- Home

- »

- Advanced Interior Materials

- »

-

Non-woven Abrasives Market Size, Industry Report, 2033GVR Report cover

![Non-woven Abrasives Market Size, Share & Trends Report]()

Non-woven Abrasives Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hand Pads & Rolls, Belts, Discs), By End-use (Household, Electronics & Semiconductor, Transportation, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-460-5

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-woven Abrasives Market Summary

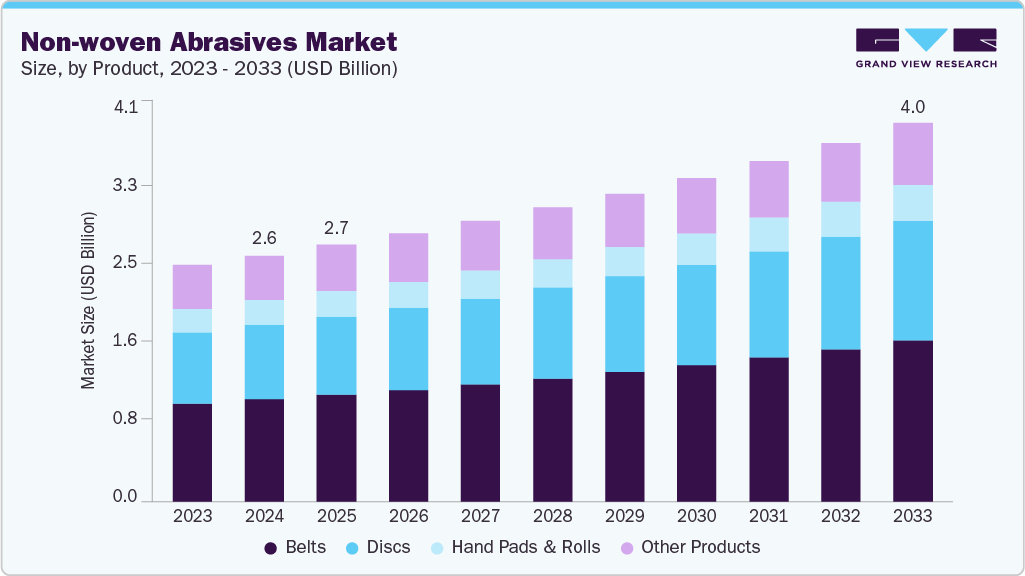

The global non-woven abrasives market size was estimated at USD 2.62 billion in 2024 and is projected to reach USD 4.03 billion by 2033, growing at a CAGR of 5.0% from 2025 to 2033. This growth is attributed to the increasing requirement for superior surface finishes in various industries such as automotive, aerospace, and electronics.

Key Market Trends & Insights

- By region, the Asia Pacific dominated the non-woven abrasives market with the largest revenue share of 40.21% in 2024.

- By product, discs segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

- By end-use, electronics & semiconductor segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.62 Billion

- 2033 Projected Market Size: USD 4.03 Billion

- CAGR (2025-2033): 5.0%

- Asia Pacific: Largest market in 2024

Non-woven abrasives, known for their ability to provide consistent surface finishing without excessive material removal, are gaining preference for applications like paint preparation, polishing, and deburring in these industries. The metalworking industry is a major consumer of non-woven abrasives, used for tasks such as deburring, surface preparation, and polishing. The flexible nature of non-woven abrasives, which conforms to complex surfaces, makes them essential in sectors like aerospace, automotive, and shipbuilding, where high precision is crucial. As industries push for higher quality finishes, this demand is expected to increase product demand.Non-woven abrasives are becoming more popular for household applications like cleaning, polishing, and light surface finishing. The rise in DIY home projects during the pandemic has further boosted demand in household sector. Furthermore, non-woven abrasives are often more sustainable than other abrasive products because they can be washed and reused multiple times, reducing waste. Industries looking to adopt environmentally friendly practices see non-woven abrasives as a viable alternative to single-use products.

Although non-woven abrasives are ideal for surface finishing and polishing, they are generally less aggressive than traditional bonded abrasives. In applications requiring significant material removal, such as heavy industrial grinding, they may not be as effective, which can restrict their use in certain sectors. In addition to this, non-woven abrasives tend to be more expensive than conventional abrasives like sandpaper. For industries with tight budget constraints, this higher cost can be a limiting factor, particularly for large-scale operations where abrasives are used in bulk.

Innovations in the composition and structure of non-woven abrasives are creating opportunities for more durable and efficient products. These innovations can help bridge the performance gap between non-woven and traditional abrasives, especially in heavy-duty applications. Furthermore, with rise of automation in industries, there is growing demand for abrasive materials compatible with high-efficiency automated systems. Non-woven abrasives, which offer consistent performance in automated systems, are poised to benefit from this trend.

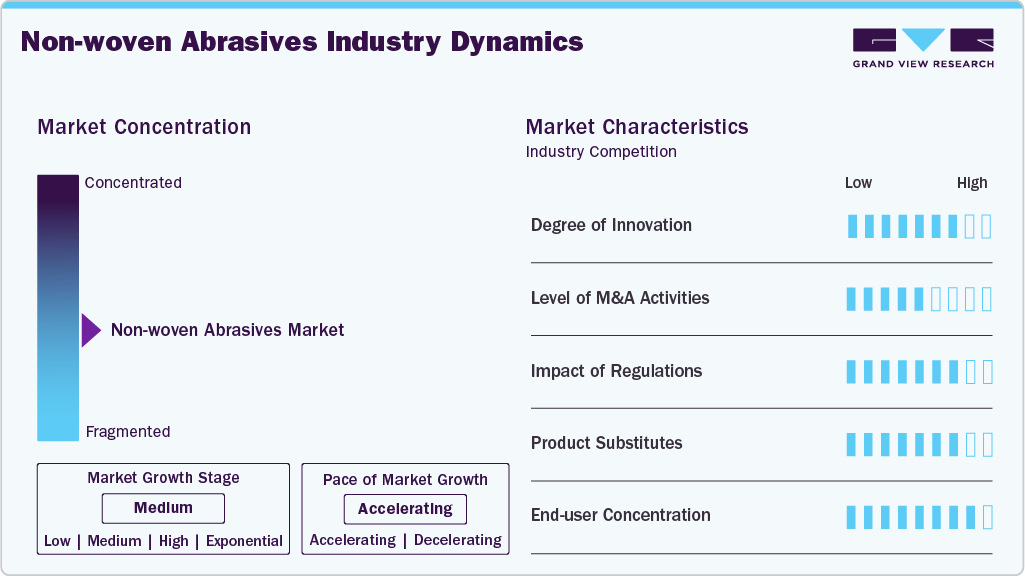

Market Concentration & Characteristics

The non-woven abrasives market is characterized by a moderate to high level of market concentration, with a few prominent players holding significant shares due to their strong brand presence, expansive distribution networks, and technical expertise. The degree of innovation in this market is relatively steady, primarily driven by the demand for high-performance abrasives tailored for specific applications such as metalworking, automotive finishing, and aerospace maintenance. Manufacturers are increasingly focusing on developing durable, heat-resistant, and precision-engineered products, incorporating advancements in synthetic fiber bonding and resin technologies. However, the market also faces challenges from product standardization and commoditization, which can limit the scope of differentiation.

Mergers and acquisitions have played a notable role in shaping the competitive landscape, with larger players acquiring regional or specialized manufacturers to expand their product portfolio and market reach. Regulatory factors, particularly those related to worker safety, environmental compliance, and emission control, significantly influence production processes and raw material usage. The availability of product substitutes such as coated and bonded abrasives exerts moderate competitive pressure, though non-woven variants retain a niche due to their unique properties, like flexibility and surface finishing capabilities. End-use concentration is evident in industries such as automotive, metal fabrication, and aerospace, where precision surface preparation is critical, thereby reinforcing demand consistency within these core segments.

Product Insights

The market is segmented into hand pads & rolls, belts, and discs. The belts segment dominated the market with a revenue share of 41.53% in 2024, driven by the growing demand for efficient surface finishing and material removal solutions across various industrial applications. Non-woven abrasive belts are extensively used in processes such as deburring, blending, polishing, and finishing, particularly in metalworking and fabrication sectors. The need for consistent surface quality and precision finishing in manufacturing operations fuels the adoption of these belts, especially in industries where surface aesthetics and uniformity are critical, such as in aerospace, automotive, and appliance production.

Discs segment is expected to grow at the fastest CAGR of 5.5% over the forecast period, driven by their widespread use in surface preparation, cleaning, and finishing applications across diverse industries. Non-woven abrasive discs are particularly valued for their flexibility, conformability, and ability to deliver uniform finishes without damaging the underlying material. These attributes make them ideal for precision tasks in industries such as metal fabrication, automotive repair, aerospace maintenance, and woodworking. The rise in demand for high-quality finishes on intricate or contoured surfaces further supports the growth of this segment, as discs can easily adapt to complex geometries and delicate substrates.

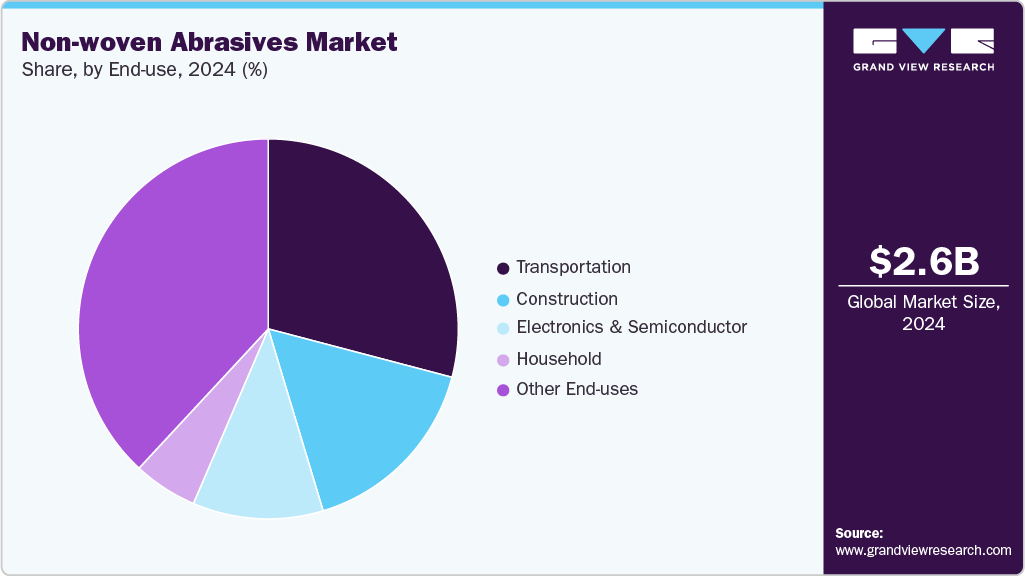

End-use Insights

The end use segment is divided into household, electronics & semiconductor, transportation, and construction. Among these, transportation end use accounted for the largest revenue share of 29.10% in 2024, driven by the increasing demand for surface conditioning and finishing solutions in the automotive, aerospace, rail, and marine industries. Non-woven abrasives are extensively used in the manufacturing, maintenance, and repair of transportation equipment due to their ability to deliver precise, uniform finishes without compromising structural integrity. Applications such as paint preparation, rust and corrosion removal, deburring, and polishing of metal components are critical in ensuring safety, performance, and aesthetic standards. As global transportation infrastructure expands and vehicle production increases, the demand for reliable abrasive solutions correspondingly rises.

Electronics & semiconductor is expected to grow at the fastest CAGR of 5.5% over the forecast period, driven by the sector’s need for ultra-precise and contamination-free surface finishing solutions. Non-woven abrasives are increasingly utilized in the fabrication of components such as circuit boards, semiconductor wafers, and microelectronic parts, where any surface irregularity or residue can lead to performance issues or product rejection. These abrasives offer the advantage of controlled material removal and excellent surface conformity, making them ideal for delicate and high-value substrates such as silicon, copper, and aluminum.

Regional Insights

The North America non-woven abrasives market is driven by the presence of a mature industrial base and a strong emphasis on innovation and technological integration. The region sees high demand for non-woven abrasives across sectors such as aerospace, automotive, metal fabrication, and machinery maintenance. Additionally, stringent occupational safety and environmental regulations have led to the preference for low-dust, heat-resistant, and durable abrasives, making non-woven variants an attractive solution. Investments in automated finishing systems and the growing repair and maintenance segment also fuel the regional market.

U.S. Non-woven Abrasives Market Trends

The non-woven abrasives market in the U.S. benefits from the country's highly diversified industrial landscape and continued investment in advanced manufacturing technologies. A key driver is the strong demand for precision finishing in aerospace and defense manufacturing, where surface quality directly impacts component performance and compliance. The country’s robust construction and automotive industries also utilize non-woven abrasives for paint preparation, blending, and surface cleaning. Moreover, increased emphasis on sustainable and efficient manufacturing practices has further encouraged the use of eco-friendly non-woven abrasive solutions.

Asia Pacific Non-woven Abrasives Market Trends

Asia Pacific non-woven abrasives market dominated the global market with the revenue share of 40.21% in 2024 and is further expected to grow at a significant rate over the forecast period. This growth is driven by rapid industrialization, urbanization, and rising demand from various industries such as automotive, metalworking, and electronics. Countries such as China, India, and Japan are major hubs for manufacturing, particularly in the automotive, aerospace, and electronics industries. The increasing production of vehicles, heavy machinery, and consumer electronics boosts demand for non-woven abrasives in surface preparation, finishing, and polishing applications.

The non-woven abrasives market in China is primarily driven by the rapid industrialization and robust expansion of the manufacturing sector. The country’s dominance in metal fabrication, automotive production, and electronics manufacturing creates substantial demand for surface preparation and finishing tools. Moreover, China's focus on improving product quality standards and increasing exports of finished goods has encouraged the adoption of advanced non-woven abrasives. Government initiatives supporting infrastructure development and industrial modernization, such as "Made in China 2025," further contribute to market growth.

Europe Non-woven Abrasives Market Trends

Europe’s non-woven abrasives market is propelled by its well-established automotive, metalworking, and aerospace industries, all of which require high-performance abrasives for surface conditioning and finishing. The region’s commitment to sustainable manufacturing, supported by the European Green Deal, has led to increased adoption of low-emission and recyclable abrasive materials. Technological advancements and high-quality standards across EU countries drive demand for precision-engineered non-woven abrasives. Additionally, automation and the integration of smart manufacturing processes across industries continue to influence product innovation and market expansion.

The non-woven abrasives market in Germany stands out as a key contributor to Europe’s non-woven abrasives market due to its leadership in engineering, automotive, and industrial machinery sectors. The country’s emphasis on product quality, durability, and efficiency fuels the demand for advanced surface finishing tools such as non-woven abrasives. High levels of R&D investment, combined with strong export activity, necessitate consistent surface treatment solutions that enhance component performance and longevity. Furthermore, Germany’s transition towards Industry 4.0 and digital manufacturing ecosystems further accelerates the adoption of specialized abrasives in automated and high-precision operations.

Latin America Non-woven Abrasives Market Trends

The Latin American non-woven abrasives market is driven by increasing industrialization, particularly in countries like Brazil and Mexico. Growing automotive assembly lines, metalworking operations, and construction projects contribute significantly to the demand for abrasive solutions. The region also benefits from rising investments in infrastructure and manufacturing capacity, which support the use of durable, cost-effective, and easy-to-use non-woven abrasives. As industries in Latin America gradually modernize and adopt global quality standards, the demand for surface conditioning tools is expected to rise steadily.

Middle East & Africa Non-woven Abrasives Market Trends

The non-woven abrasives market in the Middle East & Africa is fueled by ongoing infrastructure development, growth in oil & gas-related industries, and emerging automotive and metal fabrication sectors. Countries such as the UAE and Saudi Arabia are heavily investing in industrial diversification under national strategies like Vision 2030, creating new demand for high-quality abrasives in maintenance, repair, and fabrication. Additionally, the need for corrosion-resistant finishing in petrochemical and marine applications, combined with increasing awareness of safety and sustainability, drives the adoption of non-woven abrasive products across the region.

Key Non-woven Abrasives Company Insights

Some key players operating in the market are 3M and Saint-Gobain:

-

3M is a leading market player, primarily focusing on diversification of the abrasives portfolio and providing a wide range of products to various industries. It emphasizes investment in R&D and more on sustainability, eco-friendly materials, and technologically advanced manufacturing processes that align with the growing demand for environmentally conscious solutions.

-

Saint-Gobain is another leading market player competing by adopting a strategic approach to global expansion through mergers & acquisitions to acquire complementary businesses and strengthen its product offering portfolio. It invests heavily in R&D, focusing on the development of advanced abrasives technologies.

DWALT is the emerging participant in the market.

-

DEWALT was established in 1924 and is based in the U.S. This company has an extensive product range comprising various power tools, hand tools, and accessories. This range includes cordless drills, circular saws, angle grinders, jigsaws, sanders, planers, nailers, and staplers, as well as a comprehensive offering of hand tools such as pliers, wrenches, and screwdrivers. It offers a range of non-woven abrasives under its accessories section of the product portfolio.

-

Mirka Ltd. was established in 1943 and is involved in the production of surface finishing technology, serving solutions for surface finishing and precision sanding. Its range of products includes abrasives & compounds, power tools, robotics & automation, dust-free sanding, and accessories.

Key Non-woven Abrasives Companies:

The following are the leading companies in the non-woven abrasives market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Saint-Gobain

- DEWALT

- Carborundum Universal Limited (CUMI)

- Sia Abrasives

- PFERD

- Mirka Ltd.

- TGA Abrasives

- Osborn

- Steel Shine

Recent Developments

-

In October 2024, Saint-Gobain announced a partnership with Dedeco Abrasive Products, a specialty abrasives manufacturer, where Saint-Gobain would market Dedeco’s sunburst abrasive line. This partnership aligns with company’s comprehensive goal of delivering abrasive solutions.

Non-woven Abrasives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.73 billion

Revenue forecast in 2033

USD 4.03 billion

Growth rate

CAGR of 5.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

3M; Saint-Gobain; Carborundum Universal Limited (CUMI); Sia Abrasives; PFERD; Mirka Ltd.; TGA Abrasives; Osborn; Steel Shine

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-woven Abrasives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the segments from 2021 to 2033. For this study, Grand View Research has segmented the global non-woven abrasives market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Hand Pads & Rolls

-

Belts

-

Discs

-

Other Products

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Household

-

Electronics & Semiconductor

-

Transportation

-

Construction

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global non-woven abrasives market size was estimated at USD 2.62 billion in 2024 and is expected to reach USD 2.73 billion in 2025.

b. The global non-woven abrasives market is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2025 to 2033 to reach USD 4.03 billion by 2033.

b. Transportation end use accounted for largest revenue share of 29.10% in 2024, driven by the increasing demand for surface conditioning and finishing solutions in the automotive, aerospace, rail, and marine industries.

b. Some key players operating in the non-woven abrasives market include 3M, Saint-Gobain, DEWALT, Carborundum Universal Limited (CUMI), Sia Abrasives, PFERD, Mirka Ltd., TGA Abrasives, Osborn, and Steel Shine.

b. The key factors that are driving the non-woven abrasives market growth is the increasing requirement of superior surface finishes in various industries such as automotive, aerospace, and electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.