Nanofibers Market Size, Share & Trends Analysis Report By Product (Polymer, Carbon, Composite, Cellulose, Metallic), By Application (Electronics, MCE, Energy, MLP), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-059-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Nanofibers Market Size & Trends

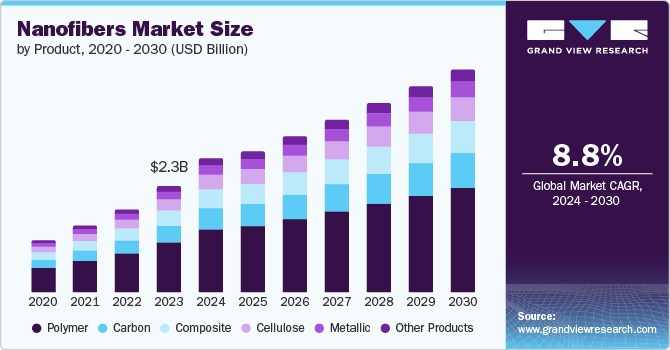

The global nanofibers market size was valued at USD 2.28 billion in 2023 and is projected to grow at a CAGR of 8.8% from 2024 to 2030. The increasing need in healthcare, filtration, and electronics is fueling the global nanofibers market, as these industries benefit from the distinctive features of nanofibers that provide significant enhancements compared to traditional materials. Furthermore, the greater mechanical endurance of nanofibers and the heightened technological progress are also significant drivers of growth.

The nanofibers market is driven by a combination of factors that are transforming various industries and applications. One of the key drivers is the significant advancements in the life sciences sector, particularly in medical applications such as drug delivery, tissue engineering, and wound dressings. The unique properties of nanofibers, including high surface area, porosity, and ability to mimic the extracellular matrix, make them highly suitable for these applications. This has led to increased demand for nanofibers in the life sciences sector, driving growth in the market.

Another major driver is the growing need for respiratory protection, particularly in response to the COVID-19 pandemic. The increased demand for nanofiber-based respiratory masks and personal protective equipment (PPE) has been substantial, as these materials provide enhanced filtration efficiency and breathability compared to traditional mask materials. Moreover, the expanding nano-electronics industry is also driving growth in the nanofibers market, as nanofibers are being used in applications such as sensors, transistors, and energy storage devices. Their unique electrical, thermal, and mechanical properties make them well-suited for these applications.

The nanofibers market is also being driven by sustainability trends and technological advancements. Increasing consumer and regulatory focus on sustainability is driving the adoption of nanofiber-based products that can be designed to be biodegradable and environmentally friendly. Furthermore, continuous improvements in nanofiber production techniques are enabling the development of more cost-effective and scalable manufacturing processes. This is expected to further boost market growth. Finally, the diverse application potential of nanofibers across industries such as water and air filtration, energy storage, composites, and sensors is also driving demand and growth in the market. As new applications are discovered, it is likely that demand will continue to increase across various industries.

Product Insights

Polymer accounted for the largest market revenue share of 46.8% in 2023. Polymer nanofibers are well-known for their flexibility, low weight, and large surface-to-volume ratio, making them essential in various fields such as healthcare and environmental engineering. In the medical industry, tissue engineering, wound healing, and drug delivery systems are being transformed because of their biocompatibility and ability to replicate the extracellular matrix. Their porous quality is well-suited for filtration uses as well, offering great effectiveness in air and water purification systems. In the field of electronics, flexible sensors, actuators, and substrates for flexible electronic devices are utilized, blending mechanical flexibility with functional performance.

Cellulose nanofibers are expected to register the fastest CAGR of 9.5% over the forecast period. Segment growth is driven by the growing demand for Cellulose Nanofibers (CNF) in cosmetic products, paint materials, optical film, and other applications. The lightweight, high-strength, and eco-friendly nature of CNF leads to its increased use worldwide, driving market growth during the forecast period.

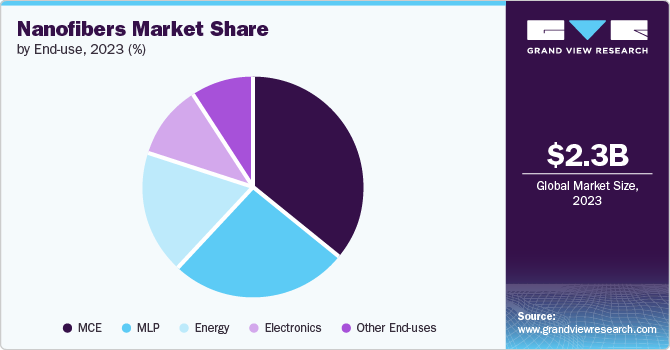

End Use Insights

The MCE segment dominated the market with a revenue share of 36.2% in 2023. Nanofibers excel at air and aerosol filtration due to their large surface area to volume ratio. This translates to highly effective capturing of pollutants, making them ideal for applicants such as air and water treatment. Stringent environmental regulations and growing concerns about air and water treatment. Stringent environmental regulations and growing concerns about air and water quality are fueling the demand of these filtration solutions for Mechanical, Chemical, & Environmental segment.

Electronics segment is projected to grow at the fastest CAGR of 9.7% during the forecast period. Nanofibers play a crucial role in making flexible electronics, aiding in the creation of wearable technology, bendable screens, and intelligent fabrics that merge top-notch performance with creative design. These fibers play a part in electronics by enhancing energy storage and conversion tools such as batteries and super capacitors, resulting in higher energy density and quicker charge-discharge rates.

Regional Insights

North America nanofibers market dominated the global nanofibers market with a revenue share of 34.0% in 2023. North America is a leading market due to its strong technological infrastructure, thriving industrial sectors, and substantial investments in research and development. The area’s dedication to promoting healthcare advancements continues to speed up the incorporation of these fibers in medical tools, tissue reconstruction, and medication distribution systems.

U.S. Nanofibers Market Trends

Nanofibers market in the U.S. dominated the North America nanofibers market with a share of 62.5% in 2023, aided by continuous advancements in nanofiber production methods and the exploration of novel applications, propelling market growth. The country has established strict environmental regulations to address air and water pollution concerns. This creates a strong demand for efficient filtration systems, where nanofiber membranes excel due to their superior filtering capabilities.

Europe Nanofibers Market Trends

Europe nanofibers market was identified as a lucrative region in 2023. The region gains advantages from a strong industrial foundation, substantial financial support from both the government and private sector for nanotechnology research, and strict rules that encourage the use of cutting-edge materials. European nations are leading the way in incorporating these fibers into different industries, such as healthcare, where they are utilized in advanced wound care, drug delivery systems, and regenerative medicine.

Nanofibers market in the UK is expected to grow rapidly in the coming years due to strong life sciences sector with a focus on innovative medical technologies. Nanofibers are finding applications in drug delivery, regenerative medicine, and advanced wound dressings, propelling market expansion in this area.

Asia Pacific Nanofibers Market Trends

Asia Pacific nanofibers market is anticipated to witness the fastest growth over the forecast period, registering a CAGR of 9.3%. Market growth is driven by expanding industrial sectors, increased R&D focus, and rising awareness of nanotechnology benefits. Countries including China, Japan, and South Korea lead production and application, backed by government initiatives, investments, and academic collaborations. The demand for eco-friendly solutions, such as water and air filtration, also boosts the market’s sustainability appeal.

Nanofibers market in China held a substantial market share in 2023 owing to the second largest health care industry globally after U.S. It is anticipated that there will be a rise in the need for nanofiber composites for drug delivery, tissue engineering, stem cell therapy, cancer therapy, and wound healing. As China’s economy continue to grow, consumers have more disposable income, leading to increased demand for high-tech products that may utilize nanofibers.

Key Nanofibers Company Insights

Some key companies in the market include Ahlstrom; TORAY INDUSTRIES, INC.; DuPont; Elmarco; and others. Companies are prioritizing expanding their customer base to gain a competitive advantage. The competitive landscape is influenced by factors such as innovative products, technological advancements, and market penetration strategies, driving organizations to differentiate themselves in the industry.

-

DuPont is a provider of fabrics, fibers, and nonwovens for over 40 years, delivering performance, protection, and versatility. With a track record of innovation and dedicated team of scientists and engineers, DuPont collaborates with industries to develop high-performing materials for various applications, including Kevlar, Nomex, Tyvek, and Tychem.

-

Elmarco is a supplier of industrial-scale nanofiber production equipment, specializing in the needle-free Nanospider technology since 2004. The company delivers high-quality nanofibers for filtration, textiles, energy storage, and biomedical applications, with over 130 global installations, offering industrial and laboratory-scale solutions.

Key Nanofibers Companies:

The following are the leading companies in the nanofibers market. These companies collectively hold the largest market share and dictate industry trends.

- Ahlstrom

- TORAY INDUSTRIES, INC.

- DuPont

- Asahi Kasei Corporation

- Donaldson Company, Inc.

- Elmarco Ltd.

- Johns Manville. A Berkshire Hathaway Company

- Jiangxi Xian Cai Nanofibers Technology Co., Ltd.

Recent Developments

-

In June 2024, Ahlstrom introduced a new line of filtration materials featuring innovative fluoro-free technology and increased longevity for tough conditions, suitable for gas turbine air intake, air pollution control, and HVAC applications.

-

In June 2024, Toray Industries, Inc. announced the release of three new Toraysee design cloth designs in late June. The 24-square-centimeter microfiber cleaning cloths were introduced and are now available for sale at optician stores in Japan and online on Amazon and Takezawa Online Shop.

Nanofibers Marker Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.89 billion |

|

Revenue forecast in 2030 |

USD 4.78 billion |

|

Growth rate |

CAGR of 8.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Taiwan, Brazil, Argentina, and Saudi Arabia |

|

Key companies profiled |

Ahlstrom; TORAY INDUSTRIES, INC.; DuPont; Asahi Kasei Corporation; Donaldson Company, Inc.; Elmarco Ltd.; Johns Manville. A Berkshire Hathaway Company; Jiangxi Xian Cai Nanofibers Technology Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Nanofibers Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nanofibers market report based on product, end use, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Polymer

-

Carbon

-

Cellulose

-

Composite

-

Metallic

-

Other Products

-

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Electronics

-

MCE

-

Energy

-

MLP

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."