Nitrocellulose Market Size, Share & Trends Analysis Report By Application (Automotive Paints, Wood Coatings, Printing Inks), By Region (Asia Pacific, Europe, North America), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-487-1

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Report Overview

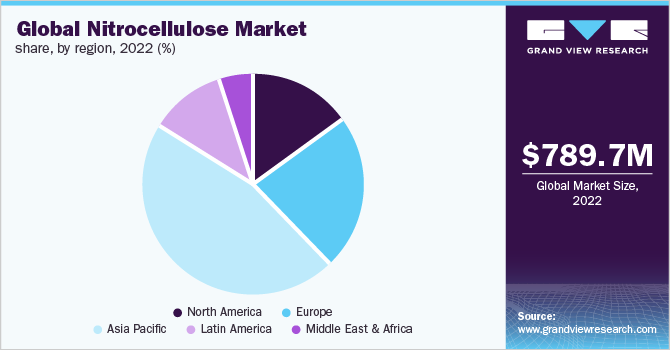

The global nitrocellulose market size was valued at USD 789.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. This is attributed to the rising product demand in printing inks, paints & coatings, and various other end-use industries. Gravure and flexographic inks used in the packaging industry use nitrocellulose as a key component. Various characteristics, such as quick drying capabilities, good adhesion, and easy application, make nitrocellulose-based inks most preferred over other substitutes. These properties also make them customizable for their specific application.

Nitrocellulose is generally manufactured from nitric acid, cellulose, and other heavy nitrate compounds. If cellulose is not completely nitrated, it can also be used as a plastic film, as well as in printing inks, and wooden coatings. The product is also referred to as guncotton when used as a low-command explosive and propellant. The explosive nature is the major challenge for market growth. Mishandling can lead to the loss of lives and other disastrous losses. The inflammable nature of the product is further expected to restrain its demand from end-use industries. Stringent regulation imposed by the governments, such as the German Explosives Act, includes the Council Directive 93/15/EEC, while the EU regulations including 67/54/EEC will further impact the industry growth from 2023 to 2030.

Nitrocellulose-based paints find applications in the automotive paint industry as well. These paints possess several favorable qualities, such as quick drying ability and compatibility with a wide range of additives. However, with time, there have been numerous substitutes for nitrocellulose-based paints with properties that are superior to the above-mentioned ones. Nitrocellulose-based paints are one of the oldest types of paints used as automotive paints. These paints have lost their market share over the years due to the availability of superior substitutes. Nitrocellulose lacquer is thin, easy to apply, and provides a glossy finish.

However, there are certain drawbacks as well, such as low resistance to scratches & pollution, low operational life, as well as the emission of large quantities of organic solvents into the atmosphere. The COVID-19 pandemic severely affected the market demand from various end-use industries, such as automotive paints, printing inks, and wood coatings, due to the impact of the nationwide lockdowns and shutting down of manufacturing units. The pandemic had affected the automotive industry, due to which, the production of automobiles had disruptively halted. This further contributed to the decline in the automotive sector, which affected the demand for nitrocellulose used in automotive paints.

Application Insights

The printing ink application segment dominated the global industry in 2022 and accounted for the highest revenue share of more than 27.85% of the total revenue. Its high share is attributed to technological development and the rise in demand for eco-friendly inks. The printing ink market is both an application and customer-specific based business. Its major applications are in the packaging and logistics industry. It also has a high demand for digital inks, outdoor signage, and inkjet printing. Rising concerns for the environment are influencing the government authorities to modernize the standard of the printing industry. The use of nitrocellulose-based lamination ink in flexography and gravure printing gives high-quality and strong color paint results. These lamination-based inks are trending in the packaging industry because of their high laminated bond strength, no odor, and little solvent retention.

Wood coating product usage varies according to its application, and is used in the decking of furniture, sliding windows and doors, carpets & coloring, are utilized for industrial purposes. In addition, wood coatings based on nitrocellulose lacquer are widely used in manufacturing steel strings for guitars as a finishing agent, and various other musical instruments, especially the U.S. Nitrocellulose is combined with other resins for flexibility and durability. The use of nitrocellulose lacquer as a finishing agent makes touch-ups and repairs easy. The market for printing inks containing cellulose nitrate is expected to grow over the forecast period as a result of the high brilliance and resolution of the graphics they produce, complete solvent evaporation, and the fast-printing speeds that can be obtained in contemporary printing machines.

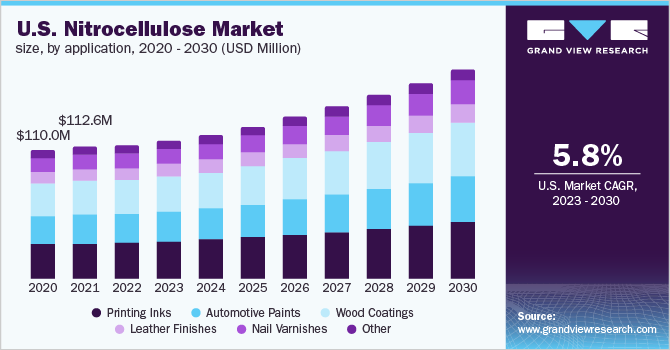

Regional Insights

Asia Pacific dominated the industry in 2022 and accounted for the maximum share of more than 45.55% of the overall revenue. This is attributed to a rise in the product application scope in the paints and coatings sector. Countries like Thailand, India, and China are the largest producers as well as exporters. Trade and use of nitrocellulose in these countries are high because of its use in products like printing inks, automotive paints, wood coating, and leather tanning & finishes. With the growing tourism sector & construction industry and improved standard of living, the demand for wooden items is anticipated to increase in countries like the U.S. and Canada, which is anticipated to boost the product demand in the North America region.

In addition, Canada is also the fourth-largest manufacturer of wooden furniture in the world, which is expected to fuel the smart homes sector in the region, in turn, boosting the demand for nitrocellulose used in the wooden coating. Germany is the market leader in the automotive sector. With this fast development in the industry, the growth of automotive paints is also high. Product demand for automotive paints is also expected to rise due to the presence of prominent automobile manufacturers in the country. This is expected to drive the market in the Europe region.

Key Companies & Market Share Insights

The industry competition is highly dependent on the quality of the product, the number of manufacturers & distributors, and their geographical locations. The top producers and companies operating in the global market are using a variety of corporate growth strategies, including mergers & acquisitions, stepping up their R&D activities targeted at creating inventive and novel goods as well as solutions, among other things. A number of industry participants and stakeholders are also concentrating on increasing their manufacturing capacities. Some of the prominent players in the global nitrocellulose market include:

-

Nitro Chemical Industry Co., Ltd.

-

T.N.C. Industrial Co., Ltd.

-

Hubei Xufei Chemical Co., Ltd.

-

Jiangsu Tailida Group

-

Sichuan North Nitrocellulose Corporation (SNC)

-

Nitrex Chemicals India Pvt. Ltd.

-

Nobel NC

-

Synthesia A.S.

-

IVM Chemicals

Nitrocellulose Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 822.0 million |

|

Revenue forecast in 2030 |

USD 1,154.6 million |

|

Growth rate |

CAGR of 4.9% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Turkey; Austria; Russia; China; India; Japan; Thailand; Vietnam; Malaysia; Indonesia; Taiwan; Mexico; Brazil; Argentina; Peru; Colombia; Chile; South Africa; Egypt; UAE |

|

Key companies profiled |

Nitro Chemical Industry Co. Ltd.; T.N.C. Industrial Co., Ltd.; Hubei Xufei Chemical Co., Ltd.; Jiangsu Tailida Group; Sichuan North Nitrocellulose Corp. (SNC); Nitrex Chemicals India Pvt. Ltd.; Nobel NC; Synthesia A.S.; IVM Chemicals |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Nitrocellulose Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nitrocellulose market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Printing Inks

-

Automotive Paints

-

Wood Coatings

-

Leather Finishes

-

Nail Varnishes

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Austria

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Vietnam

-

Malaysia

-

Indonesia

-

Taiwan

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

Peru

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Egypt

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nitrocellulose market size was estimated at USD 789.7 million in 2022 and is expected to reach USD 822.0 million in 2023

b. The global nitrocellulose market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 1,154.6 million by 2030

b. Asia Pacific dominated the nitrocellulose market with a share of 45.59% in 2022. This is attributable to rising demand for the product for manufacturing printing inks, paints & coatings, and various other end-use industries

b. Some key players operating in the nitrocellulose market include Nitro Chemical Industry Co., Ltd., Hubei Xufei Chemical Co., Ltd., Sichuan North Nitrocellulose Corporation (SNC), Nobel NC, and IVM Chemicals

b. Key factors that are driving the market growth include increasing demand for eco-friendly paints, technological advancements, and growing product demand from end-use industries such as automotive and construction

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."