- Home

- »

- Next Generation Technologies

- »

-

Net-zero Energy Buildings Market Size & Share Report, 2030GVR Report cover

![Net-zero Energy Buildings Market Size, Share & Trends Report]()

Net-zero Energy Buildings Market Size, Share & Trends Analysis Report By Component (Equipment, Solutions And Services), By Application (Commercial, Residential), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-235-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Net-zero Energy Buildings Market Trends

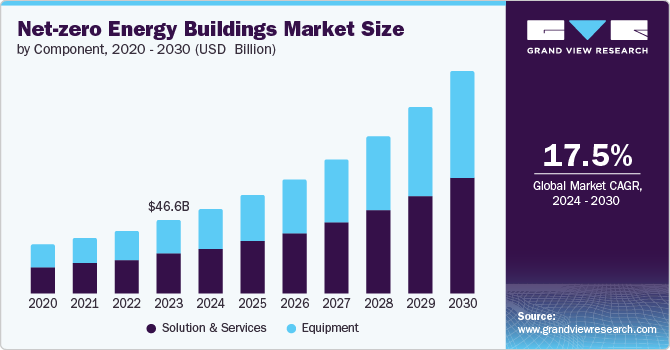

The global net-zero energy buildings market size was valued at USD 46.60 billion in 2023 and is projected to grow at a CAGR of 17.5% from 2024 to 2030. As global temperatures rise and extreme weather events become more frequent, there is a heightened urgency to reduce carbon footprints. This awareness has led governments, businesses, and individuals to seek solutions that mitigate environmental damage. Net-zero energy buildings (NZEB)s are a viable response to these challenges, as they minimize energy consumption and generate renewable energy on-site, effectively reducing reliance on fossil fuels.

Starting in 2030, the European Union (EU) aims to elevate the standard for new constructions from nearly zero-energy buildings to zero-emission buildings. Zero-emission buildings are designed to minimize energy consumption and eliminate greenhouse gas emissions associated with their operation. It includes reducing reliance on fossil fuels and ensuring that any remaining energy needs are met through renewable sources.

As consumers become more environmentally conscious, there is an increasing demand for sustainable living spaces that reflect their values. Homebuyers and tenants actively seek properties offering eco-friendly features such as efficient insulation, smart home technologies, and renewable energy systems. This shift in consumer preferences drives developers to prioritize net-zero designs in their projects to attract environmentally minded clients.

Furthermore, according to the United Nations (UN), the buildings and construction sector significantly contributes to global greenhouse gas emissions, accounting for approximately 37% of total emissions. This staggering figure highlights the urgent need for sustainable practices within the industry. The primary reasons behind these emissions are materials such as cement, steel, and aluminum, which have high carbon footprints due to their energy-intensive production processes. Consequently, net-zero building structures are designed to produce as much energy as they consume over a year, effectively minimizing their carbon footprint.

Component Insights

Solution and services dominated the market and accounted for a share of 53.3% in 2023. Software solutions that facilitate real-time monitoring and optimization of energy consumption are becoming essential tools for achieving net-zero goals. The proliferation of Internet of Things (IoT) devices enables buildings to collect vast amounts of data on energy usage patterns, which can be analyzed to improve efficiency. As these technologies evolve, they create opportunities for specialized software providers to develop tailored applications that meet specific needs within the NZEB framework.

The equipment segment is expected to register the fastest CAGR of 18.0% during the forecast period. The emergence of smart technologies has revolutionized how buildings consume energy. For instance, smart lighting systems with sensors can adjust brightness based on occupancy or natural light availability, significantly reducing energy waste. Similarly, modern HVAC systems utilize variable refrigerant flow technology and advanced controls to optimize heating and cooling based on real-time data. These innovations enhance comfort and lead to substantial cost savings over time, making them attractive investments for building owners aiming for NZEB certification.

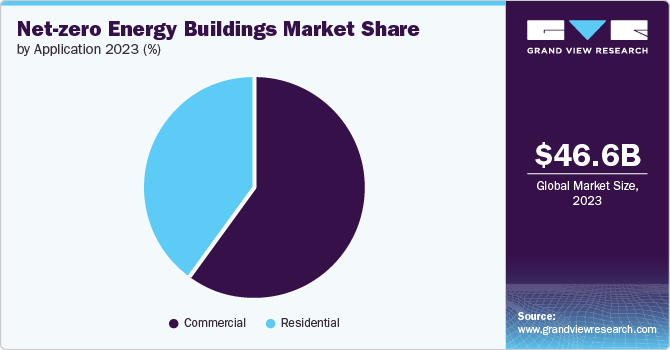

Application Insights

The commercial segment accounted for the largest market revenue share in 2023. The non-residential. Governments worldwide are implementing policies that mandate energy efficiency standards and promote sustainable building practices. Initiatives such as the Paris Agreement have led many countries to set targets for reducing greenhouse gas emissions, encouraging commercial property developers to adopt net-zero energy strategies. This regulatory push enhances compliance and positions businesses favorably in a market that increasingly values sustainability.

The residential segment is expected to register the fastest CAGR of during the forecast period. Innovations in solar panels, energy-efficient appliances, smart home technologies, and advanced insulation materials have made it more feasible and cost-effective for homeowners to achieve net-zero energy goals. These technologies enable residential buildings to generate and store energy efficiently, reducing reliance on grid-supplied energy and enhancing overall energy independence.

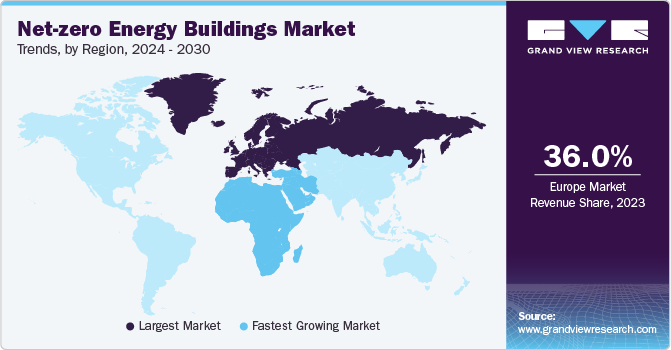

Regional Insights

North America net-zero energy buildings market held a substantial market revenue share in 2023. Heightened awareness regarding climate change impacts is driving interest in net-zero energy buildings as part of broader resilience planning efforts across communities in North America. Extreme weather events linked to climate change have prompted local governments to rethink urban planning strategies emphasizing sustainability and resilience against future risks.

U.S. Net-Zero Energy Buildings Market Trends

The U.S. net-zero energy buildings market dominated the North America market in 2023. In the U.S., the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) released the ANSI/ASHRAE Standard 228-2023. This new standard is a comprehensive evaluation framework for zero energy and zero carbon buildings, marking a pivotal step towards achieving net-zero carbon emissions in the built environment.

Europe Net-Zero Energy Buildings Market Trends

Europe net-zero energy buildings market accounted for the largest market revenue share of 36.0% in 2023. Multi-disciplinary partnerships foster innovation through shared knowledge and resources while addressing challenges related to design integration and construction practices specific to different regions within Europe. Initiatives such as Horizon Europe promote research funding to develop new solutions for sustainable building practices while encouraging cross-border cooperation on best practices for achieving net-zero goals.

Germany net-zero energy buildings market expected to grow rapidly in the coming years. Germany aims to drastically reduce greenhouse gas emissions and achieve carbon neutrality by 2045. The German government has implemented strict energy efficiency standards for buildings, compelling developers and homeowners alike to adopt NZEB designs. These standards emphasize energy efficiency and encourage the integration of renewable energy sources such as solar panels and geothermal heating systems, further promoting the construction of NZEBs.

Asia Pacific Net-zero Energy Buildings Market Trends

Asia Pacific net-zero energy buildings market is anticipated to witness significant growth over the forecast period. The rapid urbanization and economic growth in countries such as China, India, and Japan have increased energy demand and heightened awareness of environmental sustainability. Governments in these countries are under pressure to mitigate the environmental impact of urban development.

Australia net-zero energy buildings market projected to experience significant growth in forecasting period. Green building certifications such as Green Star and the National Australian Built Environment Rating System (NABERS) encourage the adoption of NZEB principles by providing recognition and validation of sustainable building practices. This has incentivized developers to invest in NZEB technologies and design strategies that enhance energy efficiency and reduce environmental impact.

Middle East & Africa Net-zero Energy Buildings Market Trends

The Middle East and Africa net-zero energy buildings market is anticipated to register the fastest CAGR growth over the forecast period. Countries such as Saudi Arabia are investing heavily in renewable energy projects as part of their Vision 2030 strategy, which aims to diversify their economies away from oil dependency. This shift has increased funding for sustainable construction practices, including NZEBs. As more investments flow into renewable energy sources such as solar and wind power, the feasibility of constructing net-zero buildings becomes more economically viable.

Key Net-zero Energy Buildings Company Insights

Some of the key companies in the net-zero energy buildings market include Altura Associates LLC, Canadian Solar Inc., Daikin Industries Ltd., General Electric Company, and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Altura Associates LLC's offerings include comprehensive consulting services that guide clients through the entire lifecycle of net-zero projects, from initial feasibility studies to final certification processes. They employ advanced modeling techniques to assess energy performance and identify opportunities for renewable energy integration, ensuring that buildings can produce as much energy as they consume over a year.

-

Daikin Industries Ltd offers a comprehensive range of energy-efficient solutions to minimize energy consumption while maximizing comfort and indoor air quality. Daikin’s product lineup includes advanced heat pumps, variable refrigerant flow (VRF) systems, and energy recovery ventilators engineered to work synergistically in NZEBs.

Key Net-zero Energy Buildings Companies:

The following are the leading companies in the net-zero energy buildings market. These companies collectively hold the largest market share and dictate industry trends.

- Altura Associates LLC

- Canadian Solar Inc.

- Daikin Industries Ltd.

- DABITRON Group Canary Islands

- General Electric Company

- GreenTree Global

- Honeywell International Inc.

- Integrated Environmental Solutions Ltd.

- Johnson Controls International plc

- Kingspan Group Plc

Recent Developments

-

In October 2023, Honeywell International Inc. and Nexii Building Solutions announced a strategic alliance aimed at advancing sustainable building development. This partnership is significant as it combines Honeywell’s expertise in building technologies with Nexii’s innovative green construction solutions. The collaboration addresses the pressing need for sustainability in the construction industry, a major contributor to global carbon emissions.

Net-zero Energy Buildings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 53.87 billion

Revenue forecast in 2030

USD 141.83 billion

Growth Rate

CAGR of 17.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Altura Associates LLC; Canadian Solar Inc.; Daikin Industries Ltd.; DABITRON Group Canary Islands; General Electric Company; GreenTree Global; Honeywell International Inc.; Integrated Environmental Solutions Ltd.; Johnson Controls International plc; Kingspan Group Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Net-zero Energy Buildings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global net-zero energy buildings market report based on component, application, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Equipment

-

Lighting

-

HVAC Systems

-

Others

-

-

Solution And Services

-

Software Solutions

-

Designing Service

-

Consulting Services

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."