- Home

- »

- Medical Devices

- »

-

Neurology Devices Market Size, Share, Industry Report, 2030GVR Report cover

![Neurology Devices Market Size, Share & Trends Report]()

Neurology Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Neurostimulation, Interventional Neurology, CSF Management, Spinal Cord Stimulation, Deep Brain Stimulation), By Region, And Segment Forecasts

- Report ID: 978-1-68038-843-5

- Number of Report Pages: 96

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Neurology Devices Market Summary

The global neurology devices market size was estimated at USD 12.83 billion in 2024 and is projected to reach USD 21.28 billion by 2030, growing at a CAGR of 8.90% from 2025 to 2030. The rising prevalence of neurological disorders such as Alzheimer's disease, Parkinson's disease, and epilepsy is fueling the demand for advanced diagnostic and therapeutic neurology devices.

Key Market Trends & Insights

- North America accounted for 39.70% of the global neurology devices market revenue in 2024.

- The U.S. dominated the North American Neurology devices market in 2024.

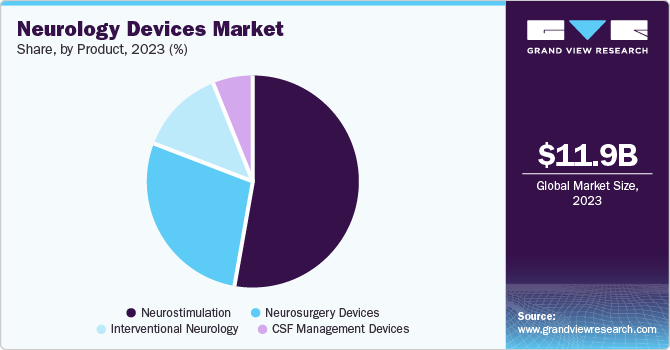

- By product, the neurostimulation segment accounted for 54.59% of the market revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.83 Billion

- 2030 Projected Market Size: USD 21.28 Billion

- CAGR (2025-2030): 8.90%

- North America: Largest market in 2024

According to Alzheimer's Disease Facts and Figures 2024, around 6.9 million Americans aged 65 and older are living with Alzheimer's, with 73% aged 75 or older. Technological advancements in neurostimulation devices such as adaptive deep brain stimulation, vagus nerve stimulation, and transcranial magnetic stimulation are significantly improving treatment outcomes for neurological disorders and diving market growth.

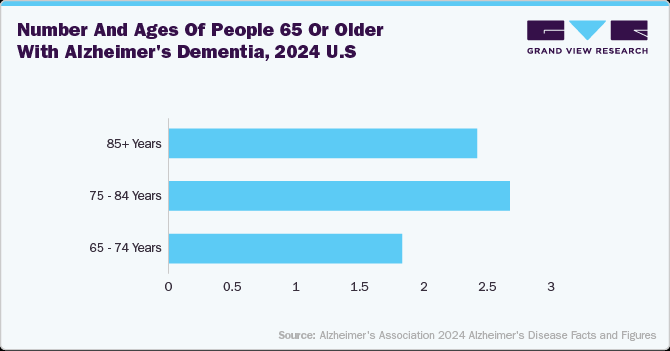

The below graph and table highlight the aging population and the rising prevalence of Alzheimer's disease in the U.S. in 2024. It shows that the majority of individuals with Alzheimer's dementia are aged 75 and older, accounting for 74% of the total cases. The data focus on the strong relation between increasing age and the risk of developing Alzheimer's disease, highlighting the need for advanced neurology devices to address this growing healthcare challenge.

The rise in home healthcare and remote patient monitoring also fuels the demand for neurology devices. Devices that enable patients to monitor their neurological conditions at home, such as portable Electroencephalography (EEGs), home-based neurostimulation devices, and wearable monitoring devices, have high demand. Remote monitoring technologies are beneficial for patients with chronic neurological disorders who need continuous care but prefer not to stay in the hospital. This trend leads to greater patient independence and reduces the strain on healthcare systems. Furthermore, companies are launching new home healthcare devices, which are expected to support market growth. For instance, in April 2024, Soterix Medical introduced the MxN-GO EEG system, a wire-free, wearable device designed for at-home use to deliver High-Definition Transcranial Electrical Stimulation (HD-tES) and EEG monitoring. The system allows simultaneous brain stimulation and brain activity recording without restricting mobility, offering a convenient and personalized solution for patients with neurological and psychiatric disorders. Its user-friendly design enables patients to undergo treatments at home, improving access to therapy while maintaining clinical-grade performance.

The rising prevalence of depression is significantly driving growth in the neurology devices market, particularly in the areas of neurostimulation and brain-monitoring technologies. With an increasing number of patients suffering from treatment-resistant depression, there is a growing demand for neurostimulation devices such as Transcranial Magnetic Stimulation (TMS), Vagus Nerve Stimulation (VNS), and Deep Brain Stimulation (DBS) implants. These devices offer alternative treatment options for individuals who do not respond to traditional antidepressants. Further, advancements in brain-monitoring technologies, including EEG and Functional MRI (fMRI), enable better diagnosis and treatment of depression by analyzing brain activity patterns.

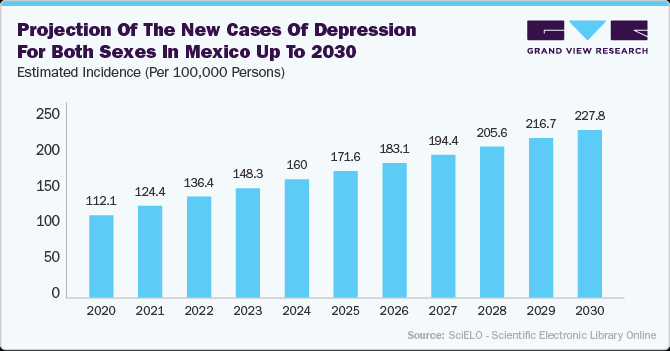

Below data showed, the projection of new depression cases in Mexico indicates a consistent increase from 112.1 thousand cases in 2020 to 227.8 thousand cases by 2030. This upward trend highlights the growing burden of mental health disorders in the country, driven by factors such as aging population, lifestyle changes, and rising stress levels. The significant rise in depression cases is expected to fuel the demand for advanced treatment options, including vagus nerve stimulation therapy, as part of neuromodulation techniques.

Government funding for studying neurological disorders plays a significant role in driving the neurology device market. Governments can help advance our understanding of various neurological conditions by allocating financial resources to research and development, creating a demand for innovative devices designed to diagnose, monitor, and treat these disorders. With funding, research institutions and universities can conduct extensive studies on neurological disorders such as Alzheimer's, Parkinson's, epilepsy, and multiple sclerosis. This research highlights the need for new and improved medical devices that can aid in diagnosing or treating these diseases.

Below table shows, several government organizations and foundations have significantly funded research on neurological disorders to advance treatment and care. The Government of Canada allocated USD 80 million in 2024 for conditions like dementia, ALS, and brain injuries, while the Department of Health and Social Care UK provided USD 515.82 million in 2021 for various dementias and Alzheimer's disease.

Some of The Major Government Funding To Study Neurological Disorders In Recent Years:

Sr. No.

Organization

Year

Funding (USD Million)

Focused Areas

1

Government of Canada

2024

80

- Dementia

- Amyotrophic Lateral Sclerosis (ALS)

- Multiple sclerosis

- Brain and spinal cord injuries

- Brain cancer

- Stroke

2

Parkinson's Foundation

2024

3

- Parkinson’s disease

3

American Brain Foundation

2023

10

- Parkinson’s disease

- Encephalitis

- Multiple sclerosis

- Alzheimer’s disease

- Brain trauma

- Autism

- Others

4

Parkinson's Foundation

2023

2.8

- Parkinson disease

5

Department of Health and Social Care UK

2021

515.82

- Pick’s Disease

- Fronto-temporal dementia

- Wernicke-korsakoff

- Parkinson’s disease dementia

- Lewy Body dementia

- Alzheimer’s disease

- Mild cognitive impairment

6

Australian Government

2020

21.8

- Alzheimer’s disease

- Autism

- Encephalitis

Source: Environment and Climate Change Canada, Commonwealth of Australia, GOV.UK, Parkinson's Foundation, Grand View Research

The increasing prevalence of Parkinson’s Disease (PD) is a significant driver of the neurology device market, driving advancements in diagnostic, therapeutic, and monitoring technologies. As a progressive neurodegenerative disorder, PD affects millions globally, with cases expected to rise due to the aging population. According to the Parkinson’s Foundation Parkinson’s Prevalence Project, 1.2 million people in the U.S. will be living with Parkinson’s by 2030. This surge has increased the demand for early diagnostic tools such as dopamine transporter imaging and EEG, which enable timely intervention. Furthermore, adopting Deep Brain Stimulation (DBS) devices has revolutionized PD treatment by improving motor symptoms and reducing medication side effects.

The following table highlights the top 15 U.S. states with the highest percentage death rates, alongside the corresponding number of PD cases. The data provides insights into regional variations, helping to identify states with the most significant prevalence and healthcare demand.

Top 15 U.S. States Based On The Death Rate (%) Due To PD, For 2022

Rank

State

Death Rate

Number of Cases

1

Utah

12.40%

343

2

Kansas

11.50%

423

3

Nebraska

11.40%

275

4

Tennessee

11.20%

957

5

New Hampshire

11.10%

218

6

Texas

11.10%

3,091

7

Oregon

11.00%

626

8

Alaska

10.90%

62

9

Indiana

10.90%

904

10

Vermont

10.90%

105

11

Idaho

10.80%

243

12

Colorado

10.70%

665

13

Iowa

10.70%

466

14

Alabama

10.70%

696

15

Georgia

10.30%

1,168

Source: CDC

The Intersectoral Global Action Plan on Epilepsy and Other Neurological Disorders 2022-2031 was launched by the WHO to improve the prevention, diagnosis, treatment, and care of neurological disorders globally. The plan aims to reduce the stigma, mortality, and disability associated with neurological conditions such as epilepsy, dementia, stroke, migraine, Parkinson’s disease, and neuroinfectious diseases. It focuses on strengthening healthcare systems, promoting universal health coverage, increasing research, and enabling collaborations between governments, healthcare providers, and communities. The initiative highlights the importance of integrating neurological care into primary healthcare systems to ensure equitable access to quality treatment, especially in low- and middle-income countries. This initiative is expected to support market growth during forecast period.

“The Intersectoral Global Action Plan 2022-2031 sets out a roadmap for countries to improve prevention, early identification, treatment and rehabilitation of neurological disorders. To achieve equity and access to quality care, we also need to invest in more research on risks to brain health, improved support for the healthcare workforce and adequate services.” Director, WHO Department of Mental Health and Substance Use.

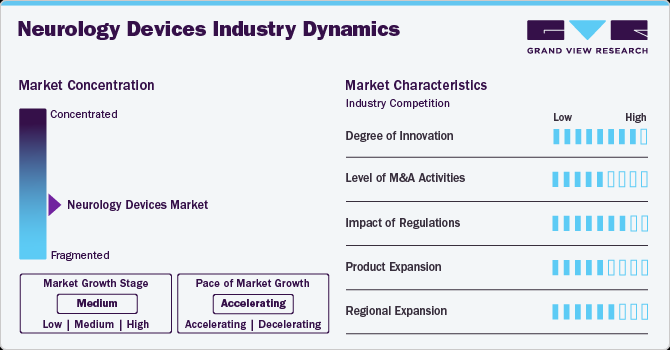

Market Concentration & Characteristics

The neurology devices market is in a significant growth stage, driven by the rising prevalence of neurological disorders, technological advancements, and increasing healthcare investments. The growing demand for non-invasive diagnostic and therapeutic devices and innovations in neurostimulation and neuromodulation technologies is accelerating market expansion.

The neurology device market is experiencing a significant surge in innovation, driven by technological advancements and a growing understanding of neurological disorders. The integration of neurotechnology into wearable formats is becoming more prevalent. For instance, in September 2024, Neurable, a Boston-based neurotechnology company, introduced the MW75 Neuro, a pair of headphones with electroencephalography sensors. Developed in partnership with audio manufacturer Master & Dynamic, these smart headphones are designed to monitor brain activity, providing users with insights into their focus levels and cognitive health.

The neurology device market is witnessing a surge in mergers and acquisitions (M&A) as companies seek to expand their technological capabilities, geographic presence, and market share. Key players acquire firms specializing in innovative technologies such as neurostimulation, AI-based diagnostics, and neurovascular treatments to strengthen their portfolios. For instance, in September 2024, Stryker completed the acquisition of NICO Corporation, a privately held company specializing in minimally invasive neurosurgical solutions. This strategic move enhances Stryker's portfolio, particularly in treating brain tumour resection and intracerebral haemorrhage.

Regulations are crucial in the neurology device market, ensuring patient safety, device efficacy, and quality standards. Regulatory bodies such as the U.S. FDA, the European Medicines Agency (EMA), and other regional authorities classify neurology devices based on their risk levels, with higher-risk devices such as deep brain stimulators undergoing more stringent evaluation processes. While these regulations promote safety, they can also pose challenges to innovation due to lengthy approval timelines and high compliance costs, potentially delaying the introduction of technologies. However, initiatives such as the International Medical Device Regulators Forum (IMDRF) aim to coordinate global regulatory standards, streamlining market access across regions.

The neurology device market is experiencing significant product expansion, driven by technological advancements, acquisitions, and a growing prevalence of neurological disorders. This growth is evident across various segments, including neurostimulation devices, interventional neurology, cerebrospinal fluid management, and neurosurgery devices. For instance, in September 2022, Brainlab, a digital medical technology company, announced the acquisition of Dr. Langer Medical GmbH, a Germany-based company specializing in intraoperative neuromonitoring (IONM) solutions and related surgical equipment. This strategic acquisition strengthens Brainlab's product expansion within the digital surgery ecosystem, enhancing its surgical precision and patient safety capabilities.

The neurology device market is experiencing significant regional expansion as key industry players seek to strengthen their global footprint. Rising incidences of neurological disorders, technological advancements, and increasing healthcare investments drive this growth. For instance, in September 2024, Medtronic, a healthcare technology company, expanded its investment in Asia by launching its first robotics experience studio in Southeast Asia. This advanced facility, located within the Medtronic Customer eXperience Center (MCXC) in Singapore, aims to accelerate the adoption of robotics and artificial intelligence (AI) in healthcare across the region through comprehensive training and education.

Product Insights

The neurostimulation segment accounted for 54.59% of the market revenue in 2024, with spinal cord stimulation devices leading this segment. These devices are primarily used for pain management in conditions such as chronic back pain and failed back surgery syndrome. The dominance of spinal cord stimulation devices can be attributed to their effectiveness in providing pain relief and improving the quality of life for patients.

In addition, technological advancements significantly drive the segment's growth by enhancing the precision, efficacy, and accessibility of neurostimulation therapies. Innovations in miniaturized implantable devices and wireless technologies have improved patient outcomes by offering personalized treatment options. The development of rechargeable and battery-free neurostimulators and non-invasive techniques such as transcranial magnetic stimulation has expanded the patient base by providing safer and more convenient alternatives.

The table below shows the recent technological advancements in neuromodulation devices, highlighting significant progress in treating neurological disorders. These advancements focus on the growing adoption of neuromodulation devices in managing chronic pain and neurological conditions.

Some Recent Technological Advancements In The Neuromodulation Device Are As Follows:

Company

Month

Year

Description

Medtronic

April

2024

Medtronic received FDA approval for its Inceptiv closed-loop spinal cord stimulator, designed to treat chronic pain. This innovative device automatically adjusts stimulation in real time by sensing biological signals, ensuring optimal therapy aligned with patients' daily activities. Inceptiv is the first of its kind to offer full-body MRI access and is the smallest fully implantable spinal cord stimulator available.

Tivic Health

August

2023

Tivic Health initiated a study for vagus nerve stimulation after receiving Institutional Review Board (IRB) approval. The study, conducted at the Feinstein Institutes for Medical Research, aims to investigate Tivic's non-invasive bioelectronic nerve stimulation system. It aims to provide greater targeting strategies and more control over the physiologic effects of stimulation.

Abbott

August

2022

Abbott's Proclaim Plus Spinal Cord Stimulation (SCS) system gained FDA approval, featuring FlexBurst360 therapy that provides tailored pain relief across multiple body areas. This recharge-free device lasts up to 10 years and allows for real-time adjustments via the NeuroSphere Virtual Clinic, enhancing patient convenience. Designed to adapt to evolving pain conditions, it utilizes Abbott's BurstDR technology, which delivers effective pain relief through mild electrical pulses.

Source: Industry Journals, Investor Presentations, Grand View Research

The interventional neurology segment is projected to grow at a CAGR of 10.51% from 2025 to 2030. This growth is fueled by the increasing incidence of neurovascular disorders such as aneurysms and arteriovenous malformations. The aneurysm coiling and arteriovenous malformation subsegment held the largest market share in 2024, reflecting the high demand for minimally invasive procedures to treat these conditions. According to the Brain Aneurysm Foundation, an estimated 6.8 million people in the U.S. have a brain aneurysm, 1 in 50 people, with an annual rate of 8-10 per 100,000 individuals. Each year, about 30,000 people in the U.S. experience a brain aneurysm rupture, occurring every 18 minutes. Globally, 500,000 deaths are attributed to brain aneurysms annually, with half of the patients being under 50 years old.

Innovations in coil technology and the introduction of flow diversion devices have improved treatment results, boosting market growth. The cerebral balloon angioplasty and stenting market is expected to grow significantly in the forecast years due to the rising cases of ischemic strokes and the increasing use of stenting procedures to reopen blocked brain arteries. Advances in imaging technologies and the development of next-generation stents are expected to drive this market growth further.

Regional Insights

North America accounted for 39.70% of the global neurology devices market revenue in 2024, driven by the high prevalence of Neurology disorders and a strong healthcare infrastructure. The region benefits from significant investments in research and development, leading to continuous innovation in Neurology devices. The aging population, which is more susceptible to Neurology conditions, further fuels market growth. Additionally, favourable reimbursement policies and the presence of major market players contribute to the region’s dominance.

U.S. Neurology Devices Market Trends

The U.S. dominated the North American Neurology devices market in 2024, owing to its advanced healthcare system and high healthcare expenditure. The country has a large patient pool suffering from Neurology disorders, including Alzheimer’s disease, Parkinson’s disease, and epilepsy, which drives the demand for innovative diagnostic and therapeutic devices. The presence of leading medical device companies and extensive research activities further bolster the market. In addition, government initiatives and funding for neurology research and the development of new treatment modalities are significant growth drivers. For instance, in FY 2024, the total funding allocation for the BRAIN (Brain Research through Advancing Innovative Neurotechnology) Initiative amounted to USD 402 million, reflecting a 40% decrease compared to the FY 2023 budget.

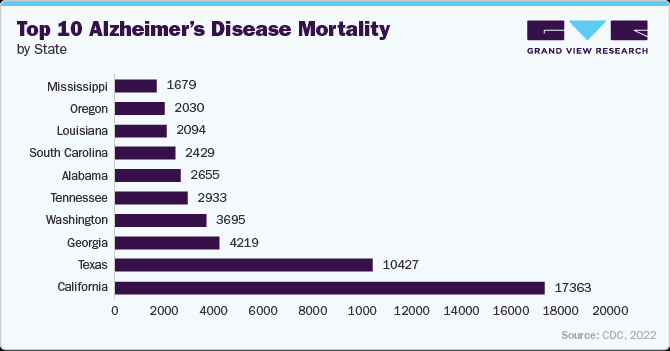

The below figure highlights the highest number of cases by state is observed in California with 17,363 cases and a rate of 37.5%, followed by Texas with 10,427 cases at a rate of 38.8%. Georgia and Washington reported 4,219 and 3,695 cases, respectively, with rates exceeding 39%. Tennessee and Alabama also had significant numbers of cases, highlighting the prevalence of the condition in the southeastern U.S.

Europe Neurology Devices Market Trends

The European Neurology devices market is expected to grow at a significant CAGR over the forecast period, driven by the high prevalence of Neurology disorders and the increasing adoption of advanced medical technologies. The region benefits from a well-established healthcare system and significant investments in research and development. Countries such as Germany, France, and the UK are major contributors to the market, with a high demand for innovative diagnostic and therapeutic devices. According to the European Brain Council, as of 2025, an estimated 7 million people in Europe live with Alzheimer's disease, which is the most common form of dementia, highlighting the significant number of dementia cases across the continent. With a rapidly aging population, this number is projected to rise to 14 million by 2030.

UK Neurology Devices Market Trends

The UK is a significant contributor to the European neurology devices market, with a growing demand for advanced neurology devices driven by the high prevalence of neurology disorders. According to Epilepsy Factsheet 2024, there are over 600,000 people with epilepsy in the UK. However, as per NHS England, as of June 30, 2024, 487,432 patients had a recorded diagnosis of dementia, an increase of 3,155 patients compared to May 31, 2024. The dementia diagnosis rate among individuals aged 65 and overreached 65.0% by June 30, 2024, slightly rising from 64.8% recorded on May 31, 2024. According to Parkinson's UK 2024, around 153,000 people in the UK are living with Parkinson's. By 2030, it is expected to increase by nearly 172,000.

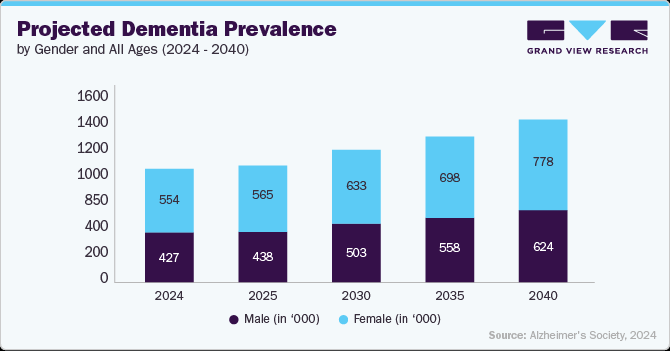

Below graph shows the projected prevalence of dementia cases across different years, segmented by gender and overall prevalence rate for all ages. The data indicates a steady increase in dementia cases from 982,000 in 2024 to 1.4 million in 2040. Female patients consistently represent a higher proportion of cases compared to males, reflecting the longer life expectancy among women.

The country’s market is supported by a healthcare infrastructure and significant investments in research and development. Government initiatives and funding for neurology research, along with the presence of leading medical device companies, are key factors driving market growth. Additionally, the increasing adoption of minimally invasive surgical techniques and advanced neurostimulation devices is expected to boost the market further.

Germany Neurology Devices Market Trends

Neurology devices market of Germany experiencing significant growth, driven by the rising prevalence of neurological disorders such as Parkinson's disease, Alzheimer's disease, epilepsy, and stroke. According to NIH, approximately 1.8 million people were living with dementia in Germany as of December 31, 2021; the number of new dementia cases in 2021 is estimated at 360,000 to 440,000. In 2033, depending on the scenario, 1.65 to 2 million people aged 65 and older may be affected. The increasing demand for minimally invasive treatments and advanced neurostimulation devices is a key trend shaping the market. Technological advancements in deep brain stimulation (DBS), neurovascular devices, and diagnostic imaging systems improve patient outcomes and improve treatment precision.

Asia Pacific Neurology Devices Market Trends

The Asia Pacific Neurology devices market is expected to grow fastest from 2025 to 2030, driven by the increasing prevalence of Neurology disorders and rising healthcare expenditure. Countries such as China and India are witnessing rapid advancements in healthcare infrastructure, which is boosting the adoption of Neurology devices. The growing awareness about early diagnosis and treatment of Neurology conditions, coupled with the increasing geriatric population, is also contributing to market growth. Moreover, the entry of key market players and the launch of innovative products are expected to propel the market further.

China Neurology Devices Market Trends

China is a key player in the Asia Pacific neurology devices market, with significant growth anticipated over the forecast period. The China neurological devices market is witnessing significant growth. The growing prevalence of neurological disorders such as Alzheimer's disease, Parkinson's disease, epilepsy, stroke, and dementia contributes to the market growth. According to a 2024 official report of China government, China has more than 16 million people suffering from dementia, including Alzheimer's disease, accounting for nearly 30% of the global total.

Furthermore, The China neurological devices market is significantly driven by various government initiatives and policies aimed at improving healthcare infrastructure and addressing the rising burden of neurological disorders. The Chinese government has implemented several national policies and funding programs to improve healthcare infrastructure and promote neurological research. In 2024, China government implant the National Dementia Plan (2024), a comprehensive plan to address the rising burden of dementia by promoting early diagnosis, treatment, and rehabilitation services.

“Aiming to improve access to timely diagnosis, treatment, and support for people living with dementia, the Plan encourages all relevant stakeholders to collaborate with multidisciplinary and multi-level teams.”- Founding Member of Alzheimer's Disease China.

Latin America Neurology Devices Market Trends

The Latin America neurology devices market is experiencing steady growth, driven by the increasing prevalence of Neurology disorders, and improving healthcare infrastructure. Countries such as Brazil and Argentina are major contributors to the market, with a growing demand for advanced diagnostic and therapeutic devices. The rising awareness about neurology conditions and the importance of early diagnosis and treatment are also contributing to market growth.

Middle East Africa Neurology Devices Market Trends

The Middle East & Africa neurology devices market is witnessing growth, driven by the rising incidence of neurological disorders such as stroke, epilepsy, Alzheimer's disease, and Parkinson's disease. The increasing demand for advanced diagnostic tools and minimally invasive treatment options propels the market. Governments in the region are investing in healthcare infrastructure development and promoting medical tourism, particularly in countries such as Saudi Arabia, the UAE, and South Africa. As per World Alzheimer Report 2024, dementia is a growing public health concern, particularly in the Middle East, with an estimated 1.3 million people affected in the region in 2021.

Key Neurology Devices Company Insights

Key players operating in the global neurological devices industry are undertaking various initiatives to strengthen their market presence and increase the reach of their components and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Neurology Devices Companies:

The following are the leading companies in the neurology devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Johnson and Johnson Services Inc.

- Penumbra, Inc.

- Microport Scientific Corporation

- Stryker

- Microvention Inc (Terumo Corporation)

- Codman Neuro (Integra Lifesciences)

- Abbott

- Boston Scientific Corporation

- Nexstim

- LivaNova PLC

- Neuropace Inc.

- electroCore, Inc.

- Axonics, Inc.

- Söring GmbH

- CooperSurgical Inc.

- Zimmer Biomet

- Brain lab AG

- Acandis GmbH

Recent Developments

-

In February 2025, Medtronic has received U.S. FDA approval for the world's first Adaptive Deep Brain Stimulation (DBS) system for individuals with Parkinson's disease. This technology uses real-time brain signals to adjust stimulation levels based on the patient's needs, offering a more personalized and responsive treatment approach.

-

In February 2025, University Hospitals of Geneva (HUG), the Department of Health and Mobility (DSM) of the Canton of Geneva, and the Wyss Center for Bio and Neuroengineering are establishing an artificial intelligence (AI) hub focused on healthcare and neuromodulation. Scheduled to launch in the second half of 2025 at Campus Biotech, this 1,000 m² facility aims to enhance the treatment and prevention of neurological and psychiatric disorders.

-

In August 2024, AbbVie acquired Cerevel Therapeutics for approximately USD 8.7 billion. The definitive agreement provides AbbVie with access to multiple clinical-stage and preclinical candidates that are being developed to treat Neurology and psychiatric disorders. This acquisition is expected to accelerate AbbVie's research and development efforts in neuroscience and advance its mission to develop innovative therapies for patients with serious and complex diseases.

-

In July 2024, Mainstay Medical Holdings plc has received regulatory approvals in the European Union, the UK, and Australia for full-body MRI conditional labelling of the ReActiv8 Restorative Neurostimulation system. As a result, all existing and future ReActiv8 patients in Europe and Australia with commercially available 45 cm leads can now safely undergo 1.5T full-body MRI scans.

-

In April 2024, GE HealthCare announced the acquisition of MIM Software, a leading medical imaging analysis and AI solutions provider. This strategic move positions GE HealthCare to accelerate innovation and deliver differentiated solutions for urology, molecular radiotherapy, radiation oncology, and diagnostic imaging. MIM Software's expertise in imaging analytics and digital workflows will be integrated across various care areas to benefit patients and healthcare systems worldwide.

-

In January 2024, Oragenics announced the acquisition of Neurology assets from Odyssey Health. The obtained assets, which encompass the primary concussion asset ONP-002 and a unique nasal delivery device, are expected to significantly broaden Oragenics' market potential. The company views these assets as a strategic match, and its proficiency in intranasal drug administration tackles a growing healthcare issue.

Neurology Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.90 billion

Revenue forecast in 2030

USD 21.28 billion

Growth rate

CAGR of 8.90% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Johnson and Johnson Services Inc.; Penumbra, Inc.; Microport Scientific Corporation; Stryker; Microvention Inc (Terumo Corporation); Codman Neuro (Integra Lifesciences); Abbott; Boston Scientific Corporation; Nexstim; LivaNova PLC; Neuropace Inc.; electroCore, Inc.; Axonics, Inc.; Söring GmbH; CooperSurgical Inc.; Zimmer Biomet; Brainlab AG; Acandis GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neurology Devices Market Report Segmentation

This report forecasts revenue & volume growth of the Neurology Devices market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neurology devices market report based on product, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Neurostimulation

-

Spinal Cord Stimulation

-

Spinal Cord Stimulation

-

Deep Brain Stimulation

-

Sacral Nerve Stimulation

-

Vagus Nerve Stimulation

-

Gastric Electric Stimulation

-

-

Interventional Neurology

-

Aneurysm Coiling and Embolization

-

Embolic Coils

-

Flow Diversion Devices

-

Liquid Embolic Reagents

-

-

Neurovascular Catheters

-

Micro Catheters

-

Micro Guidewires

-

-

Cerebral Balloon Angioplasty &Stents

-

Carotid Artery Stents

-

Filter Devices

-

Balloon Occlusion Devices

-

-

Neurothromobectomy

-

Clot Retrievers

-

Suction Aspiration Devices

-

Snare Devices

-

-

-

CSF Management Devices

-

Cerebral Shunts

-

Cerebral External Drainage

-

-

Neurosurgery Devices

-

Ultrasonic Aspirators

-

Stereotactic Systems

-

Neuroendoscopes

-

Aneurysm Clips

-

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurology devices market was estimated at USD 12.83 billion in 2024 and is expected to reach USD 13.90 billion in 2025.

b. The global neurology devices market is expected to grow at a compound annual growth rate of 8.90% from 2025 to 2030, reaching USD 21.28 billion by 2030.

b. North America dominated the neurology devices market with a share of 39.70% in 2024. This is attributable to the rise in various chronic neurological diseases and technological advancement by the key market players in the region

b. Some key players operating in the neurology devices market includes B. Braun Melsungen AG, Boston Scientific Corporation, Covidien PLC, Integra LifeSciences Holdings Corporation, Johnson and Johnson, Medtronic Inc., Stryker Corporation, W.L. Gore & Associates, Inc.

b. Key factors that are driving the market growth include growing base of aging population more prone to chronic diseases, increasing demand for minimally invasive surgeries, and rising number of stroke patients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.