- Home

- »

- Beauty & Personal Care

- »

-

Niacinamide Beauty Products Market Size Report, 2030GVR Report cover

![Niacinamide Beauty Products Market Size, Share & Trends Report]()

Niacinamide Beauty Products Market Size, Share & Trends Analysis Report By Product (Serums, Emulsions), By Concentration, By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-367-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2029

- Industry: Consumer Goods

Niacinamide Beauty Products Market Trends

The global niacinamide beauty products market size was estimated at USD 558.9 million in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. Niacinamide has seen a remarkable surge in popularity within the beauty industry, becoming a staple in many skincare routines. This rise can be attributed to its versatile benefits for various skin concerns, which have been increasingly validated by both scientific research and consumer experiences. The ingredient’s effectiveness in addressing issues such as acne, hyperpigmentation, and aging has led to its inclusion in a wide range of products, from serums to creams.

Niacinamide, also known as vitamin B3, is celebrated for its anti-inflammatory, antioxidant, and skin-strengthening properties. Its ability to improve the skin barrier function, reduce redness, and regulate oil production makes it a multifaceted ingredient suitable for all skin types. The trend towards multifunctional skincare products has further boosted niacinamide beauty product’s popularity, as consumers seek efficient and effective solutions to multiple skin concerns.

One significant trend is the formulation of higher-concentration niacinamide products. Brands like Paula’s Choice have introduced products with concentrations as high as 20%, aimed at providing more potent effects for issues such as severe hyperpigmentation and advanced signs of aging. This trend reflects a broader consumer interest in high-performance skincare ingredients that offer visible results.

Moreover, the rise of skincare layering and sophisticated routines has also contributed to the popularity of niacinamide. Its compatibility with other active ingredients like retinoids, hyaluronic acid, and antioxidants allows it to be easily integrated into existing skincare regimens without irritating. This flexibility has made it a favorite among both skincare enthusiasts and dermatologists.

Brands have been actively promoting niacinamide through educational campaigns, emphasizing its scientifically-backed benefits. Companies like Kiehl’s and Paula’s Choice provide detailed guides and resources to educate consumers on how to incorporate niacinamide into their routines effectively. This approach not only builds consumer trust but also encourages informed usage, maximizing the benefits of niacinamide.

Another notable trend is the inclusion of niacinamide in more targeted treatments and hybrid products. For example, niacinamide-infused sunscreens, primers, and even makeup products have emerged, offering multifunctional benefits. These innovations reflect the industry's response to consumer demand for products that do more than just one job, streamlining beauty routines without compromising efficacy.

Social media and beauty influencers have also played a crucial role in the rise of niacinamide. Platforms like Instagram, TikTok, and YouTube are filled with testimonials and reviews showcasing the transformative effects of niacinamide on various skin types and concerns. As consumer awareness and demand for effective, science-backed skincare continue to grow, niacinamide is likely to maintain its position as a cornerstone ingredient in the beauty products market.

Product Insights

The niacinamide serums accounted for a revenue share of around 62% in 2023. Niacinamide serums are highly popular due to their high concentration and quick absorption, making them effective for targeting specific skin concerns like acne, hyperpigmentation, and signs of aging. The trend towards multi-functional, high-performance skincare products has bolstered their demand.

The niacinamide emulsions are projected to grow at a CAGR of 7.3% from 2024 to 2030. Emulsions, known for their lightweight texture and hydrating properties, are gaining popularity among consumers who prefer a lighter feel on the skin. They are particularly favored in K-beauty routines for their versatility and gentle formulation. The most popular brands that offer niacinamide emulsions are Cosrx Advanced Snail 96 Mucin Power Essence, and Missha Time Revolution The First Treatment Essence among others.

Concentration Insights

Niacinamide beauty products with a concentration below 5% accounted for a revenue share of around 42% in 2023. Products with less than 5% concentrations are ideal for sensitive skin and beginners. These formulations focus on long-term skin health and maintenance, providing gentle but effective results without irritating.

Niacinamide beauty products with concentrations of 5% to 10% are projected to grow at a CAGR of 6.7% from 2024 to 2030. Products in this concentration range are widely used for their balance of efficacy and tolerability. They are effective for treating moderate skin concerns like uneven texture, mild hyperpigmentation, and early signs of aging.

End-use Insights

The women accounted for a revenue share of around 61% in 2023. Women predominantly use niacinamide products for anti-aging, brightening, and acne-fighting benefits. The demand is driven by the desire for multi-functional skincare solutions that address multiple concerns simultaneously.

The men's segment is projected to grow at a CAGR of 6.9% from 2024 to 2030. Men's skincare routines are increasingly incorporating niacinamide for its oil-regulating and anti-inflammatory properties. The focus is on simple, effective solutions that integrate easily into daily grooming habits.

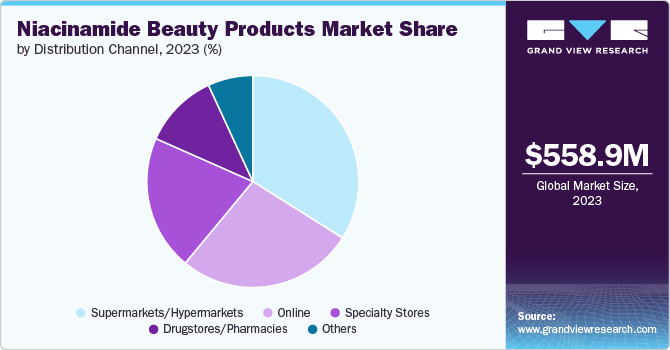

Distribution Channel Insights

The supermarkets/hypermarkets segment accounted for a revenue share of around 33% in 2023. Supermarkets and hypermarkets offer the convenience of in-person shopping, allowing consumers to physically examine products. This channel benefits from impulse purchases and the wide availability of affordable options.

The online segment is estimated is projected to grow at a CAGR of 7.4% from 2024 to 2030. Online sales have surged due to the ease of access to a wide range of products, detailed reviews, and attractive discounts. The pandemic has further accelerated this trend, with consumers preferring the convenience and safety of online shopping.

Regional Insights

The niacinamide beauty products market in North America held 23% of the global revenue in 2023. The market is driven by high consumer awareness and demand for innovative skincare solutions. The presence of major brands and extensive R&D activities contribute to the growth.

U.S. Niacinamide Beauty Products Market Trends

The U.S. niacinamide beauty products market accounted for a revenue share of around 63% in the year 2023. As a key player in the North American market, the U.S. shows robust demand for niacinamide products, with consumers prioritizing advanced, multi-functional skincare routines.

Asia Pacific Niacinamide Beauty Products Market Trends

The niacinamide beauty products market in the Asia Pacific is expected to grow at a CAGR of 6.8% from 2024 to 2030. This region, especially South Korea and Japan, is at the forefront of skincare innovations. The popularity of K-beauty and J-beauty trends has significantly boosted the niacinamide market.

Europe Niacinamide Beauty Products Market Trends

Europe niacinamide beauty products market is projected to grow at a CAGR of 5.4% from 2024 to 2030. The European market is characterized by a strong preference for natural and effective skincare ingredients. Regulatory standards and a focus on high-quality formulations drive the demand for niacinamide products.

Key Niacinamide Beauty Products Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Niacinamide Beauty Products Companies:

The following are the leading companies in the niacinamide beauty products market. These companies collectively hold the largest market share and dictate industry trends.

- L’Oreal S.A

- Unilever

- Beiersdorf

- The Estee Lauder Companies

- Minimalist

- Kao Corporation

- AMOREPACIFIC US, INC.

- Shiseido

- SkinCeuticals

- Johnson & Johnson

Recent Developments

-

In August 2023, OLAY launched its latest technological advancement: the OLAY Super Serum. This innovative skincare product features activated niacinamide, along with vitamin C, collagen peptide, vitamin E, and alpha hydroxy acid (AHA). Together, these ingredients promise remarkable skin transformation benefits.

-

In June 2023, La Roche-Posay, launched Niacinamide 10 Serum, the first mass-market serum with 10% pure niacinamide. It is clinically proven to balance skin tone, reduce dark spots, and clarify discolorations. This serum directly repairs signs of photodamage, targeting hyperpigmentation, and is part of La Roche-Posay’s commitment to providing effective, anti-aging skincare solutions.

Niacinamide Beauty Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 590.2 million

Revenue forecast in 2030

USD 846.5 million

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, concentration, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

L’Oreal S.A; Unilever; Beiersdorf; The Estee Lauder Companies; Minimalist; Kao Corporation; AMOREPACIFIC US, INC.; Shiseido; SkinCeuticals; Johnson & Johnson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Niacinamide Beauty Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global niacinamide beauty products market based on the product, concentration, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Serums

-

Creams

-

Emulsions

-

Face/Body Wash

-

Others

-

-

Concentration Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 5%

-

5% to 10%

-

10% to 15%

-

Above 15%

-

-

End-use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Online

-

Specialty Stores

-

Drugstores/Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global niacinamide beauty products market was estimated at USD 558.9 million in 2023 and is expected to reach USD 590.2 million in 2024.

b. The global niacinamide beauty products market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 846.5 million by 2030.

b. Asia Pacific dominated the niacinamide beauty products market with a share of around 45% in 2023. The popularity of K-beauty and J-beauty trends has significantly boosted the niacinamide beauty products market.

b. Some of the key players operating in the niacinamide beauty products market include L’Oreal S.A; Unilever; Beiersdorf; The Estee Lauder Companies; Minimalist; Kao Corporation; AMOREPACIFIC US, INC.; Shiseido; SkinCeuticals; Johnson & Johnson

b. Key factors that are driving the niacinamide beauty products market growth include rise of skincare layering and sophisticated routines, various benefits of inclusion of niacinamide in skincare, surge in innovation by the key players in the niacinamide beauty products, and inclusion of niacinamide in more targeted treatments and hybrid products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."