Neural Processor Market Size, Share & Trend Analysis Report By Operation, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-476-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Neural Processor Market Size & Trends

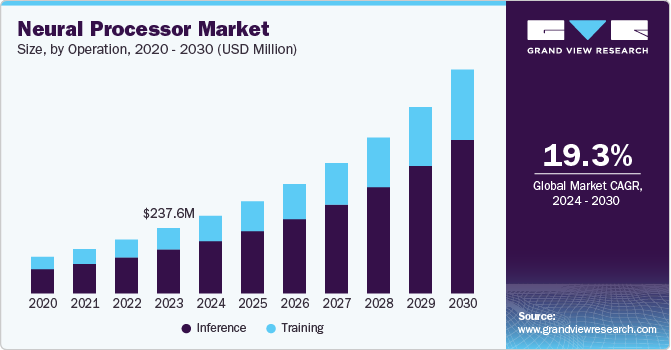

The global neural processor market size was estimated at USD 237.6 million in 2023 and is projected to grow at a CAGR of 19.3% from 2024 to 2030. The neural processor market is growing due to the rapid expansion of artificial intelligence (AI) and machine learning (ML) applications across various sectors. These technologies require specialized hardware capable of processing complex algorithms efficiently, which traditional CPUs and GPUs struggle to handle. Neural processors are specifically designed to manage AI workloads, providing faster performance and greater energy efficiency. This increased capability makes them essential for applications such as autonomous vehicles, real-time analytics, and natural language processing. As AI becomes more prevalent in industries such as healthcare, finance, and manufacturing, the demand for neural processors continues to rise. Companies are investing heavily in research and development to create more advanced neural processors to meet these needs.

Consumer electronics are another key area contributing to the rise of the neural processor market. Devices such as smartphones, smart speakers, and home automation systems are increasingly incorporating AI features to enhance user experiences. Neural processors enable these devices to perform tasks such as voice recognition, image processing, and personalized recommendations more efficiently. As more consumers seek AI-powered functionalities in their devices, manufacturers are integrating neural processors to meet this demand. This trend has led to significant growth in the neural processor market, especially as companies compete to offer the most advanced AI-enabled products. Improvements in semiconductor manufacturing have contributed to the ability to produce neural processors more efficiently and on a larger scale. This combination of consumer demand and technological progress is accelerating the adoption of neural processors.

The growing reliance on cloud computing and edge computing has further accelerated the demand for neural processors. Cloud service providers are increasingly offering AI-as-a-service solutions that depend on neural processors to deliver high-speed, scalable AI capabilities. These processors are critical for managing large volumes of data and performing complex AI computations in real time. In edge computing, neural processors help process data closer to the source, reducing latency and improving decision-making for applications such as autonomous vehicles and smart cities. This decentralization of AI processing requires powerful neural processors to ensure smooth and efficient operations. As both cloud and edge computing grow, neural processors are becoming indispensable for enabling AI in a wide range of scenarios.

Operation Insights

The inference segment led the market and accounted for 67.3% of the global revenue in 2023. The increasing need for real-time AI decision-making drives the growth of inference operations in the neural processor market. Inference involves the application of trained AI models to new data, enabling devices to make predictions or take actions instantly. As AI-powered applications such as speech recognition, facial recognition, and autonomous systems become more widespread, the demand for faster and more efficient inference grows. Neural processors are optimized for handling these inference tasks, providing better performance and lower power consumption compared to traditional hardware. This makes them essential for a wide range of AI-driven technologies in various industries.

The training segment will see significant benefits from the increasing complexity of AI models and the growing demand for AI-driven applications. Training involves teaching AI models to recognize patterns and make predictions based on vast datasets, requiring high computational power. As industries such as healthcare, finance, and autonomous vehicles invest more in AI technologies, the need for specialized hardware to support training processes is expanding. Neural processors, optimized for these intensive tasks, are becoming crucial for efficiently training complex models. This surge in AI development and adoption is anticipated to drive the growth of the training segment in the neural processor market.

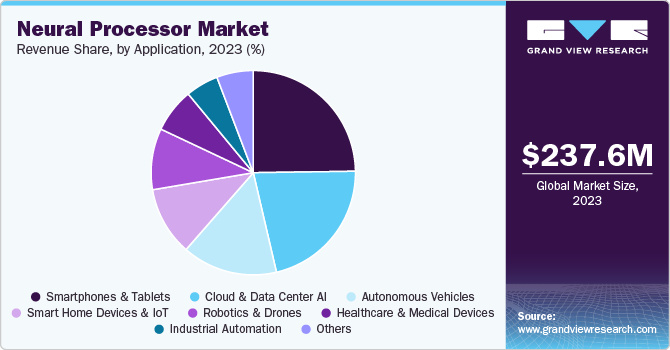

Application Insights

The smartphones and tablets segment accounted for the largest market revenue share in 2023. Smartphones and tablets dominate the neural processor market because of their widespread use and growing integration of AI-driven features. These devices rely heavily on neural processors to enhance performance for tasks like facial recognition, voice assistants, and real-time language translation. The increasing demand for AI-enhanced applications, such as augmented reality and advanced photography, requires the efficient processing power that neural processors provide. Manufacturers are constantly pushing for more powerful AI capabilities in mobile devices to meet consumer expectations. As a result, smartphones and tablets have become the primary applications for neural processors, driving their dominance in this market.

The autonomous vehicle sector is growing rapidly due to advancements in AI, sensor technology, and neural processors. These vehicles rely on AI-powered systems for real-time decision-making, such as object detection, navigation, and collision avoidance. Neural processors are crucial in processing vast amounts of data from sensors, cameras, and radar systems efficiently and quickly, enabling the vehicle to respond to its environment. The push for safer, more reliable autonomous driving solutions has led to increased investment and innovation in this sector. As regulatory frameworks evolve and consumer interest rises, the demand for autonomous vehicles continues to expand.

Regional Insights

North America dominated the market and accounted for 33.2% share in 2023. The North American neural processor market is experiencing significant growth, driven by the increasing demand for advanced artificial intelligence applications. The proliferation of cloud computing and edge devices is propelling the adoption of neural processors across various industries, including healthcare, automotive, and finance. Moreover, key players in the region are investing heavily in research and development to enhance the capabilities and performance of neural processors. The market is also seeing a trend towards the integration of machine learning algorithms, enabling faster data processing and decision-making.

U.S. Neural Processor Market Trends

The U.S. neural processor market is characterized by rapid advancements in technology, particularly in the fields of deep learning and natural language processing. Major technology companies are launching new neural processor models, enhancing computational power and energy efficiency. The growing emphasis on smart devices and the Internet of Things (IoT) is further fueling market growth, as these applications require efficient processing capabilities.

Europe Neural Processor Market Trends

In Europe, the neural processor market is witnessing a surge in demand due to increased investments in artificial intelligence and machine learning technologies. Government initiatives to promote digital transformation are driving the adoption of neural processors in various sectors, including manufacturing and automotive. Moreover, the region is focusing on developing sustainable and energy-efficient processing solutions, aligning with its broader environmental goals. The presence of established tech hubs in countries such as Germany, France, and the UK is fostering innovation and competition within the market.

Asia Pacific Neural Processor Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific (APAC) neural processor market is experiencing rapid expansion, fueled by the region's strong emphasis on technological innovation and digital transformation. Countries such as China, Japan, and India are leading the charge, investing heavily in artificial intelligence research and development to enhance their competitiveness in the global market. The rise of smart cities and the Internet of Things (IoT) initiatives is also driving demand for high-performance neural processors across various industries, including transportation and healthcare. Furthermore, collaborations between tech companies and research institutions are fostering advancements in neural processor capabilities, promoting the development of more efficient and powerful solutions.

Key Neural Processor Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In June 2024, Advanced Micro Devices, Inc. introduced processors optimized for artificial intelligence, including two series Ryzen PRO 8000, an AI-powered desktop processor for business users, and the Ryzen PRO 8040, designed for business laptops. These new Ryzen AI-powered processors aim to provide enhanced dedicated neural processing capabilities, significantly increasing AI processing power compared to previous generations.

Key Neural Processor Companies:

The following are the leading companies in the neural processor market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Arm Limited

- Aspinity, Inc.

- Bitbrain Technologies

- BrainChip, Inc.

- BrainCo, Inc.

- General Vision, Inc.

- Google LLC

- Halo Neuroscience

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

Recent Developments

-

In September 2024, Intel Corporation has released its Core Ultra 200V processors, which are the company's most power-efficient laptop chips to date. The chips include a neural processing unit optimized for running artificial intelligence models, which is four times faster than the previous generation. This new architecture enhances overall efficiency while maximizing computational power.

-

In June 2024, Advanced Micro Devices Inc. introduced its artificial intelligence processors, including the MI325X accelerator, at the Computex technology trade show. The company also detailed its new neural processing units (NPUs), designed to handle on-device AI tasks in AI PCs, as part of a broader strategy to enhance its product lineup with significant performance improvements, including the MI350 series expected to achieve 35 times better inference capabilities compared to its predecessors.

-

In May 2024, Apple Inc. has unveiled the M4 chip for the iPad Pro, utilizing second-generation 3-nanometer technology to enhance power efficiency and enable a thinner design. The chip features a 10-core CPU, a high-performance GPU featuring Dynamic Caching and ray tracing, and the fastest Neural Engine capable of 38 trillion operations per second.

-

In February 2024, MathWorks, Inc., a developer of mathematical computing software, has launched a hardware support package for the Qualcomm Hexagon Neural Processing Unit. This package enables automated code generation from Simulink and MATLAB models customized for Qualcomm’s architecture, improving data accuracy, ensuring standards compliance, and boosting developer productivity.

Neural Processor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 281.4 million |

|

Revenue forecast in 2030 |

USD 813.0 million |

|

Growth rate |

CAGR of 19.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Operation, application and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Advanced Micro Devices, Inc.; Arm Limited; Aspinity, Inc.; Bitbrain Technologies; BrainChip, Inc.; BrainCo, Inc.; General Vision, Inc.; Google LLC; Halo Neuroscience; Intel Corporation; NVIDIA Corporation; Qualcomm Inc.; Samsung Electronics Co. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Neural Processor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neural processor market report based on operation, application and region.

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Training

-

Inference

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones and Tablets

-

Autonomous Vehicles

-

Robotics and Drones

-

Healthcare and Medical Devices

-

Smart Home Devices and IoT

-

Cloud and Data Center AI

-

Industrial Automation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Neural Processor market size was estimated at USD 237.6 million in 2023 and is expected to reach USD 281.4 million in 2024.

b. The global Neural Processor market is expected to grow at a compound annual growth rate of 19.3% from 2024 to 2030 to reach USD 813.0 million by 2030.

b. North America dominated the Neural Processor market with a share of 33.2% in 2023. This is attributable to its strong adoption of advanced technologies, significant investments from key players in the AI sector, and the increasing demand for neural processors across various industries, including healthcare, finance, and retail.

b. Some key players operating in the Neural Processor market include Advanced Micro Devices Inc., Arm Limited, Aspinity, Inc., Bitbrain Technologies, BrainChip, Inc., BrainCo, Inc., General Vision, Inc., Google LLC, Halo Neuroscience, Intel Corporation, NVIDIA Corporation, Qualcomm Inc., and Samsung Electronics Co. Ltd.

b. Key factors that are driving the market growth include the increasing demand for artificial intelligence applications across various industries, advancements in machine learning algorithms, and the proliferation of edge computing technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."