Network Engineering Services Market Size, Share & Trends Analysis Report By Service Type (Professional, Managed), By Connection Type (Wired, Wireless), By Organization Size (Large, SMEs), By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-144-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Network Engineering Services Market Trends

The global network engineering services market size was estimated at USD 44.09 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The need to digitize business operations and growing internet penetration are the key factors driving the market’s growth. Computer and telecom networks enable businesses to adopt new business models rapidly as network connectivity and performance support digital transformation among businesses. Network engineering service providers offer professional and managed network engineering services to businesses, helping them design, implement, and monitor networks.

Networks are constantly evolving and are increasingly getting complex, driving the need for network engineering services among businesses to virtualize and automate their systems to adapt to changes. Network deployment and management are changing owing to new technology trends, such as Network Functions Virtualization (NFV) and Software-Defined Networking (SDN). According to 2023 research by Hewlett Packard Enterprise Development LP’s HPE Aruba Networking, 44% of the surveyed 2,100 IT leaders primarily consider the network as a tool for digital transformation.

Hence, with growing digitalization among businesses, the market is expected to witness significant growth over the forecast period. Network engineering services are being rapidly adopted in North America, a region with many market players, such as Juniper Networks, Inc.; Advance Digital Systems, Inc.; Aviat Networks, Inc.; and others. According to the U.S. Central Intelligence Agency (CIA), in 2021, 312.8 million people in the U.S. had access to the Internet, with a 92% penetration rate. The market is fragmented, with many established and smaller companies.

COVID-19 Impact

The COVID-19 pandemic led to lockdowns and travel restrictions as governments implemented social distancing norms to curb the spread of the virus. This accelerated digitalization globally as people stayed at home and working and learning shifted to online mode, driving internet usage. According to U.S.-based IBM, many organizations accelerated investments in digital technologies in response to the COVID-19 pandemic. The network is a critical part of digitalization; hence, networking engineering services would have seen a rise in demand after the COVID-19 pandemic.

The COVID-19 pandemic increased the need for networks to operate at highly efficient levels as many people started working from home as countries went into lockdowns. Consumers and businesses expect efficient network services without disruptions. Hence, to meet the high demand and rise in internet traffic, network service providers and businesses would require network engineering services to monitor and optimize the network. Moreover, the COVID-19 pandemic changed business models, and many businesses started adopting online models, driving the need for efficient networks. This contributed to the growth of the market.

Service Type Insights

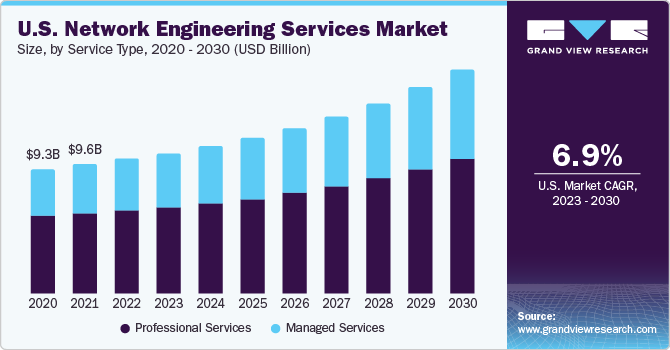

Based on service type, the market is classified into professional services and managed services. The professional services segment dominated the market, with a revenue share of over 61.0% in 2022. It is expected to grow at a CAGR of 7.1% throughout the forecast period. Professional network engineering services include design & planning, implementation, integration, and network optimization. With the growing complexity of networks, the need for professional services is rising as professional service teams have highly skilled engineers who help businesses address complex issues. For instance, U.S.-based Datavision, Inc. provides professional network engineering services, such as design & planning, and implementation, where the company’s consultants help build or redesign a network.

The need to ensure proper network deployment as per businesses needs is driving the segment’s growth. The managed services segment is anticipated to grow at the fastest CAGR of 8.1% throughout the forecast period. Managed network engineering services, including operations support and network monitoring & maintenance. Managed services help businesses in day-to-day operations and maintenance. This helps businesses, as the internal resources of the company can focus on strategic projects instead of working on mundane tasks. The need to minimize network downtime and ensure smooth operations drives the segment’s growth. Moreover, managed services relieve the stress of the company’s staff and ensure proactive help always.

Connection Type Insights

Based on connection type, the market is classified into wired and wireless. The wired segment dominated the market, with a revenue share of more than 57.0% in 2022. It is expected to grow at a CAGR of 6.8% throughout the forecast period. In wired networks, the data is communicated via physical pathways, including Ethernet cables, fiber-optic cables, and coaxial cables. Wired networks are more stable than wireless networks, offering faster speeds, especially through fiber optic and modern Ethernet cables. Moreover, wired networks are more secure as they can be accessed only through physical cables. Hence, many businesses will deploy wired networks, driving the need for network engineering services.

The wireless segment is expected to grow at the highest CAGR of 8.4% during the forecast period. Wireless networks are networks, such as Wi-Fi and Bluetooth, which can transmit data without physical cables. Wireless networks offer benefits such as mobility and ease of installation. Devices can move within the network’s range, and wireless networks are easier and cheaper to install as they do not require physical cables. Wi-Fi is now prevalent in homes, while many businesses still find wired networks reliable. The need for mobility and ease of installation is driving the segment’s growth.

Organization Size Insights

Based on organization size, the market is classified into small and medium-sized enterprises (SMEs) and large size enterprises. The large enterprises segment dominated the market, with a revenue share of more than 67.0% in 2022. It is expected to grow at a CAGR of 7.2% throughout the forecast period. Large-size enterprises are increasingly adopting digital solutions and improving their network infrastructure as they increasingly look to automate their operations, improving their efficiency. According to IBM’s Global AI Adoption Index 2022, larger companies are more likely to deploy Artificial Intelligence (AI) than smaller companies. Growing adoption of automation, the Internet of Things (IoT), and cloud-based applications in large-size enterprises is driving the segment’s growth.

The small and medium-sized enterprises (SMEs) segment is likely to grow at a CAGR of 8.1% over the forecast period. SMEs may not have the resources like large-size enterprises to afford a dedicated on-site IT team. Hence, it is an affordable option for SMEs to outsource network engineering services. According to the Organization for Economic Co-operation and Development (OECD), 70% of SMEs have accelerated the use of digital technologies due to the COVID-19 pandemic. Hence, rapid digitalization and the cost-effectiveness of outsourcing network engineering services drive the segment’s growth.

End-use Insights

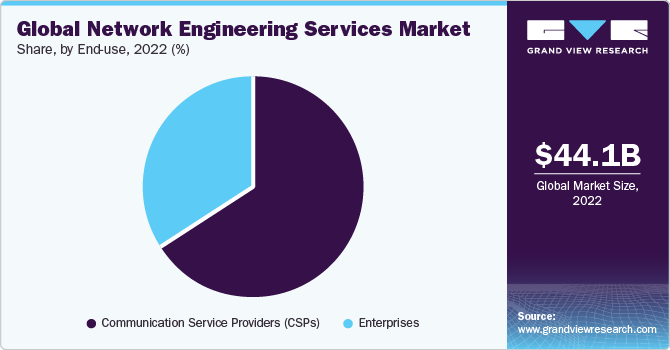

Based on end-use, the market is classified into communication service providers (CSPs) and enterprises. The communication service providers (CSPs) segment dominated the market with a revenue share of more than 65.0% in 2022 and is expected to witness a CAGR of 7.1% during the forecast period. Communication service providers (CSPs) face stiff competition and are under constant pressure to maximize revenue and improve the customer experience. Moreover, they need to optimize networks to meet the growing demand for faster internet speeds. Hence, the need to monitor and optimize networks and maximize efficiency drives the segment’s growth.

The enterprise segment is anticipated to grow at the fastest CAGR of 8.4% throughout the forecast period. Enterprises of various sectors, such as BFSI, manufacturing, automotive, healthcare, and retail & e-commerce, among others, are undergoing digital transformation. Many industries are adopting and offering digital solutions to improve their operations and customer experience. For instance, in the BFSI sector, there is significant growth in online banking, which offers customers convenience. Companies, such as U.S.-based Tri-Tech Automation, are providing industrial network services. The company provides services such as network design, deployment, and monitoring for manufacturing applications. The need to digitize and remain competitive drives the segment’s growth.

Regional Insights

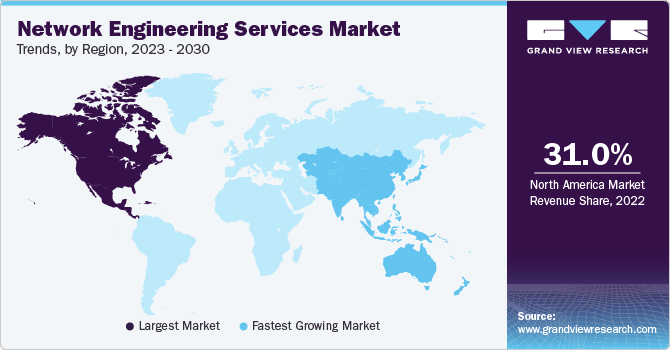

The North America region dominated the market with a revenue share of over 31.0% in 2022. It is expected to grow at a considerable CAGR of 7.1% throughout the forecast period. The region is characterized by a developed technological infrastructure with high internet and smartphone penetration. According to the U.S. National Science Foundation, a high percentage of U.S. firms are digitized. Moreover, government initiatives in the region to promote digital adoption among firms drive the market’s growth. For instance, in March 2022, the Canadian government launched the Canada Digital Adoption Program (CDAP). The program aimed to aid small and medium-sized enterprises (SMEs) in Canada in adopting or upgrading digital technologies and growing their online presence.

Asia Pacific is expected to grow at the fastest CAGR of 8.9% over the forecast period. Asia Pacific has the presence of many market players, such as India-based HCL Technologies Limited, India-based Infosys Limited, and India-based Cyient. The region’s digital landscape has been evolving rapidly in recent years across sectors, such as digital payments and e-commerce. Moreover, as per the International Federation of Robotics (IFR), Asia has led the installation of industrial robots in recent years. Growing internet penetration and an evolving digital landscape are driving the growth of the market as businesses look to adopt digital solutions to improve the customer experience.

Key Companies & Market Share Insights

The market is fragmented, with numerous local and international players. The key players are adopting strategies, such as mergers and acquisitions, to gain a competitive edge. For instance, in June 2022, Cyient announced the acquisition of Celfinet, a Portugal-based wireless engineering services organization providing network engineering services. It was acquired for USD 43.9 million. With this acquisition, Cyient aimed to aid enterprises and Communication Service Providers (CSPs) in deploying networks at scale.

Key Network Engineering Services Companies:

- SINCERA TECHNOLOGIES

- Juniper Networks, Inc.

- Datavision, Inc.

- Cyient

- HCL Technologies Limited

- Accenture

- Infosys Limited

- Advance Digital Systems, Inc.

- Movate

- Hughes Systique Corporation.

- Telefonaktiebolaget LM Ericsson

- Aviat Networks, Inc.

Network Engineering Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 46.30 billion |

|

Revenue forecast in 2030 |

USD 76.98 billion |

|

Growth rate |

CAGR of 7.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historic year |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, connection type, organization size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); U.A.E.; South Africa |

|

Key companies profiled |

Sincera Technologies; Juniper Networks, Inc.; Datavision, Inc.; Cyient; HCL Technologies Limited; Accenture; Infosys Limited; Advance Digital Systems, Inc.; Movate; Hughes Systique Corporation; Telefonaktiebolaget LM Ericsson; Aviat Networks, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Network Engineering Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global network engineering services market report based on service type, connection type, organization size, end-use, and region:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Professional Services

-

Design & Planning

-

Implementation

-

Integration

-

Network Optimization

-

-

Managed Services

-

Operations Support

-

Network Monitoring & Maintenance

-

-

-

Connection Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Sized Enterprises (SMEs)

-

Large Size Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Communication Service Providers (CSPs)

- Enterprises

-

Government & Public Sector

-

Healthcare

-

Retail & E-commerce

-

BFSI

-

Manufacturing

-

Automotive

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global network engineering services market size was estimated at USD 44.09 billion in 2022 and is expected to reach USD 46.30 billion in 2023.

b. The global network engineering services market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 76.98 billion by 2030.

b. North America dominated the network engineering services market with a share of over 31.0% in 2022. This is attributable to the presence of numerous market players and government initiatives to develop the digital ecosystem.

b. Some key players operating in the network engineering services market include SINCERA TECHNOLOGIES, Juniper Networks, Inc., Datavision, Inc., Cyient, HCL Technologies Limited, Accenture, Infosys Limited, Advance Digital Systems, Inc., Movate, Hughes Systique Corporation., Telefonaktiebolaget LM Ericsson, and Aviat Networks, Inc.

b. Key factors driving the market growth include growing digitalization and the need to manage complex networks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."