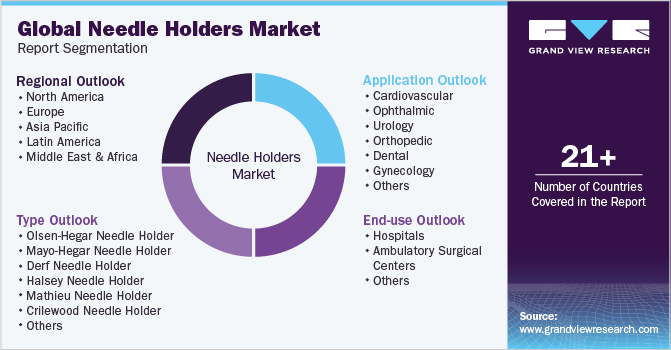

Needle Holders Market Size, Share & Trends Analysis Report By Type (Olsen-Hegar Needle Holder, Mayo-Hegar Needle Holder, Derf Needle Holder, Halsey Needle Holder), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-122-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global needle holders market size was estimated at USD 231.83 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.25% from 2023 to 2030. The growth is driven by factors such as the increasing prevalence of surgical procedures globally, advancements in minimally invasive techniques requiring precise instrument control, the growing geriatric population leading to higher demand for surgical interventions, and the continuous development of innovative needle holder designs that enhance surgical efficiency. Moreover, the rising healthcare infrastructure in emerging economies, expanding access to quality medical services, and the pursuit of improved patient outcomes are further propelling the demand for needle holders.

The global population continues to increase, which leads to a greater number of surgeries and medical procedures. A larger patient pool necessitates a higher supply of medical instruments, including needle holders. Moreover,developing countries are witnessing increased healthcare infrastructure development and access to healthcare services. This results in higher demand for medical instruments. As income levels rise in emerging markets, there is greater affordability for advanced medical procedures, which is expected to increase market growth.

Rapid advancements in medical technology have accelerated the development of innovative needle holder designs that cater to various surgical needs. Manufacturers are increasingly focusing on creating needle holders with improved grip mechanisms, ergonomic handles, and enhanced precision for delicate surgical procedures. Integration of features such as locking mechanisms and ratchets further enhances instrument control and reduces the risk of accidental needle slippage during surgeries. Surgeons are seeking tools that allow for precise movements, reduced fatigue, and better suturing techniques, which are further contributing to driving the demand for needle holders.

The increasing aging population coupled with the growing prevalence of chronic diseases has further contributed to the growth of the market.Older adults require several surgical interventions for conditions such as joint replacements, cardiac surgeries, and cancer treatments. As the geriatric population expands, the demand for surgical procedures is expected to rise, subsequently boosting the demand for surgical instruments, including needle holders. Moreover, ensuring high-quality surgical outcomes while minimizing tissue damage has become an important factor in these cases, thus, driving the adoption of advanced needle holder technologies.

Type Insights

Based on type, the Mayo-Hegar needle holder segment dominated the market with a share of over 20.64% in 2022. Mayo-Hegar needle holders have a versatile and functional design, making them suitable for a wide range of surgical procedures. Their jaws are designed to securely hold needles, sutures, and other surgical materials, making them applicable in various types of surgeries, from general procedures to specialized surgical fields such as orthopedics, gynecology, and plastic surgery. The instrument's adaptability to different surgical needs is contributing to driving the segment's growth.

The Olsen-Hegar needle holder segment is projected to witness a considerable CAGR in the coming years. The integrated design of Olsen-Hegar needle holders reduces the need for surgeons to handle multiple instruments simultaneously. This can lead to reduced hand fatigue during prolonged surgeries, enhancing surgeon comfort and minimizing the risk of instrument-related errors. As surgical teams prioritize minimizing the potential for mistakes, the convenience offered by Olsen-Hegar needle holders would further drive the segment’s adoption globally.

Application Insights

Based on application, the cardiovascular segment dominated the market in 2022 owing to the increasing prevalence of cardiovascular diseases (CVDs) globally. According to the World Health Organization (WHO), approximately 17.9 million people die due to CVDs annually. 80% of CVD-related deaths are from heart attacks and strokes, with a significant portion of these occurring among people under 70 years of age. Thus, these factors would further boost the demand for advanced and precise surgical tools, which is anticipated to increase market growth. These are important tools to perform delicate procedures, assisting surgeons in achieving accurate suturing, and contributing to the reduction of premature fatalities associated with CVDs.

The gynecological segment is projected to witness considerable growth during the forecast period. The growing trend towards minimally invasive procedures in gynecology has boosted the demand for specialized instruments that provide precision in confined spaces.Needle holders designed for gynecological applications are equipped to handle delicate procedures through small incisions. Surgeons require instruments that offer minimal scarring and reduced tissue trauma which would further drive the development and adoption of advanced needle holders tailored to gynecological needs.

End-use Insights

Based on end-use, the hospitals segment dominated the needle holders market with the highest revenue share of 45.9% in 2022. Hospitals offer a wide range of surgical procedures, such as general surgeries, specialty surgeries, and emergency interventions. The significant volume and diversity of surgeries performed in hospitals have led to an increasing demand for surgical instruments such as needle holders. Moreover, advanced healthcare infrastructure, well-equipped operating rooms, and skilled surgical teams are also contributing to the segment’s growth.

The ambulatory surgical centers segment is projected to witness considerable growth during the forecast period. The growth of the segment is attributed to the significant shift toward outpatient procedures, the increased focus on minimally invasive techniques, proper specialization in specific procedures, the presence of efficient resource utilization, and the adoption of technological advancements. As advanced needle holder designs are developed to cater to evolving surgical needs, ASCs are likely to incorporate these instruments to enhance their surgical capabilities.

Regional Insights

Based on region, North America held the largest market share of about 38.9% in 2022. This share is attributed to factors such as a strong emphasis on research and development (R&D), coupled with a high level of medical education and expertise, which drives the adoption of advanced medical devices. Manufacturers in the region are collaborating with medical professionals to develop instruments that meet the needs of several surgical specialties, further boosting the region's market growth.

Asia Pacific is estimated to grow at the highest CAGR of more than 12.19% from 2023 to 2030. This is due tothe increasing aging populationand increasing access to healthcare services. The number of surgeries performed in the Asia Pacific region is on the rise as healthcare infrastructure expands and medical facilities are becoming more accessible to the region’s population. This surge in surgical activity boosts the demand for surgical instruments such as needle holders which are essential for procedures ranging from routine surgeries to advanced medical interventions.

Key Companies & Market Share Insights

The market is fragmented owing tothe presence of diverse players. The companies are continuously investing in research and development (R&D) to introduce innovative designs and technologies. They focus on creating needle holders with enhanced grip mechanisms, ergonomic handles, and specialized features that cater to different surgical specialties and techniques. In April 2023, Cardiac Services announced a of strengthening its surgical portfolio by launching Wexler Surgical's innovative instruments. The company specializes in needle holders,forceps, retractors, scissors, and others. Some prominent players in the global needle holders market include:

-

B.Braun

-

J&J Instruments

-

Becton, Dickinson and Company

-

Olympus

-

August Reuchlen GmbH

-

Hu-Friedy

-

Nordent Manufacturing

-

Towne Brothers (PVT) LTD

Needle Holders Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2023 |

USD 255.30 million |

|

The revenue forecast in 2030 |

USD 505.50 million |

|

Growth rate |

CAGR of 10.25% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million & CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use, region |

|

Regions covered |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark, Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina, South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

B.Braun; J&J Instruments; Becton, Dickinson and Company; Olympus; August Reuchlen GmbH; Hu-Friedy, Nordent Manufacturing; Towne Brothers (PVT) LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Needle Holders Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the needle holders market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Olsen-Hegar Needle Holder

-

Mayo-Hegar Needle Holder

-

Derf Needle Holder

-

Halsey Needle Holder

-

Mathieu Needle Holder

-

Crilewood Needle Holder

-

Webster Needle Holder

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Ophthalmic

-

Urology

-

Orthopedic

-

Dental

-

Gynecology

-

Laparoscopic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global needle holders market size was estimated at USD 231.83 million in 2022 and is expected to reach USD 255.5 million in 2023.

b. The global needle holders market is expected to grow at a compound annual growth rate of 10.25% from 2023 to 2030 to reach USD 505.50 million by 2030.

b. North America dominated the needle holders market with a share of 29.3% in 2022. This is attributable to an increase in the number of surgical procedures, and increasing number of road accidents and trauma cases in the region.

b. Some key players operating in the needle holders market include B.Braun, J&J Instruments, Becton, Dickinson, Olympus, August Reuchlen GmbH, Hu-Friedy, Nordent Manufacturing and Towne Brothers (PVT) LTD.

b. Key factors that are driving the needle holders market growth include the increasing prevalence of chronic diseases, rising number of road accidents, and rise in the number of surgical procedures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."