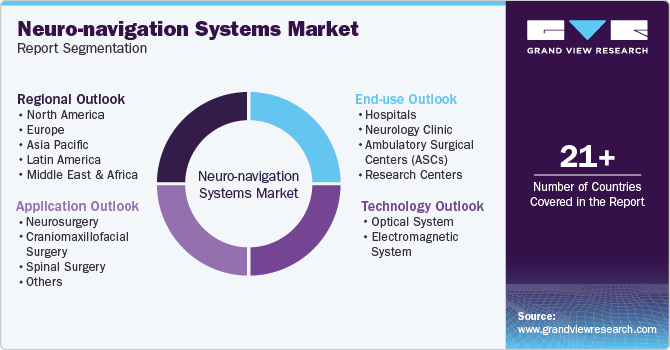

Neuro-navigation Systems Market Size, Share & Trends Analysis Report By Technology (Optical System, Electromagnetic System), By Application (Neurosurgery, Craniomaxillofacial Surgery, Spinal Surgery), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-995-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Neuro-navigation Systems Market Trends

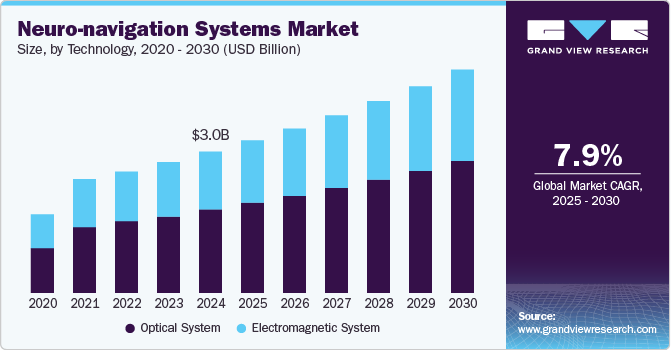

The global neuro-navigation systems market size was estimated at USD 3.02 billion in 2024 and is projected to grow at a CAGR of 7.9% from 2025 to 2030. The increasing prevalence of neurological disorders, such as brain tumors, epilepsy, and other complex conditions that require precise surgical interventions, is the primary factor driving the market growth. The aging population further exacerbates this trend, as older individuals are more prone to develop these disorders. In addition, there is a growing demand for minimally invasive surgical techniques that enhance patient safety and reduce recovery times.

Technological advancements in imaging modalities, such as MRI and CT scans, have improved the effectiveness of neuro-navigation systems by providing real-time guidance during procedures. Hence, these systems have become essential tools in neurosurgery, facilitating better surgical outcomes and patient care.

In addition, hospitals and surgical centers are increasingly adopting neuro-navigation systems to improve surgical precision and efficiency. Furthermore, continuous advancements in technology, including artificial intelligence and augmented reality, are enhancing the capabilities of these systems. These innovations promise to provide even more sophisticated tools for healthcare professionals, increasing their adoption in various surgical procedures. The collaboration between technology developers and healthcare providers plays a crucial role in fostering innovation and expanding neuro-navigation industry opportunities for neuro-navigation systems.

Moreover, as healthcare increasingly focuses on tailored treatment strategies based on individual patient needs, neuro-navigation technologies that provide real-time data become invaluable for surgeons. These systems enable customized surgical approaches that optimize outcomes for patients with unique anatomical considerations or specific conditions. Integrating telemedicine with neuro-navigation systems also presents opportunities for remote guidance during procedures, improving access to specialized care in underserved areas. These trends indicate a promising trajectory for the neuro-navigation systems industry as it adapts to meet the evolving challenges and opportunities within the healthcare landscape.

Technology Insights

The optical system segment dominated the market with a revenue share of 58.5% in 2024, driven by its exceptional accuracy and reliability in surgical applications. Optical systems utilize advanced imaging techniques, such as infrared cameras and fiducial markers, to provide real-time visualization of the surgical area. This high level of precision is crucial for neurosurgical procedures, where even minor errors can have significant consequences. The trend toward minimally invasive surgeries has increased the demand for optical navigation systems, as they facilitate smaller incisions and quicker recovery times. These systems user-friendly interfaces and intuitive designs further enhance their appeal to surgeons. Continuous advancements in optical imaging technologies are expected to maintain this segment's dominance in the market.

The electromagnetic system segment is anticipated to grow significantly over the forecast period, fueled by its versatility and ability to operate without a direct line of sight. Electromagnetic navigation systems allow for greater flexibility during surgeries, making them particularly useful in complex procedures where traditional optical systems may be limited. These systems are advantageous in deep-seated surgeries, as they accurately track instruments without requiring rigid fixation. The rising adoption of minimally invasive surgical techniques also contributes to the growth of electromagnetic systems in the neuro-navigation systems industry, as they can improve patient outcomes while reducing recovery times. Furthermore, ongoing technological innovations are enhancing the performance and affordability of these systems, making them more attractive to healthcare providers.

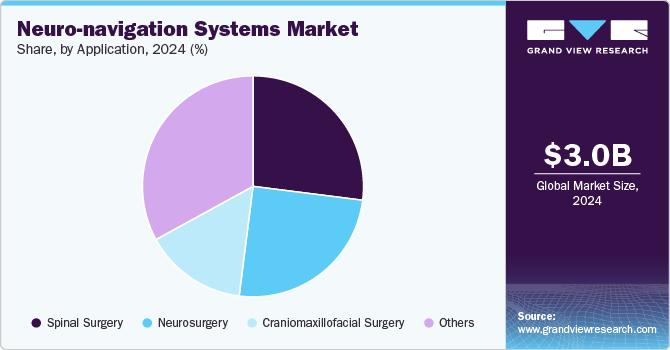

Application Insights

The others segment dominated the market with the largest revenue share in 2024, which can be attributed to its broad range of applications beyond traditional neurosurgery. This segment includes specialized procedures such as ENT surgery and orthopedic navigation, which benefit from advanced neuro-navigation technologies. The versatility of these systems allows them to be utilized across various surgical disciplines, enhancing their overall appeal in the industry of neuro-navigation systems. As healthcare providers increasingly recognize the benefits of precise navigation in diverse applications, demand for these technologies is expected to rise. In addition, ongoing research and development efforts are anticipated to lead to new applications for neuro-navigation systems, further expanding this segment's market share.

The spinal surgery segment is expected to grow significantly over the forecast period due to the increasing incidence of spinal disorders requiring surgical intervention. Conditions such as herniated discs and spinal stenosis are becoming more prevalent as populations age and lifestyles change. Neuro-navigation systems play a crucial role in spinal surgeries by providing precise guidance during complex procedures and minimizing risks associated with traditional methods. As awareness of these benefits grows among healthcare professionals, the adoption of neuro-navigation systems for spinal surgery is expected to rise significantly.

End-use Insights

The Hospitals segment dominated the market with the largest revenue share in 2024, driven by their central role in providing advanced medical care. Hospitals increasingly invest in state-of-the-art technologies to enhance surgical precision and improve patient outcomes. Integrating neuro-navigation systems into hospital settings allows for better planning and execution of complex neurosurgical procedures. In addition, hospitals often have access to a broader range of resources necessary for effectively operating these complicated systems. As more hospitals recognize the benefits of incorporating neuro-navigation into their surgical protocols, demand for these technologies is expected to rise.

The research centers segment is projected to grow at the highest CAGR over the forecast period, fueled by ongoing advancements in medical research and technology development. Research centers are at the forefront of exploring innovative applications for neuro-navigation systems, significantly contributing to their evolution and refinement. These institutions often collaborate with technology developers to conduct clinical trials validating new neuro-navigation approaches. As research centers push boundaries in neurosurgery and related fields, their need for cutting-edge navigation solutions drives growth in the neuro-navigation systems industry. Increased funding for medical research initiatives supports investments in advanced neuro-navigation technologies within these centers.

Regional Insights

North America neuro-navigation systems market dominated the global market with a revenue share of 45.5% in 2024, driven by high healthcare expenditure and advanced medical infrastructure. In addition, North America has a high prevalence of neurological disorders that necessitate precise surgical interventions, further boosting demand for these technologies. The presence of leading manufacturers and research institutions contributes significantly to market growth by fostering continuous advancements in neuro-navigation solutions. As healthcare providers seek improved patient outcomes through enhanced surgical precision, North America is expected to maintain its dominant position in this market.

U.S. Neuro-navigation Systems Market Trends

The U.S. neuro-navigation systems market dominates North America with a significant revenue share in 2024 due to its robust healthcare system and high demand for advanced medical technologies. The large population suffering from neurological conditions demands accurate diagnostic and treatment options available through these technologies. The presence of major players in the medical device industry facilitates rapid advancements and competitive pricing strategies that benefit U.S.-based healthcare facilities. As hospitals continue investing in state-of-the-art equipment, the U.S. market is expected to experience sustained growth.

Europe Neuro-navigation Systems Market Trends

Europe neuro-navigation systems market held a substantial share in 2024, fueled by increasing investments in healthcare technology and rising awareness about advanced surgical solutions. The growing prevalence of neurological disorders across Europe further fuels the demand for precise navigational tools that enhance surgical outcomes during complex procedures. Academic institutions and industry players collaborate to promote research initiatives to advance neuro-navigation capabilities within Europe’s healthcare landscape. As regulatory frameworks evolve to support technological integration into clinical practice, Europe’s market is positioned to expand.

Asia Pacific Neuro-navigation Systems Market Trends

Asia Pacific neuro-navigation systems market is expected to register the highest CAGR of 8.6% over the forecast period, which can be attributed to rapid advancements in healthcare infrastructure and increasing awareness about neurosurgical innovations. Countries within this region are investing heavily in modernizing their medical facilities while expanding access to advanced technologies such as neuro-navigation systems. The growing incidence of neurological disorders coupled with an aging population contributes significantly to this trend as more patients seek effective treatment options that require precise navigation during surgery. Local manufacturers are emerging with cost-effective solutions tailored to regional needs, making these technologies more accessible across diverse healthcare settings.

The China neuro-navigation systems market dominates the Asia Pacific with a significant revenue share in 2024. Due to its large population base and increasing prevalence of neurological disorders requiring surgical intervention. The country’s focus on enhancing its healthcare system has led to substantial investments to improve access to advanced medical technologies such as neuro-navigation systems within hospitals nationwide. Ongoing research initiatives to develop innovative applications for these technologies further support growth prospects within China’s market landscape. As awareness about effective treatment options continues rising among patients and healthcare providers alike, demand for neuro-navigation solutions is expected to increase significantly over time.

Key Neuro-navigation Systems Company Insights

Some key companies operating in the market include Medtronic, Stryker, 7D Surgical, Inc. (SeaSpine), Synaptive Medical, and Soterix Medical Inc. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches to expand their market presence and address the evolving healthcare demands through the neuro-navigation systems market.

-

Medtronic offers advanced products in the neuro-navigation systems market, focusing on enhancing surgical precision and patient outcomes. Its flagship NeuroSmart Portable Micro Electrode Recording (MER) Navigation System is specifically designed for Deep Brain Stimulation (DBS) procedures to treat conditions such as Parkinson's. In addition, its portfolio includes the StealthStation S8 Surgical Navigation System, which integrates optical and electromagnetic technologies for comprehensive cranial navigation.

-

Stryker offers a comprehensive array of neuro-navigation products and solutions. Its flagship product includes the iNtellect Cranial Navigation System, which integrates advanced imaging and navigation technologies to assist neurosurgeons during complex procedures. This system features intuitive software and real-time tracking capabilities. In addition, the company portfolio includes the Frameless Guiding System for accurate biopsies and the Skull Mounted Tracker Kit, which enables minimally invasive navigation without rigid fixation.

Key Neuro-navigation Systems Companies:

The following are the leading companies in the neuro-navigation systems market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker

- 7D Surgical, Inc (SeaSpine)

- Synaptive Medical

- Soterix Medical Inc.

- Nexstim Oyj

- Claron Technology Inc.

- Zimmer Biomet

- Brainlab AG

- Northern Digital Inc. (Roper Technologies, Inc.)

Recent Developments

-

In April 2024, Medtronic India launched the NeuroSmart Portable Micro Electrode Recording (MER) Navigation system, designed for Deep Brain Stimulation (DBS) therapy to treat Parkinson’s disease specifically. This innovative system enhances precision during surgeries to alleviate symptoms such as tremors and stiffness common in Parkinson’s patients.

-

In July 2023, Stryker launched the Q Guidance System with Cone Beam Computed Tomography (CBCT) integration. This innovative system enhances surgical precision and efficiency during orthopedic surgeries, particularly joint replacement surgeries. It provides real-time imaging and analytics.

Neuro-navigation Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.25 billion |

|

Revenue forecast in 2030 |

USD 4.75 billion |

|

Growth rate |

CAGR of 7.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Technology,application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Medtronic; Stryker; 7D Surgical; Inc. (SeaSpine); Synaptive Medical; Soterix Medical Inc.; Nexstim Oyj; Claron Technology Inc.; Zimmer Biomet; Brainlab AG; and Northern Digital Inc. (Roper Technologies, Inc.). |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Neuro-navigation Systems Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global neuro-navigation systems market report based on technology, application, end use, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Optical System

-

Electromagnetic System

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Neurosurgery

-

Craniomaxillofacial Surgery

-

Spinal Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Neurology Clinic

-

Ambulatory Surgical Centers (ASCs)

-

Research Centers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."