- Home

- »

- Consumer F&B

- »

-

Non-alcoholic Spirits Market Size And Share Report, 2030GVR Report cover

![Non-alcoholic Spirits Market Size, Share & Trends Report]()

Non-alcoholic Spirits Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Whiskey, Rum, Gin, Vodka), By Distribution Channel (On Trade, Off Trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-475-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-alcoholic Spirits Market Summary

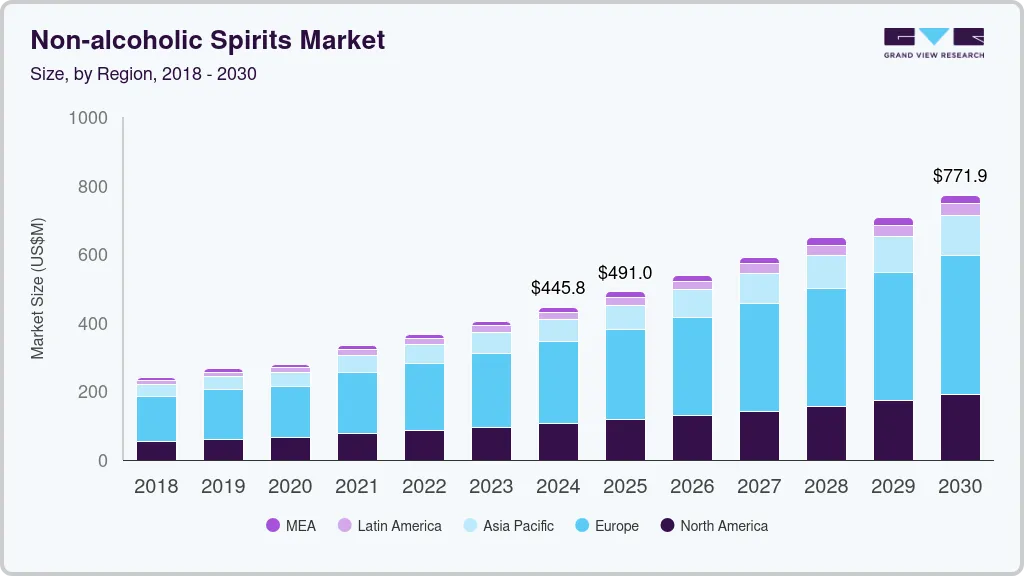

The global non-alcoholic spirits market size was estimated at USD 445.8 million in 2024 and is expected to reach USD 771.9 million in 2030, growing at a CAGR of 9.5% from 2025 to 2030. The market for non-alcoholic spirits has been experiencing significant growth in recent years, driven by several factors and trends.

Key Market Trends & Insights

- North America non-alcoholic spirits market is expected to grow at a CAGR of 9.4% from 2024 to 2030.

- The non-alcoholic spirits market in the U.S. is growing.

- By product, vodka segment accounted for a revenue share of 35.3% in 2023.

- By distribution channel, sales through on trade segment accounted for a revenue share of 56.8% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 445.8 Million

- 2030 Projected Market Size: USD 771.9 Million

- CAGR (2025-2030): 9.5%

- North America: Largest market in 2023

One of the primary reasons is the increasing focus on health and wellness. Many consumers, particularly younger ones, are more health-conscious and are looking to reduce their alcohol intake to avoid its negative effects on both physical and mental health. This has led to a rise in the popularity of non-alcoholic beverages, which allow people to enjoy the social aspects of drinking without the calories, sugars, or potential harm associated with alcohol.The "Sober Curious" movement, which encourages individuals to explore a lifestyle with reduced or no alcohol consumption, has also played a significant role in the rising popularity of non-alcoholic spirits. This movement is part of a broader trend of mindfulness and intentional living, where people are more conscious about their lifestyle choices and their impact on their bodies and minds. Social norms are changing as well, with a growing acceptance of non-drinking at social gatherings, reducing the pressure to consume alcohol. Non-alcoholic spirits provide a sophisticated and flavorful alternative that allows non-drinkers to fully participate in social rituals, making them an attractive option for those who want to enjoy a crafted drink without alcohol.

Younger generations, especially Gen Z, are inclined towards non-alcoholic beverages for several reasons. Gen Z is highly health-conscious, prioritizing mental and physical wellness in their lifestyle choices. They are more likely to avoid substances that can negatively impact their health, such as alcohol. Furthermore, Gen Z has grown up in a digital age where social media heavily influences their behavior. Platforms like Instagram, TikTok, and YouTube promote healthy lifestyles and non-alcoholic alternatives, making these products trendy and desirable among younger consumers. Gen Z also values authenticity and transparency from brands, and many non-alcoholic beverage companies market themselves as ethical and health-focused, aligning with the values of this generation.

There is a strong emphasis on innovation in product development, with companies crafting non-alcoholic spirits that closely replicate the taste, aroma, and mouthfeel of traditional alcoholic beverages. This involves using botanicals, specialized distillation methods, and other techniques to create authentic and satisfying flavors. For instance, in April 2024, Boston Beer Co. introduced a non-alcoholic ready-to-drink (RTD) fruit brew named General Admission in the United States. This innovative beverage blends the characteristics of a non-alcoholic beer with fruit-infused seltzer water, offering a refreshing option for consumers. General Admission is available in select markets, including Albany, New York; Raleigh, North Carolina; and Indiana, and can also be purchased online through direct-to-consumer shipping across various states. The fruit brew has four vibrant flavors: Lemon-Lime, Orange Ovation, Grapefruit Groove, and Raspberry Remix.

Product Insights

Vodka accounted for a revenue share of 35.3% in 2023. The rise of the sober curiosity movement, where people are more conscious of their drinking habits and are exploring alcohol-free lifestyles, has driven demand for non-alcoholic options like vodka that allow them to participate in social drinking without consuming alcohol.Consumers are increasingly mindful of their health and are seeking low or no-alcohol alternatives to reduce calorie intake and avoid the negative effects of alcohol. Non-alcoholic vodka offers a way to enjoy cocktail flavors without the health concerns associated with traditional spirits.

Gin is expected to grow at a CAGR of 9.8% from 2024 to 2030. Gin is known for its unique botanical flavors, which can be replicated in non-alcoholic versions. Consumers seeking complex, aromatic flavors find non-alcoholic gin appealing as it offers a sophisticated taste experience without alcohol.The growing innovation in the non-alcoholic spirits market has led to the development of high-quality non-alcoholic gin options. Brands focus on creating authentic-tasting products, expanding the variety and appeal, which drives consumer interest and demand. In August 2024, Aldi (a supermarket chain) launched two new non-alcoholic gin options under Greyson’s brand: 0% London Dry and 0% Pink Berries, responding to the increasing demand for alcohol-free alternatives among younger consumers in Britain.

Distribution Channel Insights

Sales through on trade accounted for a revenue share of 56.8% in 2023. There is a rising demand for non-alcoholic alternatives as more consumers seek to moderate their alcohol intake or abstain from alcohol altogether. By offering non-alcoholic spirits, on-trade venues can cater to this growing demographic, providing options that appeal to those who want to enjoy the experience of drinking without alcohol. This trend reflects a broader shift in consumer preferences towards healthier and more inclusive beverage options, which bars and restaurants are eager to accommodate to attract and retain customers. Non-alcoholic spirits allow bars and restaurants to create a more inclusive environment for all guests, including those who do not drink alcohol. By offering a variety of non-alcoholic options, venues can ensure that everyone feels included in the social experience, regardless of their drinking preferences.

Sales through off trade are expected to grow at a CAGR of 9.0% from 2024 to 2030.Non-alcoholic spirits are becoming more widely available through off-trade channels, making them easily accessible for consumers to purchase and enjoy at home. The convenience of buying these products in supermarkets, liquor stores, and online allows consumers to explore and experiment with different non-alcoholic options without needing to visit a bar or restaurant. This increased availability in everyday shopping locations makes it simple for consumers to incorporate non-alcoholic spirits into their regular routines. In addition, the expansion of online retail and e-commerce platforms has significantly boosted the sales of non-alcoholic spirits. Consumers are increasingly comfortable purchasing beverages online, and the convenience of home delivery has made it easier for people to try non-alcoholic spirits.

Regional Insights

North America non-alcoholic spirits market is expected to grow at a CAGR of 9.4% from 2024 to 2030. Social norms around drinking are evolving in North America, with a growing acceptance of alcohol-free lifestyles and an increased preference for mindful drinking. As more people seek out social experiences that do not center around alcohol, non-alcoholic spirits offer a sophisticated and inclusive option, catering to a diverse range of consumers who want to enjoy the social aspects of drinking without alcohol.

U.S. Non-alcoholic Spirits Market Trends

The non-alcoholic spirits market in the U.S. is growing. American consumers' growing emphasis on health and wellness shifts towards low or no-alcohol beverages. People are increasingly mindful of their alcohol intake and are looking for alternatives that offer the enjoyment of a cocktail without the health risks associated with alcohol, such as high caloric content and potential long-term health issues.

Asia Pacific Non-alcoholic Spirits Market Trends

The non-alcoholic spirits market in Asia Pacific accounted for a revenue share of 32.4% in 2023. In the Asia Pacific region, a rising awareness of the benefits of a healthy lifestyle leads to decreased alcohol consumption. Consumers are increasingly looking for healthier beverage options that do not compromise on taste or experience. Non-alcoholic spirits offer a way to enjoy sophisticated drinks without the negative health impacts of alcohol, aligning with this trend. In addition, the variety of products, including non-alcoholic versions of popular spirits like gin, vodka, and whiskey, has made it easier for consumers to find options that suit their tastes and preferences, increasing demand.

Europe Non-alcoholic Spirits Market Trends

The non-alcoholic spirits market in Europe is expected to grow at a CAGR of 8.5% from 2024 to 2030. European consumers increasingly focus on health and wellness, preferring low or no-alcohol beverages. Non-alcoholic spirits allow individuals to enjoy the taste and experience of traditional spirits without the negative health impacts of alcohol, such as calories and potential long-term health issues. This aligns with the growing trend of reducing alcohol intake for better physical and mental health.

Key Non-alcoholic Spirits Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective, quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies also focus on raising consumer awareness of the ambiguity of the types used while strictly adhering to international regulatory standards.

Key Non-alcoholic Spirits Companies:

The following are the leading companies in the non-alcoholic spirits market. These companies collectively hold the largest market share and dictate industry trends.

- Seedlip

- Lyre's

- Ceder's

- Monday Gin

- Ritual Zero Proof

- Kin Euphorics

- Töst

- Spiritless

- Pentire

- Harp & Bard

Recent Developments

- In March 2024, London-based spirits brand KAHOL introduced its complete range of non-alcoholic spirits, designed to mimic a wide variety of traditional spirits at 0% ABV. KAHOL's products are crafted using traditional alcohol production techniques and proprietary technology. The original spirit undergoes denaturing before aging and infusion, resulting in a flavor and mouthfeel that resembles alcoholic spirits.

Non-alcoholic Spirits Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 491.0 million

Revenue forecast in 2030

USD 771.9 million

Growth rate (Revenue)

CAGR of 9.5% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Seedlip; Lyre's; Ceder's; Monday Gin; Ritual Zero Proof; Kin Euphorics; Töst; Spiritless; Pentire; Harp & Bard

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-alcoholic Spirits Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-alcoholic spirits market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Whiskey

-

Rum

-

Gin

-

Vodka

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On Trade

-

Off Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-alcoholic spirits market size was estimated at USD 385.4 million in 2023 and is expected to reach USD 412.8 million in 2024.

b. The global non-alcoholic spirits market is expected to grow at a compounded growth rate of 8.7% from 2024 to 2030 to reach USD 681.5 million by 2030.

b. Gin is expected to growth with a CAGR of 9.8% from 2024 to 2030. A growing focus on health and wellness, particularly among younger generations like Gen Z and millennials, is driving consumers to seek lower-alcohol or alcohol-free alternatives. Many individuals are becoming more mindful of their alcohol consumption, leading to a preference for non-alcoholic gin that allow them to enjoy social experiences without the negative effects of alcohol.

b. Some key players operating in non-alcoholic spirits market include Seedlip, Lyre's, Ceder's, Monday Gin, Ritual Zero Proof and others.

b. Key factors that are driving the market growth include rising innovation in non-alcoholic beverages and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.