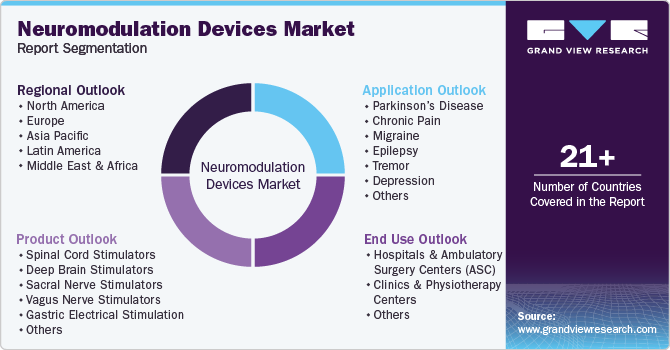

Neuromodulation Devices Market Size, Share & Trends Analysis By Product (Spinal Cord Stimulators, Deep Brain Stimulators), By Application (Parkinson’s Disease, Chronic Pain), By End-use, By Region, 2025 - 2030

- Report ID: GVR-4-68039-958-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Neuromodulation Devices Market Trends

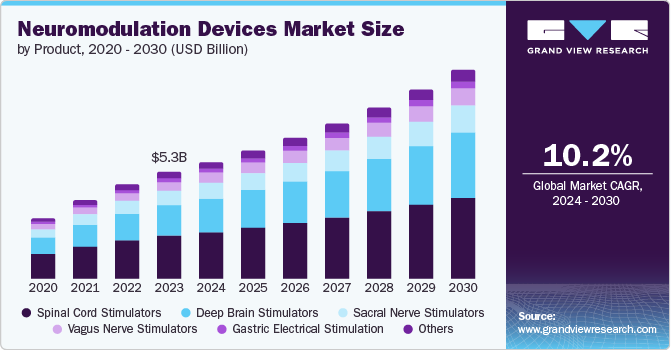

The global neuromodulation devices market size was estimated at USD 5,795.81 million in 2024 and is anticipated to grow at a CAGR of 8.51% from 2025 to 2030. The increasing incidence of chronic pain, neurological disorders, and mental health conditions is expected to drive the demand for effective and innovative treatment solutions. In addition, technological advancements, including the creation of more advanced and minimally invasive neuromodulation devices, further fuel market growth.

Significant government funding plays a pivotal role in advancing the understanding of neurological disorders and enhancing treatment options. By directing financial resources toward research initiatives, governments actively support groundbreaking discoveries, foster technological innovation, and promote the development of more effective neuromodulation technologies. This financial backing is critical in shaping the landscape of neurological disorder treatments and delivering transformative improvements in patient care. For instance, according to data released in December 2023 by the National Institute of Neurological Disorders and Stroke (NINDS), research into Parkinson’s Disease (PD) benefited from approximately USD 125 million in funding from NINDS, contributing to the USD 259 million allocated by the National Institutes of Health (NIH) for PD research. This substantial investment underscores the commitment to advancing research, diagnosis, treatment, and the overall management of PD.

Increased government funding also accelerates scientific progress and encourages collaboration among researchers, medical professionals, and technology developers, with the goal of improving the lives of individuals affected by neurological disorders. In addition, public support can help make neuromodulation technologies more accessible by reducing costs, improving insurance coverage, or subsidizing related expenses.

Technological advancements in neuromodulation devices are significantly improving their effectiveness and ease of use, contributing to market expansion. Enhancements such as advanced materials for electrodes and leads are boosting the performance and efficacy of these devices. In August 2023, Medtronic obtained CE Mark approval for its Inceptiv spinal cord stimulator (SCS), which incorporates closed-loop sensing technology to manage chronic pain. This advance device automatically modifies stimulation based on real-time spinal cord signals, improving therapy effectiveness during everyday activities. The Inceptiv is recognized as the world thinnest SCS device and is compatible with MRI scans, representing a major advancement in neuromodulation technology. Introduction of such technologically advanced neuromodulation devices, along with continuous research efforts by major industry players, is expected to drive market growth over the forecast period.

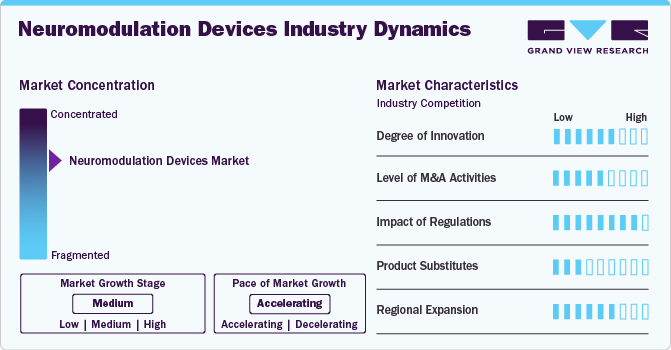

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The neuromodulation devices market is characterized by a high degree of growth due to increasing the increasing government funding propels scientific advancements and encourages collaboration between researchers, medical professionals, and technology developers.

Innovation in the neuromodulation devices market is significantly high, focusing on enhancing patient outcomes, increasing the applications of neuromodulation devices and development of technologically advanced devices. For instance, in September 2024, Abbott launched a pivotal clinical trial named the TRANSCEND study to assess the efficacy of its DBS system in managing Treatment-resistant Depression (TRD), a severe form of major depressive disorder. The U.S. FDA has awarded Abbott Breakthrough Device designation for this research under its Breakthrough Devices Program, which accelerates the review process for innovative technologies that have the potential to significantly enhance the lives of individuals with life-threatening or irreversibly debilitating conditions.

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a crucial role in shaping the market. Stringent approval processes ensure safety and efficacy, while post-market surveillance requirements encourage continuous product improvement. In addition, reimbursement policies and regional healthcare regulations impact the accessibility and adoption of neuromodulation devices. Favorable regulatory frameworks can expedite market entry, while delays or stringent rules may act as barriers to growth.

The level of mergers and acquisitions (M&A) activity in neuromodulation devices is driven by increasing market presence, accessing advanced technology, and increasing product offerings to reach a larger patient pool. For instance, in November 2023, Boston Scientific Corporation announced the completion of the acquisition of Relievant Medsystems Inc., the company that developed the Intracept Intraosseous Nerve Ablation System. This system is the only therapy cleared by the U.S. FDA for treating vertebrogenic pain, a type of chronic lower back pain.

The availability of alternative treatments, such as pharmacological therapies, surgery, or physical rehabilitation, presents competition for neuromodulation devices. However, neuromodulation technologies offer non-pharmaceutical, targeted, and long-term solutions for conditions such as chronic pain, epilepsy, and Parkinson’s disease. As these devices demonstrate improved clinical outcomes and fewer side effects, they are increasingly positioned as preferred options over traditional therapies.

Industry players are actively pursuing regional expansion strategies to tap into emerging markets and address unmet healthcare needs. Companies are focusing on regions such as Asia Pacific, Latin America, and the Middle East, where rising healthcare expenditures and growing awareness of advanced therapies drive demand. Collaborations with local healthcare providers, distributors, and government agencies are essential to overcoming market entry challenges and ensuring sustainable growth across diverse geographies.

Product Insights

Spinal cord stimulators held the largest market share of around 39.67% in 2024. Spinal cord stimulation devices are primarily used for patients without sufficient pain relief from non-surgical pain treatments. These devices utilize their advanced features to improve the patient’s overall quality of life & sleep and can significantly reduce the need for pain medicines. Furthermore, the ability of these devices to be used along with other pain management treatments and their wide range of applications, such as back pain, post-surgical pain, injuries to the spinal cord, and others, are expected to drive their demand over the forecast period.

Deep brain stimulators segment is expected to grow at grow at the highest CAGR of 9.53% during the forecast period. Deep brain stimulation (DBS) is widely employed to manage movement disorders associated with Parkinson’s disease, dystonia, essential tremor, and other neurological conditions. When medications lose effectiveness, DBS offers a viable alternative to traditional treatment approaches. The technology alleviates symptoms, reduces dependency on medication, and improves patients' quality of life, positioning it as a preferred option for managing Parkinson’s disease and related conditions.

Application Insights

Parkinson’s disease held the largest market share of around 26.90% in 2024. The rising prevalence of Parkinson's disease, coupled with the increasing acceptance of deep brain stimulation as an effective treatment option, is expected to drive segment growth. Parkinson’s disease is a progressive neurological disorder resulting from the degeneration of dopamine-producing cells in the Substantia Nigra Pars Compacta. This leads to motor symptoms such as resting tremors, bradykinesia, rigidity, impaired mobility, and balance issues. According to Parkinson's UK, around 153,000 individuals were living with the condition in 2023. Similarly, a 2022 study supported by the Parkinson’s Foundation indicated that approximately 90,000 new cases are diagnosed annually in the U.S.

Chronic pain segment is expected to grow at the fastest CAGR during the forecast period. The chronic pain segment is expected to witness significant growth due to the increasing acceptance of neuromodulation devices for managing chronic pain and the increasing recognition of the limitations of traditional pain relief methods. Chronic pain, along with discomfort lasting more than three months, affects millions globally, significantly impacting quality of life. For instance, according to the U.S. Pain Foundation article published in August 2023, around 21% of the U.S. population, equating to 51.6 million adults, experiences chronic pain, which is characterized as pain persisting for over 3 months.

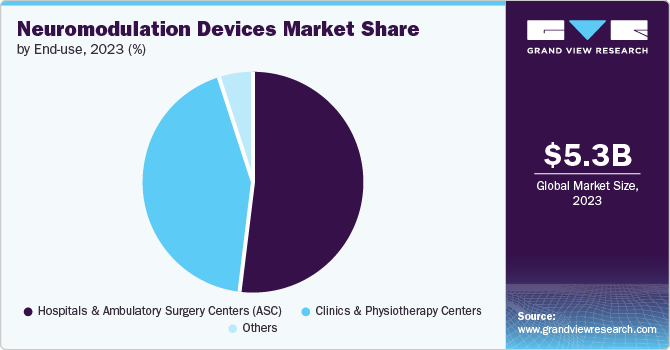

End-use Insights

Hospitals & Ambulatory Surgery Centers (ASC) held the largest market share of in 2024 and same segments is expected to show fastest growth during the forecast period. Hospitals are increasingly adopting advanced neuromodulation techniques to address conditions such as chronic pain, epilepsy, and treatment-resistant depression, where traditional pharmacological approaches are not giving effective outcomes. Furthermore, the increasing integration of other advanced technologies, such as robotic surgery, to introduce neuromodulation devices in patients’ bodies is further contributing to the segment growth.

Clinics & physiotherapy centers is expected to grow at a substantial rate during the forecast period. Clinics and physiotherapy centers are significantly increasing the adoption of neuromodulation devices owing to their better outcomes compared to other treatment alternatives. This shift is largely driven by the limitations of medications, which often result in inadequate patient outcomes, prompting healthcare providers to explore innovative solutions.

Regional Insights

North America neuromodulation devices market dominated with a share of 43.68% in 2024, owing to increase in the prevalence of various neurological disorders, such as Alzheimer’s disease, Parkinson’s disease, and epilepsy, and a rise in the demand for minimally invasive neurological procedures. Moreover, rapid technological advancements, presence of key manufacturers in the region, increase in R&D investments, and a rise in government funding & initiatives.

U.S. Neuromodulation Devices Market Trends

The U.S. neuromodulation devices market held a significant share of market in 2024. An increasing number of initiatives being undertaken by various organizations is expected to fuel neuromodulation devices market growth in the U.S. For instance, The Bee Foundation (TBF), a nonprofit organization, is focused on spreading awareness and reducing the number of deaths due to cerebral aneurysms through innovative research. TBF invites proposals for a brain aneurysm research grant, which is expected to help the organization achieve its aim of reducing mortality due to brain aneurysms. These factors are expected to boost the market during the forecast period.

The neuromodulation devices market in Canada held a significant share of market in 2024. The Canadian government reports that approximately 3.6 million Canadians are currently living with neurological conditions. Canada is projected to observe a substantial surge in the number of people diagnosed with neurological disorders over the next two decades, primarily due to an aging population. This increase is expected to be especially pronounced in cases of Alzheimer's disease and other dementias, as well as Parkinson's disease.

Europe Neuromodulation Devices Market Trends

The Europe neuromodulation devices market is experiencing significant growth. Europe held the second-largest market share and is anticipated to grow at a significant rate over the forecast period. Europe is one of the most advanced regions globally with advanced technologies and infrastructure, resulting in significant healthcare facilities and high-quality patient care.

The neuromodulation devices marketin UK is expected to show significant growth. The UK has advanced medical & research facilities, making it a significant market in Europe. The UK government is expected to allocate substantial funds for developing regulatory measures for various neurological conditions. Several factors such as excessive alcohol consumption, drug addiction, smoking, and high blood pressure contribute to brain aneurysms

Asia Pacific Neuromodulation Devices Market Trends

The neuromodulation devices market in Asia Pacific is experiencing rapid growth due to the presence of several local players in China and Japan is expected to boost the market growth. Rising awareness about neurological disease treatment options and improvements in clinical development framework of emerging economies are expected to drive market growth. Furthermore, establishment of organizations such as the Asia-Pacific Centre for Neuromodulation (APCN), which is founded for conducting research and promoting awareness about associated benefits of deep brain stimulation surgeries, is anticipated to boost market growth.

The neuromodulation devices market in China is growing with a lucrative growth rate. China is the second most populated country in the world, and the one with the most patients with neurological disorders. In 2021, China reported the highest incidence and prevalence of Parkinson's disease among the G20 nations, with age-standardized rates of 24.3 per 100,000 people and 245.7 per 100,000 people, respectively. These figures significantly exceeded the global average, indicating a concerning trend in China's Parkinson's disease burden.

Latin America Neuromodulation Devices Market Trends

The neuromodulation devices market in Latin America is experiencing significant growth. Latin America’s economy is majorly driven by Brazil. The healthcare spending of this region is reported to be around 3.2% of GDP, which is third in terms of healthcare spending after North America and Western Europe. Growing health awareness and increasing demand for technologically advanced medical devices, including neuromodulation devices, are among the key factors expected to boost market growth.

Middle East And Africa Neuromodulation Devices Market Trends

The neuromodulation devices market in MEA is experiencing growth driven by the MEA accounted for a considerable market share in 2024. High disease burden, increasing privatization, and growing penetration of health insurance have created growth opportunities in the neuromodulation devices market in Middle Eastern countries. The prevalence of neurological disorders has increased in the past few years in the region due to changes in lifestyle and the growing consumption of alcohol, driving the neuromodulation devices market.

The neuromodulation devices market in Saudi Arabia is driven by increasing incidence of dementia, Alzheimer’s disease, and migraine in the country is driving the market growth in Saudi Arabia, however low adoption of advanced healthcare facilities and lack of skilled healthcare professionals in Saudi Arabia may hinder the market growth. Therefore, the market is anticipated to grow at a moderate rate over the forecast period.

Some of the major government funding initiatives to study neurological disorders in recent years are:

|

Sr. No. |

Organization |

Year |

Funding (USD Million) |

Focused Areas |

|

1 |

Government of Canada |

2024 |

80 |

|

|

2 |

Parkinson's Foundation |

2024 |

3 |

|

|

3 |

American Brain Foundation |

2023 |

10 |

|

|

4 |

Parkinson's Foundation |

2023 |

2.8 |

|

|

5 |

Department of Health and Social Care UK |

2021 |

515.82 |

|

|

6 |

Australian Government |

2020 |

21.8 |

|

Key Neuromodulation Devices Company Insights

Key market players are focusing on the launch of innovative acquisitions, growth strategies, and technological advancements. For instance, in November 2023, Boston Scientific Corporation announced the completion of the acquisition of Relievant Medsystems Inc., the company that developed the Intracept Intraosseous Nerve Ablation System. This system is the only therapy cleared by the U.S. FDA for treating vertebrogenic pain, a type of chronic low back pain. These advancements in neuromodulation devices market are anticipated to boost market growth over the forecast period.

Key Neuromodulation Devices Companies:

The following are the leading companies in the neuromodulation devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Medtronic

- Boston Scientific Corporation

- Nexstim

- LivaNova PLC

- Neuropace Inc.

- Nevro Corporation

- electroCore, Inc.

- Axonics, Inc.

- Laborie

Recent Developments

-

In July 2024, Mainstay Medical Holdings plc has received regulatory approvals in the European Union, the UK, and Australia for full-body MRI conditional labeling of the ReActiv8 Restorative Neurostimulation system. As a result, all existing and future ReActiv8 patients in Europe and Australia with commercially available 45 cm leads can now safely undergo 1.5T full-body MRI scans.

-

In February 2024, Boston Scientific Corporation announced that the U.S. FDA has approved an expanded indication for the WaveWriter SCS System, allowing it to be used for treating chronic low back and leg pain in individuals without a history of back surgery, commonly known as Non-Surgical Back Pain (NSBP).

-

In January 2024, Abbott announced that it received approval from the U.S. FDA to launch the Liberta RC DBS system. This system is the smallest rechargeable DBS device in the world, with remote programming capabilities, and was created to treat individuals with movement disorders.

-

In November 2023, Nevro Corp. announced the acquisition of Vyrsa Technologies (Vyrsa), a privately held medical technology company specializing in minimally invasive treatment options for patients with chronic sacroiliac joint (SI Joint) pain.

Neuromodulation Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.37 billion |

|

Revenue forecast in 2030 |

USD 10.39 billion |

|

Growth rate |

CAGR of 8.51% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue, competitive landscape, growth factors, and trends |

|

Segment scope |

Product, application, end-use, region |

|

Regional scope |

North America, Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Abbott; Medtronic; Boston Scientific Corporation; Nexstim; LivaNova PLC; Neuropace Inc.; Nevro Corporation; electroCore, Inc.; Axonics, Inc.; Laborie |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Neuromodulation Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global neuromodulation devices market report on the basis of product, application, end-use and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Spinal Cord Stimulators

-

Deep Brain Stimulators

-

Sacral Nerve Stimulators

-

Vagus Nerve Stimulators

-

Gastric Electrical Stimulation

-

Others

-

-

Application Outlook (Revenue USD Million, 2018 - 2030)

-

Parkinson’s Disease

-

Chronic Pain

-

Epilepsy

-

Migraine

-

Urinary & Faecal Incontinence

-

Tremor

-

Depression

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Ambulatory Surgery Centers (ASC)

-

Clinics & Physiotherapy Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neuromodulation devices market size was estimated at USD 5,795.81 million in 2024 and is expected to reach USD 6.37 billion in 2025.

b. The global neuromodulation devices market is expected to grow at a compound annual growth rate of 8.51% from 2025 to 2030 to reach USD 10.39 billion in 2030.

b. The spinal cord stimulators segment dominated the market with a share of 39.67% in 2024 due to the increased use of spinal cord stimulators for treating chronic pain and nerve pain.

b. Some of the key players in the global neuromodulation devices market are Boston Scientific Corporation, Abbott, NEVRO CORP., Neuronetics, and Medtronic, among others

b. The rise in the prevalence of lifestyle diseases such as chronic pain and depression increased investment by private players for research and development of neurological disorders, and the increasing number of neurological diseases are some of the factors driving the growth of the global neuromodulation devices market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."