- Home

- »

- Consumer F&B

- »

-

Non-alcoholic Wine Market Size And Share Report, 2030GVR Report cover

![Non-alcoholic Wine Market Size, Share & Trends Report]()

Non-alcoholic Wine Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sparkling, Still), By ABV (%), By Packaging (Bottles, Cans), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-242-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-alcoholic Wine Market Summary

The global non-alcoholic wine market size was estimated at USD 2.26 billion in 2023 and is projected to reach USD 3.78 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. The demand for non-alcoholic wine is driven by the rise in the number of consumers exploring alcohol alternatives during Dry January and the increasing availability of non-alcoholic beverages in the market. This trend has led to a surge in sales and the entry of both new and established brands into the industry.

Key Market Trends & Insights

- North America accounted for a revenue share of 49.58% in 2023.

- The non-alcoholic wine market in the U.S. is expected to grow at a CAGR of 6.4% from 2024 to 2030.

- By distribution channel, the off-trade segment accounted for a revenue share of 89.00% in 2023.

- By product, the sparkling wine segment accounted for the largest revenue share of 60.41% in 2023

Market Size & Forecast

- 2023 Market Size: USD 2.26 Billion

- 2030 Projected Market Size: USD 3.78 Billion

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2023

Non-alcoholic wine is made through a process of dealcoholization, which can be water-intensive and energy-intensive. Different methods, such as reverse osmosis and vacuum distillation, are used to remove the alcohol from the wine. The dealcoholization process has a carbon footprint, and efforts are made to offset this through organic and minimal intervention farming practices. To cater to the high demand for non-alcoholic wine, several companies are exploring lightweight packaging options, such as cans, to reduce their carbon footprint.

The rise in several younger consumers exploring alcohol adjacent and non-alcoholic beverages is positively favoring the demand in the market. For instance, Drizly, a U.S.-based online marketplace for alcoholic and non-alcoholic beverages, in 2022, stated that the younger demographic is keen on trying non-alcoholic wine. The study showcased that 22% of millennials and 21% of the Gen Z populace in the U.S. were most curious about exploring non-alcoholic wine. This trend, in turn, has made non-alcoholic wine popular at weddings, events, and restaurants. For instance, in the U.S., non-alcoholic wines are available at Beverly Hills Hotel, Blue Hill Farm, and other popular hotel chains.

Furthermore, the increasing trend of reducing alcohol content in beverages and drinks among consumers is anticipated to drive the growth of the market. Several brands are addressing the growing demand among consumers for non-alcoholic beverages by expanding their product portfolio by introducing new non-alcoholic wine to the market. For instance, wineries such as Stella Rosa, Barton & Guestier, Miller Family Wine Co, and Veuve du Vernay are expanding their portfolio of alcohol-removed wine.

Market Concentration & Characteristics

The non-alcoholic wine market demonstrates a medium to high degree of innovation, with companies consistently adopting newer technology to cater to evolving consumer preferences. Advances in production techniques have led to non-alcoholic wine with enhanced taste profiles, mimicking the complexity and nuances found in traditional wine. Winemakers are employing innovative methods to capture the essence of grape varieties, fermentation, and aging processes without the presence of alcohol.

The mergers and acquisitions are in the range of medium to high in the non-alcoholic wine market. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions aiming to gain a competitive edge and achieve economies of scale.

The primary regulatory aspect for non-alcoholic wine is the permissible alcohol content. Different countries define non-alcoholic beverages based on specific alcohol-by-volume (ABV) thresholds. For example, in the United States, beverages containing less than 0.5% ABV are considered non-alcoholic.

Mocktails, or virgin cocktails, are non-alcoholic versions of traditional mixed drinks. These beverages combine various juices, syrups, and other ingredients to create flavorful and visually appealing drinks without the need for alcohol.

Product Insights

The sparkling wine segment accounted for the largest revenue share of 60.41% in 2023. Sparkling non-alcoholic wine offers a sophisticated and celebratory alternative for those who choose not to consume alcohol. The effervescence and refreshing taste of sparkling non-alcoholic wine make them an appealing option for social gatherings and special occasions. The availability of a wide variety of flavors and styles also contributes to their dominance. In response, several manufacturers are launching non-alcoholic sparkling wine. In December 2023, U.S.-based Mionetto, a provider of sparkling wine announced its entry into the non-alcoholic beverage category by launching zero-proof sparkling wine that copies the flavor of its flagship wine Prosecco Brut. The wine has notes of cranberry, apple, and peaches.

On the other hand, still wine is expected to grow at a CAGR of 8.9% from 2024 to 2030. The growing consumer focus on healthier beverages is anticipated to drive the demand for non-alcoholic wine. These wines provide healthier options for those who want to enjoy the taste of wine without the alcohol content. In addition, advancements in the production of non-alcoholic wine have led to improved taste and quality, making them more appealing to consumers. This has played a significant role in driving the demand for non-alcoholic still wine. In October 2023, U.S.-based Surely brand announced the launch of the non-alcoholic Red Blend. wine includes a mix of de-alcoholized wine with an exclusive blend of botanicals, organic teas, and other natural ingredients.

Packaging Insights

The bottled packaging segment accounted for a market share of 86.84% in 2023. Bottled non-alcoholic wines are well-suited for social occasions such as weddings and events where the act of serving and sharing wine is integral to the experience. The presence of a cork and the sound of its opening can add a ceremony aspect to the consumption of non-alcoholic wine, making it more suitable for celebrations, dinners, and gatherings. Additionally, the rising preference for non-alcoholic wine in celebratory events is also favoring the demand in this segment.

On the other hand, the canned packaging segment is expected to grow at a CAGR of 9.1% from 2024 to 2030. The lightweight, durable, and convenient nature of canned non-alcoholic wine makes them well-suited for various outdoor activities, providing consumers with a practical and enjoyable alternative to traditional bottled beverages in dynamic and mobile settings. For instance, in November 2023, U.S.-based non-alcoholic wine startup OJOY Wine Co. announced the launch of OJOY Sparkling Blanc. The canned beverage includes 100% California wine, which is produced by dealcoholizing technology. The wine includes 0.5% alcohol by volume and has flavor notes of citrus, apricot, and black currant.

Distribution Channel Insights

The off-trade segment accounted for a revenue share of 89.00% in 2023. The primary driver behind the increasing sales of non-alcoholic wine through off-trade channels is the strategic emphasis on enhancing product visibility. This heightened visibility plays a pivotal role in capturing consumer attention, influencing purchasing decisions, and ultimately boosting sales. For example, hypermarkets & supermarkets and hypermarkets showcase a diverse range of non-alcoholic wine, including different brands, varietals, and styles. This variety not only caters to different consumer preferences but also encourages exploration and trial of various options.

On the other hand, the on-trade segment is expected to grow at a CAGR of 6.6% from 2024 to 2030. The increasing number of restaurants and bars serving non-alcoholic wine is a major factor contributing to the growth of the segment. Non-alcoholic wine offers new possibilities for food and wine pairings. Restaurants are increasingly recognizing the importance of catering to diverse dietary preferences and needs, including those who prefer non-alcoholic options. Non-alcoholic wine can be paired with a wide range of dishes, enhancing the dining experience for those who want to enjoy a wine-like beverage without the alcohol content.

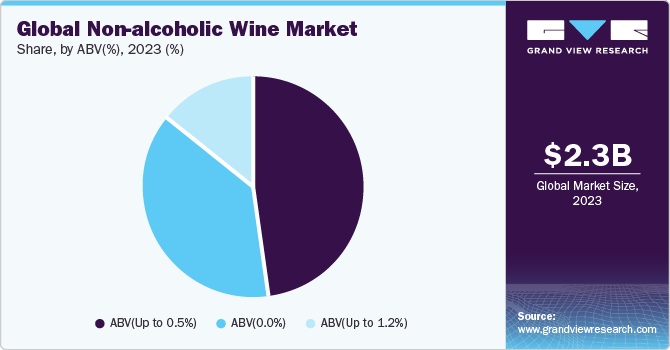

ABV (%) Insights

The ABV (up to 0.5%) segment accounted for a revenue share of 47.67% in 2023. Growing consumer awareness of the negative health impacts of excessive alcohol consumption is propelling the demand in this segment. Non-alcoholic wine with a low ABV provides a bridge between complete abstinence and traditional wine consumption, catering to those who are consciously choosing to moderate their alcohol intake.

Several market players have taken cognizance of this trend by launching non-alcoholic wine with an ABV of up to 1.5%. In October 2023, FRE brand by a key player in the market, Sutter Home Wine Estate announced the launch of 87ml mini ‘wine in FRE Chardonnay and Cabernet Sauvignon varieties. These mini wines are ideal for on-the-go consumption. The availability of single-serve options helps the company cater to consumers looking for convenient choices, especially those on the go or wanting a single glass of wine. This convenience can attract more customers and enhance their overall experience.

The ABV(0.0%) is projected to register a CAGR of 8.4% over the forecast period. Smartphones and tablets are increasingly using non-alcoholic wine. Advances in technology and production processes have led to the development of non-alcoholic wine that closely mimics the taste and quality of traditional wine. This improvement in flavor contributes to the growing acceptance of 0.0% ABV wine. For instance, Germany-based Schloss Wachenheim AG offers a wide range of non-alcoholic sparkling wines that include an ABV(0.0%)

Regional Insights

North America accounted for a revenue share of 49.58% in 2023. The increasing awareness of health risks associated with excessive alcohol consumption among consumers is driving a paradigm shift towards healthier lifestyles. Consumers are actively seeking alternatives that allow them to enjoy the ritual and experience of wine without the negative health impacts of alcohol. Manufacturers are responding by focusing on research and development to create diverse and high-quality non-alcoholic wine options.

U.S. Non-alcoholic Wine Market Trends

The non-alcoholic wine market in the U.S. is expected to grow at a CAGR of 6.4% from 2024 to 2030, owing to a significant shift in consumer preferences towards healthier lifestyles, leading to increased interest in non-alcoholic alternatives. Non-alcoholic wine caters to individuals looking to reduce their alcohol consumption without sacrificing the social and sensory aspects of enjoying a glass of wine. In October 2022, Sovi Wine Co. launched non-alcoholic wine bottles, including a 2021 Chenin Blanc and a Reserve Red Blend. These premium non-alcoholic wines are made from high-end fruit sourced from California's Clarksburg AVA. The alcohol is removed through a vacuum distillation process, retaining the flavors and aromas of the wine.

Asia Pacific Non-alcoholic Wine Market Trends

Asia Pacific is anticipated to grow at a CAGR of 13.0% from 2024 to 2030. There is a growing awareness of the health risks associated with excessive alcohol consumption, leading to a shift towards healthier lifestyles and an increasing number of consumers opting for non-alcoholic alternatives. The impact has been particularly noticeable in Japan, a country experiencing a declining population and a significant decrease in alcohol consumption among the younger generation. To address the demand several companies in the country are offering non-alcoholic wine. Japan-based Kirin Holdings Co. offers non-alcoholic wine.

Key Non-alcoholic Wine Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that the key players are focusing on strategic initiatives such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In January 2024, U.S.-based Free AF, an alcohol-free brand, announced the launch of a non-alcoholic Sparkling Rosé at Sprouts Farmers Market across the U.S. The Free AF Sparkling Rosé is a ready-to-drink, alcohol-free sparkling wine that features a fragrant, fruity, and floral undertone. The product is available in 4-Packs at Sprouts Farmers Market, priced at USD 17.99.

-

In October 2023, Oceano Wine announced the launch of a non-alcoholic luxury wine, Oceano Zero Pinot Noir. The wine is sourced from the sustainably-certified Spanish Springs Vineyard.

-

In October 2023, New Zealand-based provider of non-alcoholic wine, Giesen introduced Giesen 0% Sparkling Brut. The non-alcoholic wine range includes 0% Sauvignon Blanc, Pinot Grigio, Riesling, Rosé, and Premium Red.

Key Non-alcoholic Wine Companies:

The following are the leading companies in the non-alcoholic wine market. These companies collectively hold the largest market share and dictate industry trends.

- Schloss Wachenheim AG

- Australian Vintage Limited

- Sutter Home Wine Estate

- Miguel Torres S.A

- DGB (Pty) Ltd.

- Bodega La Tautila

- Grüvi

- Chateau Diana Winery

- Hill Street Beverage Company Inc.

- Ariel Vineyards

- Neobulles SA

- Thomson and Scott

- Giacobazzi A.e Figli srl

- Pierre Chavin

- Weingut Leitz KG

- San Antonio Winery (Stella Rosa)

- Proxies

- Giesen

Non-alcoholic Wine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.39 billion

Revenue forecast in 2030

USD 3.78 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ABV(%), packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain;

Finland; Belgium & Luxembourg; Hungary; China; Japan; Australia; Brazil; South Africa

Key companies profiled

Schloss Wachenheim AG; Australian Vintage Limited; Sutter Home Wine Estate; Miguel Torres S.A; DGB (Pty) Ltd.; Bodega La Tautila; Grüvi; Chateau Diana Winery; Hill Street Beverage Company Inc.; Ariel Vineyards; Neobulles SA; Thomson and Scott; Giacobazzi A.e Figli srl; Pierre Chavin; Weingut Leitz KG; San Antonio Winery (Stella Rosa); Proxies; Giesen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-alcoholic Wine Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the non-alcoholic wine market report based on product, ABV(%), packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sparkling

-

Still

-

-

ABV (%) Outlook (Revenue, USD Million, 2018 - 2030)

-

ABV (0.0%)

-

ABV (Up to 0.5%)

-

ABV (Up to 1.2%)

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-trade

-

Off-trade

-

Hypermarkets & Supermarkets

-

Online

-

Specialty Stores & Tasting Rooms

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Finland

-

Belgium & Luxembourg

-

Hungary

-

-

Asia Pacific

-

Japan

-

Australia

-

China

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-alcoholic wine market size was estimated at USD 2.26 billion in 2023 and is expected to reach USD 2.39 billion in 2024.

b. The global non-alcoholic wine market is expected to grow at a compounded growth rate of 7.9% from 2024 to 2030 to reach USD 3.78 billion by 2030.

b. Sparkling wine dominated the market with a share of 59.8% in 2023. The effervescence and refreshing taste of sparkling non-alcoholic wines make them an appealing option for social gatherings and special occasions.

b. Some key players operating in white non-alcoholic wines market are Schloss Wachenheim AG, Australian Vintage Limited, Sutter Home Wine Estate, Miguel Torres S.A, DGB (Pty) Ltd., Bodega La Tautila, Grüvi, Chateau Diana Winery, Hill Street Beverage Company Inc., Ariel Vineyards, Neobulles SA, Thomson and Scott, Giacobazzi A.e Figli srl, Pierre Chavin, Weingut Leitz KG, San Antonio Winery (Stella Rosa), Proxies, and Giesen.

b. The demand for non-alcoholic wines is being driven by the rise in number of consumers exploring alcohol alternatives during Dry January, and the increasing availability of non-alcoholic beverages in the market. This trend has led to a surge in sales and the entry of both new and established brands into the non-alcoholic wine market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.