Network Traffic Analysis Market Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment (On-premise, Cloud), By Organization Size, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-305-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Network Traffic Analysis Market Trends

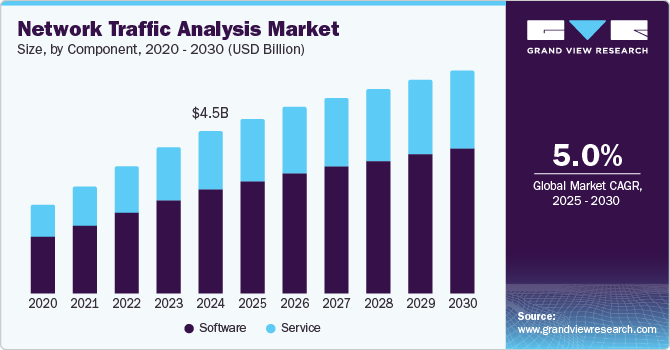

The global network traffic analysis market size was valued at USD 4.52 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. The increasing complexity of network environments, driven by the rise of cloud services and the proliferation of connected devices, necessitates advanced tools for effective management and security. Organizations are increasingly concerned about cyber threats, leading to a heightened demand for robust network traffic analysis solutions that provide real-time visibility into network activities.

The surge in cyber threats has heightened the demand for robust monitoring systems to detect anomalies and mitigate risks. For instance, the Australian Cyber Security Centre (ACSC) reported receiving more than 76,000 cybercrime reports, reflecting an increase of nearly 13% from the previous financial year. Moreover, the ongoing digital transformation across various industries drives the demand for advanced network management solutions that address the requirements of cloud computing and Internet of Things (IoT) devices. Organizations increasingly adopt these technologies and require sophisticated tools to manage and optimize network performance effectively.

Moreover, as businesses seek to leverage big data analytics for strategic insights, comprehensive visibility into network performance becomes essential. Enhanced analytics capabilities allow organizations to optimize their network resources, improve user experiences, and proactively address potential issues before they escalate. This growing reliance on data analytics supports operational efficiency and fosters innovation, making it a vital factor in the continued expansion of the network traffic analysis industry.

Component Insights

The software segment dominated the market with a share of 64.0% in 2024. This dominance can be attributed to the growing need for advanced analytics and monitoring tools that help organizations manage complex network environments. As data traffic continues to increase, businesses are investing in software solutions that provide real-time insights, enhance security measures, and optimize network performance. For instance, Suricata is an open-source Intrusion Detection System (IDS) that monitors network traffic and offers intrusion prevention, network security monitoring, and packet capture capabilities. It analyzes network traffic for known attack patterns and identifies suspicious activities, enabling real-time detection of potential malware behaviors. The ability to analyze large volumes of data effectively has made software an essential component for organizations aiming to maintain operational efficiency and safeguard against cyber threats.

The service segment is projected to grow at a significant CAGR during the forecast period, driven by the increasing demand for professional support in the network traffic analysis industry. As organizations increasingly adopt complex network management solutions, they require expert assistance for implementation, configuration, and ongoing management to maximize their investments. This trend is particularly evident as businesses seek to effectively enhance their internal capabilities in managing network traffic. Services such as training, consulting, and managed services are becoming integral to ensuring that organizations can navigate the details of their network environments.

Deployment Insights

The on-premise segment dominated the market with the largest revenue share in 2024 due to organizations' preference for controlling their sensitive data and infrastructure. Many businesses, particularly in highly regulated industries such as finance and healthcare, prioritize on-premise solutions to meet stringent compliance requirements and ensure data security. These deployments allow organizations to implement robust security measures tailored to their specific needs while minimizing exposure to external vulnerabilities associated with cloud solutions.

The cloud segment is projected to grow at the highest CAGR during the forecast period. The shift toward cloud deployment is driven by factors such as scalability, cost-effectiveness, and ease of access to advanced analytics tools. Cloud solutions enable businesses to quickly adapt to changing demands without significant upfront investments in infrastructure. In addition, the rise of remote work has accelerated the need for cloud-based network management tools to provide real-time visibility and control over distributed networks.

Organization Size Insights

The large enterprise segment dominated the market with the largest revenue share in 2024 due to substantial investments made by these organizations in optimizing their network management and security protocols. Large enterprises often face complex network environments characterized by high volumes of data traffic across multiple locations. Consequently, they require advanced traffic analysis tools that can provide comprehensive visibility into their networks while ensuring compliance with regulatory standards. The significant resources these organizations allocate toward cybersecurity measures underscore their commitment to protecting sensitive information from increasing cyber threats.

The SME segment is expected to grow at the highest CAGR over the forecast period as Small and Medium Enterprises (SMEs) increasingly recognize the importance of robust network management solutions. The proliferation of affordable cloud-based offerings has made it easier for SMEs to access advanced network traffic analysis tools that were previously only feasible for larger organizations. This growing awareness among SMEs about cybersecurity risks is prompting them to invest in effective monitoring systems to safeguard their operations against potential breaches while enhancing overall operational efficiency.

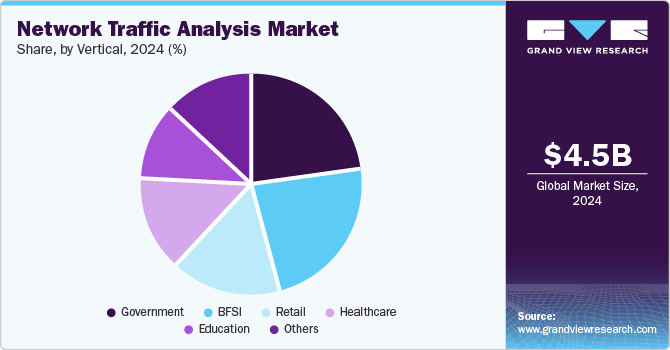

Vertical Insights

The government segment dominated the market with the largest revenue share in 2024 due to stringent regulatory requirements and a strong focus on cybersecurity initiatives. Government agencies are tasked with protecting sensitive information from cyber threats while ensuring compliance with various data privacy and security regulations. Investments in network traffic analysis solutions are critical for maintaining secure communications across government networks and safeguarding critical infrastructure from potential attacks. For instance, the Department of Homeland Security (DHS) Science and Technology Directorate’s Secure and Resilient Mobile Network Infrastructure (SRMNI) and Emergency Communications Research and Development Program provide research and development support for the Cybersecurity & Infrastructure Security Agency (CISA) 's priorities. As cyber threats continue to evolve, government entities are increasingly adopting sophisticated monitoring tools that enhance their ability to detect anomalies and respond effectively to incidents.

The healthcare segment is expected to grow at the highest CAGR over the forecast period as healthcare providers prioritize data security and compliance with regulations such as HIPAA. The rise of telehealth services and digital health records has amplified the need for effective network traffic analysis tools to monitor patient data flows while ensuring privacy and security. As healthcare organizations strive to improve their IT infrastructure in response to increasing cyber threats, investments in comprehensive network traffic analysis solutions become essential for maintaining trust among patients and stakeholders while ensuring operational integrity within this critical sector.

Regional Insights

North America network traffic analysis market dominated the global market with a revenue share of 28.8% in 2024 due to the region's advanced IT infrastructure, which supports the deployment of sophisticated network management solutions. The rapid adoption of emerging technologies, such as artificial intelligence and machine learning, has further enhanced the capabilities of network traffic analysis tools, enabling organizations to monitor and secure their networks efficiently. In addition, the increasing frequency of cyber threats has prompted businesses in North America to invest heavily in network traffic analysis solutions to protect sensitive data and maintain compliance with regulatory standards.

U.S. Network Traffic Analysis Market Trends

The U.S. network traffic analysis market dominated the regional market in 2024. The country's robust economy and technological advancements have fostered a conducive environment for the growth of the network traffic analysis industry. Major technology companies and data center operators are concentrated in the U.S., driving innovation and competition within this sector. Furthermore, government initiatives aimed at enhancing cybersecurity measures have bolstered demand for network traffic analysis tools as organizations seek to implement comprehensive monitoring systems that can detect and respond to potential threats effectively.

Asia Pacific Network Traffic Analysis Market Trends

The Asia Pacific network traffic analysis market is expected to grow at the highest CAGR from 2025 to 2030, driven by rapid digital transformation across the region. Countries including India, Japan, and Australia are experiencing significant increases in internet penetration and connected devices, leading to a surge in data traffic that necessitates effective network management solutions. In addition, the growing awareness of cybersecurity threats has prompted organizations in the Asia Pacific region to adopt advanced network traffic analysis tools to safeguard their operations. For instance, a China Judicial Big Data Research Institute report revealed that Chinese courts arbitrated 282,000 cybercrime cases between 2017 and 2021. Furthermore, the expansion of IT infrastructure and investments in cloud computing further support this growth trajectory within the network traffic analysis market.

China network traffic analysis market dominated the Asia Pacific region in 2024. The country's rapid economic growth has led to significant telecommunications and IT infrastructure advancements, creating a favorable environment for adopting network traffic analysis solutions. As Chinese enterprises increasingly recognize the importance of data security and operational efficiency, investments in network monitoring tools have surged. Moreover, government policies promoting technological innovation and cybersecurity initiatives play a crucial role in driving demand for effective network traffic analysis within China.

Europe Network Traffic Analysis Market Trends

Europe network traffic analysis market is expected to grow at a significant CAGR from 2025 to 2030, fueled by increasing regulatory pressures and a focus on data protection. The European Union's stringent data privacy regulations, such as GDPR, have compelled organizations to enhance their security measures and invest in comprehensive monitoring solutions. As businesses strive to comply with these regulations while managing complex networks, demand for advanced network traffic analysis tools is rising. In addition, the growing emphasis on digital transformation across various European sectors fosters innovation within the network traffic analysis industry.

Key Network Traffic Analysis Company Insights

The network traffic analysis market features several key players that shape its landscape. Arista Networks, Inc. provides advanced telemetry solutions for real-time visibility into network performance, while Broadcom enhances its offerings through strategic acquisitions that improve network management capabilities. Cloudflare, Inc. focuses on integrating robust security features with its network analysis tools, while Zoho Corporation Pvt. Ltd. offers analytics solutions that empower businesses to monitor and analyze network traffic effectively. These companies play a significant role in shaping the network traffic analysis industry.

-

Arista Networks, Inc. specializes in advanced network observability solutions that enhance visibility and security across high-density networks. The company offers a range of products, including the DANZ Monitoring Fabric, which provides real-time monitoring and analytics capabilities for network traffic. Arista’s solutions are designed to support non-blocking packet capture and advanced telemetry, enabling organizations to optimize their network performance while ensuring robust security measures.

-

Cloudflare, Inc. provides a suite of tools that enhance the security and reliability of internet applications. The company’s network traffic analysis solutions integrate seamlessly with its Content Delivery Network (CDN) and security offerings, allowing organizations to monitor traffic patterns and detect anomalies in real-time. Cloudflare’s platform is designed to protect against DDoS attacks and other cyber threats while ensuring optimal performance for users worldwide.

Key Network Traffic Analysis Companies:

The following are the leading companies in the network traffic analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Arista Networks, Inc.

- Broadcom

- Cloudflare, Inc.

- Fortra, LLC

- Kentik

- Zoho Corporation Pvt. Ltd.

- NEC Corporation

- NETSCOUT

- Netreo

- Progress Software Corporation

Recent Development

-

In March 2024, Arista Networks, Inc. announced a new network observability software integrating network infrastructure performance with computer and server systems data. This offering aims to provide valuable insights into application and workload performance across wide-area networks, campuses, and data centers. The software, known as CloudVision Universal Network Observability (CV UNO), automates visibility for networks, systems, and applications while utilizing AI-driven analysis to enhance operational efficiency and reduce human error.

-

In November 2024, Broadcom Inc. announced significant advancements in its VeloCloud product portfolio to enhance enterprises' capabilities in connecting and supporting both AI and non-AI workloads. A key element of this announcement is the VeloRAIN (Robust AI Networking) architecture, which harnesses artificial intelligence and machine learning to enhance the performance and security of distributed AI workloads.

Network Traffic Analysis Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.87 billion |

|

Revenue forecast in 2030 |

USD 6.21 billion |

|

Growth Rate |

CAGR of 5.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, organization size, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa |

|

Key companies profiled |

Arista Networks, Inc.; Broadcom; Cloudflare, Inc.; Fortra, LLC; Kentik; Zoho Corporation Pvt. Ltd.; NEC Corporation; NETSCOUT; Netreo; Progress Software Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Network Traffic Analysis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global network traffic analysis market report based on component, deployment, organization size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprise

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Government

-

Retail

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."