New York Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Hemp, Marijuana), By Derivatives (CBD, THC, Others), By Cultivation (Indoor Cultivation, Greenhouse Cultivation), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-420-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

New York Legal Cannabis Market Trends

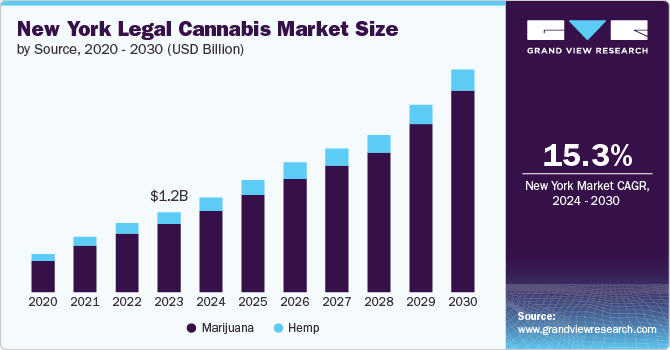

The New York legal cannabis market size was estimated at USD 1.16 billion in 2023 and is expected to grow at a CAGR of 15.3% from 2024 to 2030. Rising acceptance of its use for medical purposes and the legalization of cannabis for recreational purposes are the key factors driving the market growth. For instance, in March 2021, New York State legalized cannabis for adult use by enacting the Marijuana Regulation & Taxation Act (MRTA). This act led to the development of a new Office of Cannabis Management (OCM), which a Cannabis Control Board regulates to oversee and implement the law. Thus, the implementation of this act improves the monitoring of the cannabis supply chain in New York.

An increase in awareness about the benefits of medical cannabis has led to a higher number of registered healthcare practitioners in New York who are willing to prescribe cannabis, thereby driving market growth in the state. The ongoing increase in the legalization and acceptance of medical cannabis products has led to market growth. For instance, the U.S. Food and Drug Administration (FDA) has approved Marinol and Syndros, a cannabis-derived drug product, for the treatment of nausea associated with cancer chemotherapy and anorexia associated with weight loss in AIDS patients.

Furthermore, the legalization of cannabis in the state is expected to generate substantial revenue, create new job opportunities, and reduce illegal cannabis sales. The government can generate the revenue through taxes levied. In 2022-2023, application fees, license fees, and cannabis tax revenue totaled nearly USD 16.3 million. The Cannabinoid Hemp Program generated nearly USD 1.1 million, the Adult-Use Cannabis Program generated nearly USD 3.6 million, and the Medical Cannabis Program generated over USD 11.6 million in New York.

Moreover, favorable initiatives started by the government and public and private companies fuel market growth. For instance, the Cannabis Compliance Training and Mentorship (CCTM) Program in New York helped experienced food and beverage processors and cannabis growers to shift to a well-regulated adult-use cannabis market. The initiative was designed to cultivate and diversify the pipeline of farmers and processors ready to participate in New York's adult-use cannabis sector. In 2023, there were over 240 individuals participated in this program, including 42 legacy processors and 94 legacy cultivators.

The growing number of companies entering the local markets to cater to the rising demand for cannabis, the launch of new products, and favorable government initiatives support the market growth. For instance, in December 2023, Acreage Holdings, Inc., a cannabis cultivation and retailing company, introduced The Botanist THC-infused gummies with three fruit flavors such as Mandarin Orange (1:1 THC: CBD), Peach Nectarine (5:1 CBD: THC), and Red Raspberry (10mg THC) in New York.

A positive attitude of consumers toward the consumption of cannabis and cannabinoid (CBD) based products led to the rise in demand for cannabis-based products. For instance, according to data published in NYP Holdings, Inc., in July 2023, 2.7 million individuals in New York consume cannabis at least once a month. Thus, such factors fuel the market growth in the state.

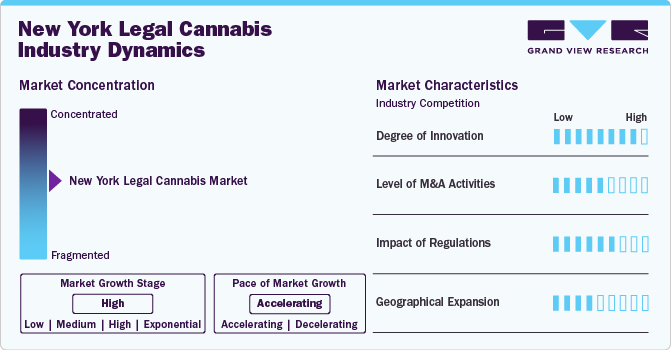

Market Concentration & Characteristics

The market is characterized by a high degree of innovation. Factors such as increasing R&D activities on the use of cannabis and its medicinal properties, growing awareness among people regarding the medicinal benefits of cannabis, and rising demand for cannabis-infused products are fostering research activities on cannabis. For instance, NYU Grossman School of Medicine's Department of Psychiatry, a medical school in New York, is conducting research on cannabidiol as a potential treatment for psychiatric disorders.

The market is characterized by a medium level of mergers and acquisitions (M&A). Several market players are acquiring smaller players to strengthen their market positions. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies. For instance, in May 2021, Aphria and Tilray Brands, Inc. entered a merger to form TILRAY, the leading cannabis-focused consumer packaged goods company.

The industry in New York is flourishing due to a structured regulatory framework for the consumption, cultivation, and sale of cannabis. In New York, The New York State Office of Cannabis Management (OCM) licenses processors, cultivators, dispensaries, and distributors to cultivate and sell cannabis.

Many companies are adopting this strategy to strengthen their business and expand their product portfolio. For instance, in November 2023, COOKIES CREATIVE PRODUCTIONS & CONSULTING, INC., a cannabis lifestyle brand, entered New York’s legal cannabis market and launched cannabis-infused preroll and vape products. Both New York citizens and tourists more than the age of 21 can legally purchase Cookies products.

Source Insights

By source, the marijuana segment dominated the market with the highest revenue share in 2023 and is anticipated to witness the fastest CAGR of 16.3% over the forecast period. The market for marijuana in New York is anticipated to increase owing to growing awareness regarding its therapeutic applications, such as eye pressure reduction, appetite enhancement, and pain management. Moreover, changing consumer behavior toward recreational marijuana and introducing educational programs for cannabis cultivation and its medical properties fuel the market growth. For instance, in February 2023, the SUNY Cannabis Career and Education Expo was organized by The CannaBusiness Education Hub for the exploration of advancements and opportunities in New York’s growing cannabis industry in Schenectady.

The hemp segment held a significant revenue share in 2023 due to the increasing awareness of the levels of CBD present in it. This led to a rise in demand for hemp extracts across various industries such as cosmetics, personal care, food and beverages, nutraceuticals, pharmaceuticals, textiles, and non-textiles. Consumers are increasingly adopting cannabis in various non-textile applications to reduce deforestation, pollution, and non-biodegradable waste. For example, New York Hemp Oil is the only USDA Certified Organic hemp company in New York State which offers hemp-based CBD products and more.

Derivatives Insights

By derivatives, the CBD segment dominated the market with the largest revenue share of 62.1% in 2023. Due to the rise in demand for various CBD-infused products, including cannabis oil, beauty products, gummies, beverages, capsules, etc., boosted the market growth in the state. CBD enters the human body in different ways, such as vaping, smoking, and, topically, through the skin. CBD is utilized to produce medical drugs and medical drugs personal care products. For example, Beautyque NYC, a New York Cannabis cosmetics company, offers various products such as CBD Tinted Moisturizer, CBD Collagen Boost Serum, CBD Activated Charcoal Cleanser, CBD Men's Moisturizer, and many more.

The other segment held a significant market share in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. This segment includes elements of the cannabis plant, such as terpenes, flavonoids, and other minor cannabinoids (CBN, CBG, THCV). Various advantages offered by these minor cannabinoids and terpenes in treating various medical conditions and introducing new products are propelling the market growth. For instance, in July 2024, Grön, a manufacturer of cannabis-infused edibles, launched its full lineup of MEGA flavors and Sugar-Coated Pearls in New York. The Sugar-Coated Pearls include Blackberry Lemonade (1:1:2 CBN/CBD/THC, Indica), Blueberry Lemonade (3:1 CBG/THC, sativa), Pomegranate (4:1 CBD/THC, hybrid), Raspberry Lemonade (sativa), Tangelo (2:1:1 THC/CBC/CBG, sativa), Peach Prosecco (1:1 CBD/THC, hybrid), Tart Cherry (10:1 CBN/THC, Indica), and Watermelon (Indica).

Cultivation Insights

By cultivation, the indoor cultivation segment led the market with the largest revenue share of 56.8% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The introduction of new indoor cannabis cultivation facilities and favorable government initiatives drive market growth. For instance, in June 2024, New York state-approved home cannabis cultivation, permitting adults to cultivate their own plants. The New York State Cannabis Control Board approved and adopted regulations allowing adults aged 21 and above to grow cannabis plants at home.

The outdoor cultivation segment held a significant share in 2023. Cultivating cannabis in an outdoor setting is generally more cost-effective than indoor cultivation, owing to the presence of essential growth elements in the natural environment. This advantage has led to an increase in outdoor cultivation activities, as it mitigates the requirement for expensive agricultural infrastructure and reduces operational expenditures, thereby accelerating segment growth.

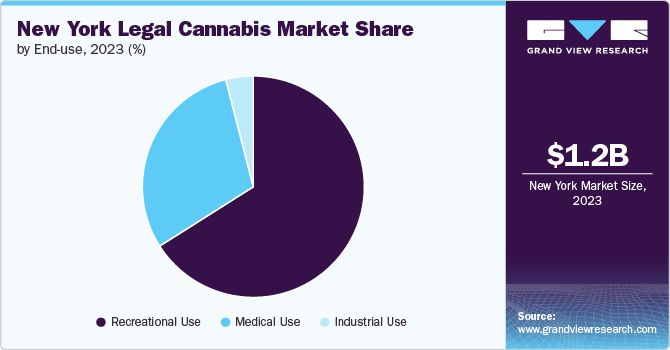

End-use Insights

By end-use, the recreational use segment dominated the market in 2023 with a revenue share of 65.7% and is expected to grow at the fastest CAGR over the forecast period. Recreational use of cannabis includes smoking and consuming it in the form of foods & beverages, vapes, and gummies. Moreover, the legalization of cannabis for recreational purposes and the increase in the launch of new cannabis-based food products boost the segment's growth. For instance, in February 2023, Cycling Frog, a provider of cannabis products, collaborated with Gasko & Meyer, New York-based beverage distributors, to bring its THC and CBD products to New York.

The medical use segment is anticipated to grow significantly over the forecast period. The medical application of cannabis has witnessed major growth as the number of scientific studies supporting its benefits in the treatment of various diseases has increased. Psychological conditions such as anxiety disorders, PTSD, bipolar disorder, depression, ADHD, multiple sclerosis, Alzheimer’s disease, and Parkinson’s disease can be effectively treated with medical cannabis, owing to its therapeutic benefits. Thus, such factors fuel the segment's growth.

Key New York Legal Cannabis Company Insights

The growing demand for cannabis-infused cosmetics and food items is anticipated to propel the entry of new companies into the market. Key market players engage in strategic alliances such as mergers & acquisitions, collaborations, partnerships, and product launches with other industry participants to expand their market presence.

Key New York Legal Cannabis Companies:

- Curaleaf Holdings, Inc.

- New York Hemp Oil

- COOKIES CREATIVE PRODUCTIONS & CONSULTING, INC.

- ACREAGE HOLDINGS.

- Cannabist Company Holdings Inc.

- Cresco Labs.

- PharmaCann Inc.

- Vireo Health International, Inc.

- Green Thumb Industries (GTI)

Recent Developments

-

In July 2023, the RIFF cannabis brand from Tilray Brands, Inc. launched new THC beverages featuring two fruit flavors: wild raspberry lemonade and blue raspberry ice.

-

In April 2023, Cann, a cannabis startup, launched its cannabis beverage brand in New York. State residents can purchase Cann through direct-to-consumer and at retailers.

New York Legal Cannabis Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.37 billion |

|

Revenue forecast in 2030 |

USD 3.22 billion |

|

Growth rate |

CAGR of 15.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, derivatives, cultivation, end-use |

|

State scope |

New York |

|

Key companies profiled |

Curaleaf Holdings, Inc., New York Hemp Oil, COOKIES CREATIVE PRODUCTIONS & CONSULTING, INC., ACREAGE HOLDINGS., Cannabist Company Holdings Inc., Cresco Labs., PharmaCann Inc., Vireo Health International, Inc., Green Thumb Industries (GTI) |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

New York Legal Cannabis Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the New York legal cannabis market report based on source, derivatives, cultivation, and end-use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Hemp Oil

-

Industrial Hemp

-

-

Marijuana

-

Flower

-

Oil and Tinctures

-

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Cultivation

-

Greenhouse Cultivation

-

Outdoor Cultivation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Use

-

Medical Use

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Post Traumatic Stress Disorder (PTSD)

-

Cancer

-

Migraines

-

Epilepsy

-

Alzheimer’s

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Tourette’s

-

Diabetes

-

Parkinson's

-

Glaucoma

-

Others

-

-

Recreational Use

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."