- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Natural Fiber Market Size & Share, Industry Report, 2030GVR Report cover

![Natural Fiber Market Size, Share & Trends Report]()

Natural Fiber Market (2025 - 2030) Size, Share & Trends Analysis Report By Plant-based Fiber (Cotton, Linen, Jute, Hemp), By Animal-based Fiber (Wool, Silk), By Region (North America, Europe, Asia Pacific, C&SA, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-528-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Fiber Market Summary

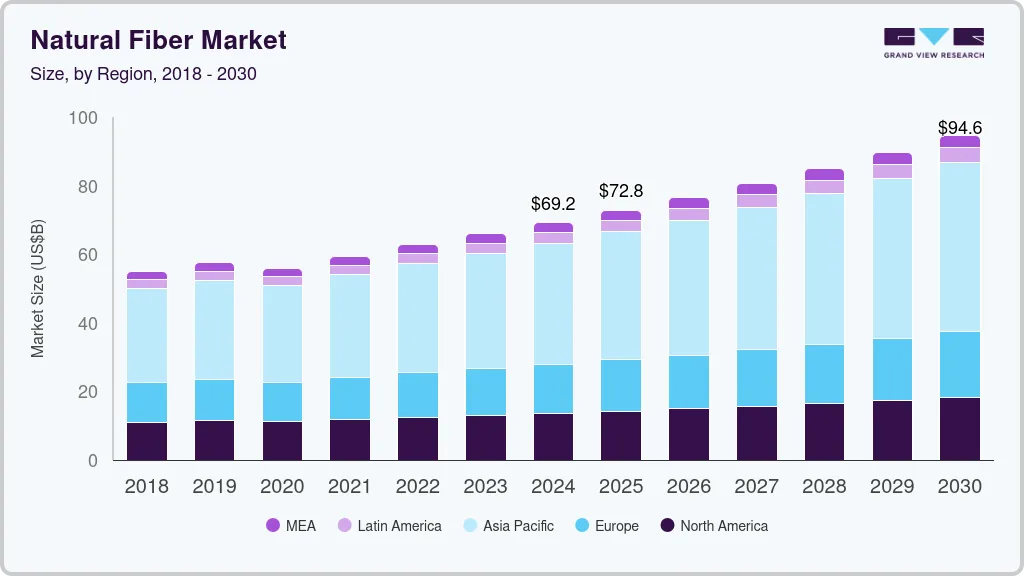

The global natural fiber market size was estimated at USD 69.23 billion in 2024 and is projected to reach USD 94.65 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. This growth is driven by increasing environmental concerns and the shift toward sustainable materials.

Key Market Trends & Insights

- Asia Pacific was the largest revenue-generating market in 2024, accounting for over 51.1% of the global share.

- S. is driven by increasing consumer preference for sustainable and eco-friendly materials, particularly in the textile and apparel industries.

- Cotton led the plant-based fiber market with an 82.0% revenue share in 2024.

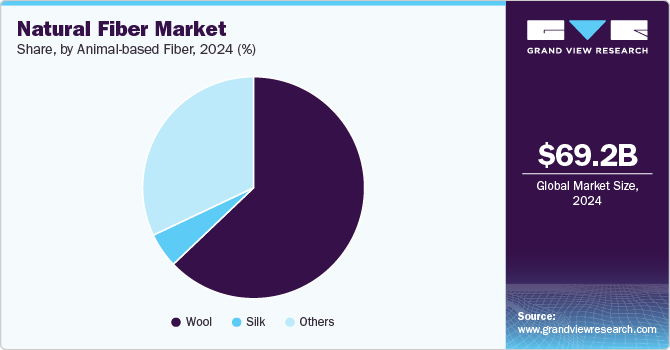

- The wool segment led the animal-based fiber market with a 62.9% revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 69.23 Billion

- 2030 Projected Market Size: USD 94.65 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Consumers and industries alike are seeking alternatives to synthetic fibers, which are often associated with environmental pollution and high carbon footprints.

Natural fibers such as cotton, flax, hemp, jute, and wool are biodegradable, renewable, and offer superior comfort, breathability, and durability. Governments and regulatory bodies worldwide are promoting the use of natural fibers through policies, incentives, and awareness campaigns, further propelling market expansion. In addition, the fashion and textile industries are witnessing a surge in demand for eco-friendly products, leading to increased adoption of natural fibers in clothing, home furnishings, and industrial applications.

Advancements in agricultural practices and fiber-processing technologies are enhancing the yield and quality of natural fibers, making them more competitive with synthetic alternatives. Innovations in fiber blending and treatment techniques have improved the performance characteristics of natural fibers, making them suitable for a wider range of applications, including automotive, construction, and composites. The growing emphasis on circular economy principles, where products and materials are reused and recycled, is also supporting the market growth.

Moreover, the rising demand for sustainable packaging solutions is driving the use of natural fibers in biodegradable packaging materials. The food and beverage, cosmetics, and e-commerce industries are increasingly adopting natural fiber-based packaging to reduce plastic waste and comply with stringent environmental regulations. In addition, consumer awareness regarding the adverse health effects of synthetic fibers in clothing and bedding is boosting the preference for organic and naturally sourced fibers. As a result, the global natural fiber industry is poised for continuous growth, driven by sustainability trends, technological advancements, and regulatory support.

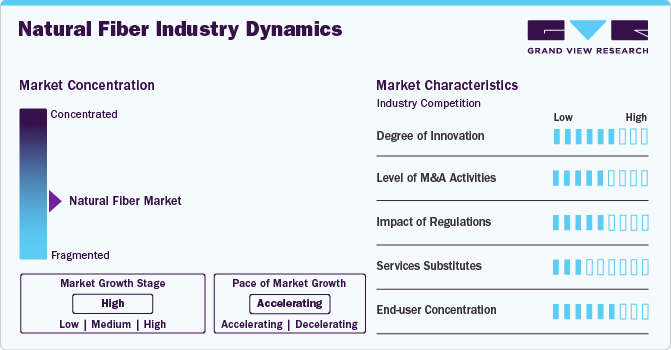

Market Concentration & Characteristics

The global natural fiber industry exhibits a moderate to high level of market concentration, with key players holding significant shares due to established supply chains, technological advancements, and brand equity. The degree of innovation within the industry is evolving, primarily driven by advancements in fiber processing techniques, sustainability initiatives, and the integration of natural fibers into high-performance applications such as composites and technical textiles. Innovation is also evident in bioengineering efforts to enhance fiber quality and durability, as well as in the development of eco-friendly dyes and treatments. In addition, the regulatory landscape significantly influences market dynamics, with stringent environmental regulations promoting the use of biodegradable and sustainable fibers while restricting synthetic alternatives. Government policies, such as subsidies for organic fiber production and restrictions on chemical processing, further shape market competition and industry growth.

Service substitutes in the natural fiber industry are relatively limited, as synthetic fibers are the primary alternative. However, growing environmental concerns and regulatory measures favoring biodegradable materials have increased the adoption of natural fibers in industries such as automotive, construction, and apparel. End-use concentration in the market is high, with the textile industry being the dominant consumer, followed by applications in paper, composites, and medical textiles. The automotive sector is also witnessing increased usage of natural fibers due to their lightweight and sustainable properties. As demand diversifies across multiple industries, market players are focusing on strategic partnerships, technological advancements, and compliance with regulatory standards to maintain competitiveness and expand their customer base.

Plant-based Fiber Insights

Based on plant-based fiber, the cotton segment led the market with the largest revenue share of 82.0% in 2024, driven by the increasing demand for sustainable and eco-friendly products. As consumers become more environmentally conscious, they are turning away from synthetic fibers, which are often derived from non-renewable resources, and opting for plant-based alternatives. Cotton, being biodegradable and renewable, aligns with these growing preferences for sustainable materials. This shift in consumer behavior is not only seen in the textile industry but also in the fashion and home goods markets, where cotton-based products such as clothing, bedding, and upholstery are gaining popularity.

The hemp segment is expected to grow at the fastest CAGR of 6.5% over the forecast period, driven by a combination of sustainability, health trends, and technological advancements. As environmental concerns around synthetic fibers grow, hemp has gained significant attention due to its eco-friendly attributes. Hemp requires fewer pesticides, and less water compared to other crops, making it an ideal alternative for environmentally conscious consumers and businesses. The rising awareness of sustainability in both the fashion and construction industries has led to an increased demand for hemp-based products, positioning it as a key player in the shift towards greener and more sustainable materials.

Animal-based Fiber Insights

Based on animal-based fiber segment, the wool segment led the market with the largest revenue share of 62.9% in 2024. The increasing awareness of the benefits of wool in terms of comfort and durability drives its use in fashion and interior design. The natural elasticity and resistance to wrinkles add to wool's appeal, particularly in high-end markets where longevity and quality are prioritized. The rise in interest in luxury wool products, such as merino wool and cashmere, has also spurred market growth. These fibers are often associated with premium textiles, and their demand in global fashion markets, especially in the luxury segment, has seen a steady increase.

The silk segment is expected to grow at the fastest CAGR of 3.5% over the forecast period. Technological advancements in the sericulture industry play an important role in driving the silk market. Innovations in silk production processes and improvements in quality control allow for more sustainable production, reducing waste and environmental impact. These advancements are making silk more accessible and attractive to environmentally conscious consumers.

Regional Insights

The natural fiber market in North America is anticipated to grow at the fastest CAGR during the forecast period. Growing demand for natural fiber-based composites in the automotive and construction sectors is driving market growth in North America. Automakers are increasingly incorporating natural fibers in vehicle interiors and structural components to reduce weight and improve fuel efficiency. Similarly, in construction, the demand for sustainable insulation and reinforcement materials is rising. The expanding application of natural fibers in medical textiles, geotextiles, and home furnishings also contributes to market growth. Moreover, the shift toward organic and ethically sourced textiles, driven by consumer awareness and industry certification standards, is further propelling demand for natural fibers in North America.

U.S. Natural Fiber Market Trends

The natural fiber market in the U.S. is driven by increasing consumer preference for sustainable and eco-friendly materials, particularly in the textile and apparel industries. Growing awareness of environmental concerns, such as plastic pollution and carbon emissions from synthetic fibers, has led to a shift toward biodegradable and renewable alternatives like cotton, flax, hemp, and jute. In addition, advancements in fiber processing technologies and innovations in bio-based textiles have enhanced the durability and versatility of natural fibers, making them more competitive with synthetic counterparts. The rising demand for organic and ethically sourced textiles, supported by eco-conscious fashion brands and regulatory initiatives promoting sustainable manufacturing, further fuels market growth.

Asia Pacific Natural Fiber Market Trends

Asia Pacific dominated the natural fiber market with the largest revenue share of 51.1% in 2024, driven by increasing demand for sustainable and biodegradable materials across various industries, particularly textiles, automotive, and construction. The region's strong textile manufacturing base, especially in countries like India, China, and Bangladesh, significantly boosts natural fiber consumption. Government initiatives promoting organic and eco-friendly textiles, such as subsidies for jute and cotton farming, further support market expansion. In addition, the growing awareness among consumers regarding the environmental impact of synthetic fibers has accelerated the shift towards natural alternatives, enhancing demand for fibers like cotton, jute, hemp, and coir.

The natural fiber market in China is anticipated to grow at a significant CAGR during the forecast period. The Chinese government has implemented stringent environmental regulations and policies that promote the use of biodegradable and renewable materials, reducing dependence on synthetic alternatives. Programs such as the "Made in China 2025" initiative and green manufacturing incentives encourage domestic industries to integrate natural fibers into textiles, automotive components, and packaging solutions. In addition, rising consumer awareness of sustainability and the adverse environmental impact of synthetic fibers has boosted demand for natural fiber-based apparel, home furnishings, and industrial applications.

Europe Natural Fiber Market Trends

The natural fiber market in Europe is driven by increasing consumer preference for sustainable and biodegradable materials across various industries, including textiles, automotive, and packaging. Stringent environmental regulations by the European Union, such as the EU Green Deal and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, are encouraging the use of natural fibers as eco-friendly alternatives to synthetic materials. The growing emphasis on circular economy principles and carbon footprint reduction further supports the adoption of natural fibers in manufacturing and industrial applications. In addition, government incentives and subsidies promoting organic and sustainable fiber production are fostering market growth.

The is anticipated to grow at a significant CAGR during the forecast Germany natural fiber market period. Technological advancements in fiber processing and bioengineering are key drivers of the German market. Innovations in fiber treatment, blending techniques, and composite manufacturing have expanded the applications of natural fibers in high-performance industries. The increasing demand for biodegradable and compostable materials in packaging, along with rising awareness of microplastic pollution, has further fueled the shift toward natural fiber-based solutions. Moreover, Germany’s focus on research and development, combined with collaboration between industries and academic institutions, is accelerating the development of high-quality natural fiber products with improved durability and functionality.

Latin America Natural Fiber Market Trends

The natural fiber market in Latin America is anticipated to grow at a significant CAGR during the forecast period. The rising adoption of natural fibers in automotive, construction, and composite applications, driven by their lightweight, durable, and environmentally friendly properties, is driving market growth. The increasing focus on circular economy practices and corporate sustainability goals is encouraging industries to replace synthetic materials with natural alternatives. Moreover, Latin America's strong textile manufacturing base, coupled with increasing consumer awareness of sustainable fashion, is contributing to higher demand for organic cotton and other plant-based fibers. Advancements in fiber processing technologies, along with investments in research and development for enhancing fiber quality, are further accelerating the market’s growth in the region.

Middle East & Africa Natural Fiber Market Trends

The natural fiber market in China is anticipated to grow at a substantial CAGR during the forecast period. The rise in demand for organic and natural textiles, particularly in the fashion and home decor sectors, is a significant driver. As consumers increasingly seek out natural alternatives to synthetic fibers, MEA manufacturers are capitalizing on this opportunity by promoting environmentally friendly products, such as organic cotton and linen, to cater to the rising eco-consciousness. The growing popularity of sustainable fashion is bolstered by regional collaborations between textile producers and global brands focused on promoting ethical sourcing and manufacturing. In addition, advances in technology, such as the development of more efficient and environmentally friendly fiber processing methods, further drive the natural fiber industry.

Key Natural Fiber Company Insights

Some of the key players operating in the market include Vardhaman Textiles Limited and Grasim Industries Limited.

-

Vardhaman Textiles Limited offers a wide range of products, including synthetic yarns, dyed and mélange yarns, and specialty fibers. Known for its commitment to sustainability, Vardhaman has embraced eco-friendly manufacturing practices and has a strong presence in the natural fiber industry, offering sustainable and biodegradable fiber solutions.

-

Grasim offers a wide range of products, including rayon fibers, specialty fibers, and blended fabrics. With a strong focus on sustainability, Grasim has integrated eco-friendly practices into its manufacturing process, contributing to the advancement of the natural fiber market.

ANANDHI TEXSTYLES and Bcompare some of the emerging market participants in the natural fiber industry.

-

ANANDHI TEXSTYLES is a prominent manufacturer and supplier of premium natural fiber-based textiles in India. The company specializes in a wide variety of products, such as organic cotton fabrics, linen, and hemp textiles, catering to the growing demand for sustainable and eco-friendly materials. ANANDHI TEXSTYLES prioritizes high-quality production processes that minimize environmental impact while ensuring durability and aesthetic appeal in its product offerings.

-

Bcomp is an innovative company focused on natural fiber composites, providing sustainable and high-performance materials made from renewable fibers like flax, hemp, and jute. The company’s product offerings are designed to meet the needs of industries such as automotive, construction, and consumer goods, offering eco-friendly alternatives to traditional materials like plastics and fiberglass.

Key Natural Fiber Companies:

The following are the leading companies in the natural fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Vardhaman Textiles Limited

- Grasim Industries Limited

- ANANDHI TEXSTYLES

- Bcomp

- The Natural Fibre Company

- Procotex,

- FlexForm Technologies

- Bast Fibre Technologies Inc.

- Lenzing AG

- Barnhardt Natural Fibers

Recent Developments

-

Toyoshima & Co., Ltd. and FOOD REBORN Co., Ltd. established a strategic alliance in March 2022 with the goal of creating natural fiber materials from leftover agricultural goods. This partnership is driven by a shared commitment to sustainability, as both businesses work to develop eco-friendly products that support environmental preservation. In line with the growing need for sustainable solutions in the material production industry, their combined efforts seek to lessen waste and its negative effects on the environment.

Natural Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 72.77 billion

Revenue forecast in 2030

USD 94.65 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Plant-based fiber, animal-based fiber, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan, Australia, Brazil

Key companies profiled

Vardhaman Textiles Limited, Grasim Industries Limited, ANANDHI TEXSTYLES, Bcomp, The Natural Fibre Company, Procotex, FlexForm Technologies, Bast Fibre Technologies Inc., Lenzing AG, Barnhardt Natural Fibers.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Fiber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural fiber market report based on plant-based fiber, animal-based fiber, and region.

-

Plant-based Fiber Outlook (Revenue, USD Million, 2018 - 2030)

-

Cotton

-

Linen

-

Jute

-

Hemp

-

Others

-

-

Animal-based Fiber Outlook (Revenue, USD Million, 2018 - 2030)

-

Wool

-

Silk

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global natural fiber market size was estimated at USD 69.23 billion in 2024 and is expected to reach USD 72.26 billion in 2025.

b. The global natural fiber market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 94.65 billion by 2030.

b. The cotton segment led the market and accounted for the largest revenue share of 82.0% in 2024, driven by the increasing demand for sustainable and eco-friendly products.

b. Some of the key players operating in the natural fiber market include Vardhaman Textiles Limited, Grasim Industries Limited, ANANDHI TEXSTYLES, Bcomp, The Natural Fibre Company, Procotex, FlexForm Technologies, Bast Fibre Technologies Inc., Lenzing AG, Barnhardt Natural Fibers.

b. The key factors that are driving the natural fiber market include growing demand for sustainable and eco-friendly materials as consumers and industries shift away from synthetic fibers due to environmental concerns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.