Neurosurgical Instruments Market Size, Share & Trends Analysis Report By Product (Cutting and Dissecting Instruments, Tissue Handling and Manipulation Instruments), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-494-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

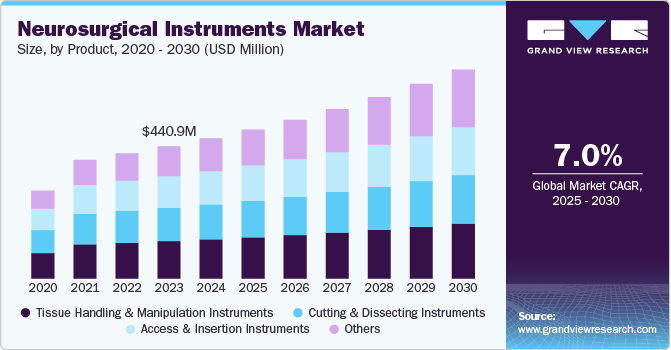

The global neurosurgical instruments market size was estimated at USD 1.76 billion in 2024 and is projected to grow at a CAGR of 7.00% from 2025 to 2030. Market growth is driven by advancements in neurosurgical technologies and the increasing prevalence of neurological disorders. For instance, according to data published by the WHO in March 2024, neurological conditions affected more than 3 billion people globally in 2021.

The prevalence of neurological conditions is also witnessing significant growth, with an increase of around 18% since 1990. Instruments such as scalpels and scissors are evolving with precision-engineered designs, enabling neurosurgeons to perform minimally invasive procedures with greater accuracy, further propelling their demand for neurosurgical procedures.

The rising incidence of conditions such as Alzheimer's disease, Parkinson's disease, and epilepsy has heightened the demand for advanced diagnostic and therapeutic tools. For instance, according to the Alzheimer's Association, 6.9 million Americans aged 65 years and above are living with Alzheimer's in 2024, which is around 1 in every nine people aged 65 years and above. This prevalence is also expected to reach around 13 million by 2050. Moreover, it was the 5th leading cause of death among the senior age group in 2021. Such a high prevalence of conditions requiring healthcare services and neurological instruments that can offer effective diagnosis, and treatment is expected to drive the market growth over the forecast period.

The development of advanced devices that offer enhanced precision and functionality further increases their adoption by healthcare providers to improve patient outcomes. For instance, in April 2023, Orthofix Medical Inc. launched two new access retractor systems, the Fathom Pedicle-Based Retractor System and the Lattus Lateral Access System, enhancing solutions for minimally invasive spine procedures. These innovations aim to improve surgical efficiency and adaptability with reproducible surgical workflow and enhanced visualization. Such advancements in surgical instruments are expected to fuel their adoption and drive market growth over the forecast period.

There is a significant rise in the number of surgical procedures performed globally. According to data published by the Mayo Foundation for Medical Education and Research in June 2024, their neurosurgeons perform over 9,000 surgeries annually. A study published by ScienceDirect in 2022 reported that there are approximately 22.6 million neurosurgical consultations annually worldwide, with 13.8 million cases requiring operative intervention. Moreover, a study published by the National Library of Medicine in November 2023 indicated that a total of 33,483 neurosurgical operations were performed between 2012 and 2022. As the number of neurosurgeries continues to rise globally, the demand for instruments such as cutting and dissecting tools, as well as access and insertion instruments commonly used in these procedures, is expected to increase significantly.

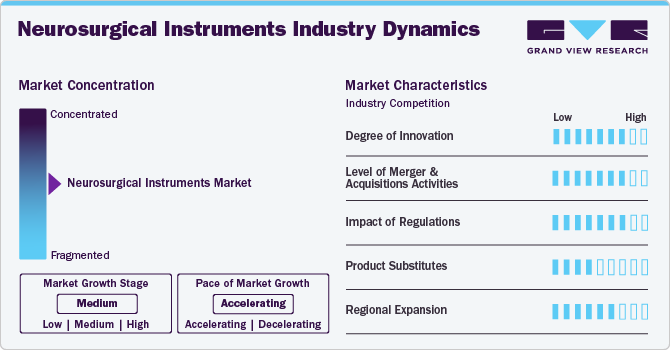

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market is characterized by rising prevalence of neurological disorders, advancements in neurosurgical techniques, growing neurological awareness and developing healthcare infrastructure and rising adoption of advanced surgical instruments.

The neurosurgical instruments industry exhibits a high degree of innovation due to rapid technological advancements and increased investment in R&D. Companies are focusing on developing cutting-edge solutions to address the growing prevalence of neurological disorders. Startups and emerging players are gaining funding and investment for developing neurosurgical instruments. For instance, in July 2023, Hubly Surgical raised USD 3 million to develop and commercialize neurosurgical drills.

Regulatory frameworks significantly impact the neurosurgical instruments industry by ensuring safety and efficacy. Regulatory authorities such as the U.S. Food and Drug Administration (FDA) and Health Canada regulate these instruments. For instance, the FDA has classified neurosurgery instruments into different classes for regulatory oversight. According to the Code of Federal Regulations, nonpowered neurosurgical instruments are considered Class I (general controls). It includes specialized chisels, curettes, osteotomes, elevators, blades, forceps, dissectors, gouges, surgical knives, hooks, rasps, scissors, spatulas, separators, spoons, blade holders, blade breakers, probes, etc.

The level of M&A activities in the neurosurgical instruments industry is moderate as companies seek to enhance their product portfolios and expand market reach. For instance, in July 2023, ARCH Medical Solutions acquired gSource LLC, a New Jersey-based manufacturer of surgical instruments, enhancing ARCH's position in the medical device market. Such initiatives enable companies to leverage technologies and expertise, enhancing innovation. This strategy helps companies to access more resources for better market positioning and development.

The threat of substitutes in the neurosurgical instruments industry is low, influenced by the availability of alternative treatment options such as pharmacological therapies and lifestyle interventions. Advancements in device technology, such as minimally invasive procedures, provide significant advantages over traditional treatments, thereby reducing the impact of substitutes in the market.

Product Insights

The tissue handling and manipulation instruments segment led the market with the largest revenue share of 27.95% in 2024. This dominance can be attributed to their critical role in crucial brain and spine surgical procedures. These instruments are designed to provide the precision and control required for crucial tissue handling. Their ergonomic designs and availability in various sizes and shapes cater to the diverse needs of neurosurgeons, ensuring accuracy, safety, and efficiency. This combination of functionality and reliability makes tissue handling and manipulation instruments central to neurosurgery, driving their prominence in the market.

The other instruments segment is expected to grow at the fastest CAGR over the forecast period. It includes instruments such as implants, cranial expanders, probes, and curettes. The rising advancement in implants used in neurosurgeries and its launches are expected to drive segment growth over the forecast period. Manufacturers are developing 3D-printed cranial implants. Such developments are expected to support the segment growth.

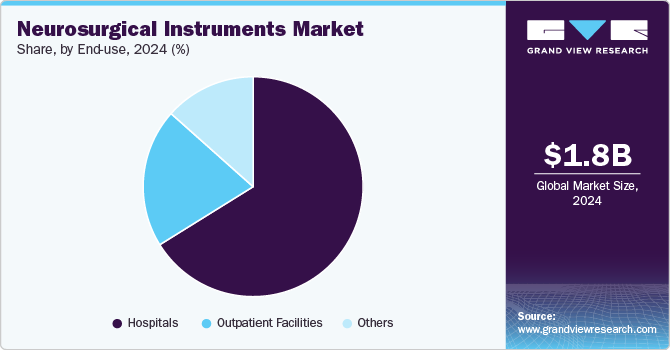

End Use Insights

Based on end use, the hospitals segment led the market with the largest revenue share of 66.17% in 2024, and is expected to witness at the fastest CAGR over the forecast period. Hospitals are the primary healthcare facilities for performing complex neurosurgical procedures. These facilities are often equipped with advanced operating rooms, which enhance surgical precision and outcomes. Furthermore, hospitals serve as referral centers for critical cases requiring multidisciplinary care, including neurology, radiology, and anesthesiology expertise, which is crucial in managing complex neurosurgical interventions. Moreover, hospitals' developing healthcare infrastructure and adopting neurosurgical technologies to serve a larger patient base further contribute to this growth. For instance, in September 2024, the Neurosurgery department at Tata Memorial Centre, Mumbai, upgraded its facilities to establish the Advanced Centre of Neurosurgical Oncology. It now features advanced surgical equipment to provide affordable treatment for complex brain and spine tumors, enhancing care accessibility in India.

The outpatient facilities segment is also expected to witness at a significant CAGR over the forecast period, owing to their increasing adoption of minimally invasive procedures, growing patient footfall, and the increasing number of outpatient facilities. These facilities usually address patients seeking less invasive treatment options with shorter recovery times, aligning with the shift toward patient-centric care. Moreover, outpatient facilities often provide cost-effective solutions compared to inpatient hospital stays, making them an attractive option for patients and healthcare systems aiming to reduce medical expenses. Furthermore, the increasing number of outpatient facilities has significantly increased their access to patients. For instance, in September 2024, a new neurology clinic was opened at the Westview Health Centre in Stony Plain, providing specialized care for neurological conditions. The clinic aims to improve access to services for patients in the region, addressing a significant need for neurological healthcare in the community. Such initiatives are further expected to fuel the segment growth over the forecast period.

Regional Insights

North America dominated the neurosurgical instruments market with the largest revenue share of 37.43% in 2024, owing to the advancements in surgical techniques, the rising prevalence of neurological disorders, and increasing demand for minimally invasive procedures. The rising incidence of conditions such as traumatic brain injuries, tumors, and road accidents has increased the number of neurosurgical interventions in the region. For instance, according to the American Cancer Society, around 25,400 cases of malignant tumors of the brain or spinal cord were estimated to be diagnosed in 2023. Moreover, brain and spinal cord tumors were estimated to cause around 18,760 mortalities in the country in 2023. This rising prevalence of neurological conditions has increased the demand for various neurosurgical procedures, thereby contributing to market growth.

U.S. Neurosurgical Instruments Market Trends

The neurosurgical instruments market in the U.S. held a significant share of the market in North America in 2024, owing to the advancements in neurosurgical procedures and the increasing prevalence of neurological disorders such as brain tumors, traumatic brain injuries, and spinal conditions. For instance, according to the U.S. Centers for Disease Control and Prevention (CDC), traumatic brain injuries caused around 214,110 hospitalizations in 2020 and around 69,473 deaths in 2021 in the U.S. Moreover, the aging population in the U.S. is contributing to the rising number of neurosurgical interventions, as older adults are more vulnerable to conditions requiring surgical management, further contributing to the market growth.

The Canada neurosurgical instruments market is experiencing steady growth, due to rising neurological disorders such as brain tumors, epilepsy, and traumatic brain injuries. Moreover, government investments in healthcare infrastructure and increasing neurosurgeon adoption of technologically advanced tools further expand the market.

Europe Neurosurgical Instruments Market Trends

The neurosurgical instruments market in Europe is experiencing significant growth driven by advancements in minimally invasive surgical techniques, the rising prevalence of neurological disorders, and increasing investments in healthcare infrastructure. Furthermore, an aging population and a growing focus on surgical outcomes are encouraging innovation, with manufacturers prioritizing user friendly designs and advanced material technologies. For instance, in June 2024, Penumbra launched its BMX81 and BMX96 neuro-access catheters in Europe following CE mark approval. These devices enhance stroke management options for physicians, featuring laser-cut stainless-steel technology for improved stability and trackability.

The UK neurosurgical instruments marketis expected to grow at a significant CAGR over the forecast period, due to the high prevalence of various neurological conditions requiring surgical procedures. According to a report published by the UK Research and Innovation (UKRI) organization in June 2022, there are around 900,000 accidents and emergency attendances annually in the UK with head injuries, and around 160,000 people are admitted to hospital each year.

The neurosurgical instruments market in Germany is anticipated to witness at a significant CAGR during the forecast period, due to the advancements in minimally invasive surgical techniques and the country’s developed healthcare infrastructure. In addition, favorable reimbursement policies and continuous investments in neurosurgical research and development by key manufacturers and institutions in the country further drive the adoption of innovative and technologically advanced neurosurgical instruments.

Asia Pacific Neurosurgical Instruments Market Trends

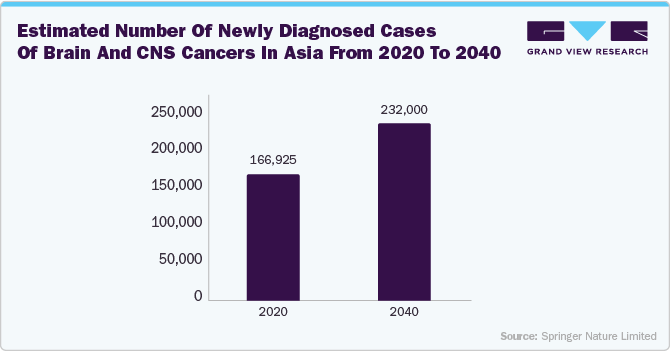

The neurological instruments market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the advancements in neurosurgical procedures, rising prevalence of neurological disorders, and increasing healthcare investments. Moreover, the growing adoption of cutting-edge technologies such as robotic-assisted neurosurgery further drives market expansion.

The China neurosurgical instruments marketis expected to grow at the fastest CAGR over the forecast period, due to the rising adoption of advanced surgical instruments in the country’s healthcare facilities, developing healthcare infrastructure, and the aging population of the country, which is significantly vulnerable to various neurological conditions. According to the WHO, the elderly population of China aged 65 years and above is expected to reach 402 million people or 28% of the total population in 2040, increasing from around 176 million elderly people in 2019.

Latin America Neurosurgical Instruments Market Trends

The neurosurgical instruments market in Latin Americais experiencing significant growth, driven by the rising prevalence of neurological disorders such as brain tumors, aneurysms, and traumatic brain injuries; rising government healthcare investments and increasing access to specialized neurosurgical care further boost the adoption of these instruments. Furthermore, growing medical tourism in the countries of the region further supports demand for high-quality neurosurgical devices, particularly those used in complex procedures requiring precision and durability.

Middle East and Africa Neurosurgical Instruments Market Trends

Theneurosurgical instrumentsmarket in MEAis experiencing growth driven by the increasing incidences of neurological disorders such as brain tumors, traumatic brain injuries, and spinal conditions. Rising awareness and improved access to advanced healthcare facilities in urban areas are fueling demand for cutting and dissecting instruments. Furthermore, the expansion of minimally invasive neurosurgical procedures has also contributed to the rising adoption of neurosurgical instruments.

The Saudi Arabia neurosurgical instruments market is expanding due to increasing prevalence of the neurological disorders such as brain tumors, epilepsy, and Parkinson's disease. Moreover, the country’s focus on expanding healthcare infrastructure and adopting advanced surgical technologies aligns with its Vision 2030 initiative, further encouraging the adoption and utilization of specialized neurosurgical tools in the country’s healthcare infrastructure.

Growing Brain Tumor/ Cancer Patient Population

The growing incidence of brain tumors and cancers is expected to increase the demand for neurosurgical instruments in the coming years. According to data from the National Foundation for Cancer Research, approximately 25,400 malignant tumors of the brain and spinal cord will be diagnosed in the U.S. in 2024, with around 18,760 expected fatalities. An article published by Springer Nature Limited in September 2024 estimates that the number of new cases of brain and central nervous system cancers in Asia will rise by 39.3% between 2020 and 2040. Therefore, the increasing number of patients suffering from brain cancers is anticipated to drive the demand for neurosurgical instruments in the near future.

Key Neurosurgical Instruments Company Insights

Aesculap, Inc. - a B. Braun company; BOSS Instruments, Ltd.; adeor medical AG.; Rebstock Instruments GmbH; KLS Martin Group; Medline Industries, LP.; Integra LifeSciences Corporation; Acumed LLC, a Colson Medical; evonos GmbH & Co. KG; and Anatomics Pty Ltd. are some of the major players in the neurosurgical instruments industry. Companies operating in the industry are launching novel products and expanding their product portfolios to expand their presence in the market. In addition, manufacturers showcase their products at various conferences and events and emphasize the global supply of their products.

Key Neurosurgical Instruments Companies:

The following are the leading companies in the neurosurgical instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Aesculap, Inc. - a B. Braun company

- BOSS Instruments Ltd.

- adeor medical AG.

- Rebstock Instruments GmbH

- KLS Martin Group

- Medline Industries, LP.

- Integra LifeSciences Corporation

- Acumed LLC, a Colson Medical

- evonos GmbH & Co. KG

- Anatomics Pty Ltd

Recent Developments

-

In April 2024, 3D Systems revealed that the company received 510(K) approval from the FDA for its VSP PEEK Cranial Implant. It is a patient-specific, 3D-printed cranial implant solution. Such approvals are anticipated to drive the market growth in the coming years.

-

In March 2024, a neurosurgeon working at Northwestern Medicine is the first neurosurgeon in the U.S. to use a new neurosurgical drill, an auto-stopping cranial drill named the Hubly Drill, to protect a patient in the intensive care unit.

Neurosurgical Instruments Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.87 billion |

|

Revenue forecast in 2030 |

USD 2.62 billion |

|

Growth rate |

CAGR of 7.00% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue, competitive landscape, growth factors, and trends |

|

Segment covered |

Product, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, & MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Aesculap, Inc. - a B. Braun company; BOSS Instruments, Ltd.; adeor medical AG.; Rebstock Instruments GmbH; KLS Martin Group; Medline Industries, LP.; Integra LifeSciences Corporation; Acumed LLC, a Colson Medical; evonos GmbH & Co. KG; Anatomics Pty Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Neurosurgical Instruments Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neurosurgical instruments market report based on the product, end use and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Cutting and Dissecting Instruments

-

Blade, Knife, Cutter & Scissors

-

Dissector

-

Drill & Perforator

-

-

Tissue Handling and Manipulation Instruments

-

Forceps

-

Needle Holder

-

Elevator

-

Hook

-

Rongeur

-

Spatula

-

Retractor

-

-

Access and Insertion Instruments

-

Cannula

-

Catheter

-

Introducer

-

Trocar

-

Needle

-

Suction Tube

-

-

Others

-

Cranial Expander

-

Implants

-

Probe

-

Punches

-

Caliper

-

Curettes

-

Clip

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurosurgical instruments market was valued at USD 1.76 billion in 2024 and is expected to reach USD 1.87 billion by 2025.

b. The global neurosurgical instruments market is estimated to grow at a compound annual growth rate (CAGR) of 7.00% from 2025 to 2030 to reach USD 2.62 billion by 2030.

b. North America dominated the neurosurgical instruments market and accounted for the largest revenue share of 37.43% in 2024. This can be attributed to the presence of key manufacturers in the region and the rising prevalence of neurological disorders across North America.

b. Some key players operating in the neurosurgical instruments market include Aesculap, Inc. – a B. Braun company, BOSS Instruments, Ltd., adeor medical AG., Rebstock Instruments GmbH, KLS Martin Group, Medline Industries, LP., Integra LifeSciences Corporation, Acumed LLC, a Colson Medical, evonos GmbH & Co. KG and Anatomics Pty Ltd.

b. The growth of the neurosurgical instruments market is propelled by advancements in neurosurgical technologies, an increasing number of surgical procedures, and the rising prevalence of neurological disorders.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."