New England Air Compressor Market Size, Share & Trends Analysis Report By Product (Reciprocating, Rotary/Screw) By Lubrication (Oil Free, Oil Filled), By Operating Mode, By Type, By Application, By Power Range, By State, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-488-3

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

New England Air Compressor Market Trends

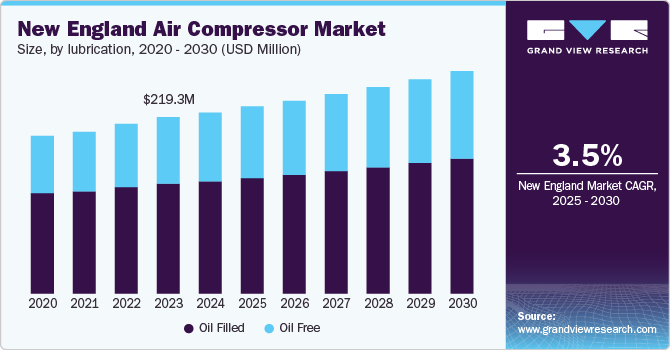

The New England air compressor market size was estimated at USD 225.0 million in 2024 and is projected to grow at a CAGR of 3.5% from 2025 to 2030. Stringent environmental regulations and increasing emphasis on sustainability have led industries to adopt more environmentally friendly product. Air compressors are used in various pollution control and emission reduction processes to ensure compliance with these regulations.Rising automation and robotics in many industries are driving market growth since air compressors are crucial in powering pneumatic systems used in these applications.

Moreover, energy-efficient air compressors, which consume less electricity and lower operational costs, are in high demand across power generation, petroleum, chemicals, and manufacturing industries. These industries value the cost-effectiveness and improved energy distribution offered by such compressors, especially as compressed air plays a vital role in their processes, including in the manufacturing and automotive industries.

Drivers, Opportunities & Restraints

The growth potential for the market in New England states can be linked to their manufacturing strengths. States such as Massachusetts and New York, with robust machinery manufacturing, could see increased demand for air compressors as these industries expand. In addition, Connecticut's focus on chemical manufacturing may require specialized air compressors for various processes. As these industries grow, they are likely to drive further investments in air compressors, supporting both local economies and the broader manufacturing landscape.

The growth of the market has been hampered by the high initial prices and increased maintenance costs. Manufacturers of air compressors are required to invest substantially in research and development activities to develop their robust lubrication portfolios.

The demand for air compressors in the healthcare industry is steadily increasing, driven by the critical need for reliable and clean compressed air in various medical applications. These compressors are essential for powering medical devices, including ventilators, anesthesia machines, and pneumatic surgical tools, ensuring they operate effectively and safely.

Product Insights

The demand for centrifugal compressors is driven by their capability to reduce operating costs by eliminating the need for down streaming filters and replacement of compressor oil separators, making them a viable option in both consumer and oil filled applications. In applications requiring clean and oil-free compressed air, centrifugal air compressors are a suitable choice, ensuring lubrication quality and process integrity.

The rotary/screw segment accounted for 43.2% of the market share in 2024. The features of rotary/screw air compressors, such as low noise output, high energy efficiency, good performance, easy maintenance, and uninterrupted operation, are anticipated to attract more and more customers over the forecast period resulting in an increasing demand for rotary/screw air compressors. Furthermore, rotary/screw air compressors have a compact design, suitable for installations with limited space. This space-saving feature is beneficial for businesses with space constraints

Lubrication Insights

The oil-free lubrication segment is expected to grow due to the implementation of legislation to reduce emissions and increased emphasis on environmental safety. Factors such as rapid industrialization and growth of the food processing, manufacturing, and semiconductor sectors are propelling the demand for air compressors.

The oil filled segment accounted for 60.8% of the market share in 2024. Oil-filled air compressors are widely used in the energy, manufacturing, and chemical industries. They are more robust and make less noise than oil-free compressors. The aforementioned factors are expected to drive the demand for oil-filled air compressors over the forecast period.

Operating Mode Insights

Internal combustion engine air compressors provide a self-contained source of compressed air, eliminating the need for external power. Internal combustion engines, such as gasoline or diesel engines, provide a reliable source of high-power output. This power is essential for driving air compressors that generate large volumes of compressed air at high pressures, making ICE compressors suitable for heavy-duty applications.

The electric segment held a 54.1% market share in 2024. Electric air compressors are versatile tools used in various industries and applications. One of the primary driving factors for electric air compressors is their energy efficiency. Electric compressors tend to be more energy-efficient than their gasoline or diesel counterparts, resulting in cost savings over time.

Application Insights

The semiconductor industry relies on precision manufacturing. Compressed air is used in critical applications, such as semiconductor wafer handling, where even the slightest contamination can lead to lubrication defects. Therefore, the demand for precise and reliable compressed air systems has increased with the growth of the semiconductor industry

The manufacturing segment dominated the market in 2024 accounting for a revenue share of 33.8%. With a focus on sustainability and cost-effectiveness, manufacturers are looking for energy-efficient solutions. Newer air compressor technologies, like variable speed drives (VSD) and oil-free compressors offer energy savings, reducing operational costs, which aid in the market growth.

Power Range Insights

While the initial investment in a high-power air compressor may be substantial, it can lead to cost savings in the long run due to improved efficiency and reduced maintenance requirements, a notable factor driving the segment’s growth. In addition, the ability to deliver large volumes of compressed air at high pressures enhances lubrication in oil filled processes.

The 51-250 kW segment dominated the market in 2024 accounting for a market share of 36.3%. Air compressors in the 51 kW to 250 kW range offer several benefits due to their increased power and capacity. These compressors can provide a higher volume of compressed air, making them suitable for applications that require a significant amount of air, such as oil filled manufacturing, large-scale construction, and mining.

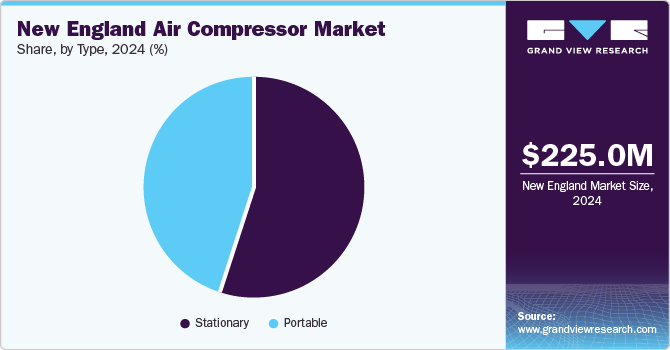

Type Insights

The introduction of energy-efficient portable air compressors has accelerated their use in various oil-filled activities. A portable air compressor's efficiency depends on its design, size, and usage. Smaller, well-maintainedair compressors with modern technology tend to be more energy efficient.

The stationary segment dominated the market in 2024 accounting for a market share of 54.4%. Stationary air compressors are typically more extensive and more powerful than portable ones, which are suitable for heavy-duty applications. They can run continuously without frequent refueling or recharging, which is essential for Oil Filled processes.

State Insights

The market for air compressors in the state of New York is expected to expand at a CAGR of 3.7% over the forecast period. The rising demand for air compressors in New York's healthcare industry is driven by the need for advanced medical equipment and efficient facility operations. With hospitals and clinics increasingly investing in innovative technologies, air compressors play a critical role in powering essential equipment such as ventilators, surgical tools, and diagnostic machines.

The market for air compressors in Massachusetts held 25.1% revenue share in 2024. The stability in motor vehicle sales in the state indicates consumer confidence and economic activity, which is assessed to be correlated with increased demand for air compressors in the automotive sector. As vehicle sales grow, so does the need for maintenance and repair services, where air compressors are essential for tire inflation, painting, and various automotive tools, driving the growth of the market.

Key New England Air Compressor Company Insights

Some of the key players operating in the market include ENTACT and WSP.

-

Ingersoll Rand is a multinational corporation that sells its lubrications under more than 40 brands, including Gardner Denver and Ingersoll Rand. Centrifugal compressors, rotary vanes, scrolls, reciprocating pistons, and rotary screws are the five basic types of air compression technologies that the company focuses on.

-

Kaeser Kompressoren specializes in the lubrication of compressed air and vacuum solutions, offering an array of lubrications. Besides manufacturing, the company provides consulting, rental services, and maintenance support. Kaeser Compressors, Inc., a direct subsidiary, extends the brand's reach from its home base in Coburg, Germany

Key New England Air Compressor Companies:

- Atlas Copco AB

- Ingersoll Rand

- Hitachi Global Air Power US, LLC.

- KAESER KOMPRESSOREN

- MAT Holding, Inc.

- Quincy Compressor LLC

- Chicago Pneumatic (Atlas Copco)

- Speedaire Air Compressor

Recent Developments

-

In January 2023, Ingersoll Rand announced the acquisition of the Air Treatment Business Division of SPX Flow, a provider of processing solutions. The Air Treatment division expands Ingersoll Rand's core compressor Lubrications with a highly complementary Lubrication portfolio of cost-effective compressed air filters, dryers, and other consumables with a high attachment rate.

-

In May 2021, Atlas Copco announced the acquisition of Northeast Compressor, a provider of air compressor equipment and related services to Oil Filled customers in the U.S. The acquisition will bolster Atlas Copco's presence in New York, U.S.

New England Air Compressor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 232.5 million |

|

Revenue forecast in 2030 |

USD 276.4 million |

|

Growth Rate |

CAGR of 3.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in units, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, lubrication, operating mode, type, application, power range, state |

|

Country scope |

Connecticut, New Hampshire, Maine, Rhode Island, New York, Vermont, Massachusetts |

|

Key companies profiled |

Atlas Copco AB, Ingersoll Rand, Hitachi Global Air Power US, LLC., KAESER KOMPRESSOREN, MAT Holding, Inc., Quincy Compressor LLC, Chicago Pneumatic (Atlas Copco), and Speedaire Air Compressor |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

New England Air Compressor Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the New England air compressor market based on product, lubrication, operating mode, type, application, power range, and region:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Lubrication Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

Operating Mode Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Electric

-

Internal Combustion Engine

-

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Portable

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Healthcare & Medical

-

Automotive

-

Oil & Gas

-

Manufacturing

-

Food & Beverage

-

Semiconductor & Electronics

-

Others

-

-

Power Range Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

Over 500 kW

-

-

State Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Connecticut

-

New Hampshire

-

Maine

-

Rode Island

-

New York

-

Vermont

-

Massachusetts

-

Frequently Asked Questions About This Report

b. The New England air compressor market size was estimated at USD 225.0 million in 2024 and is expected to reach USD 232.5 million in 2025.

b. The New England air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2030 to reach USD 276.4 million by 2030.

b. The rotary/screw segment dominated the market in 2024 accounting for 43.3% of the overall revenue share. Rotary/screw air compressors are used significantly in industrial processes, manufacturing, and construction sectors for their ability to provide a continuous and reliable source of compressed air. Rotary/screws are used for powering pneumatic tools, equipment, and automation systems in various industries, including automotive, aerospace, and metalworking

b. Some of the key players operating in the New England air compressor market are Atlas Copco AB, Ingersoll Rand, Hitachi Global Air Power US, LLC., KAESER KOMPRESSOREN, MAT Holding, Inc., Quincy Compressor LLC, Chicago Pneumatic (Atlas Copco), and Speedaire Air Compressor

b. The New England Air Compressor market is primarily driven by the increasing demand for energy-efficient air compressors in manufacturing industries. Moreover, a rise in investments made in the semiconductors industry is fostering a conducive environment for market growth. Furthermore, technological advancements are enabling buyers to avail low-cost portable compressors and reduce operational costs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."