermore, the trend toward sustainable and green manufacturing practices is likely to fuel the demand for adhesives and sealants in Mexico. The shift towards sustainable construction practices and the increasing demand for energy-efficient buildings are expected to further boost the market for sealants in Mexico.

Key North America Adhesives And Sealants Company Insights

The market is characterized by a high degree of market concentration, with a few key players dominating the market. This concentration has been driven by the significant barriers to entry, including the need for substantial capital investment and technical expertise. Some key players operating in this market include Henkel Corporation, Sika AG, and 3M:

-

Henkel Corporation, a subsidiary of Henkel AG & Co. KGaA, is a key player in the North American adhesives and sealants market. The company offers a wide range of well-known consumer and industrial brands, including Loctite, Technomelt, and Bonderite adhesives. Henkel’s products are used extensively across various industries such as construction, automotive, and packaging

-

Sika AG is known for its polyurethane technology-based products, which are popular in the building and construction industry. The company’s strong focus on research and development, coupled with its wide product portfolio, has helped it maintain a significant presence in the market

Key North America Adhesives And Sealants Companies:

- Henkel Corporation

- Sika AG

- 3M

- H.B. Fuller Company

- Evonik Industries

- RPM International Inc.

- Dow

- Wacker Chemie AG

- Arkema

- Arkema Group

Recent Developments

-

In February 2024, Henkel acquired Seal for Life Industries LLC - a supplier of protective coating and sealing solutions. This acquisition supports Henkel's growth platform for maintenance, repair, and overhaul (MRO), and will enable the company to offer a wider range of high-quality products to its customers

-

In November 2023,Sika started expanding its polymer production capacity at its Sealy site in Texas to meet the growing demand for its concrete admixture in the US and Canada

-

In May 2023, H.B. Fuller Company acquired Adhezion Biomedical - a US-based medical adhesives company with proprietary cyanoacrylate technologies for surgical care, wound management, and infection prevention. The move solidifies H.B. Fuller's position as a major player in the medical adhesives industry, creating opportunities for further expansion and growth

North America Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.28 billion

Revenue forecast in 2030

USD 21.07 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, product, application, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Henkel Corporation; Sika AG; 3M; H.B. Fuller Company; Evonik Industries; RPM International Inc.; Dow; Wacker Chemie AG; Arkema; Arkema Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Adhesives And Sealants Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America adhesives and sealants market report based on technology, product, application, and country:

-

North America Adhesives Technology Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Water based

-

Solvent based

-

Hot melt

-

Other Technology

-

-

North America Adhesives Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Acrylic

-

Epoxy

-

EVA

-

Polyurethanes

-

PVA

-

Styrenic block

-

Other Products

-

-

North America Adhesives Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Automotive & Transportation

-

Building & Construction

-

Consumer & DIY

-

Footwear & Leather

-

Furniture & Woodworking

-

Medical

-

Paper & Packaging

-

Other Products

-

-

North America Sealants Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Silicones

-

Polyurethanes

-

Acrylic

-

Polyvinyl acetate

-

Other Products

-

-

North America Sealants Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Construction

-

Automotive

-

Packaging

-

Assembly

-

Consumers

-

Other Products

-

-

North America Sealants Country Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The market is characterized by a high degree of market concentration, with a few key players dominating the market. This concentration has been driven by the significant barriers to entry, including the need for substantial capital investment and technical expertise. Some key players operating in this market include Henkel Corporation, Sika AG, and 3M:

b. The growth of North America adhesives and sealants market is attributed to a confluence of factors such as advancements in chemical engineering, an uptick in manufacturing and construction activities, and a heightened demand for sustainable and high-performance materials. As industries seek more efficient and durable bonding solutions, the market is set to adhere to an upward path, sealing its importance in the fabric of North American commerce.

b. The North America adhesives and sealants market was estimated at USD 14.49 billion in 2023 and is expected to reach USD 15.28 billion in 2024.

b. The North America adhesives and sealants market is expected to grow at a CAGR of 5.5% from 2024 to 2030 to reach USD 21.07 billion by 2030.

b. U.S. dominated the North America adhesives and sealants market with a revenue share of 83% in 2023. This dominance can be attributed to the extensive use of adhesives and sealants in various industries such as construction, automotive, and packaging that are thriving in the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."