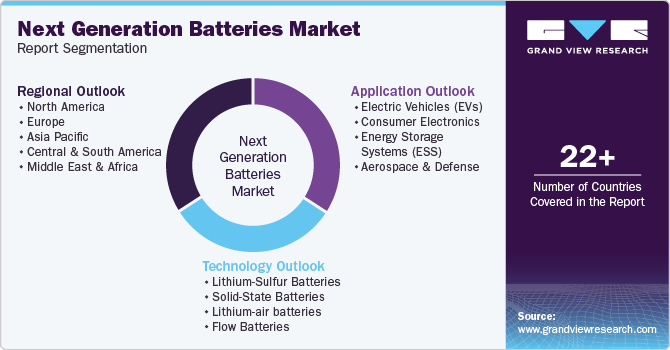

Next Generation Batteries Market Size, Share & Trends Analysis Report By Technology (Lithium-Sulfur Batteries, Solid-State Batteries), By Application (Electric Vehicles (EVs), Consumer Electronics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-462-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Next Generation Batteries Market Trends

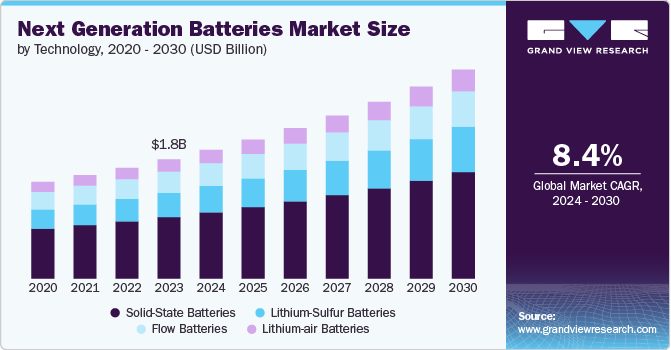

The global next generation batteries market size was estimated at USD 1.76 billion in 2023 and is expected to grow at a CAGR of 8.4% from 2024 to 2030. The global next-generation batteries market is growing steadily, driven by the increasing demand for advanced energy storage solutions, particularly for electric vehicles (EVs) and renewable energy sectors. As industries and governments around the world focus on transitioning to cleaner energy sources, the need for innovative battery technologies has become more pronounced. Next-generation batteries, such as solid-state, lithium-sulfur, and sodium-ion batteries, offer improved energy density, enhanced safety features, and better performance over traditional lithium-ion batteries.

The market is expected to see considerable expansion in the coming years due to ongoing technological advancements and rising investments in research and development. Electric vehicles continue to drive much of the demand for high-performance batteries, while the growing renewable energy sector further accelerates the need for efficient energy storage solutions. Additionally, major global regions such as Asia Pacific, North America, and Europe are investing significantly in battery infrastructure and manufacturing, contributing to the market's overall growth trajectory.

As industries increasingly prioritize sustainability and energy efficiency, the next-generation batteries market is positioned for significant growth. Companies are developing cutting-edge technologies to meet the rising demand for cleaner, more efficient energy storage solutions, while governments around the world are introducing policies and incentives to promote the use of advanced batteries. This market growth reflects a larger trend toward adopting energy-efficient technologies and reducing reliance on conventional energy storage methods.

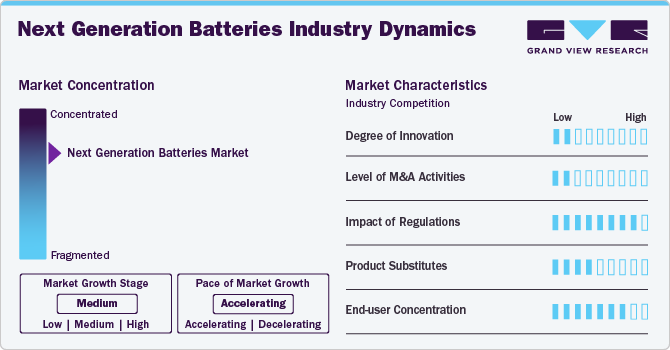

Market Concentration & Characteristics

The next-generation batteries market is a dynamic and competitive space, with established players and innovative newcomers vying for dominance. The industry faces stiff competition from key players in various sectors. Leading companies such as QuantumScape, Solid Power, SES AI Corporation, and Enovix have been in the industry for years, boasting extensive experience and established customer bases.

At the same time, startups and smaller companies are entering the fray with cutting-edge technologies and disruptive business models, aiming to capture market share. As the demand for more efficient, safer, and high-performing batteries increases, these new entrants are challenging established players with innovations in solid-state, lithium-sulfur, and other advanced battery technologies. Established companies, in turn, are leveraging their experience and resources to maintain their competitive edge, focusing on strategic collaborations, R&D investments, and scaling up production capabilities to meet growing market demand.

To strengthen their foothold, companies in the next-generation batteries market are increasingly focusing on new product launches, particularly in advanced battery technologies, to cater to emerging sectors like electric vehicles and renewable energy storage. This competitive environment is driving rapid advancements in battery technology, shaping the future of energy storage solutions across multiple industries.

Technology Insights

The solid-state batteries emerged as the largest segment with a revenue share of about 51.50% in 2023 and are expected to witness robust growth from 2024 to 2030. This dominance is attributed to their superior energy density, enhanced safety features, and longer life cycles than traditional lithium-ion batteries. Solid-state batteries utilize a solid electrolyte rather than a liquid or gel, which minimizes the risk of leakage and thermal runaway, making them particularly appealing for high-performance applications such as electric vehicles and advanced electronics. The growing emphasis on improving battery safety and efficiency has propelled solid-state batteries to the forefront, positioning them as a preferred choice for many industries looking to leverage cutting-edge energy storage solutions.

Furthermore, lithium-sulfur batteries are gaining attention in the automotive sector due to their potential for higher energy density than traditional lithium-ion batteries. This could lead

to electric vehicles with longer driving ranges and potentially lower costs. Moreover, these batteries offer devices with longer battery life and potentially faster charging times. This technology is extensively beneficial for smartphones, laptops, and wearable devices where energy density and lightweight designs are crucial.

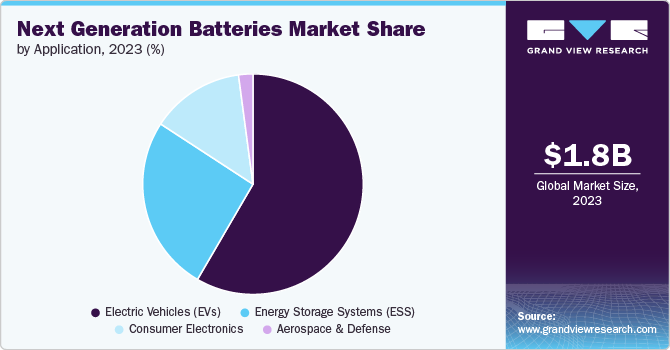

Application Insights

Electric Vehicles (EVs) emerged as the largest application segment with a revenue share of about 58.36% in 2023 and is expected to witness robust growth from 2024 to 2030. This dominance reflects the rapid acceleration in EV adoption driven by increasing environmental awareness, government incentives, and advancements in battery technology. The growing emphasis on reducing carbon emissions and transitioning to sustainable transportation solutions has positioned EVs at the forefront of the market. Next-generation batteries, with their superior energy density, longer life cycles, and improved safety features, are crucial in meeting the performance requirements of modern electric vehicles, making them an integral part of the automotive industry's shift toward electrification.

Moreover, the rapid growth of renewable energy sources such as solar and wind is one of the primary drivers behind the expansion of energy storage systems. Since renewables are intermittent and unpredictable, effective energy storage is required to store excess energy generated during peak times and discharge it when demand is high or when renewable generation is low. Next-generation batteries with longer lifespans, higher energy density, and faster charge/discharge capabilities will enable better integration of renewables into the grid, improving energy reliability and reducing reliance on fossil fuels

Regional Insights

The next-generation batteries market in North America is experiencing significant growth, driven by increasing demand for electric vehicles (EVs) and renewable energy storage solutions. The U.S. government's push for clean energy initiatives, along with substantial investments in EV infrastructure, has accelerated the development and adoption of advanced battery technologies. Additionally, collaborations between automotive manufacturers and battery developers are fueling innovation in solid-state and other next-gen battery technologies. North America is poised to remain a key market due to rising R&D activities and the expansion of battery production facilities.

U.S. Next Generation Batteries Market is flourishing, particularly due to the rapid expansion of the electric vehicle sector and growing investments in renewable energy storage systems. The country’s focus on reducing carbon emissions and achieving energy independence has spurred demand for advanced battery technologies. Major automotive companies, like Tesla and General Motors, are actively working on developing next-gen batteries, including solid-state and lithium-metal options, to enhance EV performance. Additionally, U.S.-based companies are increasingly partnering with global battery manufacturers to drive innovation and strengthen the domestic supply chain.

Asia Pacific Next Generation Batteries Market Trends

Asia Pacific next generation batteries market dominated and accounted for the largest revenue share of 64.48% in 2023. This dominance is primarily attributed to the region's rapid adoption of electric vehicles, increasing investments in renewable energy infrastructure, and a strong focus on developing advanced battery technologies. Key countries such as China, Japan, and South Korea are at the forefront of battery manufacturing, research, and innovation, further bolstering the region's market presence. In addition, government initiatives supporting clean energy and the presence of major battery manufacturers in the region are expected to drive sustained growth and ensure Asia Pacific remains a critical player in the market.

China next generation batteries market remains the global leader in the next-generation batteries market, accounting for the largest share of production and consumption. The country’s strong focus on electric vehicle adoption and renewable energy projects has positioned it as a key player in battery innovation. Chinese companies, such as CATL and BYD, are leading the development of advanced battery technologies, including solid-state and lithium-ion alternatives. Government incentives for EV purchases and investments in battery production facilities are further driving the market. China’s dominance is expected to continue as it enhances its global supply chain and technological capabilities.

Europe Next Generation Batteries Market Trends

The next generation batteries market in Europe is a major player, driven by stringent environmental regulations and strong government initiatives to promote clean energy and electric vehicles. Countries like Germany and France are at the forefront of this movement, with significant investments in battery research and manufacturing facilities. The European Union's Green Deal, along with increasing EV adoption and renewable energy projects, is accelerating the shift toward advanced battery technologies. Europe is also focusing on reducing its dependence on imported batteries, fostering the growth of domestic battery production and innovation hubs.

France next generation batteries market is driven by its commitment to sustainable mobility and renewable energy. The French government’s focus on achieving carbon neutrality by 2050 has led to increased investments in electric vehicles and battery storage solutions. Major French automakers, such as Renault, are actively investing in next-gen battery technologies to improve EV performance and reduce costs. Additionally, France is promoting the development of local battery manufacturing facilities to support domestic production and strengthen its position in the European battery supply chain.

Central & South America Next Generation Batteries Market Trends

The next-generation batteries market in Central & South America is gradually expanding, driven by the region’s growing focus on renewable energy and electric mobility. Countries like Brazil and Chile are investing in clean energy projects, including solar and wind, which require advanced energy storage solutions. While the market is still in its early stages compared to North America and Asia, rising demand for energy storage systems and electric vehicles is expected to drive growth. Regional governments are also exploring partnerships with global battery manufacturers to enhance local production capabilities.

Middle East & Africa Next Generation Batteries Market Trends

The Middle East & Africa region is seeing increasing interest in next-generation batteries, particularly for renewable energy storage solutions and electric vehicle applications. The region's focus on diversifying energy sources beyond oil and gas has led to growing investments in clean energy, including solar and wind projects, which require efficient battery storage. Countries like the UAE and South Africa are taking steps to adopt advanced battery technologies to support these initiatives. While the market is still developing, ongoing investments in infrastructure and partnerships with global battery manufacturers are expected to drive growth.

The next generation batteries market in Saudi Arabia is gaining traction as part of the country’s Vision 2030 plan, which aims to diversify the economy and reduce dependence on oil. The government is focusing on expanding renewable energy projects, including large-scale solar and wind farms, which require advanced battery storage solutions. Additionally, Saudi Arabia is investing in electric vehicle infrastructure, with plans to increase EV adoption in the coming years. These initiatives, along with partnerships with international battery manufacturers, are expected to drive the growth of the next-generation batteries market in the country.

Key Next Generation Batteries Company Insights

The market is consolidated, with a few dominant players holding a significant share. These key players primarily serve sectors such as electric vehicles, renewable energy storage, aerospace, and consumer electronics. Companies are focusing on organic and inorganic growth strategies, including technological innovation, strategic partnerships, mergers & acquisitions, and facility expansions, to strengthen their market position and drive growth.

Key Next Generation Batteries Companies:

The following are the leading companies in the next generation batteries market. These companies collectively hold the largest market share and dictate industry trends.

- LG Chemicals

- Phinergy

- Amprius Inc.

- Mitsubishi Chemical

- Seeo

- Panasonic Corporation

- Sion Power

- Envia Systems Inc.

- Ambri Inc.

- Hitachi

Recent Developments

-

In August 2024, BYD announced to launch second-generation blade battery system which has an energy density of 190 Wh/kg. The battery shall be installed in electric vehicles and is expected to substitute LFP batteries in the near future.

Next Generation Battery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.90 billion |

|

Revenue forecast in 2030 |

USD 3.09 billion |

|

Growth rate |

CAGR of 8.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

USD in million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue Forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

LG Chemicals; Phinergy; Amprius Inc.; Mitsubishi Chemical; Seeo; Panasonic Corporation; Sion Power; Envia Systems Inc.; Ambri Inc.;Hitachi |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Next Generation Batteries Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global next generation batteries market report based on the technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-Sulfur Batteries

-

Solid-State Batteries

-

Lithium-air batteries

-

Flow Batteries

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Vehicles (EVs)

-

Consumer Electronics

-

Energy Storage Systems (ESS)

-

Aerospace and Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global next generation batteries market size was estimated at USD 1.76 billion in 2023 and is expected to reach USD 1.90 billion in 2024.

b. The global next generation batteries market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 3.09 billion by 2030.

b. Based on technology, solid-state batteries were the dominant segment in 2023 with a revenue share of about 51.50% in 2023. This is attributable to their higher energy density, enhanced safety, and longer life cycle compared to conventional lithium-ion batteries. Their solid electrolyte reduces risks of leakage and fire, making them ideal for electric vehicles and advanced electronics.

b. Some of the key players operating in this industry include LG Chemicals, Phinergy, Amprius Inc., Mitsubishi Chemical, Seeo, Panasonic Corporation, Sion Power, Envia Systems Inc., Ambri Inc., Hitachi.

b. Key factors driving the next-generation batteries market include increasing demand for electric vehicles, advancements in renewable energy storage, and the need for safer, more efficient energy solutions with longer lifespans and higher energy densities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."