- Home

- »

- Medical Devices

- »

-

Nordic Regulatory Affairs Market Size, Industry Report, 2030GVR Report cover

![Nordic Regulatory Affairs Market Size, Share & Trends Report]()

Nordic Regulatory Affairs Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Regulatory Consulting, Legal Representation), By Category, By Type, By Company Size, By Product Stage, By Indication, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-331-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nordic Regulatory Affairs Market Summary

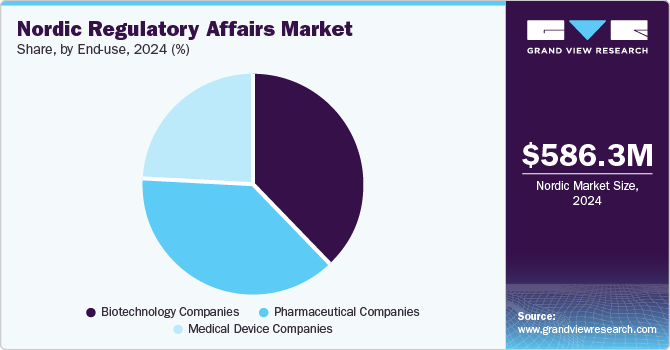

The Nordic regulatory affairs market was estimated at USD 586.3 million in 2024, is projected to reach USD 890.7 million by 2030, growing at a CAGR of 7.25% from 2025 to 2030. The changing regulatory landscape, increasing demand for a faster approval process, and economic and competitive pressures are some of the key factors expected to drive the market.

Key Market Trends & Insights

- Denmark regulatory affairs market accounted for the largest regional revenue share of 34.13% in 2024.

- The outsourcing segment dominated the market in 2024 with a 59.55% share.

- By end use, the biotechnology segment is projected to witness the highest CAGR over the forecast period.

- The legal representation segment is expected to witness the highest CAGR among services over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 586.3 Million

- 2030 Projected Market Size: USD 890.7 Million

- CAGR (2025-2030):7.25%

- Denmark: Largest Nordic market in 2024

The entry of life sciences companies in the Nordic markets, especially in countries such as Denmark and Sweden, for R&D collaborations and the evolution of new areas, such as orphan drugs, biosimilars, advanced therapy medicinal products (ATMPs), and personalized medicine, are further anticipated to contribute to the market growth as such new areas would require advanced technical expertise for compliance with regulatory requirements.

The industry is driven by a stringent regulatory framework and evolving compliance requirements. While the region adheres to EU regulations for pharmaceuticals and medical devices, country-specific variations add complexity, necessitating specialized regulatory expertise. The implementation of the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) has heightened compliance demands, prompting companies to seek external regulatory support. Additionally, national agencies such as the Swedish Medical Products Agency (Läkemedelsverket) and Danish Medicines Agency (Lægemiddelstyrelsen) impose local regulatory requirements, further driving the need for outsourcing. As regulatory scrutiny intensifies, firms must ensure timely approvals, risk mitigation, and ongoing compliance, making outsourcing a cost-effective solution.

In addition, a recent regulatory change from the European Medicines Agency (EMA) stated the updated guidelines for the Environmental Risk Assessment (ERA) of medicinal products. The new version, replacing the 2016 guidelines, will take effect from September 2024. This update mandates that an ERA be conducted for all new marketing authorization applications (MAAs), including those through centralized, mutual recognition, decentralized, or national procedures. Therefore, increasing regulatory requirements complexity would lead companies to collaborate with outsourcing providers to effectively manage the increased workload, ensure compliance with the latest standards, and navigate global markets.

The growth of the biopharmaceutical and medical device sectors is a key driver of the Nordic regulatory affairs industry. The region hosts leading biotech clusters, such as Medicon Valley, spanning Denmark and Sweden, fostering innovation in biologics, cell and gene therapies, and digital health solutions. Rising R&D investments and a strong pipeline of advanced therapies increase regulatory complexities, stimulating companies to seek specialized outsourcing providers. Additionally, Nordic firms expanding into global markets require strategic regulatory guidance to navigate diverse approval pathways, including EMA, FDA, and Asian agencies. The MedTech sector, particularly in AI-driven diagnostics and wearable medical devices, is also witnessing rapid market growth, requiring ongoing regulatory updates.

Complexities about market access and pricing regulations in the Nordic region, requiring specialized regulatory expertise. Strict Health Technology Assessment (HTA) frameworks and joint price negotiations through the Nordic Pharmaceutical Forum influence drug approval strategies. Companies are outsourcing regulatory affairs to navigate reimbursement challenges and ensure market entry. Moreover, sustainability and ESG compliance are also reforming regulatory outsourcing demand. With a strong focus on green pharmaceuticals, eco-friendly packaging, and carbon reduction, Nordic authorities are tightening environmental requirements. Firms seek outsourced regulatory support to align with evolving sustainability policies.

Additionally, Brexit has altered trade and regulatory pathways, pushing companies to re-evaluate approval strategies for the UK, EU, and Nordic markets. As the region strengthens ties with global regulators, outsourcing partners help businesses navigate post-Brexit compliance complexities, ensuring seamless market access. These factors are collectively driving demand for specialized regulatory affairs services in the Nordic market.

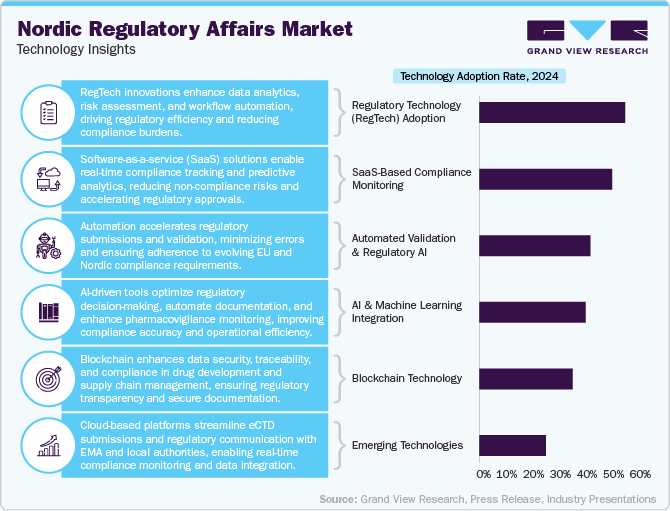

Technology Insights

The Nordic regulatory affairs industry is developing rapidly, driven by digital transformation, automation, and the growing complexity of compliance requirements. Regulatory technology (RegTech) is playing an increasingly critical role, with companies utilizing AI-driven analytics, cloud-based compliance platforms, and eCTD (electronic Common Technical Document) submission tools to streamline regulatory processes. Nordic firms are integrating machine learning algorithms for pharmacovigilance, automated dossier management, and risk assessment, reducing manual workload and accelerating faster market approvals.

Blockchain technology is also emerging in regulatory affairs, enhancing data security, traceability, and transparency in drug development and supply chain compliance. Additionally, e-learning platforms and digital collaboration tools are improving regulatory intelligence sharing among outsourced service providers and pharmaceutical firms. With the increasing adoption of software-as-a-service (SaaS) solutions, companies are shifting toward real-time compliance monitoring and predictive analytics, reducing the risk of non-compliance.

The Nordic region’s strong prominence on sustainability is also influencing the technology landscape, driving demand for eco-friendly digital documentation and lifecycle assessment tools for regulatory submissions. Cloud-based regulatory systems, integrated with the European Medicines Agency (EMA) and local authorities’ databases, are enhancing seamless communication and real-time updates on compliance changes.

As regulatory frameworks become more stringent under EU MDR, IVDR, and evolving pharmaceutical laws, outsourcing firms are investing in automated validation systems and AI-powered regulatory impact analysis tools to support life sciences companies. This shift towards data-driven, tech-enabled regulatory outsourcing is expected to enhance efficiency and compliance readiness in the Nordic region.

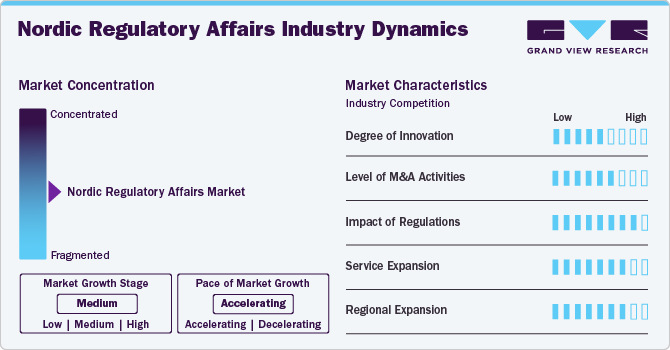

Market Characteristics & Concentration

The market growth stage is medium, with an accelerating pace. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, service expansions, and regional expansions.

The industry is witnessing steady innovation, driven by digital transformation and artificial intelligence (AI) integration. Automation in compliance management, eCTD submissions, and data analytics is improving efficiency. Companies are investing in advanced regulatory technologies, but innovation adoption remains moderate due to strict regulatory oversight and risk aversion.

Regulations have a high impact on the Nordic regulatory affairs market. Regulatory frameworks significantly influence market dynamics, with EU MDR, IVDR, and local Nordic agency requirements shaping compliance needs. Strict pharmacovigilance, GMP, and clinical trial regulations drive outsourcing demand. Frequent policy updates create challenges, requiring companies to stay agile. High regulatory complexity results in a high market concentration among specialized firms.

The level of M&A activities in the biomarker discovery outsourcing market is moderate, as firms seek to expand service portfolios and geographic reach. Large regulatory outsourcing providers acquire niche consultancies to enhance expertise in pharmaceuticals, biologics, and medical devices. The market remains competitive, with consolidation increasing the degree of concentration among key players offering end-to-end regulatory solutions.

The industry is witnessing rapid service expansion. Companies are broadening service offerings to include end-to-end regulatory consulting, market authorization support, and post-market surveillance. AI-driven compliance tools and e-submission platforms are growing trends. The market remains moderately fragmented, with specialized firms focusing on comprehensive regulatory affairs outsourcing to meet evolving compliance and digital transformation needs.

Regulatory service providers are expanding operations within Nordic countries and broader EU markets to meet growing demand. Companies leverage regional expertise to support pharmaceutical, biotech, and medical device firms in navigating local regulations. Market entry into Denmark, Sweden, Finland, and Norway is increasing, contributing to a moderate to high concentration in the healthcare sector.

Type Insights

The outsourcing segment dominated the market with a share of 59.55% in 2024. Pharmaceutical, biotech, and MedTech firms pursue specialized expertise to navigate evolving regulations. Companies rely on CROs and regulatory consultancies to handle market authorization applications, compliance audits, and post-market surveillance. Additionally, digital transformation in regulatory processes fuels the adoption of RegTech solutions and eCTD services. Outsourcing offers cost efficiency, flexibility, and faster market entry, making it a strategic approach for both startups and established firms in the region.

The in-house segment is projected to witness considerable growth during the forecast year. The rise of digital health, personalized medicine, and sustainability regulations necessitates specialized in-house expertise. Several Nordic companies utilize internal regulatory teams for streamlined communication with local authorities, ensuring faster approvals and compliance. As regulatory complexity increases, the demand for skilled professionals in-house is rising, reducing reliance on external consultancies for critical compliance functions.

Service Insights

The regulatory writing & publishing segment dominated the regulatory affairs market in 2024. The growth of the segment is attributed to increasing compliance demands, stringent documentation requirements, and the adoption of digital submission platforms. With evolving EU MDR, IVDR, and EMA guidelines, companies outsource regulatory writing to ensure accuracy in clinical trial reports, risk assessments, and Common Technical Document (CTD) submissions. Additionally, the shift toward eCTD and automated regulatory workflows accelerates demand for specialized expertise. Outsourcing partners offer efficiency, cost-effectiveness, and local regulatory knowledge, helping pharmaceutical and medtech firms navigate complex compliance landscapes while optimizing time-to-market for new therapies and devices in the region.

The legal representation segment is expected to witness the highest CAGR over the forecast period. The segment demand is driven by evolving post-market surveillance requirements and pharmacovigilance requirements. Additionally, Brexit’s impact has heightened the need for specialized regulatory legal services, ensuring seamless market access. Outsourcing legal representation optimizes compliance efficiency while mitigating regulatory risks in the Nordic region.

Categories Insights

The drugs/pharmaceuticals segment dominated the industry in 2024. With stringent EU and national regulations, companies increasingly rely on outsourcing partners for market authorization applications, pharmacovigilance, and lifecycle management. The demand for regulatory expertise is rising due to evolving drug safety standards, pricing regulations, and strict health technology assessments (HTAs). Additionally, digital transformation in regulatory submissions, including eCTD requirements, is driving the need for specialized service providers. Outsourcing helps pharmaceutical firms streamline approval processes, ensure compliance with Nordic regulatory bodies, and accelerate market entry while managing operational costs effectively.

The biologics segment is projected to witness considerable growth during the forecast year. The growth of the segment is mainly attributed to factors such as increasing R&D investments from pharmaceutical and biotechnology firms. Biologic drugs require highly controlled environments during development and manufacturing, as even minor variations can impact cell integrity and product efficacy. Ensuring regulatory compliance in areas such as Good Manufacturing Practice (GMP), market approvals, and post-market surveillance is critical. As a result, companies are outsourcing regulatory services to maintain precision, reduce errors, and streamline compliance with stringent Nordic and EU guidelines. This growing reliance on specialized outsourcing partners is boosting revenue expansion in the segment.

Indication Insights

The oncology segment dominated the market in 2024. The growth of the segment is mainly due to the growing prevalence of chronic diseases, such as cancer, along with the presence of several innovative pipeline products. In Sweden, oncology holds the leading position in terms of drug development activity.

The immunology segment is projected to witness the highest CAGR from 2025 to 2030. The growing usage of immunological molecules in cancer therapy, coupled with their potential to facilitate the treatment of various cardiovascular, neurological, and inflammatory diseases, is anticipated to boost segment growth. Moreover, advancements in immunology research have resulted in the development of innovative cell and gene therapies and biologics, which will further boost the demand for regulatory affairs.

Product Stage Insights

The clinical studies segment dominated the market in 2024. The increasing prevalence of chronic diseases and the emergence of new diseases are anticipated to increase the number of clinical trials, requiring stringent regulatory oversight to ensure transparency, ethical compliance, and data credibility. Regulatory outsourcing supports sponsors in navigating complex approval processes, Good Clinical Practice (GCP) compliance, and ethics committee submissions. As the Nordic region continues to attract global clinical research, outsourcing regulatory functions ensures adherence to evolving guidelines, accelerates trial approvals and enhances the reliability of study outcomes, driving market growth.

The preclinical segment is projected to witness the highest CAGR over the analysis timeframe. The high segment growth is due to increasing demand for innovative drugs, biologics, and medical devices. Regulatory compliance is crucial at this stage to ensure adherence to safety, efficacy, and ethical guidelines before human trials begin. Companies increasingly outsource regulatory services to navigate complex requirements, streamline approvals, and ensure compliance with Good Laboratory Practice (GLP). The growing need for novel treatments is driving investments in preclinical research, further increasing the demand for specialized regulatory expertise.

Company Size Insights

The medium company size segment dominated the market in 2024. The growth of the market is mainly due to lacking extensive in-house regulatory expertise among medium scale companies; thus these firms are increasingly relying on outsourcing partners for market approvals, documentation, and post-market compliance. Regulatory service providers offer specialized services, enabling mid-sized pharmaceutical and medical device companies to navigate complex EU and Nordic regulations efficiently. By outsourcing, these companies enhance operational flexibility, accelerate product approvals, and ensure adherence to evolving regulatory requirements, driving segment growth.

The large-scale segment is projected to grow lucratively, as major biopharmaceutical and medical device firms seek comprehensive regulatory support. These companies prefer outsourcing to specialized providers with global reach, ensuring seamless operations across multiple markets. Long-term partnerships are favored to maintain regulatory continuity and avoid operational disruptions. Additionally, outsourcing enables efficient management of complex compliance requirements, market approvals, and post-market surveillance. The increasing reliance on established regulatory service providers is driving market expansion, allowing large firms to streamline processes and focus on core innovation and commercialization strategies.

End-use Insights

The pharmaceutical companies segment dominated the market in 2024. The growth of the segment is mainly due to rising R&D investments and an increasing number of drug approvals. As pharmaceutical firms accelerate product development, the demand for regulatory support in registration, licensing, and market authorization is growing. With frequent drug launches and commercialization, outsourcing ensures efficient compliance with evolving Nordic and EU regulations. This enables pharmaceutical companies to streamline approval processes, reduce regulatory complexities, and focus on innovation while maintaining compliance with stringent industry standards.

The biotechnology segment is projected to witness the highest CAGR over the forecast period. The growth of the segment is mainly due to rising demand for biologics and increased investment in biopharmaceutical manufacturing. Advanced healthcare infrastructure in the region further drives the need for regulatory support in areas such as GMP compliance, patent filings, audits, and quality assurance. Biotech firms increasingly outsource these services to ensure smooth market entry and regulatory adherence, enhancing market growth.

Country Insights

Denmark regulatory affairs market accounted for the largest revenue share of 34.13% in 2024. The growth is owing to its strong pharmaceutical and biotechnology sector, supported by a well-established regulatory framework. The country hosts leading biopharma companies and research hubs, increasing demand for specialized regulatory services. Strict compliance with EU MDR, IVDR, and GMP standards drives outsourcing for market approvals, pharmacovigilance, and clinical trial regulations. Additionally, Denmark’s focus on innovation in biologics and personalized medicine further accelerates the need for expert regulatory support, making outsourcing a key growth driver in the market.

The regulatory affairs market in Sweden is expected to grow at a considerable rate over the forecast period, driven by a growing number of drug development projects and high-quality clinical trial outcomes. Despite its small population, the country boasts an advanced healthcare system and strong research participation. Collaboration between industry, academia, and healthcare institutions further enhances its appeal in the global market. Major pharmaceutical companies like Pfizer, MSD, and GSK prioritize Sweden for clinical trials, increasing the demand for regulatory support. As Sweden strengthens its position as a global drug development hub, the need for specialized regulatory affairs outsourcing rising significantly, thereby driving overall market demand.

Key Nordic Regulatory Affairs Company Insights

The Nordic regulatory affairs market is moderately competitive in nature. Several key industry players operating in the industry are undertaking various initiatives, such as strategic partnerships, service expansions, and digital innovation to strengthen their market presence. Global firms leverage their extensive expertise and regional presence to cater to pharmaceutical, biotech, and medical device companies.

Key Nordic Regulatory Affairs Companies:

- Pharma Assist Sweden AB

- Genpact

- Criterium, Inc.

- ICON plc

- Parexel International Corporation, Inc.

- Global Pharma Consultancy AB

- Freyr

- Charles River Laboratories

- Accell Clinical Research LLC

- Regsmart Lifesciences AB

- PHARMALEX GMBH

- Pharmexon

Recent Developments

-

In January 2025, Canyon Labs acquired iuvo BioScience’s lab services and consulting divisions to offer comprehensive end-to-end solutions, boosting its presence in the regulatory affairs market. This strategic move enhances the ability to streamline regulatory processes, particularly within ophthalmic clinical research and pharmaceutical development.

-

In October 2023, VCLS announced the acquisition of MedEngine to expand its capabilities and position itself as a leading player in regulatory affairs with comprehensive services from preclinical to post-launch.

-

In September 2023, Freyr entered into a partnership agreement with the PKG Group LLC. The partnership aimed to navigate stringent regulatory procedures and accelerate submission activities in a quick turnaround time.

Nordic Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 627.6 million

Revenue forecast in 2030

USD 890.7 million

Growth rate

CAGR of 7.25% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, services, categories, indication, stage, company size, end-use, region

Country scope

Denmark; Norway; Sweden; Finland; Iceland

Key companies profiled

Pharma Assist Sweden AB; Genpact; Criterium, Inc.; ICON plc; Parexel International Corporation, Inc.; Global Pharma Consultancy AB; Freyr; Charles River Laboratories; Accell Clinical Research LLC; Regsmart Lifesciences AB; PHARMALEX GMBH; Pharmexon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Nordic Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Nordic regulatory affairs market report based on services, categories, indication, stage, type, company size, end-use, and country.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Writing

-

Publishing

-

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Categories Outlook (Revenue, USD Million, 2018 - 2030)

-

Drugs

-

Innovators

-

Preclinical

-

Clinical

-

Pre-market Approval (PMA)

-

-

Generics

-

Preclinical

-

Clinical

-

Pre-market Approval (PMA)

-

-

-

Biologics

-

Biotech

-

Preclinical

-

Clinical

-

Pre-market Approval (PMA)

-

-

ATMP

-

Preclinical

-

Clinical

-

Pre-market Approval (PMA)

-

-

Biosimilars

-

Preclinical

-

Clinical

-

Pre-market Approval (PMA)

-

-

-

Medical Devices

-

Diagnostics

-

Preclinical

-

Clinical

-

Pre-market Approval (PMA)

-

-

Therapeutics

-

Preclinical

-

Clinical

-

Pre-market Approval (PMA)

-

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical studies

-

PMA

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Denmark

-

Sweden

-

Norway

-

Finland

-

Iceland

-

Frequently Asked Questions About This Report

b. The global nordic regulatory affairs market size was estimated at USD 586.3 million in 2024 and is expected to reach USD 627.6 million in 2025.

b. The global nordic regulatory affairs market is expected to witness a compound annual growth rate of 7.25% from 2025 to 2030 to reach USD 890.7 billion by 2030.

b. The product registration & clinical trial applications held the largest share of 36.38% in 2024. The segment growth is owing to stringent EU and Nordic regulations, rising pharmaceutical innovations, and increasing demand for faster market access drive outsourcing for product registration services. Moreover, growing clinical research activities, stricter ethical guidelines, and complex approval processes necessitate expert regulatory support, boosting demand for clinical trial application outsourcing.

b. Some of the market players operating in the Nordic region include Pharma Assist Sweden AB, GenPact Ltd; PRA Health Sciences; Charles River Laboratories International, Inc.; ICON plc; Parexel International Corporation; Inc.; Freyr, Global Pharma Consultancy AB, Accell Clinical Research Llc; and Regsmart Lifesciences AB.

b. Changing regulatory landscape, increasing demand for the faster approval process, and economic & competitive pressures, are some of the key factors expected to drive the Nordic regulatory affairs market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.