- Home

- »

- Organic Chemicals

- »

-

North America Acetic Acid Market Size & Share Report, 2030GVR Report cover

![North America Acetic Acid Market Size, Share & Trends Report]()

North America Acetic Acid Market Size, Share & Trends Analysis Report By Application (Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Purified Terephthalic Acid), By Country And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-273-8

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

North America Acetic Acid Market Trends

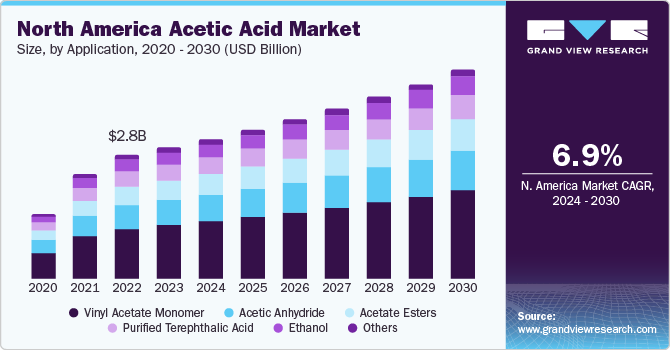

The North America acetic acid market was valued at USD 2.92 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030. The growth is majorly driven by the food and beverage industry, especially in the U.S. Other factors contributing to the growth of the acetic acid market in the region is the increasing demand from the paints and coatings industries. Acetic acid is used in water-based paints, coatings, and adhesives in the form of vinyl acetate monomer.

Overall economic growth in the region, increase in household income, as well as consumer expenditure, and changes in consumer lifestyle, have led to the changes in the dietary patters of the population. This has positively impacted the demand for meat products in North America. Thus, the application of acetic acid in meat industry has witnessed exceptional rise and this has become one of the prominent application in the region.

The global acetic acid market is also driven by the increase in demand from the pharmaceutical, food & beverage, and paints & coatings industries around the world, further fuelling the North America market. The U.S. is also home to several leading acetic acid manufacturers and suppliers like LyondellBasell Acetyls LLC, and Silverline Chemicals. In addition, the country is one of the leading consumers of Vinyl Acetate Monomer (VAM) due to being the leading consumer of paints and coatings. The coatings segment is expected to be the major market in the U.S. due to the increasing residential and non-residential constructions after its recovery from the global economic crisis.

Market Concentration & Characteristics

The market is moderately fragmented in nature. The growth is medium, and the pace is accelerating. Key market players are extensively investing in research and development activities to enhance their product portfolios and increase their market share. The existing strong presence of major players throughout the value chain is likely to act as an entry barrier in the market for new players.

The threat of substitutes is predicted to be low as there are no potential external substitutes that offer benefits similar to acetic acid. Very mild organic acid is expected to act as a substitute for acetic acid at several places without causing any harmful burns upon skin contact.

Impact of regulations is in favor of the market growth. Generally Recognized As Safe (GRAS) status has been given to acetic acid by the U.S. Food and Drug Administration. Favorable rules & regulations related to the use of acetic acid in various products across the globe is expected to drive the growth.

Application Insights

Vinyl acetate monomer (VAM) dominated the market with a revenue share of over 41% in 2023. It is also expected to witness the fastest CAGR of 7.3% during the forecast period. Improvements in the lifestyle of consumers and an increase in the number of house renovation and redecoration activities across North America, especially in the U.S., are driving the demand for paints & coatings. This, in turn, is anticipated to drive the demand for acetic acid.

Acetic acid is a major material required to manufacture vinyl acetate Monomers (VAM), which is a colorless and slightly sweet liquid. Vinyl acetate Monomers is used in the production of polyvinyl alcohol (PVA) and polyvinyl acetate (PVA). Polyvinyl acetate is further used in paints & coatings and adhesives, as well as in textile treatment applications. Polyvinyl alcohol is utilized for producing water-soluble packaging products, adhesives, textile wraps, and coatings. VAM is also used in the production of polyvinyl butyral and ethylene-vinyl acetate, which is further used in the manufacturing of various end-use products such as car safety glass, packaging films, heavy-duty bags, wire and cable jackets, and coatings.

Country Insights

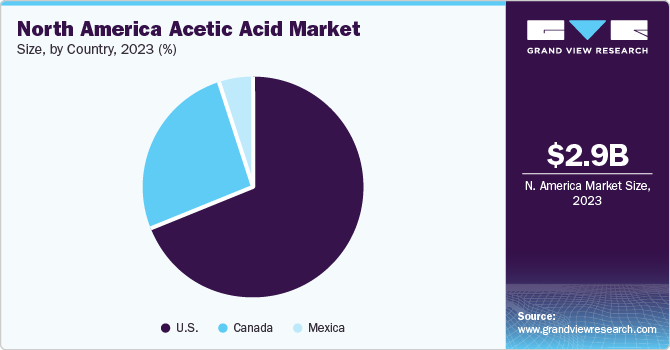

U.S. dominated the market with a revenue share of over 68% in 2023. It is also anticipated to grow at the fastest CAGR of 7.0% during the forecast period. Acetic acid is widely used in the food & beverage industry for food processing. Meat comprises a large portion of the food processing business in the U.S., implying that the product is widely consumed in the country. Due to changing consumer lifestyles and increased urbanization, which affect consumer consumption patterns, the U.S. market is expected to rise steadily over the forecast period.

The Canada market for acetic acid is growing at a similar CAGR as that of U.S. The high standards of living of the people of Canada have positioned it as an international leader in per capita coatings consumption rates at 8.4 kg per person similar to that of the U.S. The construction industry, which is a major end-user of paints and coatings, is the largest in Canada. It represents 6% of Canada’s GDP and employs more than 1.26 million individuals who help generate revenue of more than USD 90 billion every year. This factor is likely to boost the growth of the coatings segment, which will further boost the use of VAM in paint and coatings.

Mexico acetic acid market is growing at a moderate pace with meat processing being the major contributor since most Mexican dishes include meat as the main ingredient. The country's fast expansion of slaughterhouses and processing facilities has increased product accessibility in Mexico. The industry's distribution network has been strengthened, and the country's food and beverage segment has grown significantly. This is anticipated to have a positive impact on the acetic acid market in the coming years.

Key North America Acetic Acid Company Insights

The market is highly competitive with companies engaged in increasing their production capacity along with enhancing product differentiation. The companies are involved in merger & acquisition activities to increase the availability of their products in multiple parts of the world.

Key North America Acetic Acid Companies:

- Eastman Chemical Company

- Celanese Corporation

- LyondellBasell Industries Holdings B.V.

- SABIC

- HELM de México, S.A.

- DAICEL CORPORATION

- Dow

- INEOS

Recent Developments

-

In March 2024, Eastman Chemical Company announced increase in anhydride prices effective from April 1st, 2024. This rise in price is only for North & Latin America

-

In February 2024, Celanese Corporation announced its approval by the U.S. Department of Energy (DOE)’s Office of Fossil Energy and Carbon Management as a UPGrants (Utilization Procurement Grants) vendor. This has made Celanese the only producer of low-carbon acetic acid by the ECO-CC product name further complying with the sustainability concerns

North America Acetic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.11 billion

Revenue forecast in 2030

USD 4.65 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Regional Scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Eastman Chemical Company; Celanese Corporation; LyondellBasell Industries Holdings B.V.; SABIC; HELM de México, S.A.; DAICEL CORPORATION; Dow; INEOS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Acetic Acid Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America acetic acid market report based on application and country:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Vinyl Acetate Monomer

-

Acetic Anhydride

-

Acetate Esters

-

Purified Terephthalic Acid

-

Ethanol

-

Other Applications

-

-

Country Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America acetic acid market size was estimated at USD 2.92 billion in 2023 and is expected to reach USD 3.11 billion in 2024.

b. The North America acetic acid market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 4.65 billion by 2030.

b. Vinyl acetate monomer (VAM) dominated the North America acetic acid market with a share of over 41% in 2023. This is attributable to improvements in the lifestyle of consumers and an increase in the number of house renovation and redecoration activities across North America, especially in the U.S., resulting in paints & coatings demand.

b. Some key players operating in the North America acetic acid market include Eastman Chemical Company; Celanese Corporation; LyondellBasell Industries Holdings B.V.; SABIC; HELM de México, S.A.; DAICEL CORPORATION; Dow; INEOS.

b. Key factors that are driving the market growth include surge in application of acetic acid in meat industry, and increase in demand from the pharmaceutical, food & beverage, and paints & coatings industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."