Network Security Market Size, Share, & Trends Analysis Report By Component (Solution, Services), By Solution (Firewall, Antivirus), By Enterprise Size, By Deployment, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-156-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Network Security Market Size & Trends

The global network security market size was estimated at USD 21.46 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 12.6% from 2023 to 2030. The rising incidents of unsecured devices hampering organizational networks and affecting privacy laws demand businesses invest significant costs and resources to ensure network security. It ensures a higher level of authorization, authentication, and compliance policies across the users’ network. Furthermore, network security solutions also enable users to instantly identify and block devices, endpoints, and users from forming unwanted connections. Thus, network security solution offers higher protection against security breaches, safeguard critical information, help minimize malicious activities, and provide greater visibility on the security positioning of connected devices.

The recent trends, such as bring your own devices, hybrid work culture, and remote working, are constantly driving the dependency of users’ devices on organizational networks and are among the key factors driving the growth of network security across various industries such as BFSI, healthcare, government, IT & Telecommunication, and manufacturing. Furthermore, the growing use of the Internet of Things (IoT) and other connected technologies is being rapidly utilized by organizations, leading to potential threats of offering access to malicious and unsecured applications and devices. Thus, organizations that aim to remain protected against data theft, cybercrimes, and malware are significantly adopting network security solutions that help them maintain control over their network, monitor security postures, and authorize and deny access.

Network security solutions are gaining higher importance among organizations that work with systems and networked data. Furthermore, these solutions enhance network performance, manage network traffic, and ensure secure data sharing among data sources and employees. For instance, in October 2023, Kyndryl Inc. announced a strategic partnership with Palo Alto Networks, which is aimed at integrating Palo Alto Networks' platform security capabilities with Kyndryl Inc.'s network security services expertise to design, build, modernize, and manage mission-critical networking for customers across various end-user industries.

The growing adoption of IoT devices, web applications, and industrial software across verticals such as IT and telecommunication, BFSI, and healthcare contains highly sensitive information related to vendors, customers, and employees. These organizations need to maintain strict security regulatory compliance and verification guidelines, along with spending a significant amount to install network security solutions. For instance, in June 2023, Fortinet, a networking and security solutions company, announced that its Secure SD-WAN solution was adopted by 11 renowned managed security service providers named as a solution by STC, Claro Empresas, KT Corporation, Globe Business, Kyndryl, InfiniVAN, Inc., SPTel, 11:11 Systems, Sify Technologies, Tata Teleservices, and Neurosoft S.A. to provide superior user experience and drive better security outcomes without compromising security positioning.

Key companies in the market are undertaking various strategic initiatives, including new product launches, mergers and acquisitions, and partnerships to offer advanced solutions and service offerings. For instance, in September 2023, Oracle Corporation announced its participation in a wide initiative to create an innovative open standard for data and network security. Based on the initiative, Oracle Corporation will collaborate with key technology providers, applied inventions, and other leading organizations to release its Oracle Zero-Trust Packet Routing Platform, which will help businesses restrict unauthorized access and use of organizational data without putting extra complications and hurdles for legitimate activities.

Component Insights

The solution segment held the largest revenue share of 73.84% in 2022. The solution segment consists of network access control, unified threat defense, data loss prevention, IDS/IPS, firewall, antivirus, wireless security, DDoS, and VPN design to provide dynamic network security functionalities and high-performance capabilities. These advanced network security solutions provide network security, endpoint security, and web-based application security, enabling superior visibility, representation of real-time threats, and identity and access management across the users’ network. These are among the key factors anticipated to drive the growth of the solution segment in the market.

The services segment is anticipated to grow at a CAGR of 14.5% over the forecast period. Network services include deployment, maintenance, customer support, training, and consultation services. The rising demand for network security software, devices, and infrastructures is aimed at driving the service segments for an extended period owing to the regular need for license renewal, support and maintenance, and customer support requirements. These are among the key factors anticipated to drive the growth of the service segment in the market.

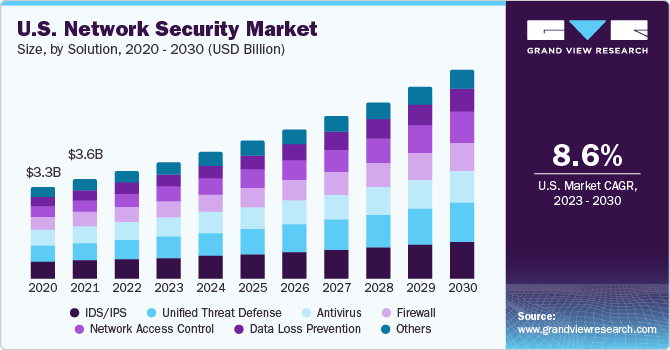

Solution Insights

The IDS/IPS segment held the largest revenue share of 18.77% in 2022. Intrusion detection systems (IDS) and intrusion prevention systems (IPS) are gaining constant attraction as they offer enhanced capabilities such as real-time network monitoring, identifying possible incidents, logging information about these incidents, and stopping and reporting them to security administrators. In addition, network operators also use IDS/IPS to evaluate problems with security policies and warn individuals from violating them. IDS/IPS is becoming a significant addition to the security infrastructure among organizations as it can stop attackers from gathering confidential information related to the users’ network. It is among the key factors anticipated to drive the growth of the IDS/IPS segment in the market for network security.

The network access control (NAC) segment is anticipated to grow at a CAGR of 14.1% during the forecast period. The demand for network access control solutions is rising among organizations as they protect organizational data and resources from theft and hacking by cybercriminals. NAC ensures that only organizational devices and users with proper permissions can access the network and networked resources. Furthermore, NAC solutions also help in identifying potential subjects that can participate in an attack and, therefore, quarantine and block access to that particular subject until the investigation is completed. Thus, the following capabilities offered by NAC are anticipated to drive market growth over the forecast period.

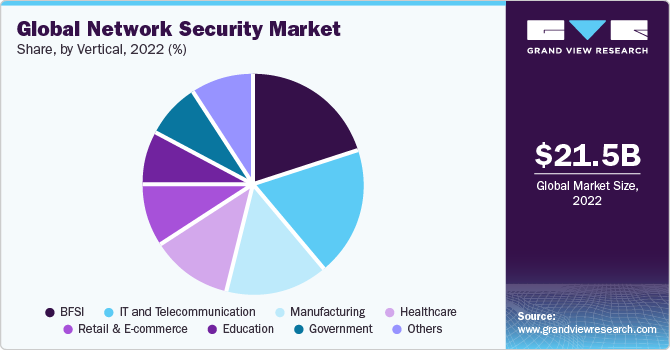

Vertical Insights

The BFSI segment held the largest market share of 20.10% in 2022. The banking and financial industries are constantly witnessing higher risks of cybersecurity breaches, data theft, network hijackings, and device compromises. Meanwhile, these industries are significantly expanding their IT spending on the latest technologies, web-based applications, and IoT devices, making them highly vulnerable to security breaches. Thus, the demand for network security solutions, including network access control, Unified Threat Defense, Data Loss Prevention, IDS/IPS, Firewall, and antivirus solutions, is rapidly growing among banking and financial services organizations.

The IT and Telecommunication segment is anticipated to grow at a CAGR of 15.2% during the forecast period. IT and Telecommunication sector are witnessing a significant surge in data security breaches and cyberattacks owing to the availability of large customer data, sharing of sensitive data through large networks, rapid use of digital technologies, and increased application of connected devices. Furthermore, the rising security concerns and growing awareness among organizations are aimed at driving the demand for network security solutions among the IT and Telecommunication industries.

Deployment Insights

The cloud-based segment held the largest revenue share of 52.26% in 2022. Cloud-based network security is primarily defined as a pay-per-use or subscription model. It allows organizations to utilize advanced network security solutions from the cloud infrastructure. Cloud-based network security offers a cost-effective and flexible way for organizations to ensure network security depending on demand, usage, and buying capabilities. Thus, the following factors are anticipated to drive the cloud-based network security segment over the forecast period.

The on-premise segment is anticipated to grow at a CAGR of 11.2% over the forecast period. On-premise network security provides an in-house solution offering where an organization can maintain their network’s security with greater flexibility depending upon their business goals, focus areas, demand, and customized security requirements, along with providing complete control on the use and management of network security solutions. Thus, the following factors are anticipated to drive the on-premise segment growth in the market.

Enterprise Size Insights.

The large enterprise segment held the largest market share of 55.25% in 2022. The growing incidences of data theft, cyberattacks, and security breaches due to the rapid use of connected devices, remote work cultures, and application of unsecured networks to access organizational data are among the key factors attracting cyber attackers toward large organizations such as IT companies, banking and financial institutions, healthcare businesses, and government organizations. Therefore, ensuring the safety and confidentiality of organizational networks is becoming a highly important aspect within large organizations.

The SMEs segment is anticipated to grow at the fastest CAGR of 13.4% over the forecast period. Small and medium enterprises are emerging as the most targeted and exploited industries by cybercriminals owing to limited adoption of security solutions, lack of technological infrastructures, and limited availability of resources. Furthermore, the rising technological advancements by key players in the market aimed at providing reliable and cost-effective solutions are among the key factors anticipated to drive market growth within the SME segment.

Regional Insights

North America held the major share of 34.19% of the target market in 2022. The market is anticipated to witness positive growth owing to the growing demand for network security solutions and services among key end-use industries, including BFSI, Government, Healthcare, Education, IT, and Telecom. Data thefts and cybercriminals are constantly targeting these industries in the region to gain access to sensitive organizational networks and devices accommodating exorbitant organizational and personal data. These are the primary factors aimed at driving the North American market growth.

Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 15.1%. The rising adoption of advanced technologies, including IoT-connected devices in major end-use industries, such as IT and Telecommunication, healthcare, BFSI, retail, manufacturing, and others, along with the growing regulatory policies and security compliance to safeguard customer data in BFSI and IT sectors is driving the demand for network security solutions in Asia Pacific. Furthermore, the significantly growing industrial infrastructure, large customer base, and rising awareness among organizations towards the adoption of network security solutions are anticipated to boost the adoption of network security solutions in the Asia Pacific region.

Key Companies & Market Share Insights

The key operating players in the market include Palo Alto Networks, Fortinet, Cisco, CrowdStrike, IBM Corporation, Trend Micro, Rapid7, Check Point, Microsoft Corporation, Sophos, Broadcom, VMware, Trellix, Proofpoint, and Akamai Technologies. To broaden their software offering, these players are utilizing a variety of strategic initiatives, such as mergers, partnerships, and acquisitions. For instance, in 2023, LogRhythm, a cyber security solution provider, announced a strategic partnership with Zscaler, Inc., a cloud security company, with the aim to help businesses across the world, gain greater network insight, and handle a variety of security challenges, including those encountered by the modern security teams. Thus, the following advancements by key players in the market are expected to drive the market growth.

Key Network Security Companies:

- Palo Alto Networks

- Fortinet

- Cisco

- CrowdStrike

- IBM Corporation

- Trend Micro

- Rapid7

- Check Point

- Microsoft Corporation

- Sophos

- Broadcom

- VMware

- Trellix

- Proofpoint

- Akamai Technologies

Network Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 24.11 billion |

|

Revenue forecast in 2030 |

USD 55.37 billion |

|

Growth rate |

CAGR of 12.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component; solution; enterprise size; deployment; vertical; region |

|

Regional Scope |

North America; Asia Pacific; Europe; MEA;Latin America |

|

Country Scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; United Arab Emirates (UAE); Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Palo Alto Networks; Fortinet; Cisco; CrowdStrike; IBM Corporation; Trend Micro; Rapid7; Check Point; Microsoft Corporation; Sophos; Broadcom; VMware; Trellix; Proofpoint; Akamai Technologies |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Network Security Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global network security market report based on component, solution, deployment, enterprise size, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Network Access Control

-

Unified Threat Defense

-

Data Loss Prevention

-

IDS/IPS

-

Firewall

-

Antivirus

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecommunication

-

Retail & E-commerce

-

Healthcare

-

Manufacturing

-

Government

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global network security market size was estimated at USD 21.46 billion in 2022 and is expected to reach USD 24.11 billion in 2023.

b. The global network security market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 55.37 billion by 2030.

b. The BFSI segment accounted for the largest market share of 20.10% in 2022. The banking and financial industries are constantly witnessing higher risks of cybersecurity breaches, data theft, network hijackings, and device compromise. Meanwhile, these industries are significantly expanding their IT spending on the latest technologies, web-based applications, and IoT devices, making them highly vulnerable to security breaches.

b. Some key players operating in the network security market include Palo Alto Networks, Fortinet, Cisco, CrowdStrike, IBM Corporation, Trend Micro, Rapid7, Check Point, Microsoft Corporation, Sophos, Broadcom, VMware, Trellix, Proofpoint, and Akamia Technologies, amongst others.

b. Network security solutions are gaining higher importance among organizations that work with systems and networked data. Further, these solutions enhance network performance, manage network traffic, and ensure secure data sharing among data sources and employees.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."