- Home

- »

- Advanced Interior Materials

- »

-

North America 3D Printing Metal Market, Industry Report, 203GVR Report cover

![North America 3D Printing Metal Market Size, Share & Trends Report]()

North America 3D Printing Metal Market Size, Share & Trends Analysis Report By Product (Titanium, Nickel), By Form (Filament, Powder), By Application (Aerospace & Defense, Medical & Dental), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-253-4

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

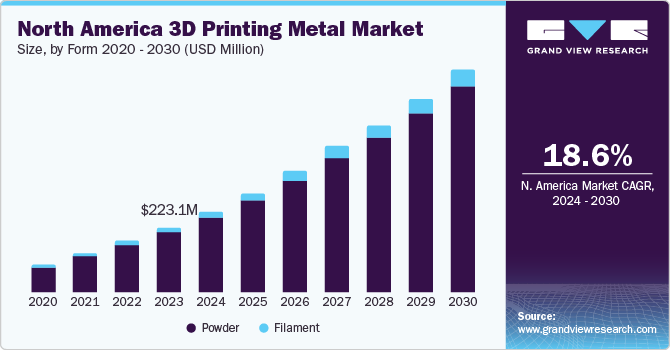

The North America 3D printing metal marketwas valued at USD 223.1 million in 2023 and is projected to grow at a CAGR of 18.6% from 2024 to 2030. This growth is attributed to several key driving factors including technological advancements, increased investment in research and development, and a growing demand for customized products. Furthermore, the adoption of 3D printing in various industries such as automotive, aerospace, and healthcare is also propelling the market forward.

Regulation plays a significant role in shaping the 3D printing metal market in North America. For instance, in the U.S., specific state laws have been enacted to regulate the use of 3D printing technology. A notable example is California’s Assembly Bill 2156, enacted in 2022. This law stipulates that any entity must be licensed to use a 3D printer to manufacture any firearm, including a frame or receiver, or any firearm precursor part. Such regulations can impact the global 3D printing metal market by imposing restrictions on certain applications of the technology. Nonetheless, a supportive ecosystem and advantageous regulatory rules facilitate the spread of 3D printing metals technology in the North American market.

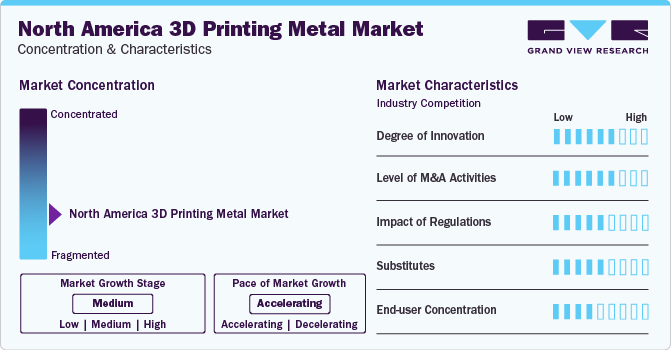

Market Concentration & Characteristics

The North America 3D printing metal market has been a center of innovation in recent years. Companies in this industry have been introducing innovative solutions and reshaping the market landscape. These companies have been instrumental in democratizing metal 3D printing, making it more accessible to a wider range of industries.

One of the key technological advancements in the market is the emergence of new printing technologies, such as binder jetting and metal injection molding. These technologies offer faster printing speeds, greater design flexibility, and the ability to create complex geometries that were previously impossible.

Furthermore, the integration of 3D printing with cutting-edge technologies such as Artificial Intelligence (AI) is poised to revolutionize the sector, paving the way for novel applications and use cases. Techniques such as Direct Metal Laser Sintering (DMLS), Selective Laser Melting (SLM), and Electron Beam Melting (EBM) represent some of the powder bed fusion methods employed in metal 3D printing. These advancements have unlocked unprecedented opportunities for the fabrication and design of intricate parts and components.

There are potential substitutes for 3D printing metal, such as high-performance polymers like PEEK and composite materials with carbon and ceramic fibers. These materials offer temperature, mechanical, and chemical resistances that are similar to metals, making them potential substitutes in certain applications.

The market is expected to have strong demand, primarily from the healthcare, automotive, and aerospace & defense industries. These sectors, where prototyping and designing play a vital role in research & development, are leading towards greater opportunities and increasing adoption of the 3D printing process.

Form Insights

The powder segment holds the largest market share, accounting for 93% of the total revenue in 2023. This dominance can be attributed to the unique properties of metal powders that make them a popular choice for 3D printing. Metal powders offer a high degree of design flexibility, allowing for the creation of complex geometries and structures. They are particularly suitable for applications in industries such as aerospace, medical, and rapid tooling areas.

The filament segment is expected to register the fastest growth rate in the North America 3D printing metal market in terms of revenue. It is projected to grow at a CAGR of 20.3% from 2024 to 2030. Filaments made from materials such as plastics, metals, and ceramics are used in fused filament fabrication (FFF) and fused deposition modeling (FDM) technology, which has a low price in comparison to other forms of 3D printing materials. These filaments are useful in the creation of intricate architecture items. As a result, the growing desire for mass customization in industries such as aerospace is a major driving force behind the growth of the filament market.

Product Insights

The titanium product segment holds the largest market share in North America's 3D printing metal market, accounting for 49.5% of the total revenue. This dominance can be attributed to the unique properties of titanium, such as its high strength-to-weight ratio, excellent corrosion resistance, and biocompatibility. These characteristics make it particularly suitable for applications in industries such as aerospace and defense, automotive, and healthcare. The demand for titanium 3D printed parts in these sectors is driving the growth of this segment. Furthermore, the titanium segment is also experiencing the fastest growth in the market.

The stainless steel segment is the second-fastest growing segment in terms of revenue in the North America 3D printing metal market. It is projected to grow at a CAGR of 20.1% from 2024 to 2030. Stainless steel is widely used in 3D printing due to its excellent mechanical properties and corrosion resistance. It is particularly popular in industries such as automotive, aerospace, and medical for the manufacturing of various components. The growth of this segment is driven by the increasing adoption of 3D printing technologies and the rising demand for stainless steel 3D printed parts in these industries.

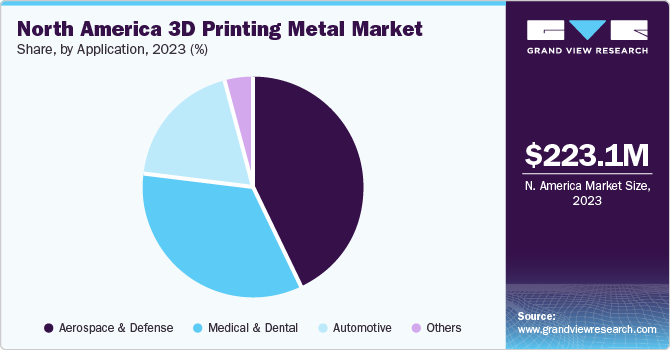

Application Insights

The aerospace and defense segment holds the largest market share in the North America 3D printing metal market, accounting for 42.7% of the total revenue. This dominance can be attributed to the unique properties of 3D printed metals that make them a popular choice for aerospace and defense applications. These industries require materials that are lightweight, strong, and resistant to extreme conditions, all of which are characteristics of 3D printed metals. The growth of this segment is driven by the increasing demand for customized aircraft parts and components, as well as increasing investments in research and development (R&D) activities related to aerospace and defense.

The medical and dental application segment is expected to register the fastest growth with a CAGR of 19.3% in terms of revenue, across the forecast period. The medical industry greatly benefits from 3D printing technology, which enables the production of prosthetic limbs, implants, and surgical tools such as forceps and hemostats. The dental 3D printing market is witnessing substantial growth. According to the American College of Prosthodontists, approximately 15% of the edentulous population opts for dentures annually, a figure projected to increase over the next two decades. Predominantly, the elderly population requires tooth replacement. However, dental procedures are not limited to this demographic, as individuals of varying ages, including those with partial tooth loss, are increasingly considering dental implants as a feasible solution.

Country Insights

U.S. 3D Printing Metal Market Trends

The U.S. held the largest market share, accounting for 90% of the total revenue in 2023. This dominance can be attributed to the country’s advanced technological infrastructure, substantial investments in research and development, and the presence of leading market players. The U.S. market is also experiencing the fastest growth, indicating a robust demand for 3D-printed metal products in various sectors such as aerospace, automotive, and healthcare.

Canada 3D Printing Metal Market Trends

Canada is projected to grow at a CAGR of 20.3% from 2024 to 2030. This growth can be attributed to the country’s strategic initiatives to promote innovation and industrial growth. The Canadian government is actively supporting the 3D printing metal industry through various initiatives. These include launching R&D projects in partnership with institutions like the University of Waterloo and the National Research Council of Canada, providing substantial funding for advanced manufacturing projects, facilitating the establishment of research centers for metal 3D printing, and implementing policy initiatives to invest in technological advancements, boost R&D, and cultivate skilled workforces necessary for 3D metal printing services.

Key North America 3D Printing Metal Company Insights

The North America 3D printing metal market is a fragmented one, with the presence of both established multinational players and regional participants. Some key players operating in this market include GE Additive, 3D Systems Corporation, and Stratasys Ltd:

-

3D Systems Corporation provides a comprehensive range of products and services related to 3D printing, including 3D printers, print materials, on-demand parts services, and digital design tools. The company's ecosystem supports advanced applications from product design to the factory floor and even to the operating room.

-

Stratasys Ltd. manufactures 3D printing equipment and materials that enable the direct creation of physical objects from digital data. Their range of systems includes affordable desktop 3D printers and large, advanced 3D production systems, making 3D printing more accessible to a wider range of users.

Key North America 3D Printing Metal Companies:

- GE Additive

- Desktop Metal

- Stratasys Ltd.

- 3D Systems

- EOS GmbH

- SLM Solutions

- Voxeljet AG

- Proto Labs

- HP Inc.

- Renishaw plc

Recent Developments

-

In September 2023, 3D Systems was awarded a USD 10.8 million contract by the U.S. Air Force for the development of a Large-format Metal 3D Printer Advanced Technology Demonstrator, marking a significant milestone not only for the company but also for the metal 3D printing industry.

-

In August 2024, SLM Solutions acquired Adira AddCreative technology. This strategic move is expected to enhance the company’s capabilities and market reach.

-

In October 2023, Voxeljet was chosen as a partner by GE Research for a project funded by the U.S. Department of Energy (DoE). The project, which has received USD 14.9 million in federal funding, involves the development and commercialization of a large sand binder jet 3D printer, known as the Advanced Casting Cell (ACC). This initiative is aimed at accelerating the United States’ transition to clean power.

North America 3D printing Metal Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 278.7 million

Revenue forecast in 2030

USD 776.4 million

Growth rate

CAGR of 18.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Form, product, application, region

Country Scope

U.S.; Canada; Mexico

Key companies profiled

GE Additive; Desktop Metal; Stratasys Ltd.; 3D Systems; EOS GmbH; SLM Solutions; Voxeljet AG; Proto Labs; HP Inc.; Renishaw plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America 3D Printing Metal Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America 3D printing metal market report based on form, product, application, and region:

-

Form Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Powder

-

Filament

-

-

Product Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Titanium

-

Stainless Steel

-

Nickel

-

Aluminum

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Medical & Dental

-

Others

-

-

Country Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America 3D printing metal market size was estimated at USD 223.1 million in 2023 and is expected to be USD 278.7 million in 2024.

b. The North America 3D printing metal market, in terms of revenue, is expected to grow at a compound annual growth rate of 18.6% from 2024 to 2030 to reach USD 776.4 million by 2030.

b. The powder segment dominated the North America 3D printing metal market with a revenue share of 93% in 2023, on account of several factors including their high degree of design flexibility, which allow the creation of complex geometries and structures.

b. Some of the key players operating in the North America 3D printing metal market include GE Additive; Desktop Metal; Stratasys Ltd.; 3D Systems; EOS GmbH; SLM Solutions; Voxeljet AG; Proto Labs; HP Inc.; Renishaw plc.

b. Key factors that are driving the North America 3D printing metal market growth include the technological advancements, increased investment in research and development, and a growing demand for customized products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."