- Home

- »

- Consumer F&B

- »

-

Natural Flavors Market Size, Share & Growth Report, 2030GVR Report cover

![Natural Flavors Market Size, Share & Trends Report]()

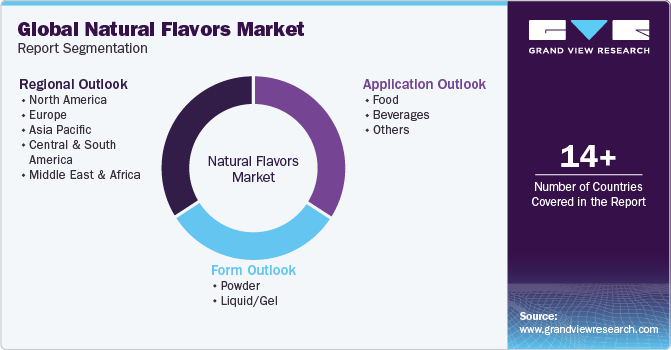

Natural Flavors Market Size, Share & Trends Analysis Report By Form (Powder, Liquid/Gel), By Application (Food, Beverages), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-256-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Natural Flavors Market Size & Trends

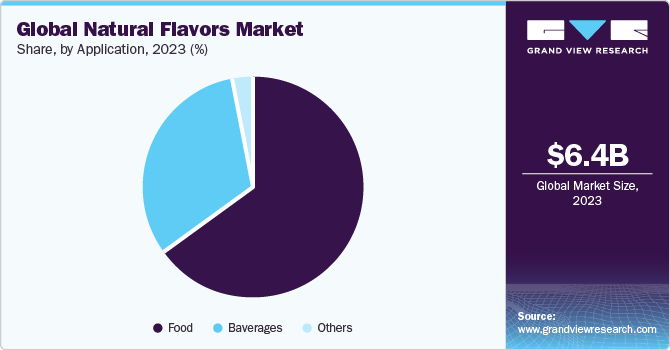

The global natural flavors market size was valued at USD 6.40 billion in 2023 and is expected to grow at a CAGR of 7.5% from 2024 to 2030. There is a growing preference for authentic flavor experiences, with natural flavors offering genuine taste profiles derived from real food sources.Concerns about environmental sustainability further fuel the demand for natural flavors, perceived as more eco-friendly options. Moreover, the diverse range of flavor options provided by natural flavors allows for innovation and differentiation in product offerings, catering to the varied tastes of consumers.

The natural flavors industry expansion is driven by evolving consumer taste and preferences. Factors such as the increasing prevalence of chronic diseases propel the demand for natural food ingredients, while growing awareness of the health benefits of natural colors further fuels market growth.

Consumer preference for natural and clean-label products, including ready-to-drink fruit beverages made from all-natural ingredients, also contributes to the market expansion. Additionally, the growth of the global confectionery and baking industry, coupled with rising per capita income and health consciousness, creates favorable conditions for market expansion.

The demand for "bold and intriguing" flavors and natural food coloring is fueled by adventurous consumers who seek unique culinary experiences and share them online. To stand out in a competitive market, brands are combining intense flavors with vibrant colors. For instance, GNT recently introduced blue granules made from spirulina, a type of blue-green algae. These granules offer enhanced color intensity, meeting the demand for high-impact hues sourced from natural and traceable ingredients.

According to Sensapure Flavors, studies confirmed that more than 70% of customers show a preference for the term "natural" over "artificial" on ingredient labels. With consumers actively avoiding products that do not display "natural" on their labels, it is evident that there is a clear choice: it is time to increase the formulation of products with natural flavors. However, working with natural flavors can pose challenges in maintaining consistent and stable flavor profiles, which are typically associated with artificial flavors.

Sustainability and ethical considerations are becoming increasingly important, with consumers now more aware of the environmental impact and ethical implications of their food choices, making natural flavors sourced from sustainable practices more appealing. Technological advancements in flavor extraction and formulation have made natural flavors more accessible and cost-effective, broadening their appeal to manufacturers.

For instance, in June 2023, Sensegen, a biotechnology-based company specializing in taste, smell, and beauty solutions, has unveiled its highly anticipated exotic flavors collection. This collection introduces a variety of captivating flavors designed for use in food and beverages. The lineup showcases six distinctive exotic flavors that stay true to the essence of each fruit: lychee, guava, papaya, yuzu, dragon fruit, and violet.

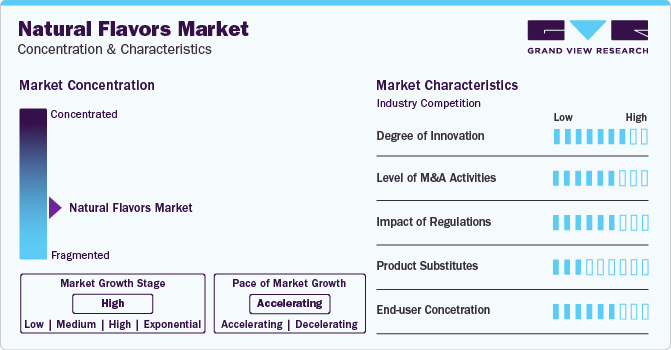

Market Concentration & Characteristics

The natural flavors market is experiencing a remarkable degree of innovation, characterized by groundbreaking advancements in food technology and formulation methods. There is a growing trend of creating complex flavor combinations using natural ingredients. Manufacturers are experimenting with blending different fruits, herbs, and spices to develop innovative flavor profiles that appeal to consumers' evolving tastes. Advancements in technology, including extraction techniques, flavor encapsulation, and analytical methods, are driving innovation in the market. These technologies enable manufacturers to create more complex flavor profiles, improve flavor stability, and enhance overall product quality.

Regulations set by governmental bodies dictate the permissible use of natural flavors in food and beverage products. Companies operating in the natural flavors industry must comply with these regulations to ensure the safety and legality of their products. Compliance requirements often include specifications on ingredient sourcing, labeling, and permissible additives, which can influence product formulations and manufacturing processes.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their market positions. Over the next few years, internationally reputed companies are likely to acquire small, medium-form companies operating in the industry in a bid to facilitate regional expansion.

Form Insights

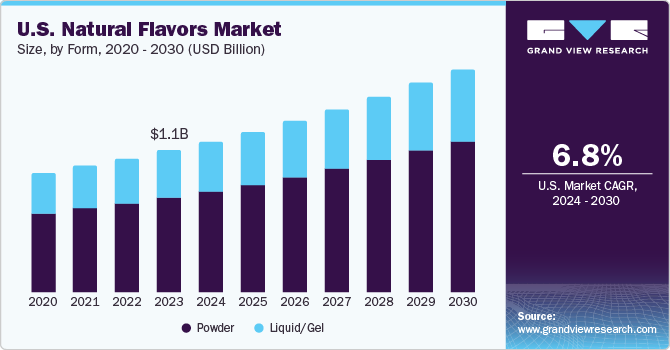

The powdered natural flavors segment accounted for a share of 66.3% in 2023. Powdered natural flavors provide flexibility in formulation, allowing manufacturers to control the intensity and flavor profile of their products more precisely. This versatility enables the creation of custom blends and formulations tailored to specific product applications and consumer preferences.

In November 2023, Zack's Mighty introduced ROLLED Tortilla Chips, the first Non-GMO Project Verified rolled tortilla chips on the market. Crafted with natural ingredients and devoid of artificial colors, these chips stand out by utilizing beet powder instead of red dye. Available in two bold varieties, Chile Lime and Fiery Nacho and ROLLED Tortilla Chips, they offer a delicious and wholesome snacking experience.

The liquid/gel natural flavors segment is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. Liquid and gel forms of natural flavors offer ease of incorporation into a wide range of food and beverage products. They can be easily mixed or blended into recipes, allowing for consistent flavor distribution and uniformity throughout the product.

Application Insights

The food application segment accounted for a share of around 65.0% in 2023. With increasing awareness of the potential health risks associated with artificial additives and synthetic ingredients, consumers are becoming more cautious about the foods they consume. Natural flavors offer a safer alternative, as they are derived from real food sources such as fruits, vegetables, herbs, and spices. This heightened health consciousness is fueling the demand for natural flavors in food applications.

The beverages application segment is projected to grow at a CAGR of 7.9% from 2024 to 2030. Natural flavors provide authentic and true-to-source flavor experiences, enhancing the taste and quality of beverages. Whether it's fruit-infused waters, flavored teas, or botanical-based sodas, beverages made with natural flavors offer genuine flavor profiles derived from real fruits, herbs, and spices, resonating with consumers seeking authentic taste experiences.

In July 2023, General Mills introduced Häagen-Dazs Cultured Crème, a luxurious addition to the yogurt aisle. Cultured Crème offers a unique fusion of yogurt and ice cream in one delicious snack. Crafted with premium ingredients, including fresh milk, cream, and real fruit, Cultured Crème is free from artificial colors and flavors, boasting a blend of dairy cultures in under nine ingredients. Available in enticing flavors such as black cherry, blueberry, coffee, lemon, strawberry, and vanilla, each single-serve cup invites consumers to indulge in a decadent yogurt experience.

Regional Insights

The natural flavors market in North America held a share of 24.8% in 2023. The region boasts a vibrant food innovation ecosystem, with numerous startups and established companies continually introducing new and innovative flavors and forms. Consumers are increasingly seeking out products made with natural flavors due to their perceived health benefits, such as being free from artificial colors and additives. As consumers become more exposed to global food trends and seek out healthier and more natural options, the demand for natural flavors is expected to continue growing.

U.S. Natural Flavors Market Trends

The U.S. natural flavors market is expected to grow at a CAGR of 6.8% from 2024 to 2030, owing to the rising demand for transparency in food and beverage ingredients, with consumers looking for products that contain recognizable, natural components.

Asia Pacific Natural Flavors Market Trends

The natural flavors market in Asia Pacific is expected to grow at a CAGR of 8.3% from 2024 to 2030. With rising disposable incomes and a growing middle class, consumers in the region are becoming more health-conscious. There is a growing preference for natural and clean-label products perceived as healthier alternatives to artificial ingredients. Natural flavors align with this trend, driving the regional demand.

Key Natural Flavors Company Insights

The market for natural flavors is highly competitive, with a range of companies offering various forms. Many big players are increasing their focus on new form launches, partnerships, and expansion into new markets to compete effectively.

Key Natural Flavors Companies:

The following are the leading companies in the natural flavors market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan

- Firmenich SA.

- Symrise

- Sensient Technologies Corporation

- International Flavors & Fragrances Inc. IFF

- Takasago International Corporation

- MANE

- Kerry Group plc

- Huabao Flavours & Fragrances Co. Ltd.

- Robertet Group

Recent Developments

-

In June 2023, T. Hasegawa launched two innovative technologies, HASEAROMA and ChefAroma flavor enhancers, aimed at creating authentic-tasting food and beverage products in the North American market.

-

In January 2023, IFF introduced CHOOZIT VINTAGE to the U.S. and Canadian markets. This revolutionary product played a crucial role in assisting cheddar cheese manufacturers in addressing undesirable flavor development during aging, streamlining the cheesemaking process, and achieving the consistent flavors and textures that consumers love., antibiotics, and cholesterol, promoting kindness towards animals and the planet.

Natural Flavors Market Report Scope

Report Attribute

Details

Market form value in 2024

USD 6.84 billion

Revenue forecast in 2030

USD 10.54 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa; UAE

Key companies profiled

Givaudan; Firmenich SA; Symrise; Sensient Technologies Corporation; International Flavors & Fragrances Inc.; IFF; Takasago International Corporation; Kerry Group plc; MANE; Robertet Group; Huabao Flavours & Fragrances Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Flavors Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural flavors market report based on form, application, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid/Gel

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Dairy Products

-

Bakery & Confectionery

-

Supplements & Nutrition Products

-

Meat & Seafood Products

-

Snacks

-

Pet Foods

-

Sauces, Dressings & Condiments

-

Others

-

-

Beverages

-

Juices & Juice Concentrates

-

Functional Beverages

-

Alcoholic Beverages

-

Carbonated Soft Drinks

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global natural flavors market size was estimated at USD 6.40 billion in 2023 and is expected to reach USD 6.84 billion in 2024.

b. The global natural flavors market is expected to grow at a compounded growth rate of 7.5% from 2024 to 2030 to reach USD 10.54 billion by 2030.

b. The food accounted for a share of 65.0% in 2023. There is a growing consumer preference for clean label products made with natural ingredients. Consumers are increasingly seeking out food products that contain recognizable and minimally processed ingredients, driving the demand for natural flavors.

b. Some key players operating in natural flavors market include Givaudan, Firmenich SA, Symrise AG, and Sensient Technologies Corporation

b. Key factors that are driving the market growth include rising preference for clean label products and Wide range of flavors available.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."