Non-volatile Dual In-line Memory Module Market Size, Share & Trends Analysis Report By Product (NVDIMM-N, NVDIMM-F), By Capacity (8GB, 16GB), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-475-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

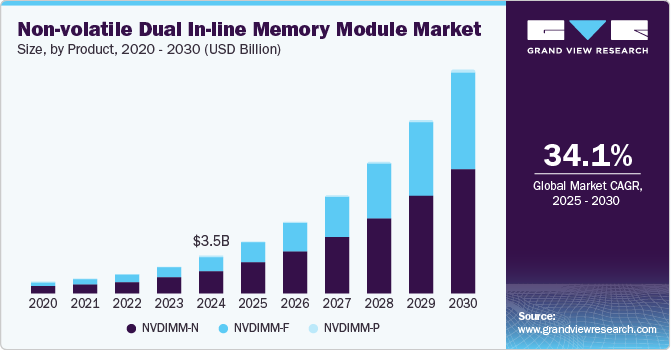

The global non-volatile dual in-line memory module (NVDIMM) market size was valued at USD 3.51 billion in 2024 and is expected to grow at a CAGR of 34.1% from 2025 to 2030. Rapidly growing demand for non-volatile memory for data center applications to protect data losses from a sudden power outage is expected to propel market growth.

The non-volatile dual in-line memory module is primarily made of a combination of DRAMs, a NAND flash, an NVDIMM controller, and a supercapacitor. During a service outage, the data is stored from DRAM to the NAND flash with the help of a supercapacitor. Additionally, once the data transmission process is completed, the supercapacitor goes into zero states. Further, when the power is back, the DRAM data has been restored from the NAND flash.

Non-Volatile Dual In-Line Memory Modules (NVDIMMs) are revolutionizing memory storage by merging the speed of DRAM with the persistence of flash memory, ensuring data retention during power outages. Their ability to deliver high-speed performance while maintaining data integrity makes them indispensable for critical applications in data centers, cloud computing, and enterprise storage. The growing adoption of data-intensive technologies such as AI, big data analytics, and IoT has significantly increased the demand for faster and more reliable memory solutions, positioning NVDIMMs as a preferred choice.

The market is witnessing a surge in demand for hybrid modules such as NVDIMM-N, which combine DRAM's speed with NAND flash's non-volatility, ensuring uninterrupted data access even during power failures. In addition, the rise of in-memory computing and real-time data processing in edge computing environments has further driven the need for low-latency, high-throughput memory solutions. These advancements cater to industries requiring seamless operations, such as financial services, high-performance computing (HPC), and industrial automation. Furthermore, technological innovations, including developments in 3D NAND and persistent memory solutions, are reshaping the landscape by enhancing performance and efficiency.

Product Insights

The NVDIMM-N led the market and accounted for the largest revenue share of 60.1% in 2024, driven by its ability to combine DRAM's high-speed performance with NAND flash's data persistence, making it ideal for applications requiring rapid data access and reliability. In addition, its low latency and high agility are crucial for real-time analytics, financial trading platforms, and in-memory computing. The increasing adoption of data-intensive technologies such as AI, cloud computing, and big data analytics further boosts demand. Furthermore, advancements in hybrid memory solutions enhance its efficiency and expand its use in critical sectors.

NVDIMM-P is expected to grow at a CAGR of 44.3% over the forecast period, owing to its advanced capabilities in providing persistent memory with higher capacity and better scalability compared to NVDIMM-N. It caters to the growing need for real-time data processing in applications such as edge computing, IoT, and enterprise storage. In addition, its ability to handle large datasets efficiently makes it essential for next-generation workloads such as AI and machine learning. Furthermore, ongoing technological innovations and new product launches tailored for hyperscale data centers are accelerating its adoption across diverse industries.

Capacity Insights

The 16 GB capacity segment dominated the global non-volatile dual in-line memory module market, with the largest revenue share of 52.0% in 2024. This growth is attributed to its higher density and faster processing capabilities compared to earlier memory models. In addition, this capacity is particularly suited for enterprise storage and server applications, enabling efficient handling of data-intensive workloads. Furthermore, major players are focusing on producing 16 GB NVDIMM-N modules to meet the rising demand for high-speed memory solutions. Its adoption is also boosted by advancements in hybrid memory technologies and increasing data center deployments.

The 32 GB and above segment is expected to grow at the fastest CAGR of 37.1% over the forecast period, due to its ability to support large-scale data processing and storage requirements in advanced applications such as AI, big data analytics, and cloud computing. This capacity is crucial for next-generation workloads, offering scalability and enhanced performance for hyperscale data centers and enterprise systems.

End Use Insights

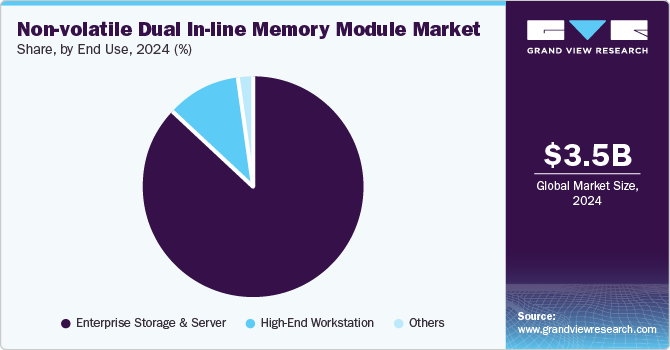

The enterprise storage and server applications segment held the dominant position in the market, accounting for the largest revenue share of 87.1% in 2024, primarily driven by the increasing demand for reliable, high-speed memory solutions to support data-intensive operations. In addition, as businesses adopt cloud computing, big data analytics, and AI, the need for persistent memory that ensures data integrity during power outages has surged. Furthermore, NVDIMMs are critical for maintaining seamless operations in mission-critical environments such as data centers, offering low latency and high throughput for efficient data processing and storage.

High-end workstations are expected to grow at a lucrative CAGR of 33.1% over the forecast period, owing to their need for advanced memory solutions capable of handling complex workloads such as 3D rendering, video editing, and scientific simulations. In addition, these workstations require high-performance memory to ensure real-time processing and uninterrupted operations. The adoption of NVDIMMs enhances system reliability by preventing data loss during power failures while improving processing speeds. Furthermore, technological advancements in persistent memory solutions are further boosting their integration into high-end computing systems across industries.

Regional Insights

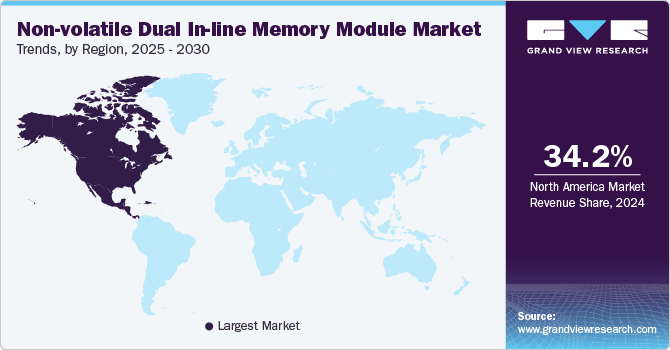

The Asia Pacific non-volatile dual in-line memory module market dominated the global market and accounted for the largest revenue share of 34.2% in 2024. This growth is attributed to the rapid expansion of data centers and the increasing adoption of advanced enterprise storage solutions. In addition, the region's growing focus on cloud computing and AI applications has created a strong demand for high-speed, reliable memory modules.

China Non-Volatile Dual In-Line Memory Module Market Trends

The non-volatile dual in-line memory module market in China led the Asia Pacific market and held the largest revenue share in 2024, driven by its robust investments in data center infrastructure and advancements in AI and big data technologies. Furthermore, the country’s focus on becoming a global leader in technology innovation has accelerated the adoption of high-performance memory solutions such as NVDIMMs. Moreover, the increasing deployment of 5G networks and IoT devices has intensified the demand for scalable and persistent memory modules, positioning China as a key player in this market segment.

Latin America Non-Volatile Dual In-Line Memory Module Market Trends

Latin America non-volatile dual in-line memory module market is expected to grow at a CAGR of 34.5% over the forecast period, attributed to the rising adoption of cloud-based services and enterprise storage solutions by businesses seeking to modernize their IT infrastructure. In addition, the region's expanding digital economy has led to increased demand for reliable memory modules that ensure data integrity during power outages.

North America Non-Volatile Dual In-Line Memory Module Market Trends

The non-volatile dual in-line memory module market in North America held a significant revenue share of 31.9% in 2024, primarily driven by the widespread adoption of advanced technologies such as AI, machine learning, and big data analytics. Furthermore, the strong presence of major technology companies and extensive data center networks has created a robust demand for memory solutions with high speed.

The U.S. non-volatile dual in-line memory module market dominated the North American market and accounted for the largest revenue share in 2024, owing to its early adoption of cutting-edge technologies and a well-established IT infrastructure. Furthermore, the growing reliance on real-time data processing in industries such as finance, healthcare, and e-commerce has fueled demand for high-capacity, non-volatile memory modules.

Europe Non-Volatile Dual In-Line Memory Module Market Trends

The growth of the non-volatile dual in-line memory module market in Europe is expected to be driven by increasing investments in data centers and enterprise storage systems to support cloud computing and digital transformation initiatives.

Key Non-Volatile Dual In-Line Memory Module Company Insights

Key players in the global non-volatile dual in-line memory module industry include AgigA Tech, Inc., Micron Technology Inc., Netlist, Inc., and others. These players employ strategies such as investing in research and development to enhance product performance and efficiency. In addition, they focus on launching innovative, high-capacity memory modules to meet evolving demands across industries.

-

AgigA Tech, Inc. manufactures innovative products such as AGIGARAM, which integrates DRAM and NAND flash to ensure data persistence during power loss. AgigA Tech operates in the memory technology segment, focusing on providing reliable and efficient solutions for enterprise storage, servers, and other critical applications.

-

Micron Technology Inc. manufactures and supplies a wide range of memory technologies, such as DRAM and NAND flash-based modules, designed for high-performance and data-intensive applications.

Key Non-Volatile Dual In-Line Memory Module Companies:

The following are the leading companies in the non-volatile dual in-line memory module market. These companies collectively hold the largest market share and dictate industry trends.

- Viking Technology Inc.

- AgigA Tech, Inc.

- Micron Technology Inc.

- Netlist, Inc

- Smart Modular Technologies, Inc.

- Rambus Inc.

- Sk Hynix, Inc.

- Intel Corporation

- HPE

Recent Developments

-

In October 2024, Micron launched its Crucial DDR5 CUDIMM and CSODIMM memory modules, a new category of clock driver memory designed to boost performance in AI PCs and high-end workstations.

-

In August 2024, SMART Modular Technologies launched a new DDR5 Registered DIMMs (RDIMMs) with a conformal coating, tailored for liquid immersion servers. These modules blend DDR5 performance with enhanced protection, ensuring reliability in demanding data center environments.

Non-Volatile Dual In-Line Memory Module Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.90 billion |

|

Revenue forecast in 2030 |

USD 21.20 billion |

|

Growth rate |

CAGR of 34.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, capacity, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa |

|

Key companies profiled |

Viking Technology Inc.; AgigA Tech, Inc.; Micron Technology Inc.; Netlist, Inc; Smart Modular Technologies, Inc.; Rambus Inc.; Sk Hynix, Inc.; Intel Corporation; HPE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Non-volatile Dual In-line Memory Module Market Report Segmentation

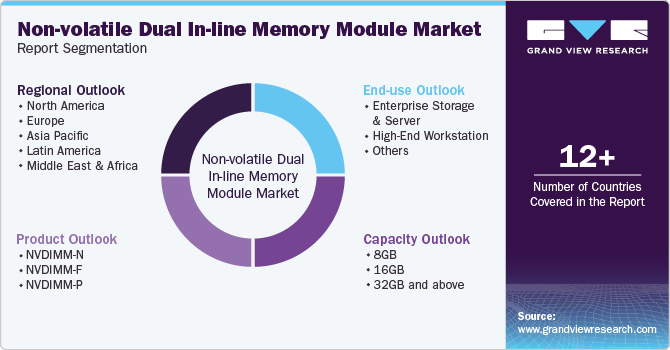

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-volatile dual in-line memory module market report based on product, capacity, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

NVDIMM-N

-

NVDIMM-F

-

NVDIMM-P

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

8GB

-

16GB

-

32GB and above

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise Storage and Server

-

High-End Workstation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."