- Home

- »

- Consumer F&B

- »

-

Natural Dog Treats Market Size, Share, Growth Report, 2030GVR Report cover

![Natural Dog Treats Market Size, Share & Trends Report]()

Natural Dog Treats Market Size, Share & Trends Analysis Report By Product (Eatables, Chewable), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Pet Stores, Online, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-401-9

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Natural Dog Treats Market Size & Trends

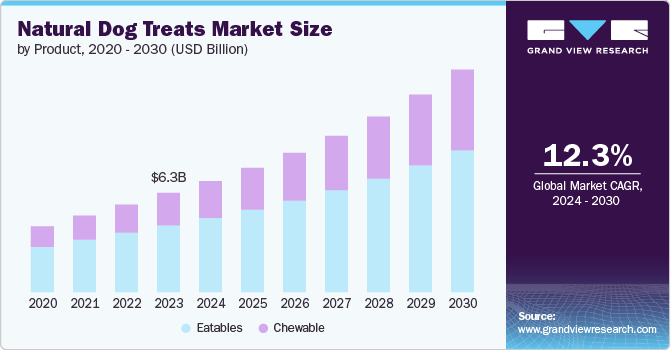

The global natural dog treats market size was estimated at USD 6.26 billion in 2023 and is expected to grow at a CAGR of 12.3% from 2024 to 2030. The rise in pet ownership globally, particularly among millennials and Gen Z, has led to a greater focus on pet health and wellness. This demographic is more inclined towards natural and organic products, extending this preference to their pets' diets.

The trend of treating pets as family members has led to higher spending on premium pet products, including natural dog treats. Pet owners are more concerned about the ingredients in pet food, seeking high-quality, natural options that mirror the health-conscious choices they make for themselves.

There is a growing awareness among pet owners about the importance of proper nutrition for their pets. Natural dog treats, free from artificial additives, preservatives, and fillers, are perceived as healthier options. This awareness is driving demand for treats that contribute to the overall well-being of pets.

The increasing adoption of pet companions, such as dogs, is anticipated to present favorable opportunities for key players in the market over the forecast period. As per the findings of the 2023-2024 APPA National Pet Owners Survey, approximately 66% of households in the U.S., totaling 86.9 million households, are pet owners. Among these households, approximately 65.1 million own at least one dog.

Moreover, major market players are introducing new products to meet the growing demand for snacks and treats among dog owners. In March 2024, BARK broadened its range of consumable products with an inaugural collection comprising seven distinct flavors of dog treats. Branded as the Snack Pack, these treats draw inspiration from popular breakfast cereals, complete with corresponding mascots and delightful surprises in each box. The treat assortment consists of four flagship 10-ounce boxes and three resealable 10-ounce bags and is currently accessible at Target outlets, on target.com, and via bark. Co.

The market is set for sustained growth, driven by innovations in product formulations, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market. Companies are adopting strategies that resonate with human food marketing, emphasizing transparency in ingredient sourcing, nutritional benefits, and eco-friendly packaging. For instance, in May 2023, U.K.-based nut butter brand Pip & Nut entered the pet-food category by partnering with Butternut Box, a local dog-food supplier. The duo launched peanut butter bites, a range of dog treats made with peanut butter.

Companies are launching extensive awareness campaigns to educate pet owners about the benefits of natural dog treats. These campaigns highlight the nutritional advantages, health benefits, and ethical sourcing of natural ingredients, thereby encouraging pet owners to choose healthier options for their pets. In April 2024, Pawlistic Treats, a trusted provider of delicious and healthy pet treats, is excited to introduce the "Treats for Treats" campaign, dedicated to supporting pets in need. Committed to offering the best for pets, Pawlistic Treats has developed a line of cat and dog treats made from natural ingredients that promote good health.

Product Insights

Eatables segment accounted for a share of 67.41% of the global revenue in 2023. Rising awareness about pet food and treats that provide functional benefits, such as supporting joint, coat and skin health, is fueling the demand for edible pet snacks and treats. Major industry players are actively launching a diverse range of products to meet this growing consumer demand. Many pet edibles now include natural ingredients like hemp and CBD, which have demonstrated promising benefits in managing various health conditions in animals, including cancer, anxiety, sleep disorders, and epilepsy. The increasing prevalence of anxiety disorders among pets, particularly dogs, is a significant driver for the expansion of this market segment.

Chewable segment is expected to grow at a CAGR of 14.0% from 2024 to 2030. Chewable treats often come with added health benefits such as dental hygiene, joint support, and digestion aid. These functional benefits are highly appealing to pet owners who are increasingly concerned about their pets' overall well-being. Chewable treats are designed to be highly palatable, making them an easy and enjoyable way for dogs to consume beneficial ingredients. The taste and texture of these treats make them a favorite among dogs, ensuring consistent demand.

Manufacturers are capitalizing on this opportunity by introducing CBD-infused chewable treats for dogs. These innovative products cater to the growing demand for natural remedies to address various health issues in pets. In March 2024, CV Sciences, Inc., a wellness company that focuses on consumer products derived from hemp extracts and other scientifically validated ingredients, launched its new CBD chew line for pets. The +PlusCBD Pet collection includes specially formulated chew treats aimed at promoting the health and well-being of dogs, harnessing the benefits of cannabidiol (CBD) to help address prevalent health concerns within the canine community.

Distribution Channel Insights

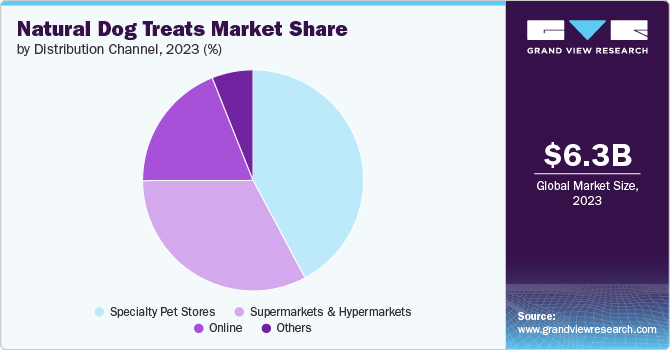

The sales of natural dog treats through specialty pet stores accounted for a revenue share of 42.21% in 2023. Growing initiatives by specialty pet stores, such as partnerships with prominent manufacturers of pet snacks and treats, are likely to boost segment growth and give players a competitive advantage. In September 2023, Pet Supermarket, a prominent specialty retailer of pet supplies with over 225 stores in the Southeast U.S., announced its new partnership with Fromm Family Foods. This collaboration highlighted Pet Supermarket's dedication to improving pet health and well-being by introducing Fromm Family Foods' dry and wet treats and complete-and-balanced foods to its stores and online platform.

The sales of natural dog treats through online channels is expected to grow at a CAGR of 13.5% from 2024 to 2030. Online platforms offer round-the-clock accessibility, allowing consumers to purchase natural dog treats at any time from the comfort of their homes or on the go. E-commerce has significantly altered consumer shopping behavior, offering several advantages, such as doorstep delivery, attractive discounts, and the convenience of finding various items on a single platform. Moreover, the availability of a diverse array of pet snacks and treats and growing customer loyalty facilitated by 'Subscribe & Save' programs are anticipated to strengthen the online channel.

Regional Insights

The natural dog treats market in North America captured a revenue share of over 52.52% in the market. North America, particularly the U.S. and Canada, has one of the highest pet ownership rates in the world. This large pet population creates a substantial market for pet-related products, including natural dog treats. Consumers in North America prioritize products made with natural ingredients and seek out organic certifications. Banana ketchup brands that offer clean label formulations can attract health-conscious consumers. Major supermarkets, specialty food stores, and online retailers in North America increasingly stock international and ethnic food products, including natural dog treats. This accessibility makes it easier for consumers to discover and purchase the product.

U.S. Natural Dog Treats Market Trends

The U.S. natural dog treat market is projected to grow at a significant CAGR from 2024 to 2030.As U.S. households increasingly choose pets like dogs and cats over children, pet owners' commitment to their furry companions' well-being and nutrition is steadily rising. The preference for clean-label, natural, and non-GMO products has become a mainstream expectation across all segments, especially for products featuring human-grade and fresh/frozen ingredients.

Europe Natural Dog Treats Market Trends

The natural dog treat market in Europe is expected to grow at a CAGR of 11.8% from 2024 to 2030. Europe has seen a notable rise in pet ownership, with more households adopting pets such as dogs and cats. This growing pet population naturally leads to increased demand for pet-related products, including snacks and treats. Urbanization and changing lifestyles in Europe have led to more people living in apartments and smaller homes. Pets, particularly dogs and cats, are becoming more popular as companions in these settings, contributing to higher spending on pet products.

Asia Pacific Natural Dog Treats Market Trends

Asia Pacific natural dog treat market is expected to witness a CAGR of 13.1% from 2024 to 2030. The rise in pet ownership has led to significant growth in the market in the Asia Pacific region. This growth is driven by evolving consumer lifestyles and an increasing focus on pet health and wellness. As dog ownership becomes more widespread across Asia Pacific countries, pet owners are increasingly seeking specialized and premium snacks and treats for their beloved companions.

Key Natural Dog Treats Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace dog treats.

Key Natural Dog Treats Companies:

The following are the leading companies in the natural dog treats market. These companies collectively hold the largest market share and dictate industry trends.

- Mars, Incorporated

- Nestlé S.A.

- The J.M. Smucker Company

- General Mills Inc.

- Colgate Palmolive Company

- Off-Leash Pet Treats

- Wellness Pet, LLC

- Merrick Pet Care

- Spectrum Brands, Inc.

- The Dog Chew Company

Recent Developments

-

In May 2024, Dr. Clauder’s partnered with protein innovator Calysta to introduce the world’s first dog treats made with FeedKind Pet protein, a groundbreaking pet food ingredient. Unveiled at the premier global pet trade fair, Interzoo, this pioneering air-dried treat from Dr. Clauder’s utilizes Calysta’s nutritionally dense protein, which is produced through natural fermentation. This non-GMO ingredient addresses market demands for high nutritional quality, excellent palatability, and health benefits for pets.

-

In March 2024, W.F. Young, the esteemed parent company behind beloved pet care brands such as Absorbine and The Missing Link, unveiled an exciting new addition to its product lineup: Honest to Goodness Plant Snacks. Designed for the health-minded canine community, these innovative plant-based treats promise to deliver the natural benefits of wholesome ingredients while catering to specific health needs.

Natural Dog Treats Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.0 billion

Revenue forecast in 2030

USD 14.03 billion

Growth rate

CAGR of 12.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

Mars, Incorporated; Nestlé S.A.; the J.M. Smucker Company; General Mills Inc.; Colgate Palmolive Company; Off-Leash Pet Treats; Wellness Pet, LLC; Merrick Pet Care; Spectrum Brands, Inc.; The Dog Chew Company

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Natural Dog Treats Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global natural dog treats market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Eatables

-

Chewable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Pet Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global natural dog treats market size was estimated at USD 6.26 billion in 2023 and is expected to reach USD 7.0 billion in 2024.

b. The global natural dog treats market is expected to grow at a compounded growth rate of 12.3% from 2024 to 2030 to reach USD 14.03 billion by 2030.

b. The eatables segment dominated the natural dog treats market with a share of 67.41% in 2023. Rising awareness about pet food and treats that provide functional benefits, such as supporting joint, coat, and skin health, is fueling the demand for edible pet snacks and treats. Major industry players are actively launching a diverse range of products to meet this growing consumer demand.

b. Some key players operating in the natural dog treats market include Mars, Incorporated; Nestlé S.A.; the J.M. Smucker Company; General Mills Inc.; Colgate Palmolive Company

b. Key factors that are driving the market growth include the trend of treating pets as family members, which has led to higher spending on premium pet products, including natural dog treats.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."