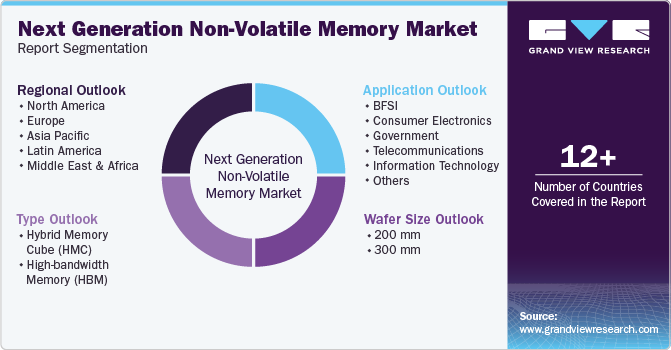

Next Generation Non-Volatile Memory Market Size, Share & Trends Analysis Report By Type (Hybrid Memory Cube, High-bandwidth Memory), By Wafer Size (200 mm, 300 mm), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-332-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

“2030 next generation non-volatile memory market value to reach USD 18.23 billion”

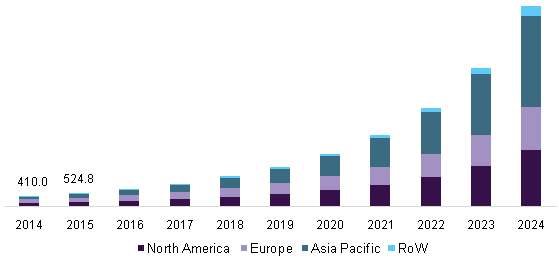

The global next generation non-volatile memory market size was valued at USD 6.15 billion in 2023 and is projected to grow at a CAGR of 17.8% from 2024 to 2030. Next-generation non-volatile memory (NVM) technologies are emerging storage solutions that enable high-speed data access and maintain data integrity during power loss. The demand for higher storage solution has risen significantly with the growing adoption of IOT devices and artificial intelligence (AI). The growing demand for data storage and processing capabilities as well as the increasing adoption of emerging technologies is driving the next generation non-volatile memory market.

The market’s growth is driven by increasing demand of heightened demand for data storage, advancements in semiconductor technology, and increased adoption of emerging technologies such as autonomous vehicles and AI. The market includes a diverse array of next-generation memory choices, such as phase-change Memory (PCM), resistive random-access memory (ReRAM), and magnetic random access memory (MRAM). These technologies offer faster access times, higher storage capacities, and superior endurance compared to traditional non-volatile memories like Flash.

The increasing volume of big data in business and the widespread adoption of cloud storage solutions have led to a rising need for high-capacity and fast storage memory. The demand for advanced products with improved performance is constantly increasing. To meet the need for memory devices offering high speed and low power consumption, various emerging non-volatile memory technologies are being developed. These technologies offer significant advantages over existing memory solutions.

As the need for high-performance data storage grows across industries like consumer electronics, automotive, and enterprise storage, these technologies provide notable advantages over traditional memory solutions. Moreover, the rise in emerging technologies like Internet of Things (IoT), Big Data analytics and machine learning has generated a significant need for effective and dependable storage solutions.

Type Insights

In 2023, high-bandwidth memory (HBM) segment emerged as the market leader, capturing the largest revenue share of 59.1% owing to the growing need for high band-with, low power consumption and adoption of emerging technologies like AI & big data analytics and rising trend of consumer electronic devices. Moreover, the advancement in the automotive industry is increasing the growth of high bandwidth memory which offers high performance and higher data transfer rates.

On the contrary, the hybrid memory cube (HMC) segment is anticipated to exhibit a CAGR of 19.0% from 2024 to 2030, attributing to its unique design, advanced technologies and better performance compared with traditional memory. HMC compact design and advanced features make it an attractive solution for different industries and application where saving energy is prioritized, like AI, IoT and machine learning and data centers.

Wafer Size Insights

300 mm dominated the market and accounted for a share of 62.6% in 2023. 300mm wafers are larger, offering more than twice the surface area per wafer than 200mm wafers. This results in increased production per wafer, leading to cost reductions. Moreover, the rise in AI, 5G, and high-performance computing is anticipated to significantly boost semiconductor demand in the coming decade. This opens vast opportunities in 300mm categories.Top of FormBottom of Form

Top of FormBottom of Form200 mm is expected to witness a CAGR of 19.6% during the forecast period. 200 mm is a well-established and mature technology with a robust ecosystem. It is utilized across a wide spectrum of nodes and applications such as microprocessors, RF, and power chips, with low defect rates and consistently high yields. The biggest drivers for 200 mm wafer are the power and compound semiconductors, which play a vital role in the consumer, automotive and industrial segments.

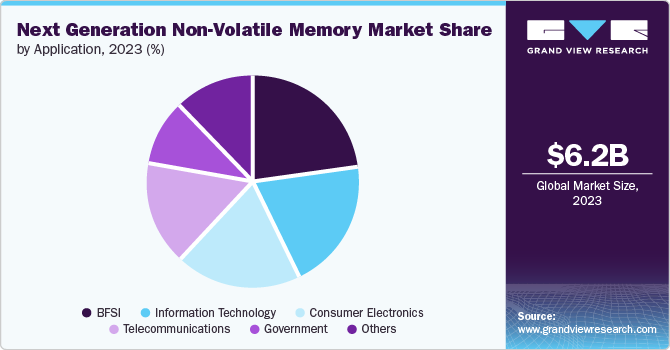

Application Insights

BFSI accounted for the largest market revenue share of 23.1% in 2023. The BFSI sector extensively leverages IoT and AI technologies to achieve substantial benefits. Big data is increasingly employed within BFSI to enhance investor decision-making and ensure consistent returns. The rapid increase in connected devices generates vast amounts of data, ideally stored in cloud. In addition, the increasing amount of financial data and the critical need for strong security measures, advanced memory technologies play a crucial role in improving operational efficiency and enhancing data security within the BFSI sector.

Telecommunication is expected to witness the fastest CAGR of 19.7% during the forecast period. Emerging technologies such as AI and IoT are propelling advancements in the telecommunications industry. Furthermore, the latest 5G technology stands out as a key driver for the industry's future. With its significant increase in bandwidth, 5G promises download speeds of up to 10GB per second, marking a substantial leap forward in technology.

Moreover, the rising popularity of mobile devices, such as smartphones and tablets, has become an integral part of modern life. There is a growing demand for these devices as consumers look for improved connectivity, advanced functionalities, and increased processing capabilities.

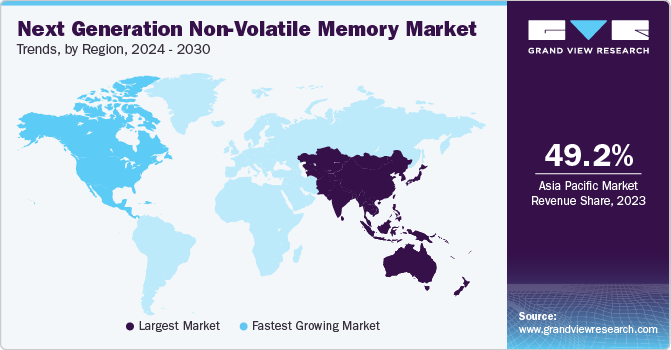

Regional Insights

The next generation non volatile memory market in North America is projected to witness the fastest CAGR of 18.9% during the forecast period, driven by factors the increasing construction of new infrastructures like data centers and the rapid growth of the digital economy in countries such as the U.S. and Canada. For instance, as of March 2024, there were a reported 5,381 data centers in the U.S., the most of country worldwide. Furthermore, heightened investments in research and development of non-volatile memory devices by major market players in the region aim to meet the demand for advanced devices, further boosting growth in the foreseeable future.

U.S Next Generation Non-Volatile Memory Insights

In 2023, the next generation nonvolatile memory market in the U.S. held a considerable share. The advancements in technology have driven demand for more efficient and reliable memory solutions across various sectors, including consumer electronics, automotive, and enterprise applications. Moreover, the robust infrastructure and ecosystem supporting research and development in the U.S. foster innovation in non-volatile memory technologies. This includes significant investments from both public and private sectors in cutting-edge research, enabling the development of novel memory architectures and materials.

Europe Next Generation Non-Volatile Memory Insights

The Europe next generation on volatile memory market is expected to witness a significant CAGR of 18.1% during the forecast period from 2024 to 2030. This growth can be attributed to heightened demand for advanced memory solutions driven by the region's robust industrial base and technological innovation. This demand is further fueled by increasing applications in sectors such as automotive, aerospace, healthcare, and consumer electronics, where reliable and efficient memory solutions are crucial for enhancing performance and reliability.

The next generation nonvolatile memory market in Germany held a prominent position in the European next generation nonvolatile memory market. Automobile sector is one of Germany’s key sectors which is increasingly relying on advanced non-volatile memory technologies to support applications such as autonomous driving systems and smart devices, where data integrity and speed are critical.

Italy’s next generation nonvolatile memory market is expected to grow rapidly in the coming years driven by its commitment to innovation and sustainability, strategic partnerships within Europe, and proactive support for technological advancement.

Asia Pacific Next Generation Non-Volatile Memory Market Trends

In 2023, Asia Pacific next generation nonvolatile memory market emerged as the leader in the market, capturing a significant revenue share of 49.20%,driven by factors inherent in its dynamic business environment. The proliferation of mobile technology and the Internet of Things (IoT) has accelerated the need for memory solutions that are energy-efficient and capable of retaining data when the power is off. Countries such as China, Japan, South Korea and others are at the forefront of semiconductor manufacturing and innovation.

China’s next generation nonvolatile memory is expected to grow lucratively in the coming years owing to the high demand for consumer electronics, coupled with the increasing penetration of Internet of Things (IoT) devices, need for efficient and reliable memory solutions. Furthermore, in response to rising demand for services such as video and phone communication, telecommuting, and online entertainment China is building new infrastructure, including data centers to meet this demand. India non-volatile memory market is expected to grow rapidly over the forecast period, owing to an increase in investment by key players.

Key Next Generation Non-Volatile Memory Company Insights

Key Next Generation Non-Volatile Memory Companies:

The following are the leading companies in the next generation non-volatile memory market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics Co. Ltd

- Micron Technology, Inc.

- Rohm Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- Western Digital Technologies, Inc.

- Honeywell International Inc.

- Crossbar Inc.

- Fujitsu Ltd.

- Japan Semiconductor Corporation

- HDD Manufacturers

Recent Developments

-

In April 2024, Samsung Electronics announced the mass production for its one-terabit (Tb) triple-level cell (TLC) 9th-generation vertical NAND (V-NAND), enhancing its leadership in the NAND flash market.

-

In May 2022, Toshiba and Japan Semiconductor announced the development of analog platform with eNVM for the applications in automotive segment.

Next Generation Non-Volatile Memory Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.82 billion |

|

Revenue forecast in 2030 |

USD 18.23 billion |

|

Growth Rate |

CAGR of 17.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Wafer Size, Application and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Samsung Electronics Co. Ltd; Micron Technology, Inc.; Rohm Co. Ltd; Toshiba Electronic Devices & Storage Corporation; Western Digital Technologies, Inc.; Honeywell International Inc.; Crossbar Inc.; Fujitsu Ltd.; Japan Semiconductor Corporation; HDD Manufacturers; |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Next Generation Non-Volatile Memory Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the next generation non volatile memory market report based on type, wafer size, application and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hybrid Memory Cube (HMC)

-

High-bandwidth Memory (HBM)

-

-

Wafer Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

200 mm

-

300 mm

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Consumer Electronics

-

Government

-

Telecommunications

-

Information Technology

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."