NFC Juice Market Size, Share & Trends Analysis Report By Type (Fruit Juice, Vegetable Juice, Fruits and Vegetable Blends), By Distribution Channel (B2B, B2C), By Packaging, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-401-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

NFC Juice Market Size & Trends

The global NFC juice market size was estimated at USD 4.09 trillion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030.The growing demand for convenient, natural, plant-based beverages drives the global market. Not from concentrate (NFC) juices, made from natural fruit and vegetable extractions without artificial chemicals or additives, are available in flavors like lemon, apple, and orange, leading to high global acceptability. These 100% fruit juices are preferred over concentrated juices for their superior nutritional and sensory qualities, prompting consumers to switch to healthier options and driving market growth.

NFC juice is perceived as more natural and less processed compared to juice made from concentrate, appealing to health-conscious consumers. It retains more of the original flavor and nutrients of the fruit because it undergoes minimal processing. The absence of reconstitution with water means that the juice maintains a closer profile to freshly squeezed juice, which is a significant selling point for many people seeking healthier beverage options.

One of the primary benefits of NFC juice is its higher nutritional content. Since the juice is not concentrated and reconstituted, it retains more of the natural vitamins, minerals, and antioxidants in the original fruit. This can lead to better health outcomes, as these nutrients are crucial for maintaining good health and preventing diseases. Furthermore, the taste of NFC juice is often superior to that of reconstituted juice, as it preserves the fresh, vibrant flavors of the fruit. This quality makes it a preferred choice for consumers who value both health benefits and sensory satisfaction in their beverages.

In addition, there is a growing consumer awareness about the negative effects of processed foods and beverages, prompting a shift towards more natural and minimally processed products. The clean label trend, where consumers prefer products with fewer and more recognizable ingredients, supports the preference for NFC juices. Moreover, the rise in disposable incomes and changing lifestyles in many parts of the world means more people can afford premium products like NFC juices. Also, the increasing prevalence of lifestyle-related diseases such as obesity, diabetes, and heart disease has encouraged consumers to opt for healthier beverage choices, thus boosting the demand for NFC juices.

Furthermore, manufacturers continually innovate to cater to the growing demand for NFC juices. They are expanding their offerings beyond traditional fruit juices to include a variety of fruit, vegetable, and fruit & vegetable blends. These blends provide consumers with unique flavor combinations and enhanced nutritional profiles. For instance, adding vegetables like spinach, kale, or beetroot to fruit juices can increase the vitamin, mineral, and antioxidant content, appealing to health-conscious consumers. Furthermore, exotic fruit blends, such as acai berry with apple or dragon fruit with pineapple, are gaining popularity as they offer new and exciting flavors.

Type Insights

NFC fruit juice accounted for a revenue share of 63.80% in 2023. As people become more health-conscious, they seek out beverages perceived as more natural and nutritious. NFC fruit juices, which undergo less processing, retain more vitamins, minerals, and antioxidants than juices made from concentrate.

NFC fruit and vegetable blends is expected to grow at a CAGR of 7.3% from 2024 to 2030. There is a growing emphasis on holistic health and wellness, with consumers looking to incorporate more plant-based nutrients into their diets. NFC fruit and vegetable juice blends are a convenient and effective way to increase the intake of essential nutrients without requiring extensive meal preparation.Consumers are attracted to getting a more comprehensive nutrient intake in a single beverage, supporting overall health and well-being.

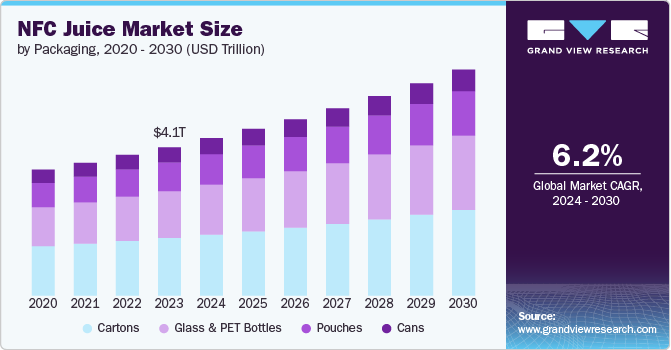

Packaging Insights

Cartons accounted for a revenue share of 38.80% in 2023. Carton packaging, often combined with aseptic processing, helps extend the shelf life of NFC juice without the need for preservatives. This allows consumers to store the juice for longer periods while maintaining its freshness and quality. These are lightweight, easy to handle, and convenient for storage and transportation. Their design often includes features like resealable caps, making them practical for on-the-go consumption and reducing waste.

Glass & PET bottles are expected to grow at a CAGR of 6.8% from 2024 to 2030. Glass bottles are often favored because they are non-reactive and do not alter the taste of the juice. They help preserve the juice's original flavor and purity, which is especially important for high-quality NFC juices. PET bottles, while less ideal than glass, are also perceived to maintain juice quality better than other packaging materials.

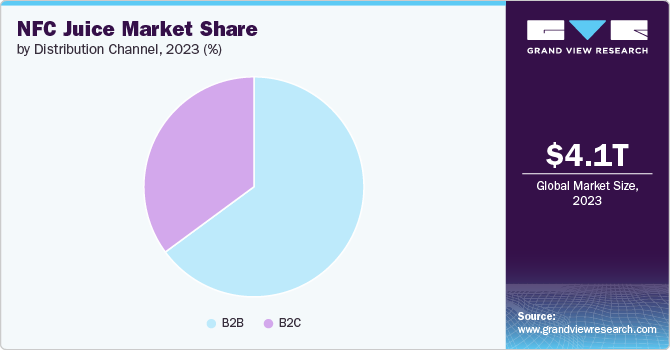

Distribution Channel Insights

Sales through the B2B channel accounted for a revenue share of 64.90% in 2023. B2B channels often offer the advantage of purchasing NFC juice in larger quantities, which can result in significant cost savings per unit. Businesses, such as restaurants, cafes, and retailers, benefit from bulk pricing and may negotiate better terms compared to purchasing through retail channels.

B2C is expected to grow at a CAGR of 6.6% from 2024 to 2030. B2C channels, such as grocery stores, online retailers, and convenience stores, offer easy and immediate access to NFC juice. Consumers can purchase the juice during regular shopping trips or online without engaging in bulk purchasing or business transactions. B2C is further segmented into supermarkets & hypermarkets, convenience stores, online, and others.

Regional Insights

The NFC juice market in North America accounted for a revenue share of 28.50% in 2023 of the global market. The rising focus on health-promoting products in North America is significantly boosting the demand for NFC fruit juices. As consumers become more mindful of their dietary choices, they increasingly seek NFC juices for their great taste and health benefits, aligning with their desire for nutritious and natural options. Moreover, with busy lifestyles, consumers seek convenient yet healthy options. NFC fruit juices offer a quick and easy way to consume essential nutrients without the hassle of preparing fresh juice, fitting well into the modern, fast-paced lifestyle.

U.S. NFC Juice Market Trends

The NFC juice market in the U.S. is facing intense competition due to massive type innovation in NFC juice. In the U.S., the demand for additive-free juices is rapidly increasing, driving NFC juice sales. Consumers prioritize health and seek juices free from artificial additives, preservatives, and sweeteners. They prefer NFC juices for their natural taste and perceived health benefits, as these products align with their desire for a healthier lifestyle.

Europe NFC Juice Market Trends

The NFC juice market in Europe is expected to grow at a CAGR of 5.7% during the forecast period. There is a growing demand for products with simple, transparent ingredient lists. NFC juices, which typically contain no added sugars, preservatives, or artificial ingredients, fit the clean label trend and appeal to consumers seeking purity and transparency in their food and beverage choices.

Asia Pacific NFC Juice Market Trends

The NFC juice market in Asia Pacific is expected to grow at a CAGR of 7.4% from 2024 to 2030. The expanding middle class in many Asia Pacific countries leads to increased disposable income and a greater focus on premium and quality food products. NFC juices, often considered a premium option, benefit from this economic growth.There is a growing preference for natural and authentic food and beverage options. With their closer resemblance to fresh fruit and minimal processing, NFC juices cater to consumers looking for natural flavors and health benefits.

Key NFC Juice Company Insights

The market is characterized by dynamic competitive dynamics shaped by product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective, quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of ingredients while strictly adhering to international regulatory standards.

Key NFC Juice Companies:

The following are the leading companies in the NFC juice market. These companies collectively hold the largest market share and dictate industry trends.

- Gat Foods

- Döhler GmbH

- Lemonconcentrate S.L.U

- Kiril Mischeff

- MAXFRUT

- Austria Juice

- BAOR PRODUCTS

- Sunimpex

- Prodalim Group

- Ariza BV

Recent Developments

-

In November 2022, Louis Dreyfus Company B.V. (LDC) announced developing a new NFC orange juice product with 30% reduced natural sugar and over three times the dietary fiber while maintaining the original taste and vitamin C levels. This innovation results from a five-year research effort by LDC’s R&D team in Bebedouro, São Paulo, Brazil. This development aligns with LDC’s commitment to providing nutritious, high-quality juices that meet the growing consumer demand for healthier options.

-

In April 2021, The Bevolution Group expanded its product line by entering the not-from-concentrate (NFC) juice category, adding new Lemon NFC, Lime NFC, and Pomelo NFC juices to its Tropics brand. These juices are characterized by their high quality, containing no additives or preservatives, and are made from single ingredients harvested at peak season, ensuring freshness and rich flavor.

NFC Juice Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.33 trillion |

|

Revenue forecast in 2030 |

USD 6.23 trillion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/trillion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, packaging, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa |

|

Key companies profiled |

Gat Foods; Döhler GmbH; Lemonconcentrate S.L.U; Kiril Mischeff; MAXFRUT; Austria Juice; BAOR PRODUCTS; Sunimpex; Prodalim Group; Ariza BV |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Global NFC Juice Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global NFC juice market report based on type, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit Juice

-

Orange

-

Pineapple

-

Mango

-

Mixed Berries

-

Peach

-

Others

-

-

Vegetable Juice

-

Fruit & Vegetable Blends

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass & PET Bottles

-

Pouches

-

Cans

-

Cartons

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Food Service

-

Food Processing

-

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global NFC juice market size was estimated at USD 4.09 trillion in 2023 and is expected to reach USD 4.33 trillion in 2024.

b. The global NFC juice market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 6.23 trillion by 2030.

b. NFC fruit juice accounted for a share of 63.8% in 2023. NFC juices are known for their superior taste and quality, closely resembling freshly squeezed juice. The minimal processing helps preserve the natural flavor and aroma of the fruit, making them more appealing to consumers who value authentic taste.

b. Some key players operating in NFC juice market include Gat Foods, Döhler GmbH, Lemonconcentrate S.L.U, Kiril Mischeff, and others

b. Key factors that are driving the market growth include rising demand for convenience and ready-to-drink options and growing consumer preference for natural and healthy beverages

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."