Neurovascular Devices Market Size, Share & Trends Analysis Report By Device (Neurothrombectomy Devices, Support Devices), By Therapeutic Application (Stroke, Cerebral Artery Stenosis), By Size, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-851-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Neurovascular Devices Market Size & Trends

The global neurovascular devices market size was valued at USD 3.19 billion in 2024 and is anticipated to grow at a CAGR of 6.01% from 2025 to 2030. The market is driven by the rising prevalence of neurovascular disorders, advancements in medical technology, and an increasing focus on minimally invasive procedures. As conditions such as stroke, cerebral aneurysms, and Arteriovenous Malformations (AVM) become more common, the demand for effective treatment options also increases.

Interventional neurology devices are used to diagnose and treat central nervous system and brain vascular disorders. Endovascular, catheter-based procedures, angiography, and fluoroscopy are all part of interventional neurology. Catheter angiography is one of the oldest in-vivo brain vascular imaging techniques used to diagnose a variety of neurological diseases including cerebral aneurysm, arteriovenous malformations, intracranial stenosis, arteriovenous fistula, and vasculitis.

The increasing prevalence of neurovascular diseases such as strokes and aneurysms is a major driving force behind the neurovascular devices market. Various neurovascular devices, including clot retrieval devices, microcatheters, and flow diversion coils, are utilized to treat these conditions. According to the Global Stroke Fact Sheet 2022 published by the World Stroke Organization (WSO), more than 12.2 million new strokes occur annually, and approximately 25% of the world's population over the age of 25 will experience a stroke in their lifetime.

In addition, data released by the Brain Aneurysm Foundation in August 2024 indicates that an unruptured brain aneurysm affects an estimated 6.8 million people in the U.S., with around 30,000 individuals suffering a brain aneurysm rupture each year. As a result, the significant number of patients affected by neurovascular diseases and the increasing use of neurovascular devices in their treatment are expected to drive market growth in the coming years.

Moreover, companies are using innovative technologies to develop neurovascular devices. For instance, in June 2024, Penumbra launched BMX 81 and BMX 96 neuro access catheters in Europe. These catheters are manufactured utilizing laser-cut stainless steel hypo tube technology to provide trackability and stability. Such product developments incorporating advanced technology are expected to drive market growth over the forecast period.

Minimally invasive surgeries are gaining popularity owing to reduced risk and trauma associated with these procedures. Smaller incisions decrease postoperative pain and facilitate speedy recovery leading to the high adoption of these procedures and triggering growth of R&D in this field. Several key players are investing in R&D for the launch of innovative minimally invasive surgical instruments. The endovascular coiling used for the treatment of intracranial aneurysm is one of the minimally invasive procedures that is widely recommended by physicians. In this procedure, a microcatheter is inserted in the groin area through the artery consisting an aneurysm. Platinum coils are then released as the coil promotes clotting of aneurysm and prevents blood from entering other regions of the brain.

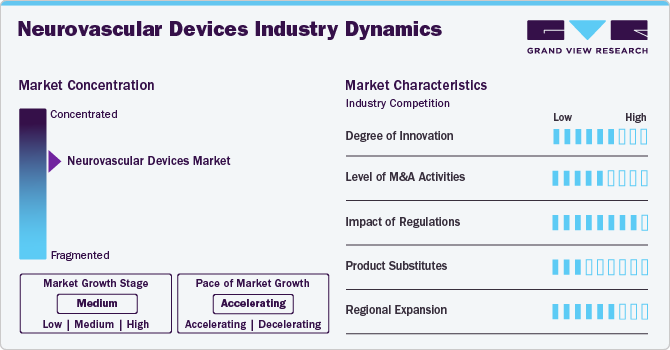

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The market is characterized by a high degree of growth due to increasing prevalence of neurovascular diseases such as strokes and aneurysms.

The market is experiencing high levels of innovation driven by advancements in minimally invasive procedures, robotics, and novel material technologies. Continuous research and development efforts focus on enhancing device safety, precision, and patient outcomes. Innovations such as next-generation stents, flow diverters, and embolization coils address unmet needs, offering more effective treatment options for conditions like aneurysms and strokes. For instance, in May 2023, CERENOVUS, Inc., a division of Johnson & Johnson MedTech, has announced that its new CEREPAK Detachable Coils are now commercially available in the U.S. These coils come in three shapes and various sizes, giving physicians a wide range of options for embolizing brain aneurysms.

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a crucial role in shaping the market. Stricter requirements for clinical trials and post-market surveillance ensure patient safety and product efficacy but can also pose challenges for companies seeking approvals. Compliance with evolving standards, such as MDR in Europe, requires firms to invest significantly in regulatory expertise and quality assurance systems. While this regulatory landscape may slow time-to-market, it drives companies to innovate and develop products with higher safety standards, enhancing market credibility.

The market is poised to experience robust mergers and acquisitions (M&A) activity as companies seek to expand their product portfolios, leverage synergies, and enter new markets. Established players are acquiring smaller innovators to gain access to cutting-edge technologies, while strategic collaborations are emerging to enhance distribution networks. For instance, in September 2023, Integer Holdings Corporation acquired InNeuroCo, Inc., a provider of catheters mainly used in interventional neurovascular procedures for treating ischemic strokes and aneurysms.

The availability of product substitutes impacts the market, with alternatives such as drug therapies and non-invasive treatment options providing competition. Although devices like stents and embolization coils are preferred for severe neurovascular conditions, pharmaceuticals may offer viable solutions in early-stage interventions. Additionally, advancements in imaging technologies could enable earlier detection, reducing the need for invasive procedures.

Industry players in the market are actively pursuing regional expansion to capitalize on emerging market opportunities. Growth is particularly strong in Asia-Pacific and Latin America, driven by increasing healthcare investments, rising awareness of neurovascular disorders, and improving access to advanced medical technologies. Companies are also establishing local manufacturing units and forging partnerships with regional distributors to navigate market-specific challenges and regulatory frameworks.

Device Insights

Cerebral embolization and aneurysm coiling devices held the largest market share of around 36.02% in 2024. Coil embolization is a minimally invasive procedure for the treatment of aneurysms, wherein, the material closes the sac and reduces the risk of bleeding. A steerable catheter is inserted through the groin and guided to the brain. Rising prevalence of aneurysm is expected to propel the segment over the forecast period. These devices are further classified into embolic coils, flow diversion devices, and liquid embolic agents. For instance, in January 2023, Luidx Medical Technologies, Inc. announced the success of the Embolic IMPASS Device in an in-vivo research linked to meningeal middle artery (MMA) embolization. This can be used to treat chronic subdural hematomas on the surface of the brain. Instead of surgery, minimally invasive MMA embolization catheter-based may be employed.

Neurothrombectomy devices segment is expected to grow at the highest CAGR of 7.13 % during the forecast. Increasing number of growth strategies by key market players such as product launch, merger & acquisition and others along with the rising prevalence of acute ischemic stroke will drive the segment growth in near future. For instance, in January 2023, Therma Bright Inc. invests in Israeli Ischemic Stroke Blood Clot Retriever Technologies Startup Inretio Inc. The PREVA basket "ensnares" the clot, enclosing it and shielding the brain from any sub-clots that break off during the thrombectomy treatment. In February 2024, Perfuze, which is developing next-generation catheter-based aspiration technology to treat acute ischemic stroke caused by major artery obstruction, has concluded a USD 23.94 million Series A financing round. Additionally, Rapid Medical, a developer of novel neurovascular devices, announced FDA 510(k) clearance for TIGERTRIEVER 13 for major vessel occlusions during the 19th Annual Conference of the Society of NeuroInterventional Surgery (SNIS) in Toronto in 2024. TIGERTRIEVER 13 is the world's smallest revascularization device, designed to remove thrombus from sensitive brain blood arteries following an ischemic stroke.

Therapeutic Application Insights

Stroke held the largest market share of around 56.86% in 2024, owing to the factors such as increasing prevalence of hypertension, stroke, and other neurological disorders. According to the CDC, 1 in 6 people worldwide will have a stroke in their lifetime and every year, more than 795,000 people in the U.S have a stroke. Strokes are the second leading cause of death globally, and account for an approximate 140,000 deaths in the U.S annually. There are various initiatives undertaken by the government worldwide to prevent stroke. In addition, the emphasis on minimally invasive techniques for stroke treatment is propelling market growth, as these methods typically lead to shorter recovery periods and fewer hospital stays compared to traditional open surgeries. Advancements in technologies, such as real-time imaging and sophisticated robotics, are improving the precision and safety of neurovascular interventions, allowing healthcare providers to carry out complex procedures with increased confidence. Furthermore, the advent of technologically advanced products are also powering the segment growth. For instance, in January 2023, Infinity Neuro announced that its Inspira aspiration catheters have acquired CE Mark approval and are now available for purchase in Europe. This is Infinity Neuro's first offer; the company intends to launch a broad spectrum of products for the treatment of ischemic and hemorrhagic stroke during 2023 and beyond.

Cerebral aneurysm segment is expected to grow at the highest CAGR of 6.53% during the forecast period, primarily as a result of the increasing prevalence of cerebral aneurysm. According to the Brain Aneurysm Foundation, around 6.5 million people in the U.S have an unruptured brain aneurysm, with approximately 30,000 developing a rupture each year. Also, the increasing number of clinical trials and the introduction of technologically improved products will fuel category expansion in the near future. For instance, in February 2023, VESALIO reported the successful first use of its NeVa VS device for the treatment of post-aneurysmal subarachnoid haemorrhage (aSAH) cerebral vasospasm in the U.S. Vasospasm is the most common aSAH consequence and the leading cause of mortality and morbidity. Furthermore, in February 2023, EndoStream Medical, a business that develops solutions for brain aneurysms, announced the enrollment of the first patient in the TORNADO-US clinical study in the U.S. The Nautilus intrasaccular system from the company will be evaluated for the treatment of cerebral aneurysms in the trial. Moreover, in April 2021, the FDA has authorized Medtronic's clot-resistant implant for the treatment of brain aneurysms, which is projected to drive segment growth in the near future.

Size Insights

0.021" held the largest market share of around 27.08% in 2024. Segment growth can be attributed to various advantages provided by the 0.021” devices, along with various product launches and product approvals. For instance, in April 2021, Bendit Technologies' 0.021" Bendit21 microcatheter has been cleared by the U.S FDA for use in the brain, peripheral, and coronary vasculature. The approval came several months after the Bendit21 microcatheter was successfully used in two life-saving surgeries in the U.S. Furthermore, in October 2021, Evasc Neurovascular introduced the eCLIPs Bifurcation Flow Diverter, the third version of their eCLIPs device. The latest generation of eCLIPs feature a shapeable delivery wire, a reduced size suitable with 0.027" and 0.021" ID microcatheters, and electrolytic detachment for more effective treatment of bifurcation cerebral aneurysms.

The others segment is expected to grow at the highest CAGR of 9.68% during the forecast period. The others segment includes devices sized at 0.015”, 0.060”, 0.84”, 0.091”, and 0.074”. The availability and benefits offered by these products are projected to drive segment expansion. For example, the AVIGO 0.014" hydrophilic guidewire seamlessly supports tracking for 021 and 027 systems. Furthermore, this device aids in catheter crossing and stability. Therefore, the abundance of products in this area is likely to promote market growth during the projection period.

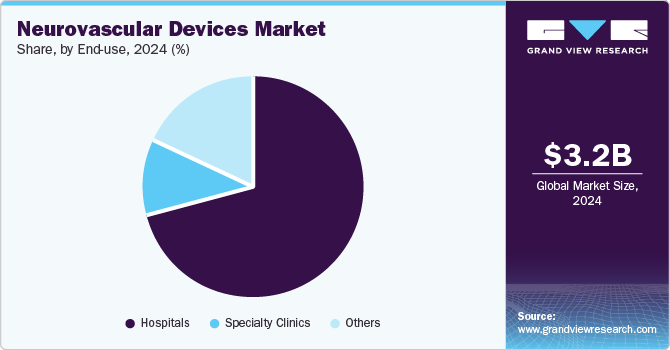

End-use Insights

Hospital held the largest market share of around 70.79% in 2024. The growth of this segment can be attributed primarily to the increasing patient pool suffering from neurovascular disorders, such as ischemic & hemorrhagic stroke, brain aneurysm, Traumatic brain injury (TBI), and Arteriovenous Malformation (AVM). For instance, according to the World Stroke Organization, throughout their lifetime, 1 in 4 people over the age of 25 years is expected to experience a stroke. Every year, 13.7 million people are expected to experience their first stroke, and 5.5 million of them may die. Without suitable action, it appears that the annual death toll will increase to 6.7 million. In addition, the increasing number of patients being admitted to hospitals due to surgeries, therapies, and treatments is projected to improve the market growth. Hence, the subsequent increase in number of patients across the globe, launch of technologically advanced products, and favorable reimbursement policies are major factors expected to fuel segment growth.

The others segment is expected to grow at the highest CAGR of 6.82% during the forecast period. The others segment includes Ambulatory Surgical Centers (ASCs), emergency care centers, and long-term care centers. An increase in number of ASCs and other healthcare modern facilities is expected to drive the segment. For instance, according to ASC Becker, the total number of Medicare-certified ASCs in the U.S. is nearly 5,700. Thus, increasing number of ASCs and rising awareness about availability & advantages of other medical facilities are expected to help this segment grow over the forecast period.

Regional Insights

North America neurovascular devices market dominated the market with a share of 27.62% in 2024 owing to the presence of key manufacturers such as Penumbra, Inc., Stryker Corporation, Johnson & Johnson, and Merit medical systems, Inc. in the region. In February 2023, Phenox Inc. stated that the FDA cleared their pRESET Thrombectomy Device for use in treating acute ischemic stroke. The product pRESET, which has been marketed in Europe for over a decade, has now been approved for use in the U.S. Furthermore, rising prevalence of neurological disorders, and increasing demand for minimally invasive surgical procedures are driving the market growth in this region.

U.S. Neurovascular Devices Market Trends

The U.S. neurovascular devices market is experiencing significant growth driven by increasing cases of cerebrovascular diseases such as strokes, aneurysms, and arteriovenous malformations. The aging population and rising prevalence of lifestyle-related conditions such as hypertension and diabetes significantly contribute to the demand for neurovascular interventions. Technological advancements, including the development of minimally invasive devices such as flow diverters, stent retrievers, and embolic coils, enhance patient outcomes and boost market expansion. Support from regulatory bodies such as the FDA fosters innovation in the sector through accelerated approvals for breakthrough devices. Collaborations between medical device companies and healthcare providers to develop novel solutions fuel growth.

The neurovascular devices market in Canada held a significant share in 2024. The country's healthcare coverage and compulsory insurance enable the adoption of advanced technologies. Industrialization in Quebec and Ontario is expected to positively impact on the market due to the entry of new market players. In addition, increasing awareness and the presence of organizations such as the Canadian Neurological Sciences Federation and the Canadian Neurovascular Health Society, which focuses on neurovascular research, are expected to support market growth in the future

Europe Neurovascular Devices Market Trends

Europe neurovascular devices market is experiencing significant growth. The market is driven by an increasing geriatric population and rapid technological advancements in reconstruction surgery are expected to propel market growth. Increasing adoption of technologically advanced devices and the growing number of CMF surgeries are anticipated to propel the market growth further. The UK and Germany are major markets in Europe. However, the lack of supportive reimbursement policies in developing countries of Europe is hindering the market growth over the forecast period.

The neurovascular devices market in UK is likely to show significant growth propelled by increasing awareness regarding the treatment of acute ischemic stroke and the presence of several major players in the market are among the major factors contributing to market growth. According to the NHS England, every year, more than 100,000 people suffer a stroke and there are 1.3 million stroke survivors in the UK. In addition, as per a study published on the UK Parliament website, in January 2023, the government revealed its intention to implement a Major Conditions Strategy in England. This strategy is set to address the conditions that are the leading causes of illness and death nationwide, with a focus on cardiovascular diseases, including stroke

The neurovascular devices market in Germany is experiencing significant growth. Increase in the prevalence of acute ischemic stroke, leading to a higher number of mechanical thrombectomy procedures, and high adoption of technologically advanced products are among the major factors driving the growth of Germany neurovascular devices market over the forecast period. Increase in mechanical thrombectomy procedures and high adoption of technologically advanced products are some of the other key factors expected to drive Germany’s market growth over the forecast period. For instance, as per a research article published in NCBI, around 2 million adults in Germany have an unruptured intracranial aneurysm. In addition, according to S. Karger AG, in January 2023, a population-based study conducted across two German cities revealed the incidence of Traumatic Brain Injury (TBI) at 13 and 17 cases per 100,000 population.

Asia Pacific Neurovascular Devices Market Trends

The Asia Pacific neurovascular devices marketis experiencing rapid growth due to several Asian Pacific market is expanding rapidly high prevalence of neurological disorders, rapid improvement in medical infrastructure, and the availability of novel products. Moreover, the presence of a large patient pool suffering from brain aneurysms & strokes and the growing need for advanced & cost-effective healthcare solutions are expected to significant regional growth opportunities in the market.

The neurovascular devices marketin China is growing with a lucrative growth rate and owing to the presence of several local & key players in the market and an increase in the number of stroke cases. For instance, a study published in JAMA Network Open in March 2023 estimated the incidence and mortality of stroke in China. The study found that the overall stroke incidence was 500 per 100,000 person-years for individuals older than 40 years. Thus, the rising incidence of stroke in China is expected to boost the country's market in the coming years.

Latin America Neurovascular Devices Market Trends

The neurovascular devices market in Latin Americais experiencing significant growth, primarily driven by the several Latin American governments are increasing their healthcare budgets to accommodate the growing demand for advanced medical technologies. Brazil and Mexico have the largest economies and have allocated significant resources to healthcare in recent years, making high-cost neurovascular devices more accessible to public hospitals.

Middle East And Africa Neurovascular Devices Market Trends

The neurovascular devices market in MEA is experiencing growth driven by a significant rise in the incidence of neurovascular diseases, mainly strokes, aneurysms, and other cerebrovascular conditions. Factors contributing to this include the growing prevalence of hypertension, diabetes, obesity, and sedentary lifestyles, all of which are major risk factors for neurovascular diseases.

Saudi Arabia Neurovascular Devices Market Trends

The growing prevalence drives the Saudi Arabia neurovascular devices marketgrowth pushing the demand for advanced neurovascular devices for early diagnosis and treatment. The increasing aging population in Saudi Arabia is also contributing to a higher risk of neurovascular conditions. The demand for neurovascular devices continues to grow as the older population is more susceptible to strokes and other cerebrovascular issues. Saudi Arabia’s Vision 2030 program focuses significantly on healthcare modernization and is a key driver for the neurovascular devices market.

Key Neurovascular Devices Company Insights

Key market players are focusing on the launch of innovative types of medical devices, growth strategies, and technological advancements. For instance, in April 2024, MicroVention, Inc., a Terumo Corporation wholly owned subsidiary, announced the completion of its first enrollment in STRAIT, a multi-center, prospective observational EU study to evaluate the performance and safety of the BOBBY balloon guide catheter for endovascular treatment of acute ischemic stroke. The BOBBY Balloon Guide Catheter is currently approved in North America and Europe. It was designed to improve compatibility and navigability with the SOFIA Plus 6Fr Aspiration Catheter while simplifying balloon preparation. These advancements in neurovascular devices market are anticipated to boost market growth over the forecast period.

Key Neurovascular Devices Companies:

The following are the leading companies in the neurovascular devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker Corporation

- Terumo Corporation

- Penumbra, Inc.

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

- Acandis GmbH

- Spiegelberg GmbH & Co. KG

- MicroPort Scientific Corporation

- ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.

Recent Developments

-

In September 2024, CERENOVUS, Inc. launched a next-generation balloon guide catheter, EMBOGUARD, for treating patients suffering from acute ischemic stroke.

-

In June 2024, Terumo Corporation introduced the LVIS EVO Intraluminal Support Device for treating wide-neck intracranial aneurysms in the U.S. market.

-

In May 2024, Penumbra, Inc. reported the CE Mark authorization and the launch of three of its neurovascular reperfusion catheters in Europe— Red 78, Red 43, and Red 72 with SENDit Technology —for treating acute ischemic strokes.

-

In April 2024, CERENOVUS, Inc., launched the CEREGLIDE 71 Aspiration Catheter in Europe; this catheter is useful for revascularizing patients suffering from acute ischemic stroke.

-

In September 2023, Terumo Corporation obtained 510(k) clearance from the FDA for its Sofia EX 5Fr 115cm intracranial support catheter for use in trans-radial access

Neurovascular Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.39 billion |

|

Revenue forecast in 2030 |

USD 4.53 billion |

|

Growth Rate |

CAGR of 6.01% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume unit and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue, competitive landscape, growth factors, and trends |

|

Segments covered |

Device, therapeutic applications, size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Medtronic; Stryker Corporation; Terumo Corporation; Penumbra, Inc.; Johnson & Johnson Services, Inc.; Integra LifeSciences Corporation; Acandis GmbH; Spiegelberg GmbH & Co. KG; MicroPort Scientific Corporation; ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Neurovascular Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an

analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global neurovascular devices market report on the basis of device, therapeutic application, size, end-use, and region:

-

Device Outlook (Revenue USD Million; Volume Unit; 2018 - 2030)

-

Cerebral Embolization and Aneurysm Coiling Devices

-

Embolic coils

-

Flow diversion devices

-

Liquid embolic agents

-

-

Cerebral Angioplasty and Stenting Systems

-

Carotid artery stents

-

Embolic protection systems

-

-

Neurothrombectomy Devices

-

Clot retrieval devices

-

Suction devices/aspiration catheters

-

Vascular snares

-

-

Support Devices

-

Micro catheters

-

Micro guidewires

-

-

Trans Radial Access Devices

-

-

Therapeutic Application Outlook (Revenue USD Million; 2018 - 2030)

-

Stroke

-

Cerebral Artery

-

Cerebral Aneurysm

-

Aneurysmal Subarachnoid Hemorrhage

-

Others

-

-

Others

-

-

Size (in Inches) Outlook (Revenue USD Million; 2018 - 2030)

-

0.027"

-

0.021"

-

0.071"

-

0.017"

-

0.019"

-

0.013"

-

0.058"

-

0.068"

-

Others

-

-

End-use Outlook (Revenue USD Million; 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurovascular devices market size was estimated at USD 3.19 billion in 2024 and is expected to reach USD 3.39 billion in 2025.

b. The global neurovascular devices market is expected to grow at a compound annual growth rate of 6.01% from 2025 to 2030 to reach USD 4.53 billion by 2030.

b. The cerebral embolization and aneurysm coiling devices dominated the global neurovascular devices market and accounted for the largest revenue share of 35.84%.

b. The stroke segment dominated the global neurovascular devices market and accounted for the largest revenue share of 56.72%.

b. North America held the largest share of 27.85% in 2023 due to the presence of key manufacturers in the region, increased R&D investments, and a rise in government initiatives.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."