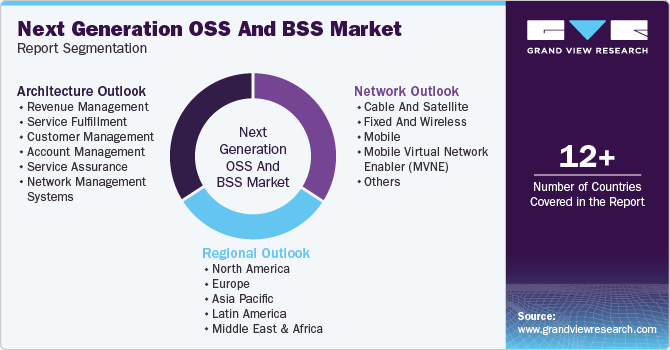

Next Generation OSS And BSS Market Size, Share & Trends Analysis Report By Architecture, By Network (Cable and Satellite, Fixed and Wireless, Mobile, MVNE, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-247-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Next Generation OSS & BSS Market Trends

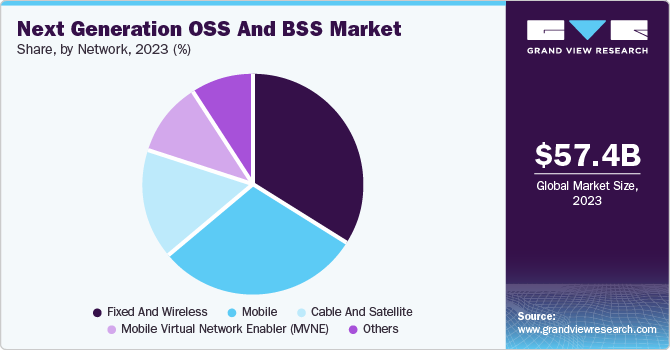

The global next generation OSS and BSS market size was valued at USD 57.45 billion in 2023 and is projected to grow at a CAGR of 13.3% from 2024 to 2030. Telecommunication companies constantly require real-time billing and revenue management, which is possible by deploying advanced OSS and BSS solutions. Communication Service Providers (CSPs) also measure customer experience and predict customer churn using next-generation OSS and BSS. OSS (operational support systems) help telecom companies oversee critical operational functions, including network inventory, fault management, network planning, and service assurance. On the other hand, BSS (business support systems) aid organizations in seamlessly conducting business- and customer-focused duties such as billing, service fulfillment, customer orders, and revenue management, among others. As a result, these solutions transform the overall performance of CSPs and enhance their growth, driving their demand.

CSPs are increasingly adopting digital technologies to enhance their operational efficiency, customer experience, and business agility. By leveraging advanced analytics, artificial intelligence (AI), and machine learning (ML), these enterprises can automate processes, predict network issues, and offer personalized services to customers. This shift towards digitalization necessitates robust OSS and BSS solutions supporting such advanced capabilities, driving market expansion. The modernization of Operations Support System (OSS) involves integrating advanced technologies to automate key workflows and leverage artificial intelligence (AI) for operations, thus improving efficiency and service quality. By automating routine tasks and processes, CSPs reduce manual interventions, minimize errors, and accelerate service delivery. For instance, in June 2024, Prodapt launched the TechCo Toolkit, integrated with ServiceNow. The solution aims to enable service providers to modernize their OSS, expedite service activation, automate critical workflows, and utilize AI for operations.

In the telecommunications sector, strategic partnerships among companies are becoming increasingly essential to address the complexities of modern networks and enhance service delivery. For instance, in April 2024, Optiva and GDi collaborated to offer pre-integrated and tested OSS and BSS software to CSPs. This collaboration aims to deliver new services for joint clients and optimize the advancement and modernization of OSS and BSS systems to match customer expectations and enhance operational efficiencies. Such partnerships enable companies to pool resources, share expertise, and co-develop advanced technologies, thereby driving the evolution of next-generation OSS and BSS solutions in the market.

CSPs face intense competition from traditional telecom operators and new entrants such as over-the-top (OTT) service providers. To stay competitive, CSPs need to keep innovating their offerings and ensure superior quality of services, which highlights the importance of advanced OSS and BSS solutions. These systems enable CSPs to optimize network performance, launch new services quickly, and provide differentiated customer experiences, allowing them to maintain a competitive edge. Thus, growing competition in the telecommunications industry is anticipated to remain a major driver for the next-generation OSS and BSS market in the coming years.

Architecture Insights

The service assurance segment accounted for the largest revenue share of 24.7% in 2023. Consumers demand high-quality, uninterrupted services and personalized experiences. This drives the need for advanced service assurance in OSS and BSS architectures. CSPs ensure that their services are consistently delivered at high standards, which requires continuous monitoring, proactive issue resolution, and real-time performance management. Enhanced service assurance capabilities aid CSPs in minimizing downtime, quickly addressing service degradation, and enhancing customer satisfaction, which is essential in the increasingly competitive industry. For instance, at the Mobile World Congress 2024 event in Barcelona, Ericsson launched a range of solutions to enable CSPs to utilize the potential of 5G and 5G standalone networks for critical applications. These solutions include the Ericsson Service Orchestration and Assurance Product and the Ericsson Dynamic Network Slicing solution.

The account management segment is expected to witness the fastest CAGR over the forecast period. As CSPs strive to offer increasingly complex services, advanced pricing models, and real-time usage-based billing, robust account management systems have become essential to accurately track and manage customer accounts. These systems ensure timely and accurate billing, reduce revenue losses for companies, and improve their financial management. Real-time account management capabilities enable CSPs to adapt quickly to market changes and offer flexible billing options, enhancing customer satisfaction and competitive advantage.

Network Insights

The fixed and wireless segment accounted for the largest market revenue share in 2023. The convergence of fixed and wireless networks is a significant driver for this market. CSPs are steadily shifting towards integrated network solutions that provide seamless connectivity and unified management across fixed and wireless infrastructures. This enables CSPs to offer bundled services, optimize resource utilization, and enhance their operational efficiency. Next-generation OSS and BSS solutions support this integration by providing network performance, streamlined provisioning, and unified billing for converged services. Additionally, with the emergence of remote working models, online education, and streaming services, CSPs need to ensure reliable and high-quality broadband connectivity for customers. Advanced OSS and BSS systems aid CSPs in managing network congestion, optimizing bandwidth allocation, and providing premium service quality.

The mobile virtual network enabler (MVNE) segment is expected to witness the fastest CAGR over the forecast period. MVNOs (Mobile Virtual Network Operators) rely on MVNEs to provide the necessary infrastructure and operational support to launch and manage their services efficiently. As more businesses and niche markets pursue to establish MVNOs, scalable OSS and BSS systems have become essential. These systems enable MVNEs to offer end-to-end solutions, including network access, billing, customer management, and service provisioning, ensuring that MVNOs can operate seamlessly and competitively. Additionally, advanced OSS and BSS solutions enable MVNEs to offer customized services, flexible billing options, and responsive customer support. By leveraging customer data and analytics, MVNEs provide personalized service offerings, proactive issue resolution, and seamless account management. These factors are expected to drive segment demand in the coming years.

Regional Insights

North America accounted for the largest revenue share of 39.7% of the global market in 2023. The region's extensive deployment of high-speed broadband and fiber optic networks and the rapid expansion of 5G technology necessitates the presence of sophisticated OSS and BSS systems to manage such complex and high-capacity networks effectively. The demand for efficient network management, real-time monitoring, and optimized service delivery is pushing CSPs to invest in next-generation OSS and BSS platforms that handle the demands of modern network infrastructure.

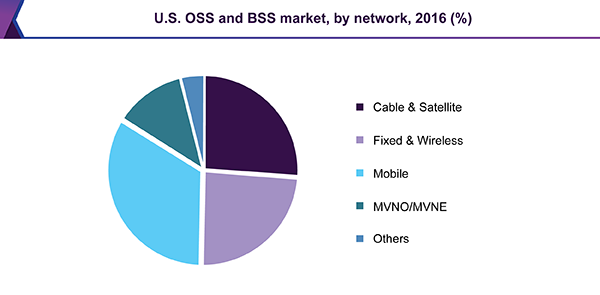

U.S. Next Generation OSS And BSS Market Trends

The U.S. next generation OSS and BSS market accounted for the largest revenue share in the region in 2023. As enterprises undergo digital transformation to enhance their operations and improve customer experiences, CSPs are transforming their infrastructure and service delivery models. Next generation OSS and BSS solutions play a crucial role in this transformation by enabling CSPs to automate processes, integrate with digital ecosystems, and offer innovative digital services. These initiatives drive the need for advanced systems supporting digitalization efforts and allowing CSPs to meet the evolving demands of customers. For instance, in April 2024, Blue Planet, a subsidiary of Ciena, introduced the Blue Planet Cloud Native Platform. The platform allows CSPs to automate and simplify their OSS ecosystem, thus improving operational efficiency and streamlining service lifecycle automation.

Asia Pacific Next Generation OSS And BSS Market Trends

The Asia Pacific next generation OSS and BSS market is anticipated to witness the fastest growth during the forecast period. The growing number of mobile users in the region, across economies such as China and India, requires efficient OSS and BSS systems to manage network traffic, ensure consistent quality of service, and provide seamless customer experiences. These systems enable CSPs to offer personalized services, handle billing and charging, and manage customer relationships effectively. The increasing reliance on smartphones for various digital services emphasizes the need for advanced OSS and BSS solutions to support the evolving telecom landscape in the region.

The next generation OSS and BSS market in China is anticipated to witness significant growth from 2024 to 2030. The presence of major players such as China Mobile, China Telecom, and China Unicom has made the market highly competitive, thus requiring CSPs to innovate and optimize their operations frequently. Next Generation OSS and BSS platforms offer the agility, scalability, and advanced features needed to launch new services quickly, optimize network performance, and simplify business processes. This competitive pressure encourages CSPs to invest in advanced solutions to maintain their market position and drive growth.

Europe Next Generation OSS And BSS Market Trends

The European next generation OSS and BSS market is anticipated to witness significant growth in the coming years. The well-established telecom infrastructure across regional economies such as Germany, France, and the UK, along with presence of several major operators, has created several growth opportunities for market players. Advanced OSS and BSS systems enable CSPs to leverage customer data and analytics to offer customized services, support, and seamless account management. By offering a premium experience, CSPs improve customer satisfaction and loyalty, which is essential for sustaining growth and competitive advantage in the regional telecom sector.

The UK next generation OSS and BSS market is projected to contribute substantially to the regional market in the coming years. With the steady increase in smartphone users and growing mobile data usage, there is a rising demand for reliable and high-performance network services. Advanced OSS and BSS solutions are essential to manage the surge in data traffic, ensure seamless connectivity, and provide personalized customer experiences. These systems enable CSPs to efficiently handle billing, customer relationship management, and service delivery. The presence of notable companies such as Cerillion, IQGeo, and Apertio, among others, has created a competitive environment that is expected to shape market growth positively in the economy.

Key Next Generation OSS And BSS Company Insights

Some key companies in the next generation OSS and BSS market include Capgemini, Accenture, Amdocs, and Hewlett Packard Enterprise Development LP, among others.

-

Hewlett Packard Enterprise (HPE) is a multinational corporation that offers advanced OSS and BSS solutions for CSPs under its telecom operations and network automation segment. The company offers SIM and device management tools, as well as OSS fulfillment solutions that automate processes for customer orders and change management. Its HPE Intelligent Assurance solution leverages AI-based analytics and machine learning to provide actionable insights, thus reducing operating costs and improving customer experience. The HPE OSS Fulfillment solution uses tools and processes that can bring new services to the market quickly.

-

Capgemini offers consulting, technology services, digital transformation, and innovative solutions in the Operations Support System (OSS) and Business Support System (BSS) sector. The company provides solutions to aid CSPs in managing and optimizing their network operations and business processes. Capgemini has partnered with Oracle to develop its Communications Transformation Platform (CTP), which leverages eTOM guidelines and intellectual property (IP) developed over several OSS/BSS implementations.

Key Next Generation OSS and BSS Companies:

The following are the leading companies in the next generation OSS and BSS market. These companies collectively hold the largest market share and dictate industry trends.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Capgemini

- Accenture

- Amdocs

- Oracle

- IBM

- CSG Systems, Inc.

- Sigma Software

- CHR Solutions

Recent Developments

-

In August 2024, Amdocs announced that it had been selected by PLDT, a telecom and digital service provider based in the Philippines, to use its next-generation OSS platform to automate, modernize, and combine PLDT’s network operations on public cloud. Besides leveraging Amdocs’ Intelligent Networking Suite, PLDT will also utilize its customer service offering for case management, a part of the Amdocs Customer Engagement Platform, to offer an improved customer experience.

-

In July 2024, CHR Solutions launched the Omnia360e OSS/BSS platform that provides customizable e-commerce features, such as one-touch self-service tools to offer an optimized customer experience. The solution has been developed using an open platform and provides seamless API integration to help CSPs meet their tailored requirements. The addition of AI-enabled insights and automation capabilities is expected to aid service providers in improving their decision-making and operational efficiency.

Next Generation OSS And BSSMarket Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 62.77 billion |

|

Revenue forecast in 2030 |

USD 132.43 billion |

|

Growth rate |

CAGR of 13.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Architecture, network, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Japan China; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; Capgemini; Accenture; Amdocs; Oracle; IBM; CSG Systems, Inc.; Sigma Software; CHR Solutions |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Next Generation OSS And BSS Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global next generation OSS and BSSmarket report based on architecture, network, and region.

-

Architecture Outlook (Revenue, USD Billion, 2018 - 2030)

-

Revenue Management

-

Service Fulfillment

-

Customer Management

-

Account Management

-

Service Assurance

-

Network Management Systems

-

-

Network Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cable and Satellite

-

Fixed and Wireless

-

Mobile

-

Mobile Virtual Network Enabler (MVNE)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."