Needle-free Drug Delivery Devices Market Size, Share & Trends Analysis Report By Technology (Jet Injectors, Inhaler Technology, Transdermal Patch Technology, Novel Needle-Free Technologies), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-879-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

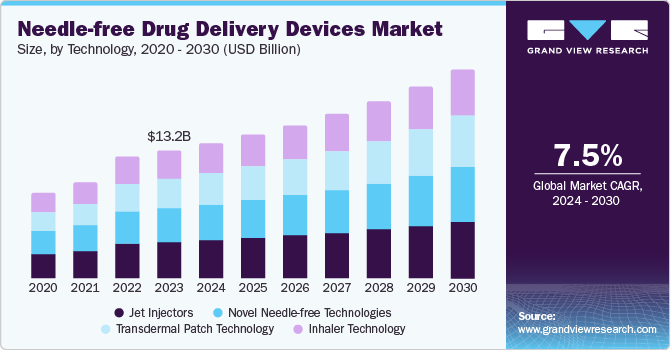

The global needle-free drug delivery devices market size was valued at USD 13.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% during the forecast period, 2024 to 2030. Increasing number of diabetes patients across the world and the requirement of convenient glucose monitoring devices are driving the market. Earlier, type 1 diabetes patients used needles to check glucose, which was a painful practice and involved risk of infections. As needle-free devices are risk free and provide painless experience, demand for these devices is exponentially increasing during the forecast period.

Moreover, technological developments in drug transportation and self-administration are expanding the market further. For instance, in November 2023, Becton, Dickinson and Company (BD) launched PIVO Pro Needle-free Blood Collection Device after receiving clearance from the U.S. FDA.

Initiatives to control the incidences of infectious diseases such as hepatitis, AIDS and others is estimated to expand the market growth during the forecast period. For instance,, according to the Centers for Disease Control and Prevention (CDC), in 2022, about 7% individuals were diagnosed with HIV infection, attributed to the injection drug use (IDU).

Needle-free devices reduce pain and decrease the risk of infection, making them preferable to standard procedures. Thus, the increasing availability of these devices and the presence of well-developed healthcare facilities in developed countries are expected to drive market growth. Furthermore, increasing initiatives by government organizations and pharmaceutical companies to sponsor extensive research and development costs for diabetes and chronic pain cases are also expected to have a positive impact on the market.

Technology Insights

In 2023, jet injectors segment held the largest share of 29.2%, owing to the key advantages such as fast working mechanism and insulin distribution over a larger area in lower layer of an individual's skin. Jet injectors are used in several applications due to standardized injections, faster response, painless experience and easy transmission into tissues. Additionally, these injectors are easy to dispose of and portable, ultimately increasing convenience in reducing medical waste and easy transport. Some of the important applications are vaccination, insulin doses, antibiotics and anesthesia.

The transdermal patch segment is projected to grow at the fastest CAGR of 9.1% during the forecast period, 2024 to 2030. The factors influencing the demand of these products are effective absorption of medications, assuring the right quantity of doses, consistent drug levels and reduction in side effects. Additionally, patches provide flexibility, ease in the use, allow the patient to perform daily activities, driving the segment growth in coming years.

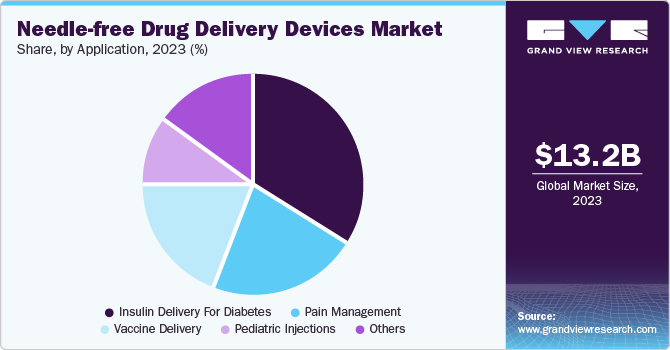

Application Insights

In 2023, insulin delivery held the largest revenue share of 33.6%. Increasing number of people suffering from diabetes due to unhealthy lifestyle are driving the segmental growth. According to the Centers for Disease Control and Prevention, about 38.4 million individuals were affected by diabetes globally in 2023, of which 11.6% were U.S. citizens. Additionally, technologically advanced products such as insulin micropump, insulin pen, insulin spray, inhalable insulin, and other novel jet injectors are accommodating the vast variety of diabetes patients across the world, further expanding the market.

Pediatric injections is expected to grow at the fastest CAGR of 8.7% from 2024 to 2030. The increasing awareness about timely immunization of infants and institutional efforts from governments across the world are expected to drive the market. Many countries are aggressively running campaigns to promote vaccination and educating parents. Global institutions such as WHO are encouraging and helping countries to conduct vaccination programs.

Regional Insights

North America needle-free drug delivery device market dominated the regional segment by capturing the largest share of 43.4% in 2023. Increased awareness of people about healthcare and tendency to adopt advanced devices are the prime drivers of the market. Additionally, equipped healthcare facilities and focus on R&D and government support are boosting regional growth. Pharmaceutical companies are focusing on developing convenient drug delivery devices for diabetes and other chronic disorders, further expanding the scope of this market.

U.S. Needle-free Drug Delivery Devices Market Trends

U.S. needle-free drug delivery device market dominated the North American regional market by capturing more than 80.0% of revenue share in 2023. It is also expected to grow at a CAGR of 7.3% from 2024 to 2030. Increasing prevalence of diabetes across all ages and income groups is the key reason propelling the U.S. market growth.

Europe Needle-free Drug Delivery Devices Market Trends

Europe needle-free drug delivery device market held the second largest revenue share of 29.7% in 2023. Presence of developed countries such as UK, Germany and France are shaping the regional market. According to WHO, Europe has the largest number of type 1 diabetes patients in the world.

Asia Pacific Needle-free Drug Delivery Devices Market Trends

Asia Pacific needle-free drug delivery device market is expected to grow at the fastest CAGR of 9.4% over the forecast period. This is due to the westernization of lifestyles and obesity are increasing risks associated with diabetes in the region. Highly populated countries such as China and India have large number of patients suffering from diabetes.

Key Needle-free Drug Delivery Devices Company Insights

The needle-free drug delivery device market is characterized by the presence of several small and large companies. It is competitive in nature and dominated by key market players such as PenJet, PharmaJet, 3M and others. Companies are adopting strategies such as new product launch, regional expansion, partnership, and distribution agreements to increase their market penetration

- PenJet specializes in drug delivery devices. It manufactures cost effective and painless needle-free injection devices in its advanced manufacturing facility. It maintains a wide range of products describing its needle-free injection technology.

Key Needle-free Drug Delivery Devices Companies:

The following are the leading companies in the needle-free drug delivery devices market. These companies collectively hold the largest market share and dictate industry trends.

- PenJet

- Zealand Pharma

- UCB S.A.

- PharmaJet

- 3M

- Verdict Media Limited

- INJEX Pharma AG

- Antares Pharma

- Endo Pharmaceuticals Inc.

- Bioject Medical Technologies, Inc.

- Crossject SA

View a comprehensive list of companies in the Needle-free Drug Delivery Device Market

Recent Developments

-

In May 2024, Serum Institute of India (SII) announced that it would acquire 20% stake in IntegriMedical to advance in needle-free injection system (NFIS) technology.

-

In October 2022, NuGen Medical Devices Inc. announced the launch of InsuJet devices in Canada. It provides 5,000 insulin injections, thereby reducing the long-term injections costs and eliminating biomedical waste & needle stick injuries and medication without anxiety.

Needle-free Drug Delivery Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 14.0 billion |

|

Revenue forecast in 2030 |

USD 21.6 billion |

|

Growth rate |

CAGR of 7.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, Technology, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

PenJet, Valeritas, Inc., Zogenix, PharmaJet, 3M, Verdict Media Limited, INJEX Pharma AG, Antares Pharma, Endo Pharmaceuticals Inc., Bioject Medical Technologies, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Needle-free Drug Delivery Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global needle-free drug delivery devices market report based on technology, application and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Inhaler technology

-

Transdermal patch technology

-

Novel needle-free technologies

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Vaccine delivery

-

Pain management

-

Insulin delivery for diabetes

-

Pediatric injections

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."