Next Generation Computing Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Type (High-performance Computing, Quantum Computing), By Deployment, By Organization Size, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-014-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Next Generation Computing Market Trends

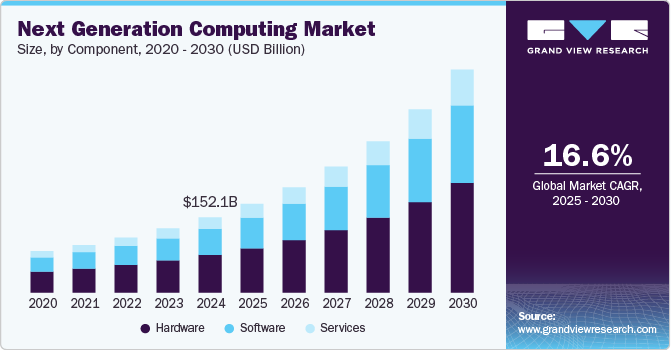

The global next generation computing market size was valued at USD 152.13 billion in 2024 and is expected to grow at a CAGR of 16.6% from 2025 to 2030. Next generation computing focuses on advancing hardware, software, and computational methodologies to address key challenges in reliability, data processing speed, security, and overall efficiency. As demand for computing and storage capacity intensifies, a growing number of research institutions, governments, and businesses are investigating cutting-edge technologies such as high-performance computing (HPC), edge computing, quantum computing, and optical computing.

The industry is driven primarily by the rapid advancements in quantum computing and edge computing, the proliferation of the Internet of Things (IoT), and the ongoing development of software and hardware innovations. Among these emerging technologies, quantum computing is recognized as the most promising due to its exceptional capability to process large datasets far more quickly than traditional computing approaches.

Moreover, enterprises across industries accelerated digital transformation to adapt to disruptions and plan operational responsiveness. Technologies such as edge computing can provide organizations with the necessary solutions to grow even in uncertain times. In March 2020, the COVID-19 High-Performance Computing (HPC) Consortium was formed, a private-public association to accelerate COVID-19 research using HPC resources. The members of the consortium include next generation computing market players such as U.S.-based Microsoft, Google, and NVIDIA Corporation.

Next generation computing technologies aim to solve complex problems that cannot be solved by conventional computing owing to speed, performance, and energy-efficiency limitations. The new computing architecture can address the requirements for data processing, transfer rates, and energy consumption. The market players provide various hardware, software, and service solutions to various industries, including healthcare, IT & telecom, and manufacturing.

The lack of a skilled workforce is a challenge for the industry. The next generation computing technologies, such as quantum and neuromorphic are still in the early stages of development. Hence, for scaling these technologies, a skilled workforce is necessary for the Research and Development (R&D) of the next generation computing products and solutions.

Component Insights

Based on components, the hardware segment held the largest revenue share of 50.1% in 2024 and is expected to register a CAGR of 16.3% over the forecast period. The growth of the segment is attributed to the availability of various next generation computing hardware products such as high-performance Central Processing Units (CPUs), memory and storage, and networking components. Moreover, robust investments from major players like Intel, NVIDIA, and AMD are fueling the segment growth. As organizations prioritize faster data processing capabilities and enhanced computational power, the demand for GPUs, CPUs, and quantum processors will continue to escalate. Furthermore, the ongoing expansion of cloud services and edge computing solutions will further amplify hardware adoption across various industries.

The services segment is projected to grow at the highest CAGR of 17.2% over the forecast period. The growth is driven by the increasing demand for advanced solutions that enhance operational efficiency and data management. As organizations continue to embrace digital transformation, investments in cloud services, particularly in areas such as AI integration and serverless computing, are expected to escalate. This growth is underpinned by the rising complexity of workloads and the need for scalable, agile solutions that support real-time data processing and analytics. Furthermore, the proliferation of IoT devices and the shift toward multi-cloud strategies will further amplify the demand for innovative service offerings, positioning businesses to leverage next-gen technologies effectively.

Type Insights

Based on type, the cloud computing segment accounted for the largest revenue share in 2024. Advantages offered by cloud computing, such as cost efficiency, flexibility, and security, contribute to segment growth. The rise of multi-cloud strategies, enabling organizations to optimize performance and reduce vendor lock-in, and the integration of AI and machine learning into cloud platforms, enhancing data analytics and automation capabilities. Additionally, hybrid cloud adoption continues to grow, allowing businesses to balance public and private cloud benefits. This evolution is further supported by advancements in edge computing and a heightened focus on cloud security, which are critical for maintaining operational resilience and compliance in an increasingly complex digital landscape

The edge computing segment is likely to grow at the highest CAGR over the forecast period. Edge computing provides benefits such as faster insights and faster response time. Market players such as France-based Atos SE, U.S.-based Intel Corporation, and NVIDIA Corporation offer solutions for edge computing. The expansion is driven by the increasing demand for low-latency applications and the integration of 5G technology, which enhances real-time data processing capabilities essential for sectors like healthcare, manufacturing, and smart cities. Key players are investing heavily in infrastructure, with hardware expected to account for nearly 40% of total spending. The shift toward decentralized computing solutions is critical for organizations aiming to optimize operational efficiency while addressing security challenges inherent in edge environments.

Deployment Insights

Based on deployment, the on-premises segment accounted for the largest revenue share in 2024. The growth is driven by organizations' increasing demand for enhanced data security and control over their computing environments. As businesses prioritize compliance with stringent data protection regulations, on-premises solutions provide a viable alternative to cloud offerings, allowing for tailored configurations that meet specific operational needs. Furthermore, the rising complexity of workloads necessitates robust infrastructure capable of handling high-performance computing tasks efficiently. Companies are expected to invest in advanced hardware and integrated systems to optimize their on-premises capabilities.

The cloud segment is likely to grow at the highest CAGR over the forecast period. Multi-cloud strategies are gaining traction, enabling organizations to optimize performance and avoid vendor lock-in while enhancing operational resilience. The integration of edge computing with cloud platforms is facilitating real-time data processing, crucial for industries like smart cities and manufacturing. Additionally, the rise of AI and machine learning within cloud services is set to enhance automation and predictive analytics capabilities. Hybrid cloud solutions will continue to evolve, allowing businesses to balance public and private infrastructure for optimal security and compliance.

Organization Size Insights

Based on organization size, the large-size enterprises segment accounted for the largest revenue share in 2024. Large enterprises across industries are adopting these technologies to improve their operations and offerings. Moreover, quantum computing is set to revolutionize data processing capabilities, offering unprecedented efficiencies that traditional methods cannot match. As these technologies converge, organizations that adopt a strategic approach to next-gen computing will not only optimize their operations but also unlock new avenues for innovation and competitive advantage in an increasingly digital landscape.

The Small and Medium Enterprises (SMEs) segment is likely to register a significant CAGR over the forecast period. The increasing demand for high-performance computing and digital transformation initiatives is driving SMEs to integrate next-gen technologies, enhancing operational efficiencies and competitive advantages. However, challenges such as initial investment costs and compatibility with existing systems may hinder some SMEs from fully capitalizing on these advancements. As the market evolves, SMEs that strategically invest in next generation computing solutions will likely emerge as key players in their respective industries.

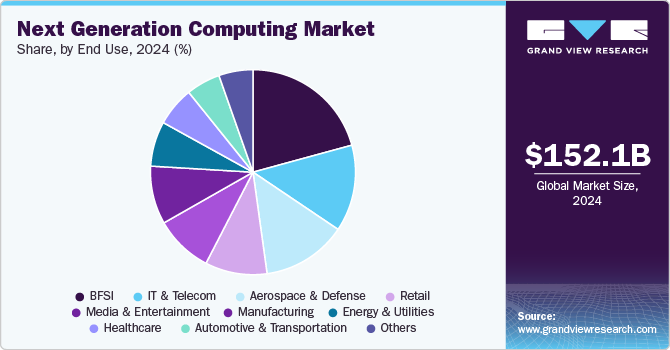

End-use Insights

Based on end-use, the BFSI segment accounted for a significant revenue in 2024. The integration of artificial intelligence (AI) and machine learning (ML) will enable hyper-personalized customer experiences and improve risk management through advanced analytics. Additionally, the adoption of cloud computing solutions will facilitate seamless operations and compliance management, which is essential for navigating the increasingly complex regulatory landscape. As these technologies mature, BFSI organizations that strategically invest in next generation computing will gain a competitive edge by enhancing customer engagement and operational agility.

The manufacturing segment is expected to grow at a significant CAGR over the forecast period. This growth is fueled by the demand for high-performance computing solutions that facilitate real-time data processing and automation across production lines. Furthermore, the shift toward Industry 5.0 emphasizes collaboration between humans and machines, leveraging digital twins and generative AI to optimize processes and improve product quality. As sustainability becomes a focal point, investments in energy-efficient computing and circular economy initiatives will also drive innovation within the sector.

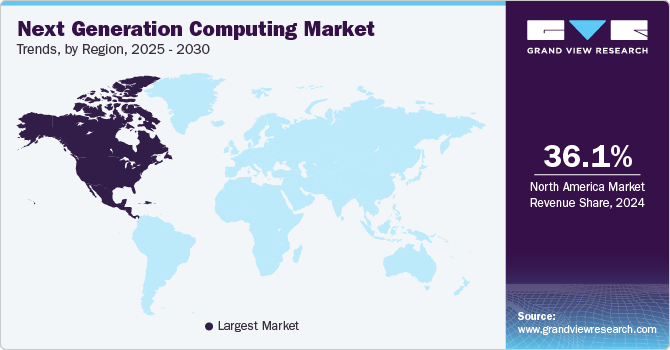

Regional Insights

North America next generation computing market dominated the global industry with a share of 36.1% in 2024. The region's dominance is supported by the presence of major industry players like Intel, Microsoft, and IBM, who are leading innovations in high-performance computing and quantum technologies. Furthermore, the increasing demand for real-time data processing and enhanced security measures in sectors such as healthcare and finance is accelerating adoption rates. As organizations prioritize digital transformation initiatives, North America is expected to maintain its leadership position in the global next-gen computing landscape.

U.S. Next Generation Computing Market Trends

The next-generation computing market in the U.S. held a dominant position in 2024. The U.S. remains a dominant player due to its robust technological infrastructure and significant R&D expenditures from leading firms like Amazon, Microsoft, and IBM. Additionally, the rising demand for real-time data processing and advancements in quantum computing are expected to further accelerate market expansion, positioning the U.S. as a critical hub for next-gen computing innovations.

Europe Next Generation Computing Market Trends

The next generation computing market in Europe is driven by increasing investments in research and development, particularly in quantum computing and edge computing technologies, which are essential for enhancing data processing capabilities and energy efficiency. The rise of the Internet of Things (IoT) is further fueling demand, as an estimated 41 billion IoT devices are expected to be deployed by 2025, necessitating robust computing infrastructures.

Asia Pacific Next Generation Computing Market Trends

The next generation computing market in Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2030. This surge is driven by rapid digital transformation initiatives, increased cloud adoption, and government support for advanced technologies such as AI, machine learning, and quantum computing. Key markets like China, India, Japan, and South Korea are leading this charge, fueled by rising IT investments and a growing demand for real-time data processing capabilities. Enterprises are increasingly upgrading legacy systems and migrating to cloud-based solutions to enhance operational efficiency and drive innovation.

Key Next Generation Computing Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

IBM is at the forefront of next generation computing, integrating advanced technologies and expertise to drive digital transformation for its clients. The company offers a comprehensive suite of services, including infrastructure, software solutions like Red Hat, and consulting services tailored to modern business needs. A significant focus is on quantum computing, where IBM leads research efforts to harness its potential for solving complex problems. Additionally, IBM emphasizes intelligent automation through AI-powered tools, such as Watson Orchestrate, designed to streamline workflows and enhance operational efficiency. Committed to sustainability, IBM aims for net-zero greenhouse gas emissions by 2030, showcasing its dedication to leveraging technology for a better future. Through these initiatives, IBM positions itself as a catalyst for innovation and progress in the tech industry.

-

Amazon Web Services (AWS) has been a leader in cloud technologies since its inception in 2006, offering a range of services that empower organizations and individuals to innovate and transform industries. AWS provides next generation computing solutions that enable users to harness the power of data for various applications, from monitoring infrastructure like wind turbines to enhancing vehicle intelligence. The platform is designed to be accessible to everyone, allowing startups and established enterprises alike to leverage advanced technology for their unique needs. AWS emphasizes inclusivity and sustainability in its operations, ensuring that its services not only drive business success but also contribute positively to communities globally. Through continuous innovation and customer-centric solutions, AWS remains committed to pushing the boundaries of what is possible in cloud computing.

Key Next Generation Computing Companies:

The following are the leading companies in the next generation computing market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Amazon Web Services, Inc.

- Intel Corporation

- Atos SE

- Microsoft

- Hewlett Packard Enterprise Development LP

- NVIDIA Corporation

- Cisco Systems Inc.

- Advanced Micro Devices, Inc

- Dell Inc.

Recent Developments

-

InNovember 2024, IBM unveiled its most advanced quantum computers, marking a significant leap toward achieving quantum advantage. These new systems are designed to enhance scale, speed, and accuracy, enabling breakthroughs in scientific research and complex problem-solving. By leveraging advanced technologies, IBM aims to accelerate the development of quantum applications across various industries, reinforcing its leadership in the quantum computing space. This launch underscores IBM's commitment to driving innovation and delivering tangible value through quantum technology.

-

In November 2024, Comviva announced a strategic collaboration with Amazon Web Services (AWS) to enhance its cloud-first, AI-driven strategy, enabling faster time to market for next-generation Software-as-a-Service (SaaS) products. This partnership aims to empower Communication Service Providers with innovative solutions while focusing on product modernization and generative AI capabilities. Over 2,000 Comviva employees will receive training on AWS technologies to support this transformation. This collaboration marks a significant step in Comviva's journey toward becoming a leading SaaS organization in the telecom sector.

Next Generation Computing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 179.51 billion |

|

Revenue forecast in 2030 |

USD 451.27 billion |

|

Growth Rate |

CAGR of 16.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, type, deployment, organization size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Chile; Argentina; UAE; Saudi Arabia and South Africa |

|

Key companies profiled |

IBM, Google, Amazon Web Services, Inc., Intel Corporation, Atos SE, Microsoft, Hewlett Packard Enterprise Development LP, NVIDIA Corporation, Cisco Systems Inc., Advanced Micro Devices, Inc, Dell Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Next Generation Computing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global next generation computing market report based on component, type, deployment, organization size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

High-Performance Computing

-

Quantum Computing

-

Cloud Computing

-

Edge Computing

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium Sized Enterprises (SMEs)

-

Large Size Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive & Transportation

-

Energy & Utilities

-

Healthcare

-

BFSI

-

Aerospace & Defense

-

Media & Entertainment

-

IT & Telecom

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Chile

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global next-generation computing market size was estimated at USD 152.13 billion in 2024 and is expected to reach USD 179.51 billion in 2022.

b. The global next-generation computing market is expected to grow at a compound annual growth rate of 16.6% from 2025 to 2030 to reach USD 451.27 billion by 2030.

b. North America dominated the next-generation computing market with a share of 36.1% in 2024. This is attributable to the presence of several next-generation computing market players and advanced technological infrastructure.

b. Some key players operating in the next generation computing market include IBM, Google, Amazon Web Services, Inc., Intel Corporation, Atos SE, Microsoft, Hewlett Packard Enterprise Development LP, NVIDIA Corporation, Cisco Systems Inc., Advanced Micro Devices, Inc, Dell Inc.

b. Key factors driving the market growth include the increasing need to process and manage complex workloads and growing R&D activities in technology companies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."