- Home

- »

- Communications Infrastructure

- »

-

Network Equipment Market Size And Share Report, 2030GVR Report cover

![Network Equipment Market Size, Share & Trends Report]()

Network Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Connectivity (2G/3G, 4G LTE), By Network Type, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-017-8

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Network Equipment Market Summary

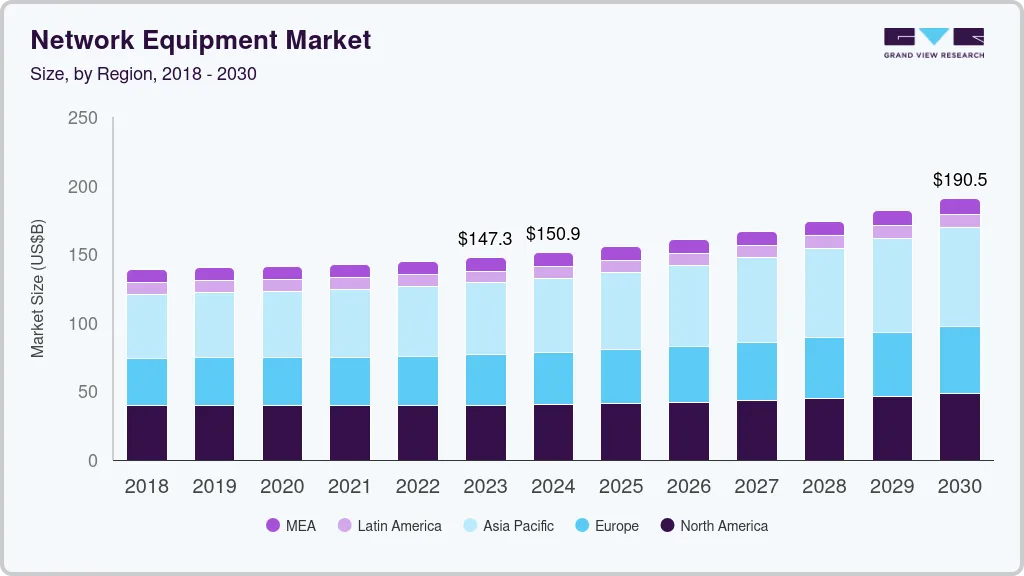

The global network equipment market size was estimated at USD 144.7 billion in 2022 and is projected to reach USD 190.5 billion by 2030, growing at a CAGR of 3.7% from 2023 to 2030. The rising deployment of Internet of Things (IoT) enabled devices across consumer, commercial, and industrial infrastructure is one of the leading factors driving demand for the equipment.

Key Market Trends & Insights

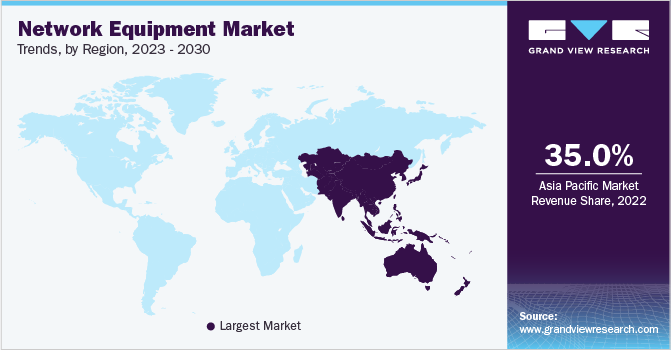

- Asia Pacific dominated the network equipment market in 2022 with a share of over 35% of the global revenue.

- The network equipment market in U.S. is expected to register significant CAGR over the forecast period.

- By component, the hardware segment dominated the market with a share of 57% in 2022.

- By connection, the 4G LTE segment dominated the market with a share of 72% in 2022.

- By network type, the public segment dominated the market with a share of 67% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 144.7 Billion

- 2030 Projected Market Size: USD 190.5 Billion

- CAGR (2023-2030): 3.7%

- Asia Pacific: Largest market in 2022

The equipment comprises the components used for setting up the network infrastructure. The market consists of network equipment hardware, software, and related services. The advent of 5G technology is anticipated to further augment the adoption of connected devices across organizations to extract relevant information from business data.Furthermore, the increase in the penetration of smart and connected devices is positively impacting the growth of the global network devices market. In addition, many enterprise customers are updating their network equipment infrastructure to improve security and ensure more efficient data exchange. Several enterprise businesses are heavily investing in creating a smart office environment by embracing technologies such as Machine Learning (ML), Augmented/Virtual Reality (AR/VR), and edge computing.

The telecom operators and service providers are increasing investments in the network devices infrastructure and solutions, thus fueling market growth. Telecom operators and service providers, including Cisco Systems, Inc. and Telefonaktiebolaget LM Ericsson, are introducing advanced solutions for the implementation of new equipment infrastructure or upgradation of the existing infrastructure of customers and businesses, which demand high-speed data capacity. For instance, in January 2022, Cisco Systems, Inc. announced the expansion of its enterprise-grade switching capabilities to secure and modernize critical infrastructure within industrial environments. Such developments are expected to propel market growth.

Adopting advanced technologies across enterprises has encouraged several organizations to adopt next-generation 5G equipment and software. The 5G-enabled infrastructure and software applications can deliver organizations a competitive advantage by ensuring quick service and support delivery to their customers. In addition, 5G-enabled networks allow organizations to improve their operational efficiency and increase their overall client base. Majority of the enterprises are increasingly integrating their legacy on-premises network infrastructure and software applications with 5G technology to achieve enhanced bandwidth coverage and capacity.

However, the lack of technological advancements and poor operational efficiencies in developing nations such as India and China will hinder the market's growth over the forecast period. However, the robust deployment of network equipment infrastructure across smart cities such as the U.S., Canada, and the UK is expected to provide lucrative opportunities for market growth. For instance, BT Group, a telecommunications service provider, announced a strategic partnership with Telefonaktiebolaget LM Ericsson to establish 4G/5G infrastructure across major business and industrial hubs across the UK, such as the Port of Tyne.

COVID-19 Impact

The COVID-19 pandemic significantly affected the global economy and 5G infrastructure roll-out and deployment plans. According to data released by the International Monetary Fund (IMF) in October 2021, the global GDP was reduced by -3.1% in 2020 due to COVID-19. Governments in several countries imposed complete/strict lockdowns during the first two quarters of 2020 to stop the spread of the virus. Several key equipment manufacturers globally temporarily shut their facilities to prevent the spread of the virus.

The pandemic also forced organizations to abruptly shift to a work-from-home model, which led to adopting online platforms to ensure business continuity and enable distance learning. This necessitated the establishment of efficient network services and solutions. Factors such as the advent of 5G technology, rising adoption of smart devices, growing penetration of internet connectivity, and technological advancements also positively impacted the demand for network equipment devices and infrastructure. Remote work culture and distance learning have boosted the roll-out of 5G services and propelled the adoption of 5G services.

Component Insights

The hardware segment dominated the market in 2022 with a share of more than 57% of the global revenue. The segment's growth can be attributed to the increasing deployment of network hardware and core equipment across several use cases. These use cases include enterprises, remote surgeries, industrial robotics, autonomous vehicles, wireless cameras, and smart cities. Moreover, emerging radio access network (RAN) services, core network services, and fixed access hardware components are also driving the hardware segment growth. The network hardware market growth depends on the adoption of network equipment and cables by small businesses, consumer premise equipment, and home applications.

The software segment is anticipated to witness significant growth at a CAGR of 3.9% over the forecast period. The software segment includes the aggregate revenue generated from implementing on-premises and cloud-based software solutions for the RAN, core network, and fixed access. The segment covers infrastructure software (including the network infrastructure management software), operations support system (OSS)/business support system (BSS), and other software (including application software).

Connectivity Insights

The 4G LTE segment dominated the market in 2022 with a share of more than 72% of the global revenue. The Voice over Long-term Evolution (VoLTE) technology uses 4G LTE networks to transmit data and route voice traffic. In addition, 4G enables faster access to applications and content, lower latency, and the latest converging services based on multimedia subsystems with unified network protocols and architectures.

The 5G segment is anticipated to grow at the fastest CAGR of 22.3% over the forecast period. The improved efficiency and higher performance offered by 5G can empower exceptional user experiences and interfaces, creating several innovative use cases for industry verticals such as automotive, retail, and education. Such enhancements are being pursued by various industry verticals to gain a competitive edge and are expected to drive the growth of the segment.

Network Type Insights

In terms of network type, the public segment dominated the market in 2022 with a share of approximately 67% of the global revenue. The segment's growth can be attributed to upcoming smart city projects worldwide. In May 2020, Hong Kong announced a subsidy plan to encourage early deployment of 5G across the Hong Kong region. Such initiatives are expected to fuel the demand for public networks, thereby contributing to market growth.

The private network is anticipated to grow at the fastest CAGR of 4.5% over the projected period. A private network has settings configured within the network routers and access points to restrict access to devices outside the network. Network equipment deployed within a private network infrastructure also comprises physical and virtual devices, such as access points, bridges, hubs, modems, gateways, routers, and switches. The growing adoption of enhanced security for the network enables the adoption of private network equipment by enterprises.

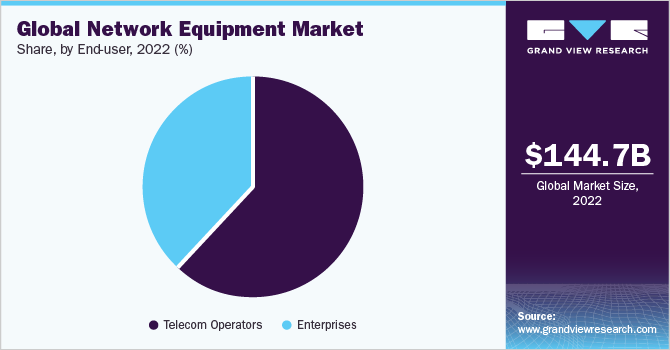

End-user Insights

The telecom operators segment dominated the market in 2022 with a share of over 61.0% of the global revenue. Telecom operators deploy network equipment and infrastructure to deliver telecommunication services, such as telephone services, data communication, and computer networking, based on various communication technologies, including microwaves. To cater to the high demand from this source, prominent network equipment providers are providing telecom operators with specialized networking services that utilize private networks incorporating LTE and 5G connectivity. Such factors are also driving the segment growth.

The enterprise segment is anticipated to grow at a promising CAGR of 4.2% over the forecast period. Enterprise network equipment includes routers, switches, cloud management networking devices, and network security devices. Network switches, gateways, routers, hubs, and modems may also be included according to the changing end-user requirements. Network equipment providers also offer enterprise-level networking equipment to ensure the safety of network functions. The enterprises demand high security of the networks, enabling private network equipment adoption.

Regional Insights

Asia Pacific dominated the network equipment market in 2022 with a share of over 35% of the global revenue. The region's growth is attributed to the high penetration of next-generation network equipment and infrastructure owing to the region's tendency to adopt new technology. In April 2022, during the Huawei Global Analyst Summit (HAS) 2022, Huawei Technologies Co., Ltd. announced that it would investigate uplink spectrum reconstruction, ultra-high bandwidth, green air interfaces, ELAA-MM, and native intelligence to assist operators in building '1+1+N' 5.5G and upgrading network capabilities. Such developments across the region are expected to maintain the dominance of the Asia Pacific region.

Europe is expected to grow at a CAGR of 4.1% over the forecast period. The growth of the regional market can be attributed to the rising collaborations, partnerships, smart city infrastructure spending, and new product launches from leading companies such as Telefonaktiebolaget LM Ericsson and Nokia Corporations. The high penetration of equipment is also driving market growth in the Europe region. Moreover, the production and development of networking parts and components across Europe also fuels market growth.

Key Companies & Market Share Insights

Key players are Cisco Systems, Inc.; Huawei Technologies Co. Ltd.; Nokia Corporation; Telefonaktiebolaget LM Ericsson; Hewlett Packard Enterprise Company; Samsung Electronics Co., Ltd. To maintain their position, leading players frequently use mergers and acquisitions, new product launches, and others. In April 2022, Ericsson and Turkcell announced a collaboration for digitalizing industries using Ericsson's Private Network technology. Through a dedicated, on-premises Ericsson Private solution, Ericsson assisted Turkcell in identifying and analyzing prospective use cases for potential engagement possibilities in sectors. Some prominent players in the global network equipment market include:

-

Telefonaktiebolaget LM Ericsson

-

Nokia Corporation

-

Samsung Electronics Co., Ltd.

-

ZTE Corporation

-

Juniper Networks, Inc.

-

Huawei Technologies Co., Ltd.

-

Cisco Systems, Inc.

-

Hewlett Packard Enterprise Development LP

-

Broadcom

-

ALE International (Alcatel-Lucent)

Network Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 147.3 billion

Revenue forecast in 2030

USD 190.5 billion

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, connectivity, network type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; India; China; Japan; Brazil

Key companies profiled

Telefonaktiebolaget LM Ericsson; Nokia Corporation; Samsung Electronics Co., Ltd.; ZTE Corporation; Juniper Networks Inc.; Huawei Technologies Co., Ltd.; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; Broadcom; ALE International (Alcatel-Lucent)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global network equipmentmarket report based on component, connectivity, network type, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

RAN

-

Core Network

-

Fixed Access

-

Others

-

-

Software

-

Infrastructure Software

-

OSS/BSS

-

Others

-

-

Services

-

Professional Services

-

Advisory/Consulting

-

Design / Optimization

-

Tools & Automation

-

Security

-

-

Deployment Services

-

Testing

-

Installation

-

Integration

-

-

Managed Services

-

Network Performance & Management

-

App / Data Management

-

RAN Operation Support

-

Core Operation Support

-

Security

-

Training

-

-

-

-

Connectivity Outlook (Revenue, USD Million, 2017 - 2030)

-

2G/3G

-

4G LTE

-

5G

-

-

Network Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Public Network

-

Private Network

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom Operators

-

Enterprises

-

Public Safety

-

Healthcare

-

Retail and e-Commerce

-

Banking, Financial Services, & Insurance

-

Government & Defense

-

Manufacturing

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global network equipment market size was estimated at USD 144.7 billion in 2022 and is expected to reach USD 147.3 billion in 2023.

b. The global network equipment market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 190.5 billion by 2030.

b. Asia Pacific dominated the network equipment market with a share of 34.7% in 2022. This is attributable to the growing demand and installation of 5G networks across the various countries such as India, Japan, China, South Korea and others.

b. Some key players operating in the network equipment market include Cisco Systems, Inc., Huawei Technologies Co. Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, Hewlett Packard Enterprise Company, and Samsung Electronics Co., Ltd

b. Key factors that are driving the network equipment market growth include the advent of 5G technology which is expected to lead a significant rise in the adoption of connected devices, rising adoption of IoT devices, and growing investments in network equipment infrastructure and solutions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.