- Home

- »

- Medical Devices

- »

-

Nephrostomy Devices Market Size & Share Report, 2030GVR Report cover

![Nephrostomy Devices Market Size, Share & Trends Report]()

Nephrostomy Devices Market Size, Share & Trends Analysis Report By Product (Guidewires, Drainage Tubes, Nephrostomy Catheters, Sheath Dilators), By End Use (Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-116-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Nephrostomy Devices Market Size & Trends

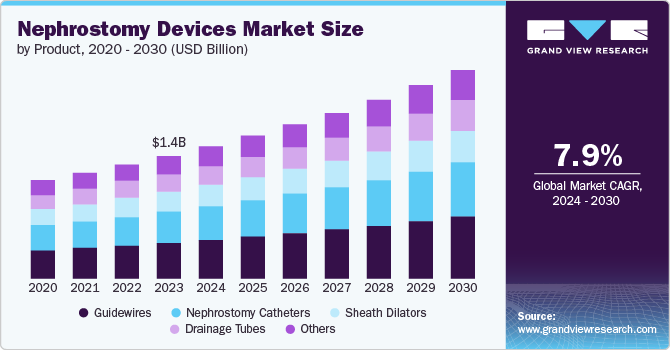

The global nephrostomy devices market size was valued at USD 1.36 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030. The rising geriatric population and the increasing prevalence of chronic kidney diseases such as kidney stones and kidney cancer (including bladder and ovarian cancer) due to lifestyle changes, lack of physical activities, intake of alcoholic beverages and aerated drinks, and dietary changes are the major contributing factors boosting market growth. In addition, the rising demand for minimally invasive procedures, increased awareness, and technological advancements have fueled the market growth positively.

The geriatric population being more susceptible to kidney diseases has helped the adoption of nephrostomy devices for its treatment. For instance, according to an article published by the Centers For Disease Control and Prevention (CDC) in May 2024, about 35.5 million people suffered from chronic kidney disease in the U.S. in 2023. In addition, CKD is more prevalent in people aged 65 years and above (34%) than in people aged 45-64 years (12%) and 18-44 years (6%).

In addition, the growing prevalence of kidney and ovarian cancer among people due to a sedentary lifestyle has led to the adoption of advanced medical equipment for its treatment. According to the American Cancer Society, an estimated 81,610 new cases of kidney cancer are expected to be diagnosed in 2024. Furthermore, as per the World Ovarian Cancer Coalition, the number of women diagnosed with ovarian cancer worldwide is estimated to rise over 55% to 503,448 as per Globocan’s 2022 projections.

In addition, obesity can increase the risk of type 2 diabetes and lead to various chronic kidney diseases. This would lead to the requirement of more minimally invasive treatment procedures such as nephrostomy, further driving the market growth. For instance, according to a report published by the World Health Organization (WHO) in March 2024, about 16% of people were living with obesity, and about 43% of adults aged 18 years and over were overweight in 2022. In addition, according to The World Obesity Atlas 2023, the global economic impact of overweight and obesity is likely to reach USD 4.32 trillion annually by 2035.

Various government initiatives and awareness programs are further likely to boost the market growth. For instance, in 2023, the National Kidney Foundation developed the Chronic Kidney Disease Change Package to assist primary care programs in transforming CKD care, improving healthcare quality, and advancing kidney health equity. In addition, the increasing advancements in the technologies related to nephrostomy are further expected to enhance market growth. Various companies have launched new products with advanced technologies to increase the adoption of minimally invasive procedures and focus on market expansion globally.

Product Insights

Guidewires dominated the market and accounted for a market share of 28.7% in 2023. It can be attributed to the rising geriatric population, improved hospital infrastructure, and technological advancements. The geriatric population is more susceptible to diabetes, which can have direct health impacts such as chronic kidney disease. This is likely to increase the demand for minimally invasive procedures such as nephrostomy and drive segmental growth. For instance, according to the Population Reference Bureau, the geriatric population is projected to increase to 82 million by 2050 in the U.S. In addition, as per the American Cancer Society, an estimated 83,190 new cases of bladder cancer and 16,840 deaths from bladder cancer are projected to occur in 2024 in the U.S.

Nephrostomy catheters are expected to grow at a significant CAGR over the forecast period. It can be attributed to the rising cases of kidney stones & urinary tract infections in both men and women. For instance, according to a report of the BMC Infectious Disease Journal published in 2023, UTI is the second most common infectious disease, affecting more than 150 million people globally annually, and more than 50% of all women and at least 12% of men experience UTI in their lifetime. This is likely to increase the adoption of nephrostomy tubes/nephrostomy catheters to drain urine from the kidney and boost the segmental growth over the forecast period.

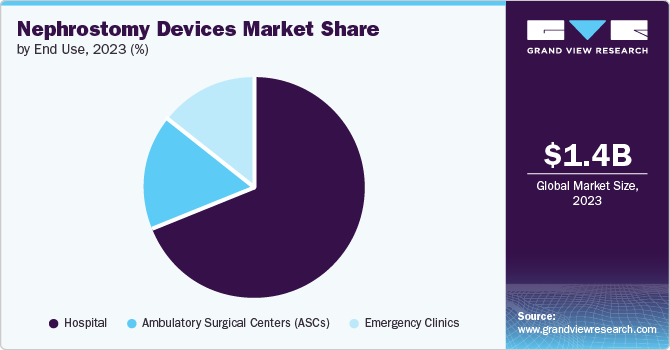

End Use Insights

Hospitals dominated the market and accounted for a market share of 69.3% in 2023. Hospitals typically have access to the latest innovations in nephrostomy technology. Hospitals also employ specialized medical professionals with expertise in urology, which increases patient confidence in undergoing procedures in these settings. In addition, the easy access to hospitals makes them a preferred option for conducting several tests by patients, driving segment growth.

Ambulatory surgical centers are expected to grow at a significant CAGR over the forecast period. The growing preference for minimally invasive procedures/surgeries aligns with the capabilities of ASCs, making them a popular choice for patients seeking efficient treatment options. It often provides more cost-effective care compared to hospitals. These factors are contributing to the segmental growth over the forecast period. For instance, according to an article by Beckers Healthcare published in April 2024, there are 6,087 Medicare-certified ASCs in the U.S.

Regional Insights

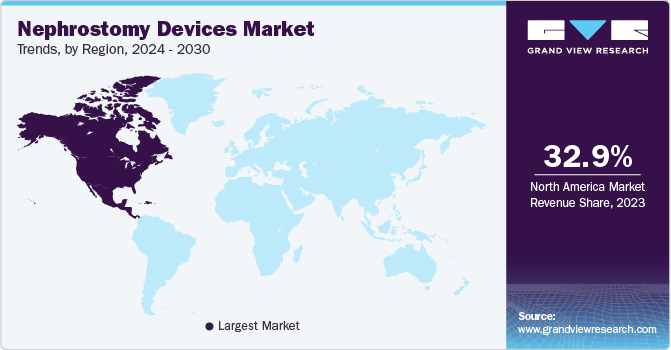

North America nephrostomy devices market dominated in 2023. It can be attributed to the increasing prevalence of chronic kidney diseases in the region. The improved healthcare sector and government investment has also contributed to the market growth. For instance, according to an article of the American Medical Association published in 2024, health spending in the U.S. increased by 4.1% in 2022 to USD 13,493 per capita. In addition, the rising awareness and the demand for innovative nephrostomy devices play a significant role. The governments of the countries in North America have been involved in creating awareness about the importance of treating CKD and the available treatment options.

U.S. Nephrostomy Devices Market Trends

The U.S. nephrostomy devices market accounted for 26.1% share of the global market in 2023 owing to factors such as improved healthcare facilities and expenditure and the increasing geriatric population leading to various CKDs. Various government initiatives and awareness programs have also contributed to the growth of the nephrostomy devices market over the forecast period. Various government initiatives and awareness programs have also contributed to the growth of the nephrostomy devices market over the forecast period. For instance, in 2023, the National Kidney Foundation entered into a partnership with the National Committee for Quality Assurance. The partnership aims at developing the Kidney Health Evaluation for Patients with Diabetes (KED), which is expected to act as a new standard for the Healthcare Effectiveness Data and Information Set (HEDIS) and further add to the market growth in the country.

Europe Nephrostomy Devices Market Trends

Europe nephrostomy devices market was identified as a lucrative region in 2023.It can be attributed to the technological advancements and improvements in healthcare facilities in this region. In addition, the growing geriatric population and prevalence of various kidney diseases have impacted the market growth. For instance, according to the World Cancer Research Fund International, there were 20,514, 14,541, and 13,714 kidney cancer cases in Germany, France, and the UK in 2022.

Asia Pacific Nephrostomy Devices Market Trends

Asia Pacific nephrostomy devices market is anticipated to witness significant growth in the nephrostomy devices market. The rising burden of CKD is leading to the increased demand for innovative and minimally invasive treatment options such as nephrostomy. For instance, as per the World Cancer Research Fund International, about 17,480 kidney cancer cases occurred in India in 2022. Increased awareness among healthcare providers and patients about the benefits of nephrostomy devices and increasing promotional strategies in this region are fostering market growth over the forecast period. For instance, in June 2023, the Health and Global Policy Institute and the Japan Kidney Association formed a comprehensive agreement on collaboration and cooperation for kidney disease.

MEA Nephrostomy Devices Market Trends

MEA nephrostomy devices market is anticipated to witness significant growth in the nephrostomy devices market due to public awareness and various initiatives. Demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, may also contribute to the growing demand for nephrostomy devices, thereby increasing the market growth in this region. For instance, according to a report of The World Ovarian Cancer Coalition ATLAS 2023 published in March 2023, there were 24,263 ovarian cancer cases in 2020 which would increase to 45,332 by 2040 in Africa.

Key Nephrostomy Devices Company Insights

Some of the key companies in the nephrostomy devices market include Boston Scientific Corporation, Teleflex Incorporated., Cardinal Health., BD., Cook Medical, and others. These companies are growing their market revenue by launching new products, collaborations, and adopting various other strategies.

-

Cardinal Health is a global company operating in the healthcare products and services market. The company offers a variety of nephrostomy devices as part of its urology product offerings, which includes a comprehensive range of catheter supplies that address different clinical needs, enhancing the overall management of urinary drainage and nephrostomy care.

-

Cook Medical is a medical device company that offers advanced solutions for nephrostomy procedures, enhancing both patient care and procedural outcomes. Cook Cope Loop Nephrostomy Set is used in the renal pelvis for nephrostomy drainage.

Key Nephrostomy Devices Companies:

The following are the leading companies in the nephrostomy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Teleflex Incorporated.

- Cardinal Health.

- BD

- Cook Medical

- B. Braun Melsungen AG

- Coloplast Group

- Olympus Corporation

- Argon Medical Devices.

- UreSil LLC

Recent Developments

-

In August 2021, Argon Medical Devices, Inc launched the SKATER mini-loop drainage catheter in the U.S. and the European Union.

Nephrostomy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.47 billion

Revenue forecast in 2030

USD 2.32 billion

Growth Rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa, Kuwait

Key companies profiled

Boston Scientific Corporation, Teleflex Incorporated., Cardinal Health., BD., Cook Medical, B. Braun Melsungen AG, Coloplast Group, Olympus Corporation, Argon Medical Devices., UreSil LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nephrostomy Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the nephrostomy devices market report based on product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Guidewires

-

Drainage Tubes

-

Nephrostomy Catheters

-

Sheath Dilators

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Emergency Clinics

-

Ambulatory Surgical Centers (ASCs)

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."