Neurology Ultrasonic Aspirators Market Size, Share & Trends Analysis Report, By Product (Standalone, Integrated), By End Use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-121-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

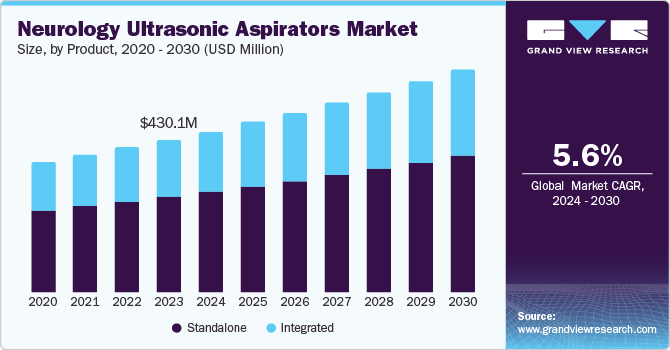

The global neurology ultrasonic market size was valued at USD 430.1 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. The growth of the neurology ultrasonic aspirators market is driven by several factors, such as high prevalence of neurological disabilities worldwide, surge in cases of brain tumors, increasing utilization of ultrasonic aspirators for skull base surgeries, application of ultrasonic aspirators for spinal tumor removal, availability of the advanced ultrasonic aspirators in the market, presence of affordable ultrasonic aspirators in the market, growing recognition of neurology ultrasonic aspirators by professionals, increasing investment in the development of novel ultrasonic aspirators.

Increasing utilization of ultrasonic aspirators for brain tumor removal is expected to drive the market during the forecast period. The National Center for Biotechnology Information (NCBI) stated that neurology ultrasonic aspirators have been utilized to extract of brain tumors. For instance, the Cavitron Ultrasonic Surgical Aspirator (CUSA) was developed to remove brain tumors while preserving the surrounding healthy tissue.

The availability of low-cost ultrasonic aspirators for various surgical procedures is also expected to drive the market. Neurology ultrasonic aspirators provide numerous advantages, including being the most adaptable and user-friendly system for precise soft tissue control. It decreases complications during surgery and minimizes blood loss during the operation. It allows delicate brain structures to be examined using precise tools in a confined space. It is commonly utilized in various surgical fields and for performing minimally invasive procedures.

The rise in cases of neurological conditions such as brain tumor and traumatic brain injury (TBI) is fueling the market expansion. For instance, the National Brain Tumor Society (NBTS) reported that 1 million Americans were living with brain tumors from 2015 to 2019. In addition, the Centers for Disease Control and Prevention (CDC) reported that the U.S. leads in the number of traumatic brain injury (TBI) cases. For instance, the Centers for Disease Control and Prevention (CDC) reports that traumatic brain injuries (TBIs) significantly contribute to mortality and disability across the U.S. The data for 2021 shows that TBIs were responsible for 69,473 deaths, translating to about 190 fatalities each day. Furthermore, TBIs are the cause of roughly 230,000 hospital admissions yearly and impact close to 1.5 million Americans.

Product Insights

The standalone segment dominated the market and accounted for a share of 62.5% in 2023; this dominance is attributed to an increase in incidents of cerebral palsy, bone dissection, and head injuries. Standalone aspirators are preferred in the market for their safety, simple design, and cost-effectiveness. They offer easy installation, versatile use across surgeries, and user-friendly features for healthcare professionals.

Integrated segment is expected to grow at the fastest CAGR of 6.1% over the forecast period due to the rising number of brain tumors and neurological diseases leading to disability. It assists surgeons in combining and suctioning soft tissues in intricate cranial neurosurgery. This technology is utilized in orbital, lacrimal, neurological conditions, and skull base surgeries. According to THE LANCET Neurology, the incidence and mortality rates of neurological disorders, which include stroke, Alzheimer's disease, other types of dementia, and meningitis, significantly increased over the last three decades attributed to the expanding and aging worldwide population and greater exposure to various environmental, metabolic, and lifestyle-related risk factors. A comprehensive new report from the Global Burden of Disease, Injuries, and Risk Factors Study (GBD) 2021 states that in 2021, 3.4 billion individuals were affected by a condition related to the nervous system.

End Use Insights

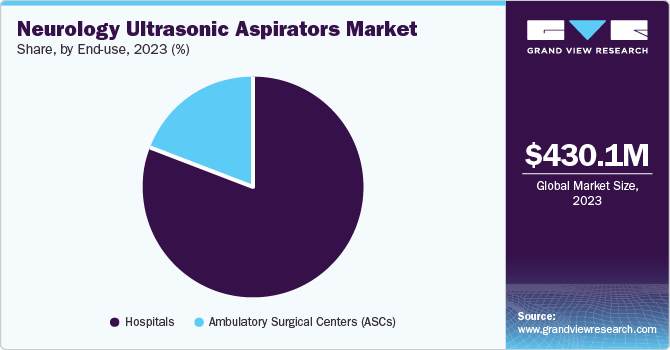

The hospitals segment dominated and accounted for a share of 80.8% in 2023 owing to the high demand for ultrasonic aspirators in hospitals. The segment is expected to witness high growth in coming years owing to the increasing acceptance of ultrasonic aspirators across the globe.

Ambulatory surgical centers segment is projected to grow at the fastest CAGR over the forecast period due to more benefits of ambulatory surgical centers over hospitals. Benefits of outpatient surgery include increased convenience and low expenses. Ambulatory surgical centers (ASCs) focus on various surgical procedures, including pain management, neurosurgeries, and diagnostic services. According to the American Hospital Association, there are 6,200 surgery centers in the U.S. Moreover, according to the ASC Data, the U.S. has 6,348 Medicare-certified Ambulatory Surgery Centers (ASCs) and 5,173 non-Medicare-certified ASCs, collectively housing 18,425 operating rooms. Among these ASCs, 3,247 are single-specialty centers, while 3,101 are multi-specialty centers.

Regional Insights

North America neurology ultrasonic aspirators market dominated the market in 2023 attributed to the high prevalence of neurological conditions, increasing awareness about ultrasonic aspirators, established healthcare facilities, and skilled neurosurgeons. In addition, the market is anticipated to be fueled by the widespread utilization of advanced medical technologies. The rise in reimbursements for new devices and surgical techniques is beneficial to the region's growth. According to the Parkinson's Foundation, in the U.S., there are almost one million individuals diagnosed with Parkinson's disease (PD), and this figure is projected to increase to 1.2 million by the year 2030. Each year, approximately 90,000 new cases of PD are identified.

U.S. Neurology Ultrasonic Aspirators Market Trends

The U.S. neurology ultrasonic aspirators market dominated the North America market with a share of 79.9% in 2023 due to the country's high utilization of ultrasonic aspirators. The market is expected to witness rapid growth during the forecast period due to increasing cases of brain and related tumors in the country. According to the study published by the American Cancer Society in August t 2021, it was estimated that in 2021, around 83,570 people in the U.S. were expected to be diagnosed with brain and other CNS tumors, with 24,530 being malignant and 59,040 non-malignant. Additionally, 18,600 individuals were projected to die due to the same illness. Malignant tumors account for less than one-third of all cases but lead to most deaths.

Europe Neurology Ultrasonic Aspirators Market Trends

Europe neurology ultrasonic aspirators market was identified as a lucrative region in this industry. The market is expected to experience rapid growth during the forecast period due to the varied applications of ultrasonic aspirators. According to the study published by the Journal of Clinical Medicine, in August 2021, the study compared neuroendoscopic ultrasonic aspirators in resecting intraventricular lesions, finding them safe and effective with a mean blood loss of 142.5 mL; half of the patients experienced temporary illness, but no permanent illness or death occurred.

The UK neurology ultrasonic aspirators market is expected to grow rapidly in the coming years due to recent technological advancements in ultrasonic aspirators used for cranial surgical procedures. These ultrasonic aspirators are highly precise and reduce the duration of the surgery.

Germany neurology ultrasonic aspirators market held a substantial market share in 2023 owing to the country's increasing adoption of minimally invasive surgical procedures. In coming years, the rise in the usage of ultrasonic aspirators to perform minimally invasive surgeries is also expected to drive the market.

Asia Pacific Neurology Ultrasonic Aspirators Market Trends

Asia Pacific neurology ultrasonic aspirators market is expected to grow at the fastest CAGR of 6.8% over the forecast period due to the high occurrence of diseases, growing government efforts, and awareness campaigns by NGOs. The significant presence of key players in economies such as China and Japan is primarily fueling the growth. An increase in brain tumor and TBI cases is also a significant factor contributing to the growth of the region. For instance, in January 2023, the Chinese University of Hong Kong, in collaboration with the Association of Pacific Rim Universities, discovered that primary brain cancer incidence is higher in wealthier countries, linking it to factors such as GDP, the Human Development Index, and the prevalence of traumatic brain injuries, carcinogen exposure, and mobile phone use. This type of cancer, most often glioma, seen an average of 240 new cases and 115 deaths annually in Hong Kong over the last decade.

Japan neurology ultrasonic aspirators market is expected to grow rapidly in the coming years due to the availability of advanced ultrasonic aspirators. These devices are expected to be more effective in tumor removal than conventional ultrasonic aspirators.

China neurology ultrasonic aspirators market held a substantial market share in 2023 owing to increased utilization of these devices in the country. Due to the high utilization of these devices in spinal surgical procedures, the market is also expected to register exponential growth during the forecast period.

Latin America Neurology Ultrasonic Aspirators Market Trends

Latin America neurology ultrasonic aspirators market is anticipated to witness significant growth over the forecast period due to the higher incidence of neurological disorders, advancements in technology, and the preference for minimally invasive surgeries, alongside improved healthcare facilities and investments. For instance, Latin American and Caribbean countries are projected to see notable increases in health expenditures due to aging populations and the shift towards non-communicable diseases, with an average annual per capita growth rate of 3.2% in Latin America and 2.4% in the Caribbean from 2018-2050. Economic challenges, including high debt and out-of-pocket payments, compound the issue. The health expenditure's GDP share is expected to rise in all LAC countries, excluding Guyana, by 2030.

Brazil neurology ultrasonic aspirators market is expected to witness rapid growth over the forecast period. Government initiatives in Brazil focus on enhancing the healthcare system through policies and programs that improve access to advanced treatments. These efforts drive the market for neurology ultrasonic aspirators by promoting the adoption of state-of-the-art medical technologies. As a result, healthcare providers are better equipped to offer cutting-edge neurological care.

Middle East And Africa Neurology Ultrasonic Aspirators Market Trends

Middle East and Africa neurology ultrasonic aspirators market is anticipated to grow significantly over the forecast period. Partnerships and funding from major industry players are driving the market forward. The increasing number of hospital admissions for traumatic surgeries is also expected to drive the neurology ultrasonic aspirators market during the forecast period.

According to the American Academy of Ophthalmology, eye injuries are a significant cause of morbidity in Bahrain, with 27% of monthly eye emergency clinic visits related to ocular injuries, primarily from occupational exposure among industrial and construction workers. Males account for 90.4% of these cases, while females represent 9.6%, and 96.1% of the injuries are unilateral compared to 3.9% bilateral.

Rising demand for neurology ultrasonic aspirators in South Africa is expected to drive the market during the forecast period. The market growth can also be attributed to the increasing utilization of these tools in various surgical procedures.

Key Neurology Ultrasonic Aspirators Company Insights

Some of the key companies in the neurology ultrasonic aspirators market include Stryker, Olympus Corporation, Integra LifeSciences Corporation, Söring GmbH, Xcellance Medical Technologies Private Limited, META Clinical Services, Bioventus, and CooperSurgical Inc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Stryker is a medical technology company specializing in various products, including orthopedic implants, surgical tools, and devices for neurosurgery and intensive care. Its focus is on innovations in surgery, neurotechnology, spine treatments, and other medical emergencies.

-

Integra LifeSciences Corporation is a medical technology company that develops collagen-based products and other medical devices, including surgical instruments, advanced wound care, orthopedic hardware, and neurosurgical systems. The company’s diverse portfolio serves various medical needs, from tissue regeneration to brain surgery.

Key Neurology Ultrasonic Aspirators Companies:

The following are the leading companies in the neurology ultrasonic aspirators market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Olympus Corporation

- Integra LifeSciences Corporation

- Söring GmbH

- Xcellance Medical Technologies Private Limited

- META Clinical Services

- Bioventus

- CooperSurgical Inc.

Recent Developments

-

In August 2022, Bioventus received FDA 510(k) clearance for its neXus SonaStar Elite handpiece, an advanced part of its ultrasonic surgical aspirator system, designed for precise soft and hard tissue removal at various frequencies, including a new 36 kHz option.

-

In December 2021, Bioventus granted FDA 510(k) clearance for its Nexus BoneScalpel Access device, which is intended for use alongside the Nexus Ultrasonic Surgical Aspirator System. This advanced surgical system is designed to improve power, versatility, and precision.

-

In July 2020, Integra LifeSciences Corporation announced the FDA approval of its CUSA (Clarity Ultrasonic Surgical Aspirator System), which is specifically indicated for neurosurgeries.

Neurology Ultrasonic Aspirators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 454.2 million |

|

Revenue forecast in 2030 |

USD 629.8 million |

|

Growth rate |

CAGR of 5.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, End Use, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Stryker; Olympus Corporation; Integra LifeSciences Corporation; Söring GmbH; Xcellance Medical Technologies Private Limited; META Clinical Services; Bioventus; CooperSurgical Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Neurology Ultrasonic Aspirators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neurology ultrasonic aspirators market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Integrated

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."