- Home

- »

- Consumer F&B

- »

-

Nata De Coco Market Size, Share And Trends Report, 2030GVR Report cover

![Nata De Coco Market Size, Share & Trends Report]()

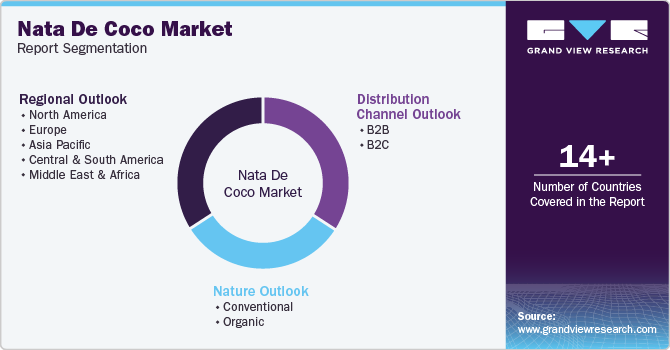

Nata De Coco Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (Conventional, Organic), By Distribution Channel (B2B, Hypermarkets/Supermarkets, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-457-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nata De Coco Market Summary

The global nata de coco market size was estimated at USD 3.51 billion in 2023 and is projected to reach USD 4.49 billion by 2030, growing at a CAGR of 3.8% from 2024 to 2030. One of the most significant drivers of the market is the growing consumer awareness about healthy eating habits.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, India is expected to register the highest CAGR from 2024 to 2030.

- Base on nature, the conventional nata de coco held a revenue share of 84.8% in 2023.

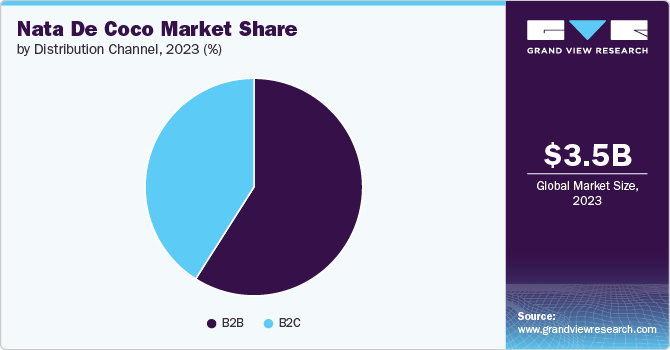

- Base on distribution channel, the sales of nata de coco through the B2B channel accounted for a revenue share of 59.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.51 Billion

- 2030 Projected Market Size: USD 4.49 Billion

- CAGR (2024-2030): 3.8%

- Asia Pacific: Largest market in 2023

With an increasing focus on maintaining a balanced diet and managing body weight, people are looking for healthier alternatives to high-calorie, sugar-laden snacks. Nata de coco, being low in calories and high in dietary fiber, has emerged as a favorable option for health-conscious consumers. It contains a high amount of insoluble dietary fiber, which is essential for promoting healthy digestion and preventing constipation. This fiber content also helps in creating a feeling of fullness, making nata de coco a popular choice for individuals looking to control their calorie intake.

Another significant factor driving the market is the increasing incorporation of nata de coco in beverages, particularly in the Asia-Pacific region. With the rapid expansion of the beverage industry and the introduction of new flavors and textures, nata de coco has become a popular ingredient in drinks like fruit juices, bubble tea, and yogurt-based drinks. The unique chewy texture of nata de coco adds a fun and exotic twist to beverages, which attracts younger consumers looking for novel experiences. In Asia, where bubble tea and flavored beverages have become cultural staples, the use of nata de coco has surged. Bubble tea, also known as "boba tea," is a beverage trend that originated in Taiwan and has taken the global market by storm. The chewy texture of nata de coco is an appealing alternative to traditional tapioca pearls, offering variety and catering to a diverse consumer base.

The market has been further stimulated by the constant innovation in product development and diversification by manufacturers. Companies are continually exploring ways to enhance the versatility of nata de coco by introducing new formats, flavors, and applications. For instance, traditional nata de coco products primarily came in syrup, but manufacturers are now offering flavored variants, dehydrated cubes, and powdered forms to cater to various preferences. Moreover, manufacturers are launching products that combine nata de coco with other ingredients to create hybrid offerings. For instance, dessert cups with a combination of fruits, jellies, and nata de coco are becoming increasingly popular. This kind of product diversification allows companies to tap into multiple market segments, from the dessert industry to the snack and beverage industries.

Innovative packaging solutions also play a crucial role in boosting sales. Manufacturers are introducing convenient, single-serving packaging that appeals to on-the-go consumers. Additionally, transparent packaging is often used to showcase the vibrant, appealing appearance of nata de coco products, particularly flavored ones, which helps attract consumers at the point of sale. Moreover, the modern lifestyle, characterized by busy schedules and limited time for meal preparation, has led to an increased demand for ready-to-eat (RTE) and convenience foods. Nata de coco fits well into this trend, as it can be consumed directly from the packaging or easily incorporated into quick meals and snacks. Its long shelf life, versatility, and ease of use make it an attractive option for manufacturers and consumers alike.

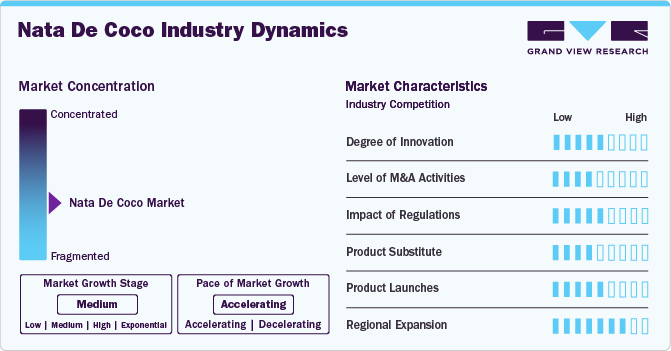

Market Concentration & Characteristics

Innovation in the market is focused on product diversification, including new flavors, organic offerings, and its use in functional and health-focused food products. Manufacturers are experimenting with different textures, infusions, and packaging solutions to cater to evolving consumer preferences. These innovations are particularly evident in beverages and ready-to-eat snacks, aiming to meet demand for natural, low-calorie, and exotic ingredients.

Mergers and acquisitions (M&A) in the market are relatively low to moderate but growing, driven by companies seeking to expand their product portfolios or enter new geographical markets. Established food and beverage companies are acquiring smaller, innovative brands to enhance their product lines with natural, plant-based ingredients. The consolidation of market players also helps streamline production and strengthen distribution networks, particularly in emerging regions.

Regulations impact the market, particularly in terms of food safety standards, organic certification, and labeling requirements. Compliance with global food safety guidelines, such as those set by the FDA and European Food Safety Authority (EFSA), is essential for exporting products. In the organic segment, stricter standards are required for certification, which influences production methods and supply chains. Regulatory frameworks can affect market entry and expansion strategies.

Substitutes for nata de coco include other chewy ingredients such as aloe vera cubes, tapioca pearls (used in bubble tea), and agar-agar. While these alternatives offer similar textures, nata de coco stands out for its nutritional benefits, such as being low in calories and rich in dietary fiber. However, the availability of substitutes might limit its adoption in certain regions, especially in beverages and desserts.

Product launches in the market have been centered around ready-to-drink (RTD) beverages, desserts, and snack segments. Innovations include flavored and organic versions, catering to health-conscious consumers. Brands are also introducing nata de coco in combination with fruit juices, bubble teas, and yogurts, focusing on exotic, tropical flavor profiles. These launches aim to tap into the growing demand for convenient, healthy, and natural products globally.

Regional expansion for nata de coco products is primarily focused on emerging markets like North America and Europe, driven by rising demand for healthy, functional, and exotic food ingredients. Asia Pacific continues to dominate, with growing exports to other regions. European markets are also expanding, fueled by increased consumer awareness of plant-based and organic products. Distribution channels are broadening, particularly in online retail, as global demand rises.

Nature Insights

Conventional nata de coco held a revenue share of 84.8% in 2023. Conventional nata de coco is far more affordable than organic alternatives, making it accessible to a broader consumer base. Organic nata de coco products are often priced higher due to the strict regulations and certification processes involved in their production. Organic farming generally requires more time, labor, and resources, including higher costs for fertilizers and pest control, which are passed on to the consumer. In contrast, conventional nata de coco benefits from cost-effective, large-scale production methods that allow it to be sold at competitive prices.

Organic nata de coco is expected to grow at a CAGR of 6.1% from 2024 to 2030. Organic nata de coco appeals to consumers who prioritize products free from synthetic pesticides, fertilizers, and GMOs. The growing interest in clean-label, plant-based, and natural products has accelerated demand for organic options across multiple food and beverage categories, including nata de coco. Organic nata de coco is often positioned as a premium product, with brands marketing it as a healthier and more sustainable option compared to its conventional counterpart. This premium positioning allows manufacturers to charge higher prices, which can lead to higher margins and drive innovation in organic product lines. The demand for premium, organic products is particularly strong in developed markets like North America and Europe, where health and wellness trends are more deeply ingrained.

Distribution Channel Insights

The sales of nata de coco through the B2B channel accounted for a revenue share of 59.0% in 2023. The B2B segment encompasses food processors, restaurants, beverage manufacturers, and other commercial enterprises that use Nata de Coco as an ingredient in their products. The scale of demand from these businesses is significantly larger than that of individual consumers. Nata de Coco is a popular ingredient in beverages (such as bubble tea and fruit drinks), desserts (like ice creams and fruit salads), and other processed foods, driving bulk purchases from food manufacturers. The sheer volume of Nata de Coco required for industrial-scale production far outweighs the demand from individual consumers.

The sales of nata de coco through B2C channel is expected to grow at a CAGR of 4.0% from 2024 to 2030. As more consumers become aware of the health benefits associated with nata de coco, such as its high fiber content and low-calorie profile, demand is growing in the B2C segment. Health-conscious individuals are increasingly incorporating Nata de Coco into their diets, either as a snack or an ingredient in homemade dishes, driving sales through retail channels like supermarkets, convenience stores, and online platforms. Moreover, the proliferation of e-commerce platforms and the growing trend of online grocery shopping have made nata de coco products more accessible to consumers. Digital platforms like Amazon, Alibaba, and local online grocery stores provide easy access to nata de coco-based products, driving growth in the B2C segment.

Regional Insights

North America nata de coco market has seen a rise in demand driven by growing consumer interest in exotic and novel food products. As health-conscious eating trends gain momentum, nata de coco, with its low-calorie profile and chewy texture, appeals to consumers seeking healthier dessert options and alternatives to traditional sweets. The increasing popularity of Asian cuisine and ingredients among North American consumers has also contributed to its adoption in various culinary applications, from trendy bubble teas to gourmet desserts. Additionally, e-commerce platforms are making it easier for consumers to access nata de coco products, further driving market growth as people are more willing to try unique ingredients outside of their traditional food habits.

Asia Pacific Nata De Coco Market Trends

The nata de coco market in Asia Pacific accounted for a revenue share of 40.2% in 2023. Nata de coco originated in the Philippines, where it has been consumed for centuries. The product is deeply ingrained in the culinary traditions of many Southeast Asian countries, including Thailand, Indonesia, and Malaysia. Its widespread cultural acceptance in the region has naturally resulted in strong demand, with Nata de coco being a popular ingredient in local desserts, beverages, and snacks. Moreover, Southeast Asia, particularly the Philippines, is one of the largest producers and exporters of Nata de coco. The region benefits from a favorable climate for coconut cultivation, providing a steady and abundant supply of raw materials for nata de coco production. This local availability of coconuts, combined with established production infrastructure, has positioned Asia Pacific as the dominant player in the global market.

Europe Nata De Coco Market Trends

The nata de coco market in Europe is expected to grow with a CAGR of 3.9% from 2024 to 2030. European consumers are increasingly interested in trying exotic and functional foods from different parts of the world. Nata de coco, with its unique texture and health benefits, appeals to consumers looking for new and exciting food experiences. This trend is especially prevalent in health-conscious segments, where products that offer both novelty and nutritional value are in high demand. Additionally, the health and wellness trend is a major driver in the European market. Consumers are looking for natural, low-calorie, and high-fiber foods that align with their healthy lifestyle choices. The growing interest in plant-based and clean-label products is also supporting the adoption of nata de coco in Europe.

Key Nata De Coco Company Insights

Key players operating in the nata de coco market are Happy Alliance Sdn Bhd., Del Monte Asia Pte Ltd., HTK CO., LTD., Nata Food Manufacturing Sdn Bhd, Prosper Foods Industry, Ltd., PT. Denikin Industri Nusantara, The Tea Planet, VIET DELTA CORPORATION, PT Pulau Sambu (Kara), and Nata Nutrico. The market participants are constantly working toward new product launches, partnerships, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

Key Nata De Coco Companies:

The following are the leading companies in the nata de coco market. These companies collectively hold the largest market share and dictate industry trends.

- Happy Alliance Sdn Bhd.

- Del Monte Asia Pte Ltd.

- HTK CO., LTD.

- Nata Food Manufacturing Sdn Bhd

- Prosper Foods Industry, Ltd.

- PT. Denikin Industri Nusantara

- The Tea Planet

- VIET DELTA CORPORATION

- PT Pulau Sambu (Kara)

- Nata Nutrico

Recent Developments

- In May 2021, NutiFood, a leading Vietnamese nutrition company, became the first in Vietnam to introduce a Tonic Food Drink (TFD) with nata de coco bits in aseptic carton packaging using SIG's drinksplus technology.

Nata De Coco Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.60 billion

Revenue forecast in 2030

USD 4.49 billion

Growth Rate

CAGR of 3.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S, Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, Indonesia, Philippines, Australia, Brazil, and South Africa

Key companies profiled

Happy Alliance Sdn Bhd.; Del Monte Asia Pte Ltd.; HTK CO., LTD.; Nata Food Manufacturing Sdn Bhd; Prosper Foods Industry, Ltd.; PT. Denikin Industri Nusantara; The Tea Planet; VIET DELTA CORPORATION; PT Pulau Sambu (Kara); Nata Nutrico

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nata De Coco Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nata de coco market report on the basis of nature, distribution channel, and region.

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets/Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Philippines

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nata de coco market size was estimated at USD 3.51 billion in 2023 and is expected to reach USD 3.60 billion in 2024.

b. The global nata de coco market is expected to grow at a compounded growth rate of 3.8% from 2024 to 2030 to reach USD 4.49 billion by 2030.

b. Conventional nata de coco dominated the nata de coco market, with a share of 84.8% in 2023. Conventional nata de coco is far more affordable than organic alternatives, making it accessible to a broader consumer base owing to which it is widely adopted by consumers.

b. Some key players operating in nata de coco market include Happy Alliance Sdn Bhd., Del Monte Asia Pte Ltd., HTK CO., LTD., Nata Food Manufacturing Sdn Bhd, Prosper Foods Industry, Ltd., PT. Denikin Industri Nusantara, The Tea Planet, VIET DELTA CORPORATION, PT Pulau Sambu (Kara), Nata Nutrico.

b. One of the most significant drivers of the nata de coco market is the growing consumer awareness about healthy eating habits. With an increasing focus on maintaining a balanced diet and managing body weight, people are looking for healthier alternatives to high-calorie, sugar-laden snacks. Nata de coco, being low in calories and high in dietary fiber, has emerged as a favorable option for health-conscious consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.