- Home

- »

- Communications Infrastructure

- »

-

Network Analytics Market Size, Share & Growth Report, 2030GVR Report cover

![Network Analytics Market Size, Share & Trends Report]()

Network Analytics Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Enterprise Size (Large, SMEs), By Component, By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-122-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global network analytics market size was estimated at USD 3.26 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 19.0% from 2023 to 2030. The growing adoption of machine learning (ML) and artificial intelligence (AI) for more smart network management, an increase in intent-based networking aligned with the organization’s goals, and a rise in focus on network security analytics are some of the factors driving the demand for the market worldwide. The need for advanced analytics to optimize, monitor, and troubleshoot the networks intricated and integrated with the Internet of Things (IoT) and cloud computing is surging the demand for the market.

The exponential surge in data generated by network devices needs sophisticated analytic tools to extract valuable insights and information. Modern networks connect a huge range of devices such as laptops and smartphones to smart appliances and IoT sensors. A continuous data production from these devices and interaction with the devices and online services results in forming a strong base for the development of the market. Further, amidst the data generation, many organizations focus to gain actionable insights to improve network security, performance, and user experience. Network analytics enable these organizations to extract meaningful information from the massive datasets, thereby overcoming the challenge of delivering actionable insights.

Increasing number of organizations are aiming to optimize network performance, minimize downtime, and enhance user experience to improve the customer experience and business operations. As more services are moved to the cloud, there is an emerging need to ensure seamless connectivity and performance. Cloud-based analytics solutions are accessible from different locations, which makes it easier for the geographically dispersed departments to manage and collaborate network analytics centrally. In addition, industries such as healthcare and finance, having strict regulations, depend on network analytics to fulfill compliance standards and maintain data security. The growing regulatory complaints and adoption of cloud services across industries are driving the demand for the market.

The rise of remote work necessitates the emergence of secure and efficient network operations, thereby driving the adoption of analytics solutions. The increase in employees working from different devices and locations makes the network environment more complex. Network analytics solutions enable managing and monitoring the growing complexity by offering insights into network connectivity, performance, and potential issues. These solutions allow organizations to troubleshoot real-time issues and monitor remote connection performance, assuring seamless connectivity for remote working employees.

The proliferation of advanced technologies across industries is expected to form opportunities for the market. Network analytics highly enhance zero-trust security models due to their continuous anomaly detection and network behavior monitoring that helps identify security threats. Further, network analytics are becoming crucial for managing the complex functioning of IoT devices, as they assure efficient communication and insight gathering from IoT-generated data.

However, growing data privacy concerns and lack of data quality are expected to hamper the demand for the market. Personal and sensitive information involvement in network analytics gives rise to privacy concerns. In addition, poor data quality generated from outdated and inconsistent data sources, or the inadequate data cleansing process can lead to unreliable insights. Organizations adopting network analytics solutions should ensure compliance with data protection regulations and execute effective data anonymization and encryption to avoid challenges.

Component Insights

In terms of components, the network intelligence solutions segment held the largest revenue share of 64.40% in 2022 and is projected to continue its dominance during the forecast period. The growing complexity of networks due to the integration of advanced technology devices, remote work setups, and cloud services has created a huge demand for network intelligence solutions. Further, the growing need among organizations for real-time visibility into security, network performance, and user experience has helped the segment's overall growth. These solutions offer insights that help organizations avoid downtime and offer seamless operations.

The services segment is anticipated to register the fastest CAGR of 20.2% over the forecast period. The exponential data generation within networks, AI and machine learning integration, and the growing need for enhanced network performance across organizations drive the growth of network analytics services. Furthermore, the need for professional and managed services to proactively offer organizations predictive insights to anticipate issues and optimize network performance has fueled the demand for the market.

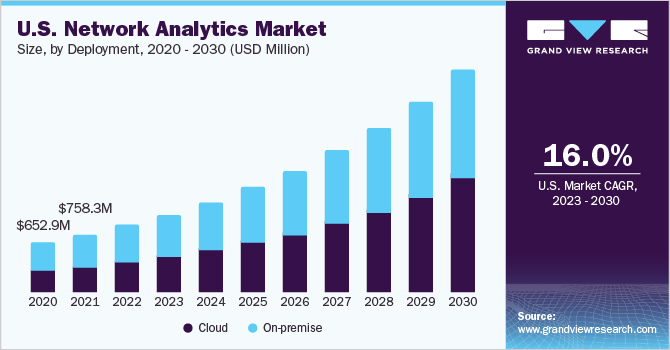

Deployment Insights

Based on deployment, the on-premise segment held the largest revenue share of 53.85% in 2022. The on-premise network analytics is a popular choice as some firms choose to secure sensitive network data to maintain better control over data privacy and security. Data localization and storage regulations are frequently necessary for industries with severe legal requirements. These compliance requirements can be met with on-premise network analytics. Businesses in some sectors or locations must store and process data within predetermined parameters. Data sovereignty requirements are supported by on-premise network analytics. In some situations, on-premise network analytics may be necessary to prevent transmitting sensitive data through external networks due to network isolation brought on by security concerns.

The cloud segment is expected to register the fastest CAGR of 20.8% over the forecast period. Advanced analytics are now required to monitor, manage, and optimize network performance inside cloud systems because of the wide adoption of cloud services. Organizations frequently use hybrid or multi-cloud configurations. Cloud network analytics support dependable performance and connectivity across various cloud platforms. Cloud infrastructures can be complicated due to their many different elements, services, and interactions. Analytics on cloud networks give insight into these intricacies, facilitating efficient management.

Enterprise size Insights

In terms of enterprise size, the large enterprises segment held the largest revenue share of 60.48% in 2022 and is projected to continue its dominance during the forecast period. The increasing spending among large enterprises to enhance the overall cyber security framework and ensure seamless and reliable user experience for the users and partners is driving the demand for the market. Many enterprises, such as healthcare and finance, are focused on maintaining compliance and following stringent regulatory requirements, thereby boosting the demand for the market over the forecast period.

The small & medium enterprises segment is anticipated to register the fastest CAGR of 21.2% over the forecast period. The accessibility of network analytics solutions across SMEs is growing owing to the increase in the need for enhanced operational efficiency across the organization. The low-cost structure of the cloud-based network analytics solution and subscription models support the growth of the market across small & medium enterprises.

End-user Insights

In terms of end-users, the telecom providers segment held the largest revenue share of 35.13% in 2022. Telecom providers manage huge amounts of data created by network devices, service interactions, and subscriber activities. Network analytics solutions allow organizations to extract insights from the generated data to optimize customer services and experience. In addition, deploying 5G networks necessitates advanced network analytics solutions to handle the increased volume of data, dynamic network connectivity, and low latency demand. The growing demand for network analytics solutions to enhance operations efficiency across telecom providers is expected to drive the market growth.

Cloud service providers are expected to register a CAGR of 19.4% over the forecast period. The growing adoption of network analytics solutions across cloud service providers for achieving optimized resource allocation and efficient server bandwidth, capacity, and other network resource usage is anticipated to fuel the demand for the market. Further, the need for analyzing historical data among the cloud service providers for predicting capacity requirements, preventing bottlenecks, and allocating resources propels the need for a market across the segment.

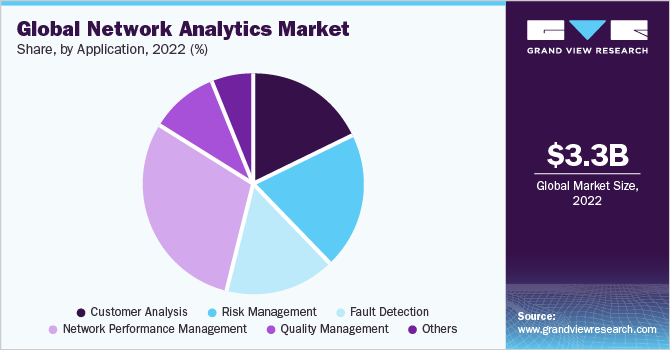

Application Insights

In terms of application, the network performance management segment held the largest revenue share of 29.83% in 2022 and is projected to continue its dominance during the forecast period. Network performance management tools are used for identifying unusual anomalies or patterns in network behavior. The anomalies are a vital indicator for network analytic systems to detect potential cyber threats and performance degradation. In addition, the tools help correlate data from multiple sources, including network applications, devices, and users. This integrated data is important for comprehensive network analytics to form a meaningful insight, thereby driving the market's growth.

The quality management segment is expected to register the fastest CAGR of 21.0% over the forecast period. Network analytics helps to detect threats and relevant patterns in the network integrated devices that can result in quality-related issues. These analytics solutions help organizations to analyze Quality of Service (QoS) parameters such as latency, bandwidth, and jitter, promising optimal service delivery. Further, the use of network analytics for assisting the root cause analysis through identifying and monitoring the data issues is anticipated to fuel the market demand.

Regional Insights

North America held the largest market share of 33.62% in 2022. Growing technological advancements and digital transformation across the region are expected to drive the demand for the market. These solutions majorly optimize networks to support advanced technologies and digital initiatives. Furthermore, organizations across North America focus on data-driven decisions, where network analytics solutions allow organizations to offer insights into network performance, security, and user behavior. These factors are, therefore, expected to drive the demand for the market across the region.

Asia Pacific is expected to register the fastest CAGR of 21.9% over the forecast period. The region has witnessed a large amount of data generation and growth in user base owing to the rising adoption of advanced technologies and devices. The growing data usage has anticipated the need for network analytics as they help to manage the data influx and assure efficient network performance. Further, diverse economies and technologies form complex network environments, which can be easily optimized and managed by network analytics solutions. These growing benefits toward achieving operational efficiency across industries are expected to generate huge demand for the market over the forecast period.

Key Companies & Market Share Insights

The key global market players in 2022 include Broadcom, Inc., Ciena Corporation, Cisco Systems, Inc., and others. Intense competition among leading players for introducing advanced and innovative products is encouraging companies to invest in the research and development of products and automation of processes.

Companies are adopting strategies to leverage new opportunities in the market and target new customers by developing customized products. For instance, in May 2023, Juniper Networks, Inc. launched the Mist Access Assurance service, the first cloud-native service. The network access control (NAC) and policy management capabilities of Juniper's wired access, wireless access, indoor location, SD-WAN, and secure client-to-cloud portfolio are now available through this new service, which makes use of Mist AI and a contemporary microservices cloud. Some prominent players in the global network analytics market include:

-

Allot Communication

-

Broadcom, Inc.

-

Ciena Corporation

-

Cisco Systems, Inc.

-

Extreme Networks.

-

Fortinet, Inc.

-

Hewlett Packard Enterprise Development LP

-

Huawei Technologies Co., Ltd.

-

International Business Machines Corporation

-

Juniper Networks, Inc.

-

Nivid Technologies.

-

Sandvine Corporation

-

SAS Institute Inc.

-

Telefonaktiebolaget LM Ericsson

-

Trend Micro Incorporated

Network Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.86 billion

Revenue forecast in 2030

USD 13.06 billion

Growth rate

CAGR of 19.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end-user, region

Key companies profiled

Allot Communication; Broadcom, Inc.; Ciena Corporation; Cisco Systems, Inc.; Extreme Networks; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; International Business Machines Corporation; Juniper Networks, Inc.; Nivid Technologies; Sandvine Corporation; SAS Institute Inc.; Telefonaktiebolaget LM Ericsson; Trend Micro Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Analytics Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global network analytics market report based on component, deployment, enterprise size, application, end-user, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Network Intelligence Solutions

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large

-

SMEs

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customer Analysis

-

Risk Management

-

Fault Detection

-

Network Performance Management

-

Quality Management

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud Service Providers

-

Managed Service Providers

-

Telecom Providers

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global network analytics market size was estimated at USD 3.26 billion in 2022 and is expected to reach USD 3.86 billion by 2023.

b. The global network analytics market is expected to grow at a compound annual growth rate of 19.0% from 2023 to 2030 to reach USD 13.06 billion by 2030.

b. Network intelligence solutions dominated the network analytics market with a share of 64.4% in 2022. The growing complexity of networks owing to the integration of advanced technology devices, remote work setups, and cloud services has formed a huge demand for network intelligence solutions.

b. The key players operating in the network analytics market include Allot Communication, Broadcom, Inc., Ciena Corporation, Cisco Systems, Inc., Extreme Networks, Fortinet, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., International Business Machines Corporation, Juniper Networks, Inc., Nivid Technologies, Sandvine Corporation, SAS Institute Inc., Telefonaktiebolaget LM Ericsson, and Trend Micro Incorporated

b. Growing adoption of machine learning (ML) and artificial intelligence (AI) for more smart network management, an increase in intent-based networking aligned with the organization’s goals, and a rise in focus on network security analytics are some of the factors driving the demand for the network analytics market across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.