- Home

- »

- Power Generation & Storage

- »

-

Nickel Zinc Rechargeable Battery Market Size Report, 2030GVR Report cover

![Nickel Zinc Rechargeable Battery Market Size, Share & Trends Report]()

Nickel Zinc Rechargeable Battery Market Size, Share & Trends Analysis Report By Type (AAA Battery, 5AA Battery), By Application (Automobile, UPS, Data Center), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-362-1

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

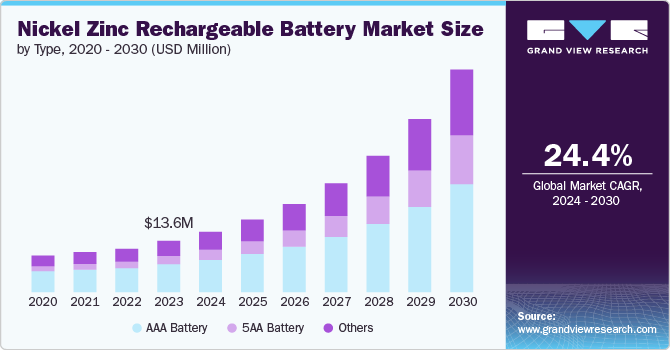

The global nickel zinc rechargeable battery market size was estimated at USD 13.60 million in 2023 and is projected to grow at a CAGR of 24.4% from 2024 to 2030. The rising demand for efficient and eco-friendly energy storage solutions, rapid expansion of electric vehicles, and ongoing advancements in battery technology are attributable factors for the market growth. In addition, supportive government policies and increasing investment in renewable energy projects aiding market growth.

The rechargeable battery market has been experiencing significant growth in recent years, driven by the increasing demand for portable electronic devices, electric vehicles, and renewable energy storage solutions. Nickel-zinc batteries offer several advantages over other battery technologies, such as high energy density, long cycle life, and environmental friendliness, making them an attractive choice for a wide range of industries

Drivers, Opportunities & Restraints

The growing reliance on data centers is a key driver for the market growth. As data centers become increasingly critical to our digital infrastructure, the demand for highly efficient and reliable power backup systems has increased. According to the International Energy Agency, data centers, artificial intelligence, and cryptocurrency consumed about 460 TWh of electricity in 2022, 2% of global electricity demand. These numbers are expected to reach over 1,000 TWh by 2026.

The market is expected to grow significantly, with the U.S., China, and other emerging markets presenting opportunities for expansion. As these countries invest in infrastructure and renewable energy, the demand for reliable and efficient battery technologies is expected to create various opportunities for nickel zinc rechargeable batteries over the next few years.

Despite the rapid growth and lucrative opportunities, the market faces restraints over high production costs. The manufacturing process for nickel-zinc batteries is complex and energy-intensive, leading to higher costs compared to other battery technologies like lead-acid and lithium-ion. High costs make it difficult for them to compete in certain applications. This particularly applies in the consumer electronics market, where lithium-ion batteries have become the dominant technology due to their lower costs and higher energy density.

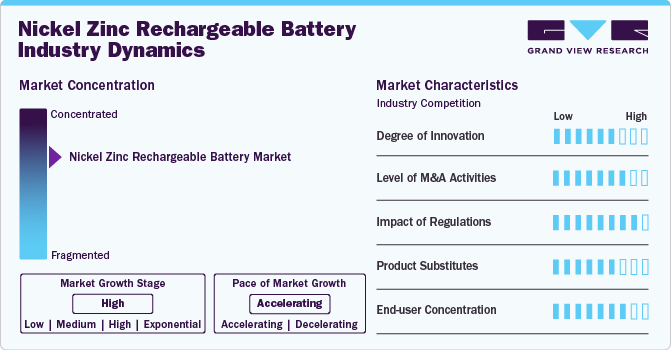

Market Concentration & Characteristics

Global market concentration is towards consolidation, with the presence of established players in the industry. The mature players collaborate with end-use product manufacturers, like automotive and electronics, thus gaining a stronger foothold in emerging markets.

The threat of substitutes is moderate, as the product faces competition from other rechargeable technologies such as lithium-ion and lead-acid batteries. The performance, cost, and environmental factors play a crucial role in the substitution threat.

Collaboration is one of the strategic initiatives opted for by market participants. Players adopt this strategy to access the required knowledge or expertise in a particular operation or business to pave the way for innovation and growth. For instance, in June 2024, AEsir Technologies, Inc. announced a collaboration with Hindustan Zinc for the development of next-gen nickel-zinc batteries. The collaboration will foster ongoing development of the company’s emerging clean technology space.

Type Insights

“AAA battery held the largest revenue share of 53.44% in 2023.”

Based on type, the AAA battery segment led the market with the largest revenue share of 53.44% in 2023. The emergence of e-commerce industry and rapid technological advancements drive the demand for consumer goods and consumer electronics globally. The increased convenience of shopping experience has enabled manufacturers and sellers to expand to a wider market, promoting the need for AAA batteries in consumer goods such as consumer electronics, household devices, and medical devices.

The 5AA battery segment is anticipated to grow at the fastest CAGR of 29.8% during the forecast period. The growing disposable income in developing and developed countries is driving the demand for various products from different industries such as consumer goods, automotive, and electronics, which is fueling the market growth. According to the U.S. Bureau of Economic Analysis, the disposable personal income in the U.S. reached USD 20,846.60 billion in April 2024 from USD 20806.50 billion in March 2024.

Application Insights

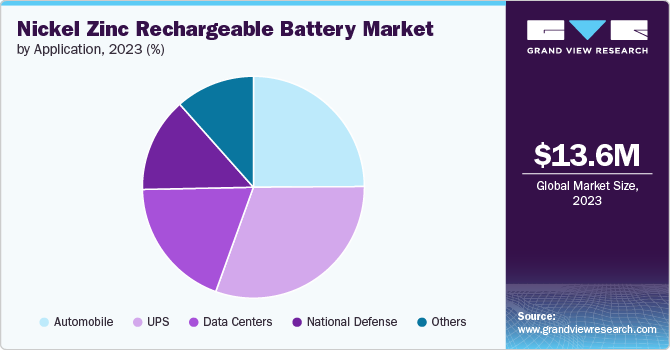

“Data center segment is anticipated to register a revenue CAGR of 25.9% over the forecast period.”

Based on application, the UPS segment led the market with the largest revenue share of 30.60% in 2023. The rapid integration of technologies such as artificial intelligence, machine learning, cloud computing, and big data has fundamentally reshaped industries, emphasizing the need for reliable power solutions such as nickel zinc rechargeable batteries. These technologies are integral to modern operations across sectors, requiring robust and uninterrupted power sources to sustain their complex computations and data processing needs.

The automobile segment holds major significance in the market. The growing demand for automobiles worldwide promotes the need for nickel zinc rechargeable batteries. This can be attributed to the increasing per capita income of individuals as well as the growing adoption of electric vehicles due to stringent governmental regulations to reduce the carbon footprint. In 2023, the electric vehicle sales crossed the 14 million units mark, registering a 34.8% y-o-y growth.

Regional Insights

“China held nearly 40% revenue share of the overall Asia Pacific nickel zinc rechargeable battery market.”

The nickel zinc rechargeable battery market in North America held over 25% revenue share in 2023. The product demand is driven by factors such as benefits like high power density, long cycle life, and safety compared to traditional batteries; environmental-friendly aspect; and government support toward clean energy technologies.

U.S. Nickel Zinc Rechargeable Battery Market Trends

The nickel zinc rechargeable battery market in anticipated to grow at the fastest CAGR over the forecast period. The growing electric vehicle production and sales in the U.S. is one of the major growth drivers for the U.S. market. The electric vehicle sales in the U.S. and Canada were 46% higher in 2023 compared to previous year.

Europe Nickel Zinc Rechargeable Battery Market Trends

The nickel zinc rechargeable battery market in Europe is anticipated to grow at a significant CAGR during the forecast period. The growing preference for sustainable and eco-friendly products is a notable trend in Europe. This is one of the major driving factors for the market growth as nickel zinc batteries offer a greener alternative to traditional battery technologies.

The Germany nickel zinc rechargeable battery market is experiencing robust growth. Surge in electric vehicle sales is one of the major growth drivers for the market. Germany, a global automotive powerhouse, has seen a significant increase in new electric car registrations in recent years as consumers become more environmentally conscious.

The nickel zinc rechargeable battery market in UK is anticipated to grow at the fastest CAGR during the forecast period. The rising need for reliable backup power systems in data centers and national defense, growing demand for sustainable and eco-friendly energy storage solutions, and rising adoption of electric vehicles are aiding to the demand for nickel zinc rechargeable batteries in the UK.

Asia Pacific Nickel Zinc Rechargeable Battery Market Trends

The nickel zinc rechargeable battery market in Asia Pacific is primarily driven by the growing demand for energy-efficient and environment-friendly power solutions. The increasing adoption of portable electronic devices and electric vehicles in the region is fueling the need for reliable and high-performance rechargeable batteries. .

Central & South America Nickel Zinc Rechargeable Battery Market Trends

The nickel zinc rechargeable battery market in Central & South America is expected to grow at a significant CAGR during the forecast period. This growth can be attributed to the increasing product demand for use in automobiles, UPS systems, data centers, and national defense.

Middle East & Africa Nickel Zinc Rechargeable Battery Market Trends

The nickel zinc rechargeable battery market in Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period. The rising popularity of consumer electronics, such as smartphones and laptops, coupled with growing data centers in Africa, is aiding market growth. For instance, as of 2023, Africa has over 100 data centers. Also, as per a news released in February 2024, Equinix is planning to investment USD 390 million towards data centers in Africa over the next five years.

Key Nickel Zinc Rechargeable Battery Company Insights

Some of the key players operating in the market include ZincFive Inc., Batterypkcell, and BetterPower Battery Co., Ltd.

-

ZincFive, Inc. was established in 2016 and is headquartered in Oregon, U.S. The company is engaged in manufacturing industrial batteries. It also manufactures nickel-zinc batteries and battery products for the data center, transportation, and automotive industries

-

Batterypkcell was established in 1998 and is headquartered in Shenzen, China. The company is involved in the production of a wide range of batteries, including nickel-zinc rechargeable batteries

-

BetterPower Battery Co., Ltd. was established in 2002 and is headquartered in Shenzen, China. It is engaged in the manufacturing and distribution of nickel metal hydride batteries, lithium batteries, and nickel-zinc batteries

Key Nickel Zinc Rechargeable Battery Companies:

The following are the leading companies in the nickel zinc rechargeable battery market. These companies collectively hold the largest market share and dictate industry trends.

- ZincFive, Inc.

- Batterypkcell

- BetterPower Battery Co., Ltd.

- ANSMANN AG

- Turnigy Power Systems

- EBLOfficial

- ZAF Energy Systems

- EverZinc Inc.

Recent Developments

-

In May 2024, ZincFive, Inc. announced the expansion of its production capacity in the U.S. for nickel zinc batteries with the establishment of a new manufacturing facility in Tualatin, Oregon, U.S.

-

In January 2024, AEsir Technologies, Inc partnered with Celgard, LLC to develop next-generation Nickel-Zinc technology, primarily to be used in data centers, aviation, telecom, Electric Vehicle charging, and energy infrastructure

-

In January 2023, ZincFive, Inc. launched the next-generation Nickel-Zinc Battery Cabinet "BC Series UPS Battery Cabinets - the BC 2" with application in data centers

Nickel Zinc Rechargeable Battery Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.98 million

Revenue forecast in 2030

USD 59.18 million

Growth rate

CAGR of 24.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; South Korea; Australia; Malaysia; Indonesia; Vietnam; Brazil; Argentina; UAE; South Africa; Saudi Arabia; Germany; UK; Spain; France; Italy; Russia; Nordic countries; Netherlands;

Key companies profiled

ZincFive, Inc.; Batterypkcell; BetterPower Battery Co., Ltd.; ANSMANN AG; Turnigy Power Systems; EBLOfficial; ZAF Energy Systems; EverZinc Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nickel Zinc Rechargeable Battery Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nickel zinc rechargeable battery market report based on type, application, and region:

-

Type Outlook (Volume, Thousand units; Revenue, USD Million; 2018 - 2030)

-

5AA Battery

-

AAA Battery

-

Others

-

-

Application Outlook (Volume, Thousand units; Revenue, USD Million; 2018 - 2030)

-

Automobile

-

UPS

-

Data Center

-

National Defense

-

Others

-

-

Regional Outlook (Volume, Thousand units; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

Nordic Countries

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Malaysia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nickel zinc rechargeable battery market size was estimated at USD 13.6 million in 2023 and is expected to reach USD 15.98 million in 2024.

b. The global nickel zinc rechargeable battery market is expected to grow at a compound annual growth rate of 24.4% from 2024 to 2030 to reach USD 59.18 million by 2030.

b. Based on application segment, UPS held the largest revenue share of more than 30.0% in 2023.

b. Some of the key vendors of the global nickel zinc rechargeable battery market are ZincFive, Inc., Batterypkcell, BetterPower Battery Co., Ltd., ANSMANN AG, Turnigy Power Systems, EBLOfficial, ZAF Energy Systems, EverZinc Inc.

b. Growing need for data centers coupled with rising production of electric vehicles are the major growth drivers for the global nickel zinc rechargeable battery market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."