- Home

- »

- Next Generation Technologies

- »

-

Narrowband IoT Market Size & Share, Industry Report, 2030GVR Report cover

![Narrowband IoT Market Size, Share & Trends Report]()

Narrowband IoT Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Network, Module), By Deployment (In-band, Guard-band, Standalone), By Device, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-180-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Narrowband IoT Market Summary

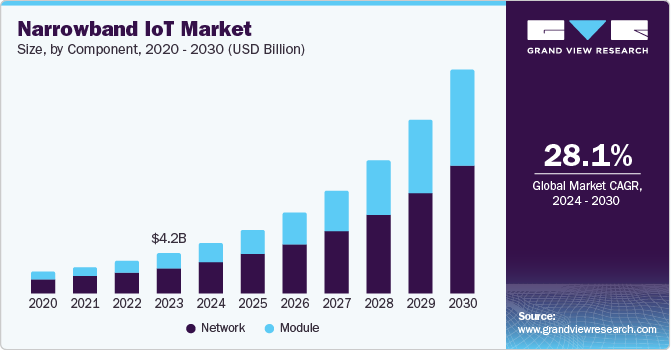

The global narrowband IoT market size was estimated at USD 4.16 billion in 2023 and is projected to reach USD 22.75 Billion by 2030, growing at a CAGR of 28.1% from 2024 to 2030. This growth is driven by the increasing adoption of IoT devices across various industries, as narrowband IoT (NB-IoT) technology offers cost efficiency and wide coverage with low power consumption, making it ideal for applications such as smart metering, asset tracking, and smart agriculture.

Key Market Trends & Insights

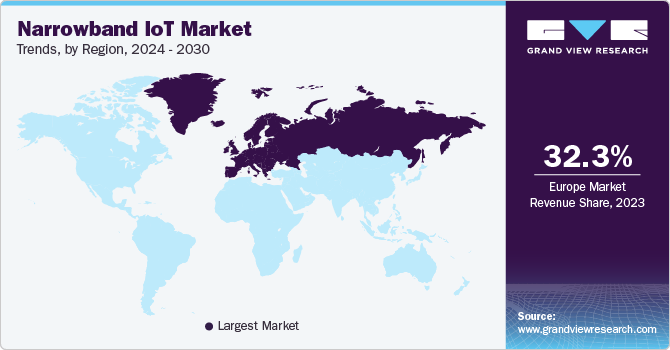

- Europe accounted for the largest revenue share of 32.3% in 2023.

- Germany dominated the European narrowband IoT market in 2023.

- By component, the network segment dominated the market and accounted for a share of 63.9% in 2023.

- By deployment, the in-band segment accounted for the largest market revenue share in 2023.

- By device, the in-band segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.16 Billion

- 2030 Projected Market Size: USD 22.75 Billion

- CAGR (2024-2030): 28.1%

- Europe: Largest market in 2023

The growing demand for real-time monitoring and analytics in logistics and supply chain management is also boosting the market, as NB-IoT enables timely and accurate data collection. Furthermore, the progress in cloud computing and the growing necessity for dependable machine-to-machine (M2M) communications in industrial environments are contributing to the increased adoption of NB-IoT.

The NB-IoT network’s ability to penetrate deep underground and in narrow spaces facilitates the deployment of IoT devices in challenging locations. Telecom service providers are responsible for ensuring network connectivity for IoT devices in standalone, in-band, and guard-band modes as part of their network installations.

Government support through policies, partnerships, and investments is crucial in driving the NB-IoT market. Governments worldwide are funding smart city initiatives to update infrastructure, improve public services, and enhance the overall quality of life. Such efforts often require numerous IoT devices to monitor electricity usage, manage waste disposal, and regulate traffic. NB-IoT is an ideal solution for these applications due to its low energy consumption and extensive coverage.

Component Insights

The network segment dominated the market and accounted for a share of 63.9% in 2023. This dominance can be attributed to network infrastructure's critical role in deploying and operating NB-IoT solutions. Telecom service providers are integral to this segment, as they ensure the necessary connectivity for IoT devices through various modes such as standalone, in-band, and guard-band. NB-IoT networks' extensive coverage and deep penetration capabilities make them ideal for applications in challenging environments, including underground and enclosed spaces.

In addition, the ongoing expansion of NB-IoT networks by telecom operators worldwide is further boosting this segment growth. The increasing adoption of smart city initiatives and the rising demand for reliable and efficient IoT connectivity across various industries are also key drivers for the network segment growth.

The module segment is expected to register the fastest CAGR of 31.1% during the forecast period. This growth is driven by the increasing demand for NB-IoT modules, which are essential components in IoT devices. These modules enable devices to connect to NB-IoT networks, facilitating various applications such as asset tracking, smart metering, and environmental monitoring. The advancements in NB-IoT technology have led to the development of more efficient and cost-effective modules, which in turn are driving their adoption across different sectors.

Furthermore, the improved battery life and low power consumption of NB-IoT modules make them highly suitable for long-term deployments in remote and hard-to-reach locations. The growing trend of digital transformation and the increasing integration of IoT solutions in industries such as healthcare, agriculture, and logistics are expected to further propel the growth of the module segment.

Deployment Insights

The in-band segment accounted for the largest market revenue share in 2023 largely due to its ability to utilize the existing LTE spectrum, allowing seamless integration with current cellular networks. By leveraging the in-band deployment mode, telecom operators can efficiently deploy NB-IoT without the need for additional spectrum, reducing both time and cost.

This mode is particularly advantageous in urban areas where spectrum availability is limited, and the demand for IoT connectivity is high. The in-band deployment also benefits from the robust infrastructure of LTE networks, ensuring reliable and extensive coverage. The growing adoption of smart city projects and the increasing need for efficient urban infrastructure management are further driving the demand for in-band NB-IoT deployments.

The guard-band segment is projected to be the fastest-growing deployment mode in the NB-IoT market over the forecast period. This rapid growth can be attributed to the guard-band’s ability to utilize the unemployed spectrum between LTE channels, which is often underutilized. By deploying NB-IoT in the guard-band, operators can maximize spectrum efficiency without interfering with existing LTE services. This mode is particularly beneficial in scenarios where spectrum resources are scarce and there is a need to optimize the available bandwidth. The guard-band deployment is also cost-effective, as it leverages existing network infrastructure, reducing the need for significant capital expenditure. The increasing demand for IoT applications in sectors such as agriculture, logistics, and environmental monitoring is expected to drive the adoption of guard-band NB-IoT deployments.

Device Insights

The wearables segment dominated the market in 2023. This dominance can be attributed to the increasing adoption of wearable devices such as fitness trackers, smartwatches, and health monitoring devices. These devices benefit significantly from NB-IoT technology due to its low power consumption and extensive coverage, which are crucial for ensuring long battery life and reliable connectivity.

The healthcare sector, in particular, has seen a surge in the use of wearables for remote patient monitoring and chronic disease management. Additionally, the growing consumer interest in health and fitness, coupled with advancements in wearable technology, has further propelled the demand for NB-IoT-enabled wearables. The integration of NB-IoT in wearables allows for continuous data transmission and real-time analytics, enhancing user experience and providing valuable insights for health and fitness applications.

The smart lighting segment is expected to register the fastest CAGR during the forecast period. The increasing implementation of smart lighting solutions in both residential and commercial settings drives this rapid growth. Smart lighting systems, including streetlights and indoor and outdoor lighting, leverage NB-IoT technology to enable remote control, automation, and energy efficiency. The ability of NB-IoT to provide reliable connectivity in various environments, including urban and rural areas, makes it an ideal choice for smart lighting applications.

Governments and municipalities are increasingly adopting smart lighting solutions as part of their smart city initiatives to reduce energy consumption and improve public safety. The growing focus on sustainability and energy conservation is also contributing to the accelerated growth of the smart lighting segment in the NB-IoT market.

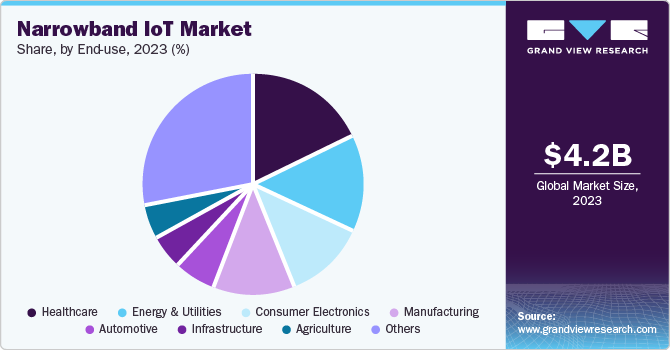

End-use Insights

The energy and utilities segment accounted for the largest market revenue share in 2023. This dominance is driven by the widespread adoption of NB-IoT technology for smart metering, grid management, and infrastructure monitoring. Smart meters, which are essential for real-time monitoring of electricity, gas, and water usage, benefit significantly from NB-IoT’s low power consumption and extensive coverage. These features enable utilities to deploy smart meters in remote and hard-to-reach locations, ensuring accurate and timely data collection. Additionally, NB-IoT facilitates efficient grid management by providing reliable connectivity for sensors and devices that monitor and control the distribution of energy.

The automotive and transportation segment is projected to grow at the fastest CAGR over the forecast period due to the increasing demand for connected vehicles and intelligent transportation systems. NB-IoT technology is crucial in enabling vehicle-to-everything (V2X) communication and enhancing road safety, traffic management, and overall transportation efficiency. The ability of NB-IoT to provide reliable, low-latency connectivity is essential for applications such as real-time traffic monitoring, fleet management, and predictive maintenance of vehicles. Furthermore, the rise of autonomous and electric vehicles is driving the need for advanced connectivity solutions where NB-IoT can offer robust and secure communication channels.

Regional Insights

Europe accounted for the largest revenue share of 32.3% in 2023. The region's effective regulatory framework has been instrumental in facilitating the successful adoption of narrow-band Internet of Things (IoT) technologies. Varied regulations pertaining to data protection and security ensure the safeguarding of personal data. Furthermore, the European Commission has issued a recent recommendation outlining the operational guidelines for RFID applications in compliance with privacy and data protection principles.

Germany dominated the European narrowband IoT market in 2023. Germany is investing heavily in research and development for the narrowband Internet of Things and new services for various application areas in today's interconnected world. Despite the positive overall outlook, safeguarding personal data continues to pose a significant challenge for the implementation of narrowband IoT technologies in Europe.

Asia Pacific Narrowband IoT Market Trends

The Asia Pacific was identified as a lucrative region for the narrowband IoT market in 2023. Significant government backing for smart city initiatives in China and India is driving the expansion of NB-IoT. For instance, with a substantial budget, India's Smart Cities Mission is encouraging the development of urban IoT applications.

China narrowband-IoT market is expected to grow rapidly in the coming years, driven by the increasing adoption of smart city initiatives and industrial automation. This growth is fueled by telecom operators' deployment of NB-IoT networks to connect a multitude of sensors and devices in both urban and industrial settings.

North America Narrowband IoT Market Trends

The narrowband IoT market in North America is anticipated to witness significant growth, driven by the region's strong technological ecosystem, which includes leading tech companies, research institutions, and startups. Moreover, substantial investments in research and innovation from public and private sectors are creating an environment conducive to technological advancement, further accelerating market growth.

U.S. Narrowband IoT Market Trends

The U.S. narrowband IoT market held a substantial market share in 2023. The country's advanced economy supports substantial investments in research and development, propelling growth in the narrowband IoT sector. Increased digitization in key industries, ongoing technological advancements, and the expanding adoption of smart connected devices are also fueling the market.

Key Narrowband IoT Company Insights

Some key companies in the narrowband IoT market include Cisco Systems, Inc., Sierra Wireless, and Verizon, among others. These market players are working on developing new modules and deploying NB-IoT networks to improve coverage and increase the scope of commercial applications where the technology can be applied.

-

Cisco Systems, Inc. has been a significant player in the NB-IoT market through its Cisco Jasper platform, which supports massive-scale IoT deployments. Cisco Jasper enables enterprises to manage NB-IoT devices efficiently, leveraging existing LTE infrastructure to provide reliable, low-cost IoT connectivity. This platform particularly benefits smart cities, smart meters, and asset-tracking industries, where low power consumption and extensive coverage are crucial.

-

Sierra Wireless provides NB-IoT solutions, particularly through its HL78 series modules, which offer ultra-low power consumption and deep coverage. These modules are designed for industrial IoT applications, such as asset tracking, smart energy, and smart cities, ensuring long battery life and robust connectivity.

Key Narrowband IoT Companies:

The following are the leading companies in the narrowband IoT market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Sierra Wireless

- Verizon

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- AT&T

- Tata Communications.

- Fibocom Wireless Inc.

- Quectel Wireless Solutions Co., Ltd

- Qualcomm Technologies, Inc.

- Intel Corporation

Recent Developments

-

In July 2024, STMicroelectronics adopted Ceva, Inc.’s Ceva-Waves Dragonfly NB-IoT platform for its new ST87M01 modules. These modules, designed for IoT applications, offer a combination of low-power, highly reliable NB-IoT connectivity and accurate GNSS positioning capabilities.

-

In February 2024, BT launched a new NB-IoT network in the UK. This network will enable the connectivity of low-data-demand IoT devices, such as streetlights and water sensors, over a smart network. By leveraging this technology, BT aims to accelerate the development of smart cities through applications such as energy optimization and infrastructure monitoring.

-

In January 2024, Airtel Business announced that it is going to provide connectivity for over 20 million smart meters deployed by Adani Energy Solutions Limited. Airtel's nationwide network will ensure reliable and secure communication between the smart meters and headend applications, enabling real-time data transfer and efficient operations.

Narrowband IoT Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.16 billion

Revenue forecast in 2030

USD 22.75 billion

Growth Rate

CAGR of 28.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, device, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, South Africa

Key companies profiled

Cisco Systems, Inc.; Sierra Wireless; Verizon; Nokia Corporation; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co. Ltd.; AT&T; Tata Communications.; Fibocom Wireless Inc.; Quectel Wireless Solutions Co., Ltd; Qualcomm Technologies, Inc.; Intel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Narrowband IoT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global narrowband-IoT market report based on component, deployment, device, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Network

-

Module

-

- Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

In-band

-

Guard-band

-

Standalone

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Alarm & Detector

-

Smart Parking

-

Smart Meter

-

Smart Lighting

-

Tracker

-

Wearables

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Agriculture

-

Infrastructure

-

Healthcare

-

Energy & Utilities

-

Manufacturing

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

- U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.