- Home

- »

- Clinical Diagnostics

- »

-

Neonatal Toxicology Market Size And Share Report, 2030GVR Report cover

![Neonatal Toxicology Market Size, Share & Trends Report]()

Neonatal Toxicology Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Specimen (Urine, Umbilical Cord, Meconium), By Technology (Mass spectroscopy, Immunoassay), By Drug (Cannabinoids, Opioids), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-358-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Neonatal Toxicology Market Summary

The global neonatal toxicology market size was estimated at USD 280.92 million in 2024 and is projected to reach USD 701.32 million by 2033, growing at a CAGR of 10.73% from 2025 to 2033. This growth is attributed to the increasing incidence of maternal drug use, along with development of more sensitive and specific testing methods.

Key Market Trends & Insights

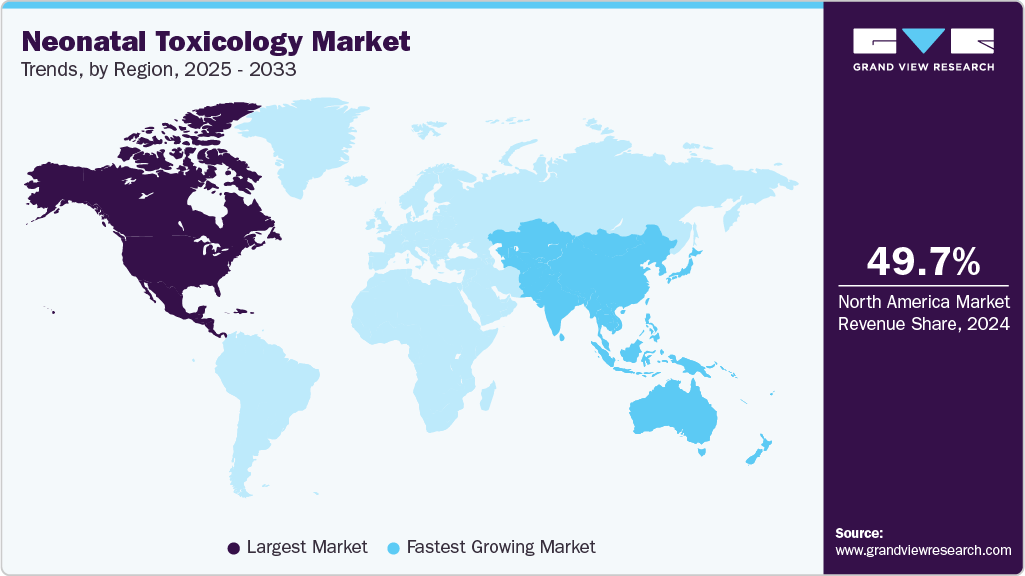

- North America neonatal toxicology market dominated the market and accounted for a 49.71% share in 2024.

- The neonatal toxicology market in the U.S. is expected to grow substantially over the forecast period.

- By specimen, the meconium accounted for largest revenue share of 39.17% in 2024.

- By technology, the mass spectroscopy segment dominated the market and accounted for the largest share of 67.11% in 2024.

- By drug, the cannabinoids segment dominated the market and accounted for the largest share of 27.23% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 280.92 Million

- 2033 Projected Market Size: USD 701.32 Million

- CAGR (2025-2033): 10.73%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The newborn mortality is also a rising concern governing the market growth, as per WHO estimates 2.3 million children died in the first 20 days of life in 2022, with estimated 6500 newborn deaths per day, accounting to 47% of all child deaths below the age of 5 years. Furthermore, increasing government initiatives and availability of newborn screening programs are likely to drive the market over the forecast period.The rising increase in maternal drug use during pregnancy has coincided with a surge in cases of neonatal opioid withdrawal syndrome (NOWS). This rise in maternal substance use, particularly opioids, has led to a concomitant increase in NOWS, a condition in which newborns experience withdrawal symptoms due to prenatal exposure to substances. The most commonly used substance in pregnancy is nicotine, followed by alcohol, marijuana, and cocaine. However, polysubstance use is as high as 50% in some studies. Notably, there has been five times increase in opioid use in pregnancy in the U S in recent years, coinciding with an "epidemic" of opioid prescription misuse. According to the data published by National Library of Medicine, substance abuse among pregnant women remains a pressing public health issue in the U.S, with nearly 6% using illicit drugs, over 8% drinking alcohol, and more than 16% smoking cigarettes. This has led to a staggering number of exposed offspring, with over 380,000 babies exposed to illicit substances, over 550,000 exposed to alcohol, and more than one million exposed to tobacco while in the womb.

Advanced analytical techniques have been created to identify and detect neonatal drug exposure and their metabolites in various biological samples. These biological samples have distinct windows of detection for exposure: acute exposure can be detected in matrices such as urine, blood, and oral fluid, typically within a short timeframe, while chronic exposure can be detected in matrices such as hair, meconium, or teeth, which provide a longer window of detection. Meconium analysis has gained prominence as a gold standard for drug testing in newborns that provides a longer window of detection for prenatal drug exposure compared to traditional urine or blood tests. Researchers are also exploring the potential of umbilical cord tissue analysis, which offers similar benefits to meconium testing but with easier and more standardized sample collection.

The market is further characterized by advancements in technology including mass spectrometry (MS), enzyme-based assays, and others. These technologies play a crucial role in detecting congenital or inborn abnormalities of metabolism at an early stage, preventing death, and promoting healthy development. Mass spectrometry techniques, particularly liquid chromatography-tandem mass spectrometry (LC-MS/MS), have emerged as gold standards due to their ability to detect and quantify a wide range of substances at very low concentrations. These methods allow for the simultaneous screening of multiple drugs and their metabolites, improving both the breadth and accuracy of testing.

Governments often establish regulations and guidelines that encourage or mandate drug testing for newborns in certain situations, such as when there's suspicion of maternal substance abuse during pregnancy. For instance, in the U.S., the Child Abuse Prevention and Treatment Act (CAPTA) encourages states to develop plans to address the needs of substance-exposed infants. Such initiatives across global regions is poised to drive the market in forecast period.

Market Concentration & Characteristics

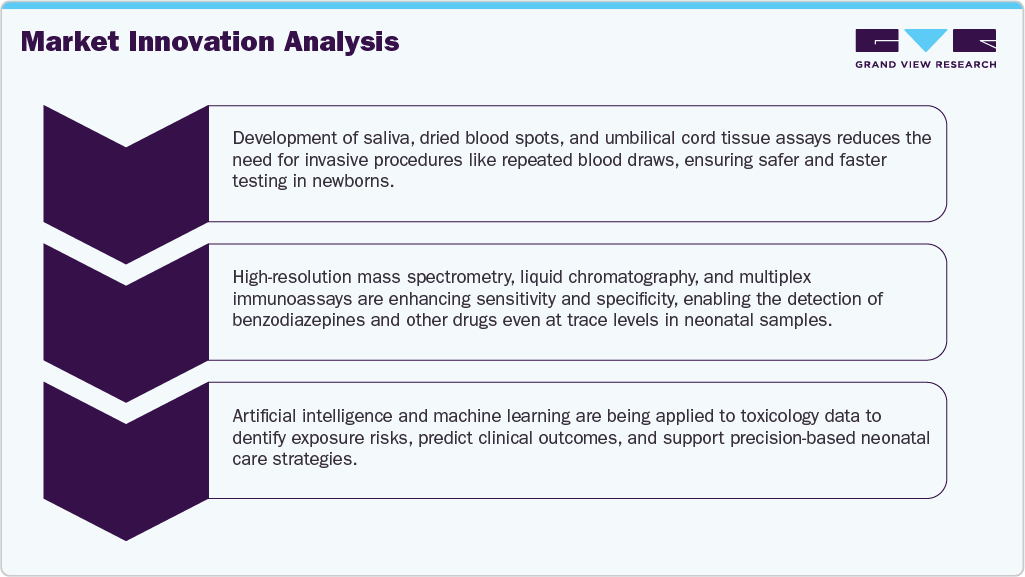

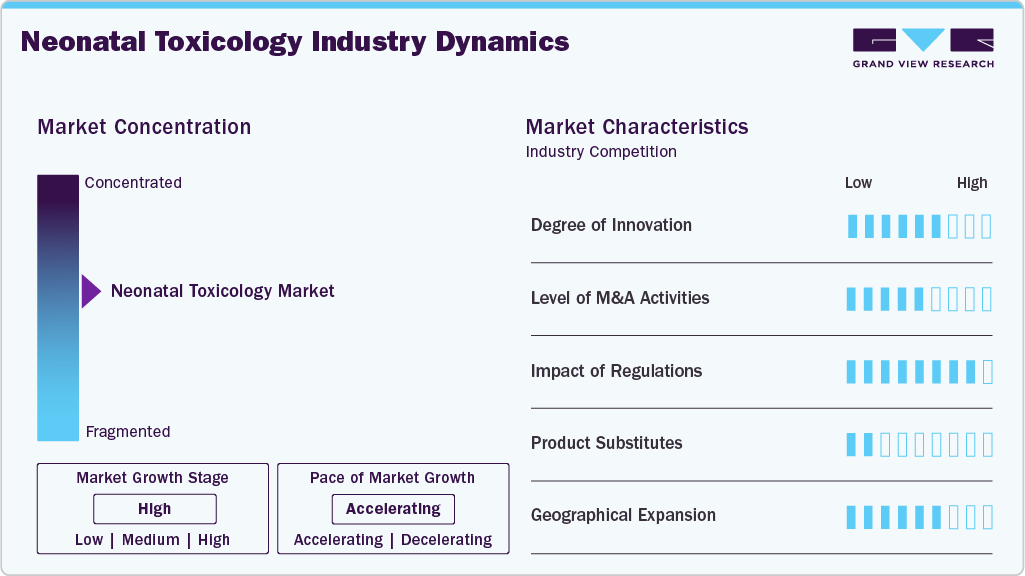

The neonatal toxicology market is characterized by a high degree of innovation, driven by the need for more accurate, rapid, and non-invasive testing methods. Recent advancements include the development of metabolomics-based approaches, improved mass spectrometry techniques, and the integration of artificial intelligence for data analysis. These innovations aim to enhance the sensitivity and specificity of toxicology screenings while minimizing sample volume requirements, which is crucial for neonatal patients.

The market is characterized by the leading players with moderate levels of technology launches and merger and acquisition (M&A) activity. Larger diagnostic companies are acquiring specialized laboratories and technology startups to expand their testing capabilities and geographical reach. These M&A activities are often aimed at consolidating resources, enhancing technological portfolios, and achieving economies of scale to better serve healthcare providers and improve market share.

Regulations play a significant role in shaping the neonatal toxicology testing market. Stringent quality control standards and approval processes set by regulatory bodies such as the FDA and EMA ensure the reliability and safety of testing methods. Compliance with these regulations can be challenging for smaller companies, potentially limiting market entry. However, these regulations also drive innovation and quality improvements, ultimately benefiting patient care and safety.

The threat of product substitutes in the neonatal toxicology testing market is relatively low due to the specialized nature of these tests. However, emerging technologies like non-invasive monitoring devices and wearable sensors are beginning to offer alternative methods for detecting certain toxins or drug exposures. While these substitutes are not yet widespread, they represent a potential shift in the market that could impact traditional laboratory-based testing methods in the future.

The market comprises of end users like hospital and clinical laboratories with neonatal intensive care units (NICUs) and specialized pediatric hospitals being the primary consumers. This concentration allows for focused marketing and sales efforts but also increases the bargaining power of these institutions. As a result, market players often need to differentiate their offerings through superior technology, comprehensive support services, or competitive pricing to secure long-term contracts with these key end users.

Specimen Insights

The meconium accounted for largest revenue share of 39.17% in 2024. This high share is attributable due to meconium testing providing higher sensitivity than urine testing and is comparable to umbilical cord tissue samples. Meconium is a valuable specimen for detecting in utero drug exposure. Recently, various studies highlighted meconium testing could identify 80-100% of cases of prenatal drug use, making it a highly sensitive method. It further offers advantages compared to traditional substances as the collection method is usually noninvasive, and sometime have very wide detection time spans up to exposure of 20 weeks for neonatal drug exposure compared to traditional urine or blood tests. Meconium testing panels at specialized labs such as Warde Medical Laboratory provides comprehensive range of drugs, including opioids, cocaine, amphetamines, methadone, phencyclidine, and THC. In addition, Arup Laboratories provide the Drug Detection Panel, Meconium, Qualitative, approved by New York DOH, which is a specialized test used to detect prenatal drug exposure in newborns. It leverages advanced analytical techniques to provide accurate qualitative results.

Umbilical Cord is anticipated to witness the fastest growth over the forecast period, owing to the emergence of umbilical cord testing as a vital tool for detecting prenatal drug exposure in newborns. Umbilical cord testing results are increasingly used in child welfare cases to assess parental fitness and determine appropriate interventions for newborns at risk due to prenatal drug exposure. Recently, in July 2022, a study published by research gate analysed 300 umbilical cord tissue (UCT) samples from mothers who tested positive for cocaine or opiates during pregnancy. The researchers used liquid chromatography-quadrupole time-of-flight mass spectrometry (LC/Q-TOF) to detect over 20 common adulterating substances in the UCT samples, caffeine and lidocaine were the most frequently detected adulterants, found in over 70% of samples. The segment is further anticipated for broader adoption in clinical settings, advancements in testing technologies, and integration into routine prenatal and neonatal care protocols.

Technology Insights

The mass spectroscopy segment dominated the market and accounted for the largest share of 67.11% in 2024. The high share is characterized by technological advancements, increasing incidences of neonatal drug exposure, and the need for accurate and rapid diagnostic solutions. The increasing. Liquid chromatography-tandem mass spectrometry (LC-MS/MS) is commonly used, allowing for the detection of a wide range of drugs and metabolites at low concentrations (as low as 0.2-20 ng/g of meconium). This technique can identify interferences that may be missed by simpler immunoassay screening methods. The rising prevalence of neonatal drug exposure due to maternal substance abuse has heightened the demand for reliable and comprehensive testing methods.

Mass spectroscopy is anticipated to witness the fastest growth over the forecast period. As regulatory bodies are increasingly approving and recommending mass spectrometry-based testing for its accuracy and ability to detect low levels of drugs, ensuring compliance with clinical guidelines and protocols. Manufacturers such as Shimadzu's provides tandem mass spectrometers ‘LCMS-8040’ which is widely adopted for newborn screening, allowing simultaneous detection of over 50 different metabolic disorders from a single blood spot sample. Furthermore, Shimadzu is collaborating with partners to proactively add new drugs such as gabapentin and kratom to their newborn drug screening panels, based on feedback about emerging drug use patterns.

Drug Insights

The cannabinoids segment dominated the market and accounted for the largest share of 27.23% in 2024 and is anticipated to grow at the fastest rate of 11.4% CAGR over the forecast period. The increasing acceptance and use of cannabis products, including marijuana, by pregnant women. Cannabis sativa(marijuana) is the most frequently used illegal drug among pregnant women. According to Jama network article, self-reported prevalence of using marijuana was between 2% and 5% during pregnancy. The increasing legalization and societal acceptance of cannabis use in many regions have led to higher rates of maternal cannabis use. This trend has heightened concerns about the impact of cannabinoids exposure on newborn health, prompting healthcare providers to advocate for comprehensive toxicology screening protocols.

The benzodiazepines segment is anticipated to grow significantly over the forecast period, due to its association with maternal drug exposure and the subsequent need for neonatal testing and monitoring. Benzodiazepines, widely prescribed for anxiety, insomnia, and seizure management, can cross the placental barrier and affect newborns, leading to complications such as respiratory distress, withdrawal symptoms, or impaired neurodevelopment. This drives the demand for specialized neonatal toxicology testing to identify exposure early and guide clinical management. Rising prescription rates, coupled with concerns over misuse and dependency, further highlight the importance of accurate screening methods. Market growth is also supported by advancements in analytical technologies and increased awareness of the long-term impacts of in utero benzodiazepine exposure.

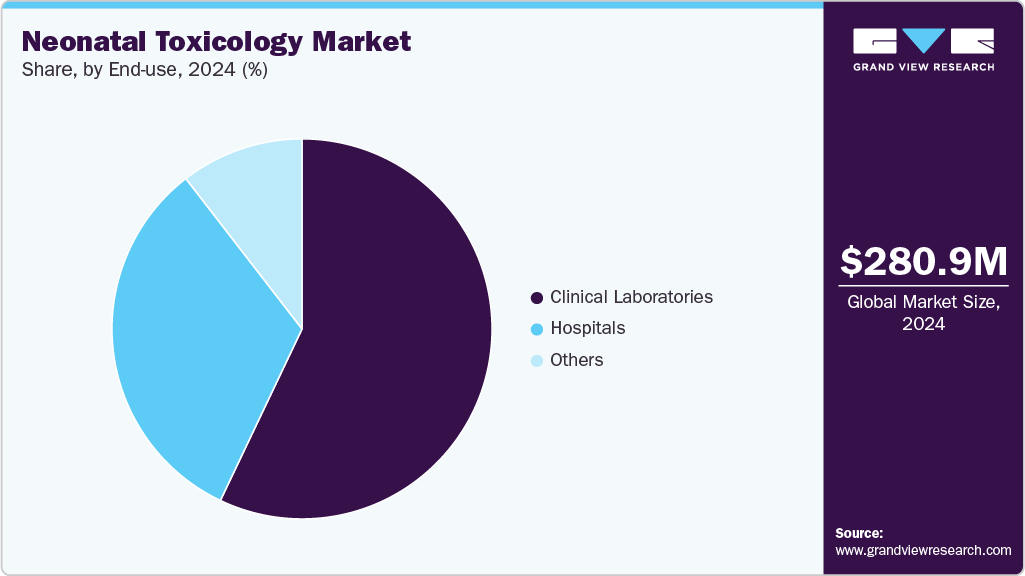

End Use Insights

The clinical laboratories segment dominated the end use segments with the largest market share of 57.07% in 2024 and is also anticipated to grow at the fastest rate of 12.17% CAGR over the forecast period. Clinical Laboratories are preferred for care due to the availability of various services under one roof. Clinical laboratories are at the forefront of providing comprehensive toxicology screening services for neonates. Labs such as NMS Labs are offering various testing services, and they cater to healthcare providers, hospitals, and neonatal intensive care units (NICUs) by offering a range of testing options that detect various substances, including drugs, toxins, and metabolites.

The hospitals segment is anticipated to grow at a substantial rate. The demand for accurate and timely diagnosis within these healthcare settings is expected to drive the adoption of advanced diagnostic tools & technologies. The availability of on-site diagnostic laboratories and the integration of comprehensive diagnostic services, including blood tests, imaging, biopsy, and molecular testing, are essential for streamlining the diagnostic process & ensuring prompt treatment initiation. Hospitals ensure proper collection, handling, and transportation of biological specimens (e.g., urine, meconium, umbilical cord tissue) for toxicology testing. Correct procedures are followed to maintain specimen integrity and prevent contamination, ensuring reliable test results.

Regional Insights

North America neonatal toxicology market dominated the market and accounted for a 49.71% share in 2024. This high share is attributable to high usage of maternal drugs during pregnancy. In the U.S., more than 10% of annual births are impacted by prenatal exposure to illicit drugs or alcohol, in the U.S., 5.9% of pregnant women use illicit drugs. In Canada, it is estimated that around 1,100 newborns under four weeks old experience adverse reactions to prescription medications each year, which are not approved by regulatory authorities for treating neonatal conditions or diseases. Furthermore, Government initiatives aimed at raising awareness about drug abuse and promoting organizational compliance for drug testing are also contributing to the market's expansion in the region.

U.S. Neonatal Toxicology Market Trends

The neonatal toxicology market in the U.S. is expected to grow substantially over the forecast period. Owing to the high prevalence of use of cannabis, studies have found the prevalence of prenatal cannabis use in the U.S. to be as high as 22.6%, with rates continuing to rise, especially in states where recreational cannabis has been legalized. The opioid epidemic has also contributed to significant rates of in-utero drug exposure.Accordingly, a study published in JAMA Network Open reported an increase in marijuana use among pregnant women from 3.4% in 2002 to 7% in recent years, Newborn screening using mass spectrometry has become the standard of care in the U.S., with coverage reaching 100%. Furthermore, there has been rise in significant percentage of newborns in the U.S. that undergoes toxicology screening at birth, reflecting the market's maturity and adoption of comprehensive screening protocol. In addition, government initiatives such as the Comprehensive Addiction and Recovery Act (CARA) have fueled investments in research and development of advanced neonatal drug testing technologies.

Europe Neonatal Toxicology Market Trends

Europe neonatal toxicology market was identified as a lucrative region in this industry. The prevalence of substance abuse during pregnancy is relatively lower in Germany compared to North America; however, the market is still witnessing growth due to increasing awareness and preventative measures. The European government’s proactive approach to healthcare policies and its commitment to funding research in toxicology are significant factors propelling market growth.

The neonatal toxicology market in the UK is expected to grow over the forecast period due to the UK faces significant challenges related to maternal substance use, including opioids, cannabinoids, cocaine, and other substances. Prenatal exposure to these drugs can have detrimental effects on neonatal health and development. Further, growing concern over prenatal substance exposure driving market growth, coupled with Advances in testing technologies improving accuracy and expanding capabilities are poised to drive growth in the market.

The neonatal toxicology market in Germany is expected to grow over the forecast period. In October 2022, German authorities announced cannabis legalization plans, after which Germany would be one of the pioneering countries in Europe to legalize marijuana, driving increase in use of illicit drugs. In Germany, the neonatal drug testing toxicology market is influenced by stringent healthcare regulations and increasing awareness about the impact of prenatal drug exposure on infant health. The country's healthcare system emphasizes early detection and intervention, driving demand for advanced screening technologies. High prevalence of maternal substance use, coupled with comprehensive public health programs, underscores the importance of effective toxicology screening in newborns.

Asia Pacific Neonatal Toxicology Market Trends

Asia Pacific neonatal toxicology market is anticipated to witness the fastest growth of 12.4% CAGR over the forecast period. This is due to market due to rapid urbanization, increasing substance abuse rates, and growing healthcare expenditure. Countries such as India and China are witnessing a rise in neonatal complications linked to maternal drug use. In addition, the expansion of healthcare infrastructure and the implementation of public health initiatives aimed at reducing drug abuse during pregnancy are contributing to market growth in this region.

The neonatal toxicology market in China is expected to grow over the forecast period China's booming medical tourism industry is driving demand for toxicological screening, including neonatal toxicology. The market is expanding rapidly, driven by the country's large population base and increasing cases of substance abuse. The Chinese government’s efforts to enhance healthcare services and implement comprehensive drug abuse prevention programs are key factors supporting market growth. In addition, the rise in public and private investments in healthcare infrastructure is expected to boost the adoption of neonatal drug testing kits.

The neonatal toxicology market in Japan is expected to grow over the forecast period. The Japanese government’s focus on improving maternal and child health outcomes, along with advancements in medical technology, is expected to drive the market. Although the prevalence of drug abuse is lower compared to Western countries, the emphasis on preventive healthcare is fostering market development.

Latin America Neonatal Toxicology Market Trends

Latin America neonatal toxicology market is anticipated to grow at a substantial growth rate over the forecast period. The expansion of healthcare infrastructure and increased investment in the healthcare sector are propelling the growth of the neonatal toxicology market in Latin America. Many countries in the region are witnessing improvements in their healthcare systems, including the establishment of specialized cancer treatment centers and the modernization of diagnostic laboratories.

The neonatal toxicology market in Brazil is expected to grow over the forecast period. In Brazil, the neonatal toxicology market is expanding, driven by the rising prevalence of drug use during pregnancy and increasing neonatal complications associated with substance abuse. Despite these challenges, there is a notable lack of awareness about the importance of neonatal drug testing among healthcare providers and the general public in developing countries like Brazil. This gap in awareness often leads to underutilization of available testing technologies, exacerbating the issue of undiagnosed and untreated neonatal drug exposure.

MEA Neonatal Toxicology Market Trends

MEA neonatal toxicology market is estimated to grow at a moderate rate due to rising awareness of benefits of newborn toxicology testing using an umbilical cord. There are several programs conducted in the various countries of MEA, however, implementation of clinical guidelines and adherence remains a challenge.

The neonatal toxicology market in Saudi Arabia is expected to grow over the forecast period. The Saudi government has been proactive in addressing substance abuse issues and improving maternal and child health outcomes. Through a combination of public health campaigns, policy reforms, and investments in healthcare infrastructure, Saudi Arabia is making strides in enhancing the quality and accessibility of neonatal drug testing. One of the key government initiatives is the National New Born Screening Program, which aims to reform and improve various sectors, including healthcare. Under this program, substantial funding has been allocated to upgrade healthcare facilities, implement advanced medical technologies, and train healthcare professionals. These efforts are critical in expanding the availability and accuracy of neonatal drug testing across the country.

Key Neonatal Toxicology Company Insights

Some of the key players operating in the market include Quest Diagnostics Incorporated, Quidel Corporation, Bio-Rad Laboratories, Inc., LabCorp, and others. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Neonatal Toxicology Companies:

The following are the leading companies in the neonatal toxicology market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics

- Quidel Corporation

- Bio-Rad Laboratories, Inc.

- LabCorp

- Clinical Reference Laboratory (CRL), Inc.

- Omega Laboratories, Inc.

- Cordant Health Solutions

- Agilent Technologies, Inc.

- USDTL

- Arup Consult

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In January 2025, Brown Gibbons Lang & Company (BGL), a leading independent investment bank and financial advisory firm, announced the sale of United States Drug Testing Laboratories Inc. (USDTL), a prominent forensic toxicology laboratory, to Northlane Capital Partners (NCP), a private equity firm focused on healthcare and business services.

-

In August 2024, Labcorp (NYSE: LH), a global leader in innovative and comprehensive laboratory services, announced the completion of its acquisition of select assets from Invitae (OTC: NVTAQ), a prominent medical genetics company. Through this integration, Labcorp and Invitae aim to strengthen support for patients, clinicians, and pharmaceutical partners across the full continuum of care-ranging from therapy development to accurate diagnosis and personalized treatment. The addition of advanced genetic testing platforms and enhanced diagnostic capabilities is expected to expand opportunities for improved screening and precision medicine.

Neonatal Toxicology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 310.20 million

Revenue forecast in 2033

USD 701.32 million

Growth rate

CAGR of 10.73% from 2024 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specimen, technology, drug, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Quest Diagnostics Incorporated; Quidel Corporation; Bio-Rad Laboratories, Inc.; LabCorp; Clinical Reference Laboratory (CRL), Inc.; Omega Laboratories, Inc.; Cordant Health Solutions; Agilent Technologies, Inc.; USDTL; Arup Consult, Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neonatal Toxicology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global neonatal toxicology market report on the basis of specimen, technology, drug, end use, and region:

-

Specimen Outlook (Revenue, USD Million, 2021 - 2031)

-

Urine

-

Umbilical Cord

-

Meconium

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2031)

-

Mass spectroscopy

-

Immunoassay

-

-

Drug Outlook (Revenue, USD Million, 2021 - 2031)

-

Cannabinoids

-

Opioids

-

Cocaine

-

Benzodiazepines

-

Amphetamines

-

Other illicit drugs

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2031)

-

Hospitals

-

Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2021 - 2031)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neonatal toxicology market size was estimated at USD 280.92 million in 2024 and is expected to reach USD 310.20 million in 2025.

b. The global neonatal toxicology market is expected to grow at a compound annual growth rate of 10.73% from 2024 to 2030 to reach USD 701.32 million by 2033.

b. North America dominated the neonatal toxicology market with a share of 49.71% in 2024. This is attributable to increasing incidence of maternal drug use, along with the development of more sensitive and specific testing methods.

b. Some key players operating in the neonatal toxicology market include Quest Diagnostics Incorporated, Quidel Corporation, Bio-Rad Laboratories, Inc., LabCorp, Clinical Reference Laboratory (CRL), Inc., Omega Laboratories, Inc., Cordant Health Solutions, Agilent Technologies, Inc., USDTL, Arup Consult

b. Key factors that are driving the market growth are increasing awareness of the impact of maternal substance abuse on neonatal health, rising incidences of neonatal abstinence syndrome (NAS), advancements in diagnostic technologies, and growing research on prenatal exposure to toxins. Additionally, supportive government initiatives and healthcare policies, coupled with increased funding for neonatal care, are propelling market growth. Enhanced screening protocols and improved treatment options for affected neonates also contribute significantly to the market's expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.