Network Probe Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premise), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End-use (Service Providers), By Region And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-311-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Network Probe Market Size & Trends

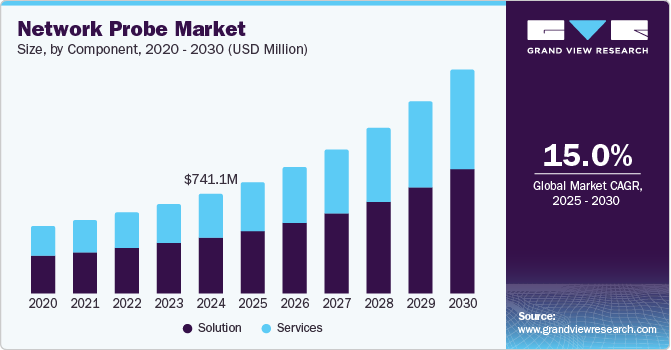

The global network probe market size was valued at USD 741.1 million in 2024 and is projected to grow at a CAGR of 15.0% from 2025 to 2030. The market growth can be attributed to increasing security concerns and network complexity. Furthermore, the need to resolve network downtime issues and stress that occur due to the exponential rise in IP traffic is accentuating the market growth.

An increasing number of companies shifting toward the latest cloud-based technologies also creates a need for established network frameworks. A network probe is a network traffic protocol and monitor analyzer that provides users with real-time data on network traffic status. It provides information on the volume and type of network traffic and assists in identifying potential bottlenecks and issues in the computer network. The increasing demand for managing networks among small businesses and IT departments is driving the market growth. Network monitoring tools enable users to monitor real-time as well as past network statistics by selecting a suitable time interval.

The increasing incidence of cyber-attacks and the growing number of network-connected devices are projected to propel the market. As organizations face heightened security threats, the demand for robust network monitoring and analysis tools has surged. Network probes are crucial in identifying vulnerabilities, detecting intrusions, and ensuring the security of data traffic. Moreover, the proliferation of Internet of Things (IoT) devices expands the need for continuous monitoring, further boosting market growth as businesses prioritize network visibility and protection against evolving cyber threats.

Component Insights

The solution segment held the largest revenue share of 56.1% in 2024, fueled by the increasing demand for advanced network monitoring, security, and performance optimization. Businesses across industries leverage sophisticated solutions for real-time network analytics, troubleshooting, and proactive threat detection. The rise in data traffic, coupled with growing cybersecurity concerns, has amplified the need for efficient network management tools. These solutions provide deep insights into network performance, enabling enterprises to identify and address issues swiftly, leading to increased adoption and dominance in the network probe industry.

The services segment is anticipated to be the fastest-growing segment at a CAGR of 15.3% over the forecast period due to the growing need for customized solutions, seamless integration, and continuous support. As organizations adopt complex network probe technologies, the demand for professional services such as consulting, deployment, training, and maintenance is rising. These services ensure businesses can optimize network performance, improve security, and manage their infrastructure efficiently. With the increasing complexity of networks and the need for expert assistance, the services segment is set to witness significant growth in the coming years.

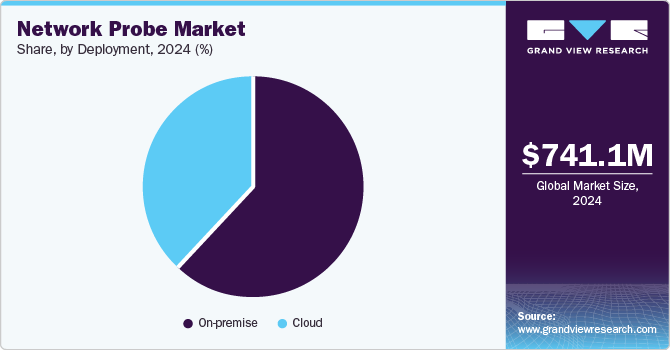

Deployment Insights

The on-premise segment dominated the market with the largest revenue share in 2024, owing to its enhanced security, control, and customization capabilities. Many organizations prefer on-premise solutions to maintain full control over their network data, ensuring compliance with internal security policies and regulatory requirements. These solutions offer more robust privacy, minimize latency, and provide the ability to integrate seamlessly with existing infrastructure. As businesses continue to prioritize data security and reliability, the on-premise deployment model remains highly favored, driving its dominance in the network probe industry.

The cloud segment is set to be the fastest-growing segment and register a substantial CAGR from 2025 to 2030, propelled by the growing adoption of cloud-based infrastructures and services. As businesses increasingly migrate to the cloud, the demand for advanced network monitoring tools will rise to ensure optimal performance, security, and reliability. Cloud network probes can provide real-time insights, enabling enterprises to manage complex cloud environments effectively. This shift is expected to drive significant growth in cloud-based network probes, accelerating market expansion.

Enterprise Size Insights

The large enterprises segment held the largest revenue share in 2024. This share can be attributed to its extensive and intricate network infrastructure that requires advanced monitoring and security solutions. These enterprises rely on network probes to ensure high performance, minimize downtime, and detect threats in real time. The need for robust analytics, compliance with industry regulations, and the growing volume of data further fuel the adoption of network probe technologies. In addition, large enterprises have significant IT budgets, enabling them to invest in comprehensive solutions and solidify their dominance in the market.

The small and medium enterprises segment is expected to experience the fastest growth and record a significant CAGR over the forecast period. With the growing reliance of businesses on digital infrastructure, the need for robust network monitoring solutions to ensure security, performance, and uptime is increasing among Small and Medium Enterprises (SMEs). Moreover, the rising cyber threats and the need for efficient data management also drive adoption of network probes by SMEs, helping optimize their IT systems. The growing affordability and scalability of these technologies make them attractive to SMEs, which is expected to contribute to the market expansion in the coming years.

End-use Insights

The enterprises segment accounted for the largest revenue share in 2024, fueled by the growing complexity of network infrastructures and the need for robust performance management and security solutions. As businesses increasingly rely on digital platforms, the demand for real-time monitoring, traffic analysis, and threat detection has surged. Enterprises require comprehensive network probe solutions to ensure seamless operations, data integrity, and compliance with industry standards. The significant IT budgets and a focus on network optimization drive widespread market adoption among enterprises, solidifying their leading position in the network probe industry.

The service providers segment is anticipated to register the highest growth over the forecast period. These providers are experiencing an increased demand for advanced network technology due to the rise in the adoption of 5G and IOT. Moreover, the significant volume of data running via data centers has created a demand for enhanced network monitoring tools. To improve subscriber experience and outperform competitors, service providers focus on offering a robust network that enhances performance, security, and visibility.

Regional Insights

North America network probe market held the largest share of 29.0% in 2024. This growth is attributable to the high investment in network infrastructure, the increase in transition to 5G networks, and the significant adoption of cloud edge computing. Advanced network monitoring solutions become critical as telecom operators and enterprises enhance their networks to support high-speed 5G and decentralized cloud computing. Network probes enable real-time performance monitoring, troubleshooting, and security, ensuring optimal operation across these complex systems. This increasing demand for network visibility and reliability in evolving infrastructure propels regional market growth.

U.S. Network Probe Market Trends

The U.S. network probe market accounted for the largest revenue share in 2024. The growing adoption of cloud-based network probe solutions and advanced digital technologies by enterprises shapes the network probe industry in the country. Cloud-based probes offer enhanced scalability, flexibility, and cost-efficiency, appealing to businesses seeking streamlined network monitoring and management. As enterprises increasingly depend on complex IT systems, the need for real-time network visibility, performance analysis, and troubleshooting grows, boosting market demand. Furthermore, the heightened focus on cybersecurity across industries further accelerates the need for advanced network probe solutions in the U.S.

Europe Network Probe Market Trends

Europe network probe market is experiencing significant growth. The increasing focus on cybersecurity and the growing demand for real-time monitoring drive the regional market. As cyber threats become more sophisticated, organizations require advanced tools to detect and mitigate security risks, creating a higher demand for network probes. Besides, the need for real-time network monitoring to ensure continuous performance, efficiency, and security is impelling market growth. Businesses prioritize proactive detection and immediate response capabilities, further fueling the adoption of network probes across various industries in Europe.

Asia Pacific Network Probe Market Trends

Asia Pacific network probe market is projected to emerge as the fastest-growing region and expand at a CAGR of 15.9% from 2025 to 2030, driven by the adoption of network probes by SMEs and the rise in digital transformation. As SMEs increasingly embrace digital technologies such as cloud computing, IoT, and AI, using efficient network management and security becomes paramount. Network probes offer vital insights into performance, helping businesses ensure seamless operations. This surge in digitalization across the region, coupled with growing concerns over network security, is anticipated to fuel the demand for network probe solutions.

India network probe market is projected to record the highest CAGR during the forecast period, due to the increasing complexity of network infrastructures and the rising demand for robust network monitoring and security solutions. As businesses adopt advanced technologies and digital solutions, managing network performance and ensuring security becomes critical. The growing frequency of cyberattacks and the need for real-time network visibility fuel this demand. Network probes provide essential tools for monitoring, troubleshooting, and safeguarding networks, making them indispensable for Indian organizations, thereby expanding the network probe industry in the country. In January 2025, Keysight Technologies, Inc. introduced AppFusion, an all-in-one network visibility program that integrates third-party security and monitoring tools into its network packet brokers. By integrating leading technologies from Forescout, Instrumentix, and Nozomi Networks, the program helps customers optimize network and security operations while reducing infrastructure costs.

Key Network Probe Company Insights

Some of the key companies in the network probe market include SolarWinds Worldwide, LLC; NETSCOUT; Broadcom; IBM; Cisco Systems, Inc.; Nokia; Catchpoint Systems, Inc.; Cubro Network Visibility; Kentik; and NEC Corporation.

-

IBM offers a wide range of technology solutions, including cloud computing, AI, data analytics, cybersecurity, and enterprise software. It delivers innovative services that enable businesses to improve efficiency, make better decisions, and drive digital transformation.

-

Cisco Systems, Inc. provides networking hardware, software, cybersecurity solutions, and cloud-based services. It specializes in routers, switches, firewalls, collaboration tools, and IoT technologies, helping businesses optimize network performance, security, and digital transformation.

Key Network Probe Companies:

The following are the leading companies in the network probe market. These companies collectively hold the largest market share and dictate industry trends.

- SolarWinds Worldwide, LLC

- NETSCOUT

- Broadcom

- IBM

- Cisco Systems, Inc.

- Nokia

- Catchpoint Systems, Inc.

- Cubro Network Visibility

- Kentik

- NEC Corporation

Recent Developments

-

In February 2025, NEC Corporation developed a vRAN solution that supports the interfaces and components recently specified by the O-RAN Alliance. This integration aims to enhance the security, performance, and scalability of Open vRAN deployments.

-

In December 2024, Rohde & Schwarz expanded its portfolio by launching a network monitoring probe tailored for mobile network operators and private enterprises and mission-critical networks. This solution is designed to enhance network performance and security.

-

In May 2021, Catchpoint integrated with Google Cloud, offering IT teams user-focused insights into the performance and health of applications and infrastructure on the platform. It is also available on Google Cloud Marketplace for simplified billing.

Network Probe Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 832.1 million |

|

Revenue forecast in 2030 |

USD 1,671.3 million |

|

Growth rate |

CAGR of 15.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; India; China; Japan; Australia; South Korea; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

SolarWinds Worldwide, LLC; NETSCOUT; Broadcom; IBM; Cisco Systems, Inc.; Nokia; Catchpoint Systems, Inc.; Cubro Network Visibility; Kentik; NEC Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Network Probe Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global network probe market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Consulting

-

Integration & Deployment

-

Training & Support

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Service Providers

-

Enterprises

-

BFSI

-

IT & Telecom

-

Government

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."