Next Generation Memory Market Size, Share & Trends Analysis Report By Technology (Volatile, Non-volatile), By Wafer Size (200mm,300mm), By Application (BFSI), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-326-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2020 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Next Generation Memory Market Size & Trends

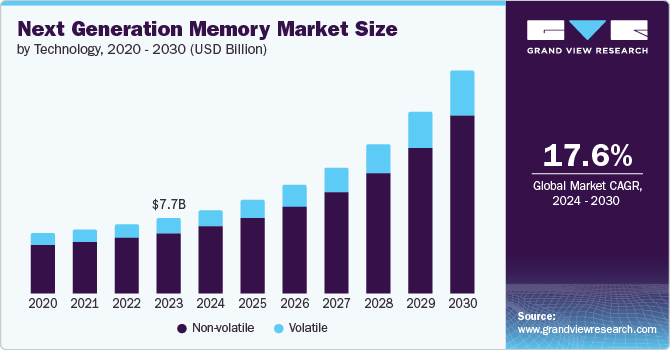

The global next generation memory market size was estimated at USD 7.72 billion in 2023, and is projected to grow at a CAGR of 17.6% from 2024 to 2030. Advancements in MRAM, ReRAM, and PCRAM, enhanced miniaturization, and integration with AI and IoT drive the next-generation memory market. High-speed, energy-efficient memory solutions are essential for data-intensive applications, consumer electronics, and the automotive industry.

Economic factors such as cost efficiency and R&D investments, along with regulatory standards, strategic collaborations, competitive innovation, and supply chain dynamics, including raw material availability and manufacturing capabilities, also play crucial roles. For instance, in June 2024, Micron Technology, Inc.'s new GDDR7 is a significant leap in graphics memory technology. It delivers the fastest speeds, highest bandwidth, and improved power efficiency, which translates to faster performance, smoother gameplay, and longer battery life for devices that use it.

Over the last few years, the next generation memory technologies market has experienced decent growth; they are now filling the market due to higher demand for better, faster and comparatively cheaper memory solutions. This, along with the growing demand for enterprise storage, is the key factor of the market growth under the investigation.

Due to the presence of higher volumes of information, there is a need for better memories and storage in the workplace. Earlier memory systems have failed to manage the growing volumes of data, the need for wider data path, and the high-speed systems of latest generation.

Currently, it is evident that the world market has a high demand for storage applications across various companies. Domain clients such as BFSI sector is increasing their investments on internet of things (IOT) technology within the next generation memory industry and leading to attractive monetary rewards. Many companies in the IT sector in their business operations are adopting the storage technologies. This growing demand is driving the adoption of the next generation storage services and devices at a very large level. In addition, it will change the approaches taken by set organizations in managing their computer.

High-speed, energy-efficient memory solutions are critical for data-intensive applications, consumer electronics, and the automotive industry. They are driving the next-generation memory market by meeting the demand for faster, more efficient performance and enabling advancements in these sectors. For instance, January 2024, KIOXIA America, Inc. introduced the industry's first Universal Flash Storage (UFS) Ver. 4.0 embedded memory devices for automotive applications. These high-performance devices, designed for next-gen automotive systems like telematics, infotainment, and ADAS, offer significant improvements with about +100% sequential read and +40% sequential write speeds. This enhanced performance leverages 5G connectivity, resulting in faster system startups and improved user experiences.

Technology Insights

In terms of technology, the next-generation memory market is segmented into volatile and non-volatile categories. The non-volatile segment held the majority share of global revenue in 2023, with over 79.7%. Hybrid Memory Cube (HMC) and High-bandwidth Memory (HBM) are the two categories of non-volatile memory. The non-volatile next-generation memory market is propelled by the exponential increase in data generation from social media, cloud computing, and IoT devices, which require advanced memory solutions to efficiently handle and store vast amounts of data. For instance, in April 2024, researchers at Dongguk University developed a novel optoelectronic memory device using rhenium selenide and 2D telluride-based van der Waals heterostructures. This device overcomes the reliability and endurance issues of conventional floating-gate nonvolatile memory devices.

Artificial Intelligence (AI) and Machine Learning (ML) applications demand high-speed data processing and storage, significantly driving the adoption of next-gen memory technologies. These technologies are crucial for meeting the performance and efficiency needs of advanced AI and ML tasks, fueling market growth and innovation.

Wafer Size Market Insights

The market is divided into two segments based on wafer size: 200 mm and 300 mm. In 2023, the 300 mm segment dominated the market in global revenue 300 mm wafer sizes in the next-generation memory market is driven by their superior production efficiency and economies of scale. These larger wafers accommodate more memory chips per unit, boosting throughput and lowering manufacturing costs per chip. This scalability makes 300 mm wafers economically advantageous for high-volume production compared to smaller alternatives like 200 mm wafers. For instance, in May 2024, STMicroelectronics announced that Samsung manufactured automotive microcontrollers featuring ePCM using a jointly developed 18nm FD-SOI process integrated with ST's ePCM technology. Sampling for automotive clients is slated for the latter half of 2024, with full-scale production scheduled to commence by the latter half of 2025. This advancement marks a significant milestone in delivering high-performance microcontrollers tailored for automotive applications, leveraging cutting-edge semiconductor processes and embedded phase change memory technology.

In 2023, the 200 mm segment is expected to grow at a significant rate over the forecast period. Adopting 200 mm wafer sizes in the next-generation memory market is primarily driven by their cost efficiency and technological advancements. Smaller wafers like 200 mm offer significant manufacturing cost advantages over larger sizes, making them highly appealing for next-gen memory technologies. In addition, ongoing advancements in semiconductor fabrication techniques and materials ensure that these smaller wafers can be utilized more efficiently without sacrificing performance, further bolstering their attractiveness in the market.

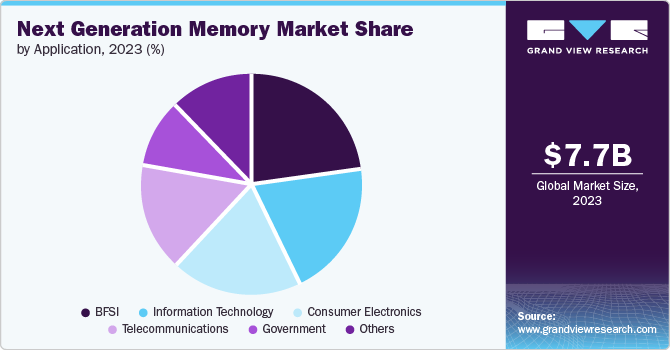

Application Insights

The market is categorized into different application segments, including BFSI, consumer electronics, government, telecommunications, IT, and others. Among these segments, the BFSI sector dominated the market in terms of revenue in 2023. Their advanced security features underscore the BFSI sector's growing dependence on next-generation memory technologies. These technologies play a crucial role in safeguarding sensitive financial data by integrating robust encryption capabilities and bolstering resistance against cyber threats and physical breaches. This enhanced security framework ensures stringent protection measures, aligning with regulatory requirements and fostering stakeholder trust. For instance, in May 2024, Infinidat launched the improved InfiniBox G4 storage system, which is available in all-flash and hybrid options. It boasts double the speed of its predecessors and offers better management tools with InfiniVerse Mobius. This release also expands cloud support for Microsoft Azure and strengthens their existing InfiniSafe data security features.

In 2023, the telecommunication segment is expected to grow at a significant rate over the forecast period. The telecommunications sector is propelling the next-generation memory market forward, fueled by escalating demands for high-bandwidth networks driven by 5G, cloud services, and the Internet of Things (IoT). These technologies require networks capable of managing massive data traffic efficiently. Next-generation memories stand out by delivering faster data access speeds than conventional memory solutions, ensuring seamless operation of bandwidth-intensive applications critical to modern telecommunications infrastructure.

Regional Insights

In 2023, North America held a significant market share globally. The region is witnessing a rapid adoption of next-generation memory technologies, which is because of various important factors such as in the finance, healthcare, and cloud computing sector’s regular need for enhanced data processing capabilities. As a result, companies are increasingly adopting the usage of advanced solutions to meet these demands. For instance, January 2024, Shelly Group AD, the IoT and smart building solutions provider, announced its latest Gen3 products at the Consumer Electronics Show 2024. These new IoT devices aim to revolutionize user interactions with smart homes and businesses. They feature enhanced memory capacity, broader compatibility, and expanded functionalities to meet evolving consumer needs in the IoT market.

U.S. Next Generation Memory Market Trends

The next generation memory market in the U.S. dominated the market with a share of 85.07% in 2023 due to the technology and semiconductor industry in the United States is on the rise due to the continuous innovation and research in memory technologies. To provide improved services to the public and enhance taxpayers' return on investment, the US government has implemented the data center optimization initiative (DCOI). The initiative focus on building and running data centres nationwide is leading to establish large-scale data center and shutting down the underperforming ones. This strategy will help in creating more opportunities within the market and will lead to its expansion.

Asia-Pacific Next Generation Memory Market Trends

By 2023, the Asia Pacific dominated the next generation memory market with a market share of 49%. Asia Pacific is leading the charge in next-generation memory due to its manufacturing might. Powerhouse countries such as China, Japan, South Korea, and India are leveraging their existing expertise in chip-making to develop and adopt these new memory technologies. This strong foundation positions them to become frontrunners in the next generation of memory solutions.

According to the SG Innovate, the Asia Pacific region is a major global manufacturing center, accounting for nearly half of the world's manufacturing output. With an increasing focus on Industry 4.0 technologies, countries in the region are bolstering their manufacturing capabilities to innovate and improve efficiency. These advancements drive economic growth and contribute significantly to regional decarbonization efforts, emphasizing sustainability as a fundamental pillar in corporate agendas and operational frameworks across various industries.

China Next Generation Memory Market Trends

The presence of prominent market players in China, is projected to have a positive impact on the market during the forecast period. The market growth is expected to be drived by the rising adoption of next generation non volatile memory in mobile phones, which aims to enhance the overall customer experience. However, the market expansion can face barriers because of low political and environmental stability and high design cost. For instance, in April 2024, BYD Company Ltd. introduced its latest energy storage system, the MC Cube-T, aiming to leverage opportunities in a rapidly expanding market. With a capacity of 6.432 MWh, the MC Cube-T is poised to redefine the value proposition of energy storage, as stated in a recent WeChat post. The system features BYD's new high-capacity, long-blade batteries. It offers individual cell energy increases of up to 11% and system-wide energy enhancements of up to 35.8%, signaling significant advancements in energy storage technology.

Key Next Generation Memory Market Company Insights

The key companies in next generation memory market are Samsung, Micron Technology, Inc., Fujitsu, SK HYNIX INC, Honeywell International Inc., Microchip Technology Inc, Everspin Technologies Inc, Infineon Technologies AG, Kingston Technology Europe Co LLP, and KIOXIA Singapore Pte. Ltd.

-

Samsung is a prominent player in next-generation memory technologies, pioneering advancements in both NAND and DRAM. Their innovations include high-capacity storage solutions such as V-NAND and advancements in DRAM, such as HBM (High Bandwidth Memory) and DDR5, catering to diverse applications from consumer electronics to enterprise-level data centers.

-

Micron Technology, Inc. is pushing the boundaries of memory with next-gen solutions. They're developing faster GDDR7 for graphics, high-bandwidth HBM for data centers, and efficient DDR5 for computing, all designed to address the ever-growing demand for higher performance and bandwidth.

Key Next Generation Memory Companies:

The following are the leading companies in the next generation memory market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung

- Micron Technology, Inc.

- Fujitsu

- SK HYNIX INC

- Honeywell International Inc.

- Microchip Technology Inc

- Everspin Technologies Inc

- Infineon Technologies AG

- Kingston Technology Europe Co LLP

- KIOXIA Singapore Pte. Ltd

Recent Developments

-

In April 2024, Samsung announced its Evo Select and Evo Plus microSD memory cards in the U.S., boasting improved read speeds of up to 160 MB/s, surpassing the previous 2023 models by 30 MB/s. These upgraded memory card lineups are designed to enhance data transfer speeds significantly, catering to consumers' growing demands for faster and more reliable storage solutions across various devices.

-

In May 2024, Micron Technology, Inc. announced that the company will be shipping a new high-performance memory for data centers. Their 128GB DDR5 RDIMM offers faster speeds and more capacity than previous models, reaching up to 5,600 MT/s. This advancement will meet the needs of modern data centers that require efficient and powerful computing.

-

In April of 2024, Kioxia Corporation made an announcement of the release of the EXCERIA G2 SD memory card line. With storage options reaching 1TB, these latest generation products are made for extended 4K video capturing.

Next Generation Memory Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.55 billion |

|

Revenue forecast in 2030 |

USD 22.65 billion |

|

Growth rate |

CAGR of 17.6% from 2024 to 2030 |

|

Historical year |

2020 - 2022 |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

June 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Technology, wafer size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa. |

|

Key companies profiled |

Samsung; Micron Technology, Inc.; Fujitsu; SK HYNIX INC.; Honeywell International Inc.; Microchip Technology Inc.; Everspin Technologies Inc.; Infineon Technologies AG; Kingston Technology Europe Co LLP; KIOXIA Singapore Pte. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Next-generation Memory Market Report Segmentation

This report forecasts revenue growth at global, regional, country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020-2030. For this study, Grand View Research has segmented the next generation memory market report based on technology, wafer size, application, and region.

-

Technology Outlook (Revenue, USD Million, 2020 - 2030)

-

Volatile

-

SRAM

-

Magneto-Resistive Random-Access Memory (MRAM)

-

Ferroelectric RAM (FRAM)

-

Resistive Random-Access Memory (ReRAM)

-

Nano RAM

-

Other

-

-

Non-volatile

-

Hybrid Memory Cube (HMC)

-

High-bandwidth Memory (HBM)

-

-

-

Wafer Size Outlook (Revenue, USD Million, 2020 - 2030)

-

200 mm

-

300 mm

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

BFSI

-

Consumer Electronics

-

Government

-

Telecommunications

-

Information Technology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."