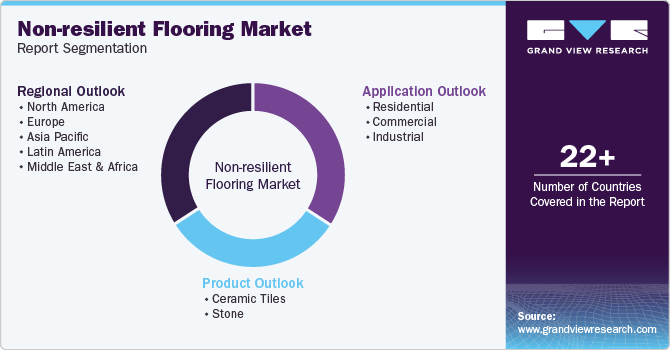

Non-resilient Flooring Market Size, Share & Trends Analysis Report By Product (Ceramic Tiles, Stone), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-463-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Non-resilient Flooring Market Size & Trends

The global non-resilient flooring market size was valued at USD 286.7 billion in 2023 and is projected to grow at a CAGR of 3.4% from 2024 to 2030. Several key factors, including advancements in non-resilient flooring technology, a rise in demand for eco-friendly and sustainable flooring solutions, and an increase in the use of wooden flooring in indoor sports facilities, drive market growth. Technological innovations in non-resilient flooring enhance product durability, aesthetic appeal, and installation efficiency, leading to market expansion.

Flooring manufacturers constantly strive for innovation and the creation of new products with enhanced qualities such as durability, ease of installation, and design. Technological progress within the flooring industry has resulted in the development of simpler products to install, demand less maintenance, and have a prolonged lifespan. For instance, in May 2024, RAK Ceramics opened The Experience Centre in Karnataka, India, a complete tile lifestyle center. The strategy is expected to help in creating awareness and drive market growth.

The rise of urbanization has significantly contributed to the demand for flooring products, particularly in emerging markets. With the increasing number of individuals relocating to cities, there is a growing necessity for new residential properties, commercial buildings, and infrastructure, all of which rely on installing quality flooring. According to the World Bank, approximately 4.4 billion people live in urban areas, which is expected to increase to 6 billion by 2045. This shift towards urbanization is expected to boost the demand for non-resilient flooring and drive market growth.

Product Insights & Trends

The stone segment dominated the market and accounted for a revenue share of 66.5% in 2023. The stone flooring is extensively used due to its durability and enduring value. These stones are favored for their usage in bathrooms, hallways, living areas, and outdoor spaces. Companies are intensifying their investments and launching new products to strengthen their position in the market. For instance, in July 2024, CNW Quartz Stone (DAFUSTONE) Company introduced the CNW Quartz Collection, which is expected to meet the demand for advanced flooring solutions.

The ceramic tiles segment is expected to grow at the fastest CAGR over the forecast period. The exceptional durability, artistic flexibility, and minimum maintenance needs make it a preferred choice for consumers. Ceramic tiles are also preferred for new construction projects and home improvement initiatives. They are common in commercial settings such as shopping centers, offices, and workspaces. In March 2024, SOMANY Ceramics launched SOMANY MAX, which is a glazed vitrified tiles collection of the company. The launch is expected to boost further competition in the industry and foster growth in the market.

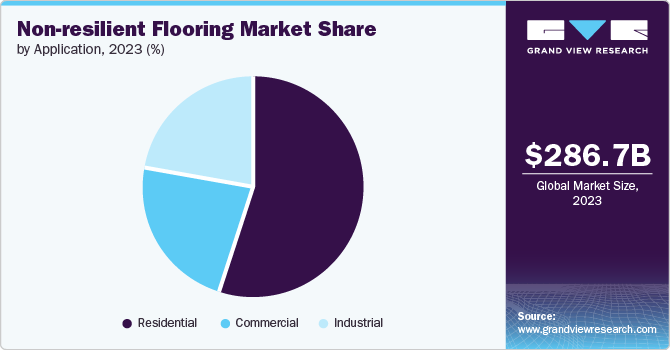

Application Insights & Trends

The residential segment accounted for the largest revenue share in the non-resilient flooring market at 55.4% in 2023. The residential segment holds a significant advantage in terms of customer base, as it includes a large number of households, surpassing both commercial and industrial sectors. The increasing urbanization and population growth further fuel the demand for housing solutions, leading to the construction of new residential structures. According to the information presented by the India Brand Equity Foundation, luxury home sales in India surged by 75% in 2023. The rising demand in the real estate industry is, thus, expected to drive market growth.

The industry segment is expected to register the fastest CAGR of 3.7% over the forecast period. The increase in industrial activities, demand for durable and long-lasting flooring, and cost-effectiveness are major factors driving market growth. Industrial settings require flooring that can handle heavy foot traffic, machinery, and potential spills. The durability of non-resilient flooring makes it a cost-effective option in the long term, which is expected to drive demand in the market.

Regional Insights & Trends

The North America non-resilient flooring market is expected to grow significantly over the forecast period owing to the presence of the local and global industry players and their expansion activities. For instance, in January 2021, Mohawk Industries, Inc., a global manufacturer of residential and commercial flooring products, announced its plans to invest USD 22.5 million to help in expanding its activities in Carroll County, U.S. This is expected to boost competition in the market and drive regional growth.

U.S. Non-resilient Flooring Market Trends

The non-resilient flooring market in the U.S. accounted for an 11.1% share of the global market due to the growing construction market and investment activities of market players. For instance, in February 2020, Mannington announced building a USD 22 million flooring plant in Georgia. The investment is expected to help in the market development and drive market growth in the region.

Europe Non-resilient Flooring Market Trends

The European non-resilient flooring market was identified as a lucrative region in this industry. The rise in the construction industry and high demand for eco-friendly flooring materials are driving the market growth in Europe. According to the European Commission, the construction industry accounts for 9% total GDP of Europe. In addition, according to Eurostat, the real estate activities sector generated USD 291.6 billion of value added in 2021.

The non-resilient flooring market in UK is expected to grow rapidly in the coming years due to the rise in construction projects within the region's residential and commercial areas, highlighting the industry's demand for quality flooring. The expansion of the construction and real estate sector, along with increasing urbanization, is driving the growth of the non-resilient flooring market. For instance, according to the Department of Business and Trade, the property sector in the UK contributes approximately 2.2 billion to the UK GDP annually.

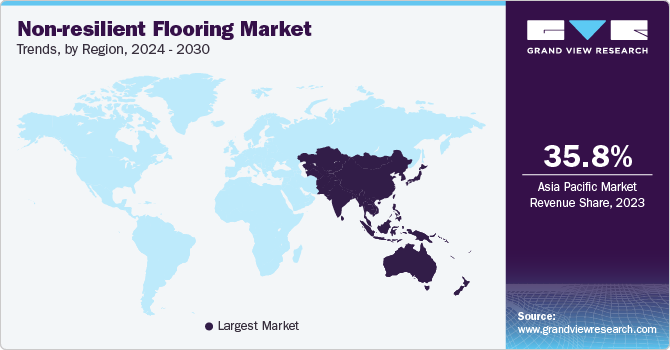

Asia Pacific Non-resilient Flooring Market Trends

Asia Pacific non-resilient flooring market dominated the global non-resilient flooring market with a revenue share of 35.8% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The Asia Pacific non-resilient flooring market has experienced significant growth due to several factors. Firstly, the rise in urbanization and the systematic transfer of rural inhabitants to urban areas in certain countries have contributed to increased demand for flooring. In addition, the development activities in major countries such as India and China are further expected to drive market demand.

The non-resilient flooring market in China is expected to grow rapidly in the coming years due to urbanization, infrastructure growth, and key development activities by private and public players. For instance, in March 2024, the construction of Metro Line 19 began in Shanghai. The implementation of such development projects is expected to increase demand for non-resilient flooring and drive growth in the market.

India's non-resilient flooring market is expected to grow rapidly in the coming years due to rapid industrialization, rising infrastructure spending, and the development of manufacturing facilities. For instance, in January 2018, Kajaria Ceramics announced an approximately USD 9.6 million investment to expand its polished vitrified tiles manufacturing capacity. Such developments are likely to help with the market development and drive its growth.

Key Non-resilient Flooring Company Insights

Some of the companies in the non-resilient flooring market include Kajaria Ceramics Limited; Mannington Mills, Inc.; MOHAWK INDUSTRIES, INC.; PORCELANOSA Grupo A.I.E.; Key players in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Crossville Inc. is a manufacturer and distributor specializing in the production of porcelain stone tile. The company offers a range of porcelain stone tile, along with a diverse selection of natural stone, glass, metals, and wall tile.

-

Kajaria Ceramics specializes in the manufacturing of a diverse range of ceramic tiles, which includes floor tiles, wall tiles, vitrified tiles, and glazed tiles. The company also engages in investments in research and development to constantly innovate and introduce new products. In addition, Kajaria Ceramics maintains an extensive distribution network to ensure the widespread availability of its products to customers.

Key Non-resilient Flooring Companies:

The following are the leading companies in the non-resilient flooring market. These companies collectively hold the largest market share and dictate industry trends.

- Victoria PLC

- Crossville Inc.

- Daltile.

- Kajaria Ceramics Limited

- Mannington Mills, Inc.

- MOHAWK INDUSTRIES, INC.

- PORCELANOSA Grupo A.I.E.

- Shaw Industries Group, Inc.

Recent Developments

-

In June 2023, Crossville, Inc. introduced the Snippet ceramic wall tile collection. This product has tone-on-tone graphic geometry, offering a wide range opportunities for personalized wall designs.

-

In Jan 2023, Daltile unveiled fresh tile collections for the upcoming spring of 2023. The latest Dal-Tile offerings showcase a range of stylish products with features such as designer stone looks, terrazzo looks, concrete designs, and natural stone mosaics.

Non-resilient Flooring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 297.9 billion |

|

Revenue forecast in 2030 |

USD 364.7 billion |

|

Growth Rate |

CAGR of 3.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030, Volume in Billion Square Feet |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Argentina, Brazil, Saudi Arabia |

|

Key companies profiled |

Victoria PLC; Crossville Inc.; Daltile.; Kajaria Ceramics Limited; Mannington Mills, Inc.; MOHAWK INDUSTRIES, INC.; PORCELANOSA Grupo A.I.E.; Shaw Industries Group, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Non-resilient Flooring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-resilient flooring market report based on product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030) (Volume in Billion Square Feet)

-

Ceramic Tiles

-

Stone

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030) (Volume in Billion Square Feet)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030) (Volume in Billion Square Feet)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."